How Do I Calculate My Unemployment Benefits In California

How do you calculate unemployment benefits. States assign your business a SUTA tax rate based on industry and history of former employees filing for unemployment benefits.

29 Free Payroll Templates Payroll Template Payroll Checks Statement Template

29 Free Payroll Templates Payroll Template Payroll Checks Statement Template

List your total wages in the last 4 quarters in which you worked.

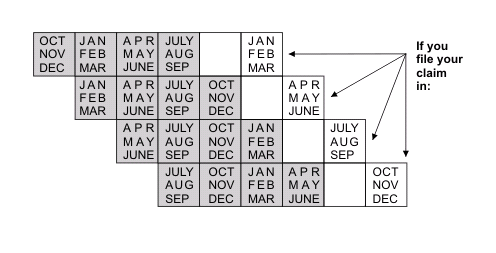

How do i calculate my unemployment benefits in california. This affects which quarterly earnings are considered as your base period see below when calculating your WBA. Confirm your claim start date. You have 10 days from the mailing date to contact EDD if something was.

This details your weekly benefit amount and the maximum amount of your claim based on past wages reported by employers. Enter the date that you filed your claim or will file your claim for unemployment PFL or DI. To calculate your reduced benefit you subtract 25 of your wages then subtract that amount from your maximum benefit.

The Unemployment Insurance UI benefit calculator will provide you with an estimate of your weekly UI benefit amount which can range from 40 to 450 per week. For more information refer to How Unemployment Insurance Benefits Are Computed PDF or the Unemployment Insurance Benefit. Your earnings during whats known as the base period will determine both your eligibility for unemployment benefits and the weekly amount youll receive.

You would earn 210 per week. Unemployment insurance benefits UI vary widely depending on the total amount of wages a person earned during the last 18 months. However there are calculators you can use to estimate your benefits.

The calendar defaults to todays date. It is based off your past earnings. Once you file your claim the EDD will verify your eligibility and wage information to determine your weekly benefit amount WBA.

The daily benefit amount is calculated by dividing your weekly benefit amount by seven. Calculating Benefit Payment Amounts. To estimate how much you might be eligible to receive add together the gross wages in the two highest quarters during that period divide by 2 and then multiply by 00385 to get your weekly benefit amount.

Weekly benefit amounts WBAs range from a minimum of 50 to a maximum of 450. 26 times your weekly benefit amount or. The weekly benefit amount is calculated by dividing the sum of the wages earned during the highest quarter of the base period by 26 rounded down to the next lower whole dollar.

The total amount of benefits potentially payable on your claim is found by taking the smaller of. Typically it amounts to around 40-50 of your typical earnings-- up to the state maximum. Calculating your weekly benefit amount Step 1.

Unfortunately theres no easy way to calculate exactly how much money youll receive through unemployment benefits or for how long youll be able to collect those benefits unless your state has an online unemployment calculator. 450 minus 75 of 320 240 210. The maximum benefit amount is calculated by multiplying your weekly benefit amount by 52 or adding the total wages subject to State Disability Insurance SDI tax paid in your base period whichever is less.

The base period is usually the earliest four of the five full calendar quarters that come before you filed your claim. How Your Weekly Benefit Amount is Calculated. California will usually consider your claim effective as of Sunday of the same week that you file.

Find your base period. They also have a handle benefits calculator here. This calculator uses the average weekly state benefit amount reported by the Department of Labor from Jan.

Unemployment takes place at the state level and each state has there own formula for determining unemployment. The benefits are paid weekly and can be estimated using Californias online UI calculator. 2020 to calculate total unemployment.

Traditional federal and state unemployment benefits are considered income for Covered California Medi-Cal and CHIP and you should include it in the income you report while using the. In addition to state benefits if you are eligible for PUA you will receive an additional 600 per week under the CARES Act. New companies usually face a.

Each state has a different rate and benefits vary based on your earnings record and the. It is based off your past earnings. How California Calculates Unemployment Benefit Amounts.

Esdwagov Calculate Your Benefit

Esdwagov Calculate Your Benefit

How To Calculate California Unemployment How Much Will You Get

How To Calculate California Unemployment How Much Will You Get

Calculating Paid Family Leave Benefit Payment Amounts

Calculating Paid Family Leave Benefit Payment Amounts

How To Calculate California Unemployment How Much Will You Get

How To Calculate California Unemployment How Much Will You Get

Calculating Your Sdi And Pfl Amount Updated Info Tales From A Type A Mom

Calculating Your Sdi And Pfl Amount Updated Info Tales From A Type A Mom

Enhanced Unemployment Benefits During The Coronavirus Crisis Smartasset

Enhanced Unemployment Benefits During The Coronavirus Crisis Smartasset

How To Calculate Texas Unemployment Benefits 7 Steps

How To Calculate Texas Unemployment Benefits 7 Steps

Missouri Mo Child Custody Agreement Create Schedule Document Modify Ca Chil Child Support Quotes Tru Child Custody Child Support Quotes Custody Agreement

Missouri Mo Child Custody Agreement Create Schedule Document Modify Ca Chil Child Support Quotes Tru Child Custody Child Support Quotes Custody Agreement

How To Calculate California Unemployment How Much Will You Get

How To Calculate California Unemployment How Much Will You Get

Unemployment Benefits And The Cares Act Bench Accounting

Unemployment Benefits And The Cares Act Bench Accounting

Calculate Child Support Payments Child Support Calculator Child Support Payme Child Support Calcula Child Support Payments Child Support Child Support Laws

Calculate Child Support Payments Child Support Calculator Child Support Payme Child Support Calcula Child Support Payments Child Support Child Support Laws

How To Calculate California Unemployment How Much Will You Get

How To Calculate California Unemployment How Much Will You Get

Workers Compensation Cost Calculator Embroker

Workers Compensation Cost Calculator Embroker

How Unemployment Benefits Are Calculated By State Bench Accounting

How Unemployment Benefits Are Calculated By State Bench Accounting

Unemployment Benefits Archives Fileunemployment Org

Unemployment Benefits Archives Fileunemployment Org

Base Period Calculator Determine Your Base Period For Ui Benefits

Base Period Calculator Determine Your Base Period For Ui Benefits

Understanding And Calculating Partial Unemployment Benefits In California Employers Group

Understanding And Calculating Partial Unemployment Benefits In California Employers Group

How To Calculate California Unemployment How Much Will You Get

How To Calculate California Unemployment How Much Will You Get

Post a Comment for "How Do I Calculate My Unemployment Benefits In California"