Is Unemployment Unearned Income For A Child

The kiddie tax rules apply to any child who. However you must still attach Form 8615 to your childs tax return.

Rules Roundup Supplemental Unemployment Benefits And Their Impact On Public Assistance Programs Making Justice Real

Rules Roundup Supplemental Unemployment Benefits And Their Impact On Public Assistance Programs Making Justice Real

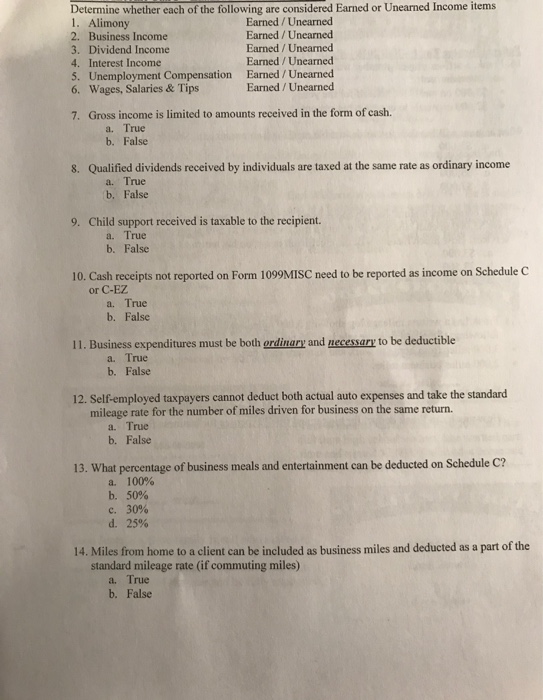

Generally the kiddie tax kicks in when a child meets all of the following.

Is unemployment unearned income for a child. Unearned Income is all income that is not earned such as Social Security benefits pensions State disability payments unemployment benefits interest income dividends and cash from friends and relatives. You do not amend your return. Unemployment income is considered unearned income for kiddie tax purposes.

The kiddie tax. Also considered unearned income are unemployment compensation taxable social security benefits pensions annuities of unearned income from a trust and capital gain distributions. Anything above 2200 however is taxed at the marginal tax rate of the parent s which usually is higher than the childs rate.

Yes Eloise will be subject to the kiddie tax because of her unemployment compensation. A childs net unearned income cant be more than his or her taxable income. Kiddie tax is calculated on Form 8615 which is then filed.

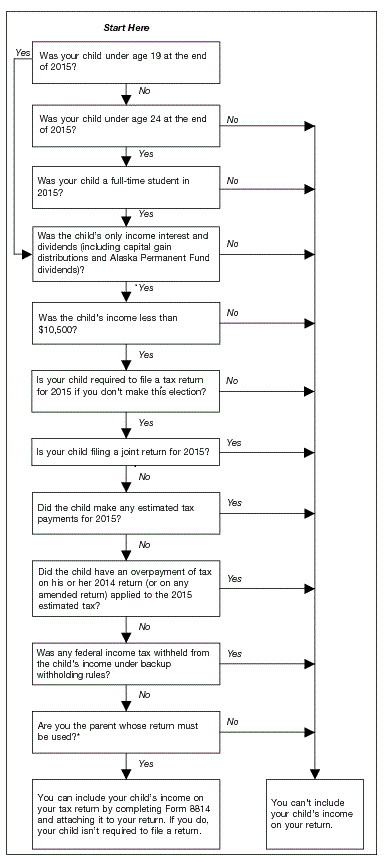

As under prior law the kiddie tax applies to a childs net unearned income if the child is under age 19 or is a full-time student under age 24 has at least one living parent has unearned income above a threshold amount 2200 for 2020 and doesnt file a joint return with a spouse for the year. This tax treatment has gained a nickname. 553 Tax on a Childs Investment and Other Unearned Income Kiddie Tax.

In-Kind Income is food shelter or both that you get for free or for less than its fair market value. It means that if your child has unearned income more than 2200 some of it will be taxed at estate and trust tax rates for tax years 2018 and 2019 or at the parents highest marginal tax rate beginning in 2020. Form 8615 may be required if earned income is not more than half their support Obviously the unemployment is unearned income but it is certainly not investment income.

Unemployment and tax credit rules Child Tax Credit Receiving unemployment income wont prevent you from claiming the Child Tax Credit. Families who received unemployment income during 2020 should also be on the lookout for two key credits as they file their taxes. The next 1100 is taxed at the childs income tax rate for 2020.

1 1100 or 2 your earned income plus 350 but the total cant be more than the basic standard deduction for your filing status. If zero or less dont complete the rest of the form. In general in 2020 the first 1100 worth of a childs unearned income is tax-free.

Unemployment income is treated the same as unearned income from investments. The earned income tax credit and the child tax. Children who are subject to the kiddie tax.

Taxpayers can elect to apply the 2020 rules to tax years 2018 and 2019. Is required to file a tax return Has more than 2200 of unearned income Was younger than 18 or was 18 and didnt have earned income that was more than half their support at the end of the tax year. If your child is required to file then the unemployment goes on their return.

This is the childs unearned income. ATX gives me the warning Return is for a child of age 18 and investment income exceeds 2200. You might evaluate if they should file their own return.

A child who receives unemployment compensation may be subject to the kiddie tax and as a result may pay substantially higher tax than an adult receiving the same compensation. At any age if you are a dependent on another persons tax return and you are filing your own tax return you standard deduction can not exceed the greater of 1100 or the sum of 350 and your individual earned income. However because this credit reduces the tax you owe you must have some taxable income to claim it.

F you can be claimed as a dependent by another taxpayer your standard deduction for 2020 is limited to the greater of. Kiddie Tax is a tax on the unearned income of dependent children under age 19. Enter on Form 8615 line 5 the smaller of line 3 or line 4.

Yes unemployment is unearned income and if a child had unearned income of more than 2200 then the the Kiddie Tax is triggered. Please see IRS Topic No. The Child Tax Credit is worth up to 2000 per qualifying child with a refundable portion of up to 1400.

The Kiddie tax uses the parents tax rate. Working young adults are special Kiddies. Unemployment compensation is considered unearned income.

Are Your Unemployment Benefits Taxable Relax Tax

Are Your Unemployment Benefits Taxable Relax Tax

Https Www Sccgov Org Sites Ssa About Us Debs Policy Handbooks Policy Handbook Calworks Afchap28 Pdf

Kiddie Tax On Unearned Income H R Block

Kiddie Tax On Unearned Income H R Block

Unemployment Benefits Are Taxable Income That May Reduce Eitc Refunds Next Spring

Unemployment Benefits Are Taxable Income That May Reduce Eitc Refunds Next Spring

Do I Qualify For Earned Income Credit While On Unemployment Turbotax Tax Tips Videos

Do I Qualify For Earned Income Credit While On Unemployment Turbotax Tax Tips Videos

Does A Dependent Child Have To File A 2020 Federal Tax Return

Does A Dependent Child Have To File A 2020 Federal Tax Return

What You Need To Know About This Year S Tax Returns With Stimulus Checks Unemployment Benefits

What You Need To Know About This Year S Tax Returns With Stimulus Checks Unemployment Benefits

What Unearned Income Means On A Dependent S Income Tax Return Cpa Practice Advisor

What Unearned Income Means On A Dependent S Income Tax Return Cpa Practice Advisor

How Do You Treat Your Children S Dividends On Your Us Tax Return

How Do You Treat Your Children S Dividends On Your Us Tax Return

Coronavirus Bulletin Board Aids Law Project

Coronavirus Bulletin Board Aids Law Project

Https Cwfphilly Org Wp Content Uploads 2019 02 P5311 2018 10 00 1098 T Pdf

8615 Filing Requirements And Ef Message 5292 Who Is Required To File Form 8615 How Do I Clear Ef Message 5292 According To Form 8615 Instructions Form 8615 Must Be Filed For Any Child Who Meets All Of The Following Conditions 1 The Child Had

8615 Filing Requirements And Ef Message 5292 Who Is Required To File Form 8615 How Do I Clear Ef Message 5292 According To Form 8615 Instructions Form 8615 Must Be Filed For Any Child Who Meets All Of The Following Conditions 1 The Child Had

Form 8615 Tax For Certain Children With Unearned Income

Form 8615 Tax For Certain Children With Unearned Income

4 Ways The Kiddie Tax Can Work For You And Your Family Her Wealth

4 Ways The Kiddie Tax Can Work For You And Your Family Her Wealth

Post a Comment for "Is Unemployment Unearned Income For A Child"