Georgia Unemployment Tax Calculator

Calculation of Weekly Benefit Amounts In Georgia as of July 2019 the minimum weekly benefit is 55 and the weekly maximum is 365. Use Ad Valorem Tax Calculator The Ad Valorem calculator can also estimate the tax due if you transfer your vehicle to Georgia from another state.

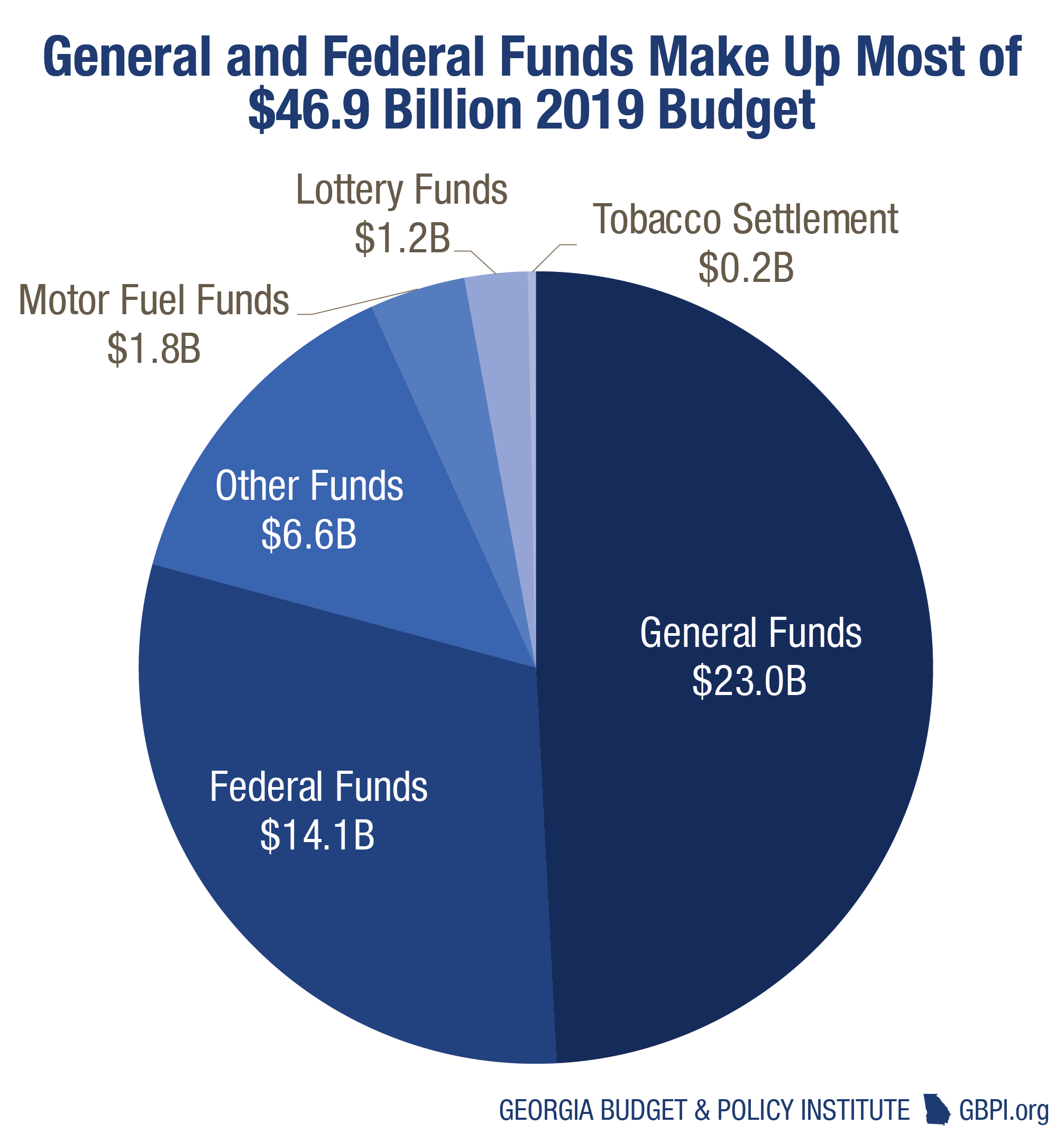

Georgia State Budget Overview For Fiscal Year 2019 Georgia Budget And Policy Institute

Georgia State Budget Overview For Fiscal Year 2019 Georgia Budget And Policy Institute

Unemployment compensation is taxable income and must be reported each year even if you have repaid some or all of the benefits received.

Georgia unemployment tax calculator. Only employers are responsible for paying the FUTA tax not employees. Alaska New Jersey and Pennsylvania collect. Report UI Fraud Report suspected cases of unemployment benefit fraud identity theft job.

Overview of Georgia Taxes Georgia has a progressive income tax system with six tax brackets that range from 100 up to 575. Arizona taxes unemployment compensation to the same extent as it is taxed under federal law. Georgia Unemployment Insurance UI program information.

Annual Tax and Wage Report For Domestic Employment - DOL 4A 8748 KB Annual tax and wage report which domestic employers must file. Information for tax year 2020 is now available. We created this calculator to aid you evaluate what you might obtain if you are entitled.

Unemployment benefits must be reported on your federal tax return. If you received unemployment benefits as well as the additional 600 per week in coronavirus relief any time during the year your tax return may be affected. UI claims filed by employers for full-time employees who work less than full-time.

Georgia Weekly Benefit Amount Calculator. State Taxes on Unemployment Benefits. We make no promises that the sum you receive will be equal to what the calculator illustrates.

Georgia Unemployment Calculator Calculate your projected benefit by filling quarterly wages earned below. The annual report and any payment due must be filed on or before January 31st of the following year. Unemployment Insurance related online services for Individuals.

File Tax and Wage Reports and Make Payments. Learn About Unemployment Taxes and Benefits. This form is for employers who voluntarily elect in lieu of contributions to reimburse the Georgia Department of Labor for benefit payments made based on wages paid by the employing unit as provided under Paragraph b of OCGA 34-8-158 of Georgia Employment Security Law.

Through the State Unemployment Tax Act SUTA states levy a payroll tax on employers to fund the majority of their unemployment benefit programs. The good news is that up to 10200 of those benefits received in 2020 are tax-free thanks to the American Rescue Plan Act of 2021. The 1099-G form is used to report taxable benefits when filing with the IRS for anyone who was paid unemployment benefits or Alternative Trade Adjustment.

For more information about COVID-19 in Georgia please visit our resource page or call the Georgia COVID-19 hotline at 844-442-2681. Calculate FUTA Unemployment Tax which is 6 of the first 7000 of each employees taxable income. This calculator uses the average weekly state benefit amount reported by the Department of Labor from Jan.

The Georgia Employer Status Report is necessary to establish an unemployment insurance tax account in Georgia. Your WBA is usually the sum of your two highest-earning quarters divided by 42. File Partial Unemployment Insurance Claims.

Results Estimated Weekly Benefit Rate WBA The calculator returns your estimated WBA based on your average weekly wage during the base period. A record number of Americans are applying for unemployment compensation due to the COVID-19 Outbreak. Quarterly tax wage report and payment information for employers.

The base period includes the first four of the last five calendar quarters completed when the applicant files a claim. An applicants weekly benefit amount depends on wages earned during the base period. That represents a lot of Americans who will find themselves grappling with taxes on their unemployment benefits when the filing season rolls around in 2021 for 2020 tax returns.

2020 to calculate total unemployment. The state of Georgia is automatically extending the 2020 individual income tax filing and payment deadline from April 15 2021 to May 17 2021 without penalties or interest. Learn About Unemployment Taxes and Benefits - Related Links.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Note that if you pay state unemployment taxes in full and on time you are eligible for a tax credit of up to 54 which brings your effective FUTA tax rate to 06.

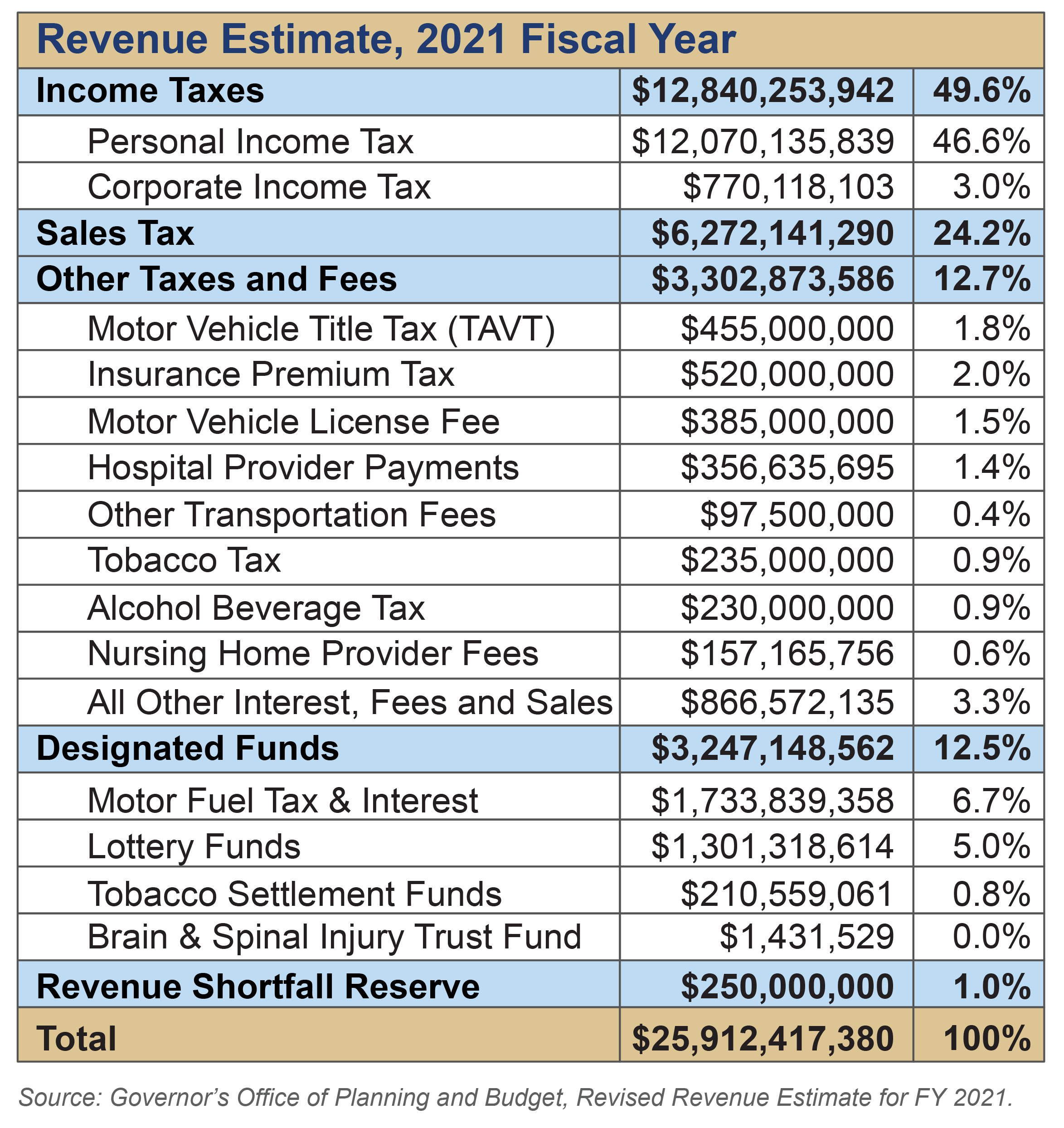

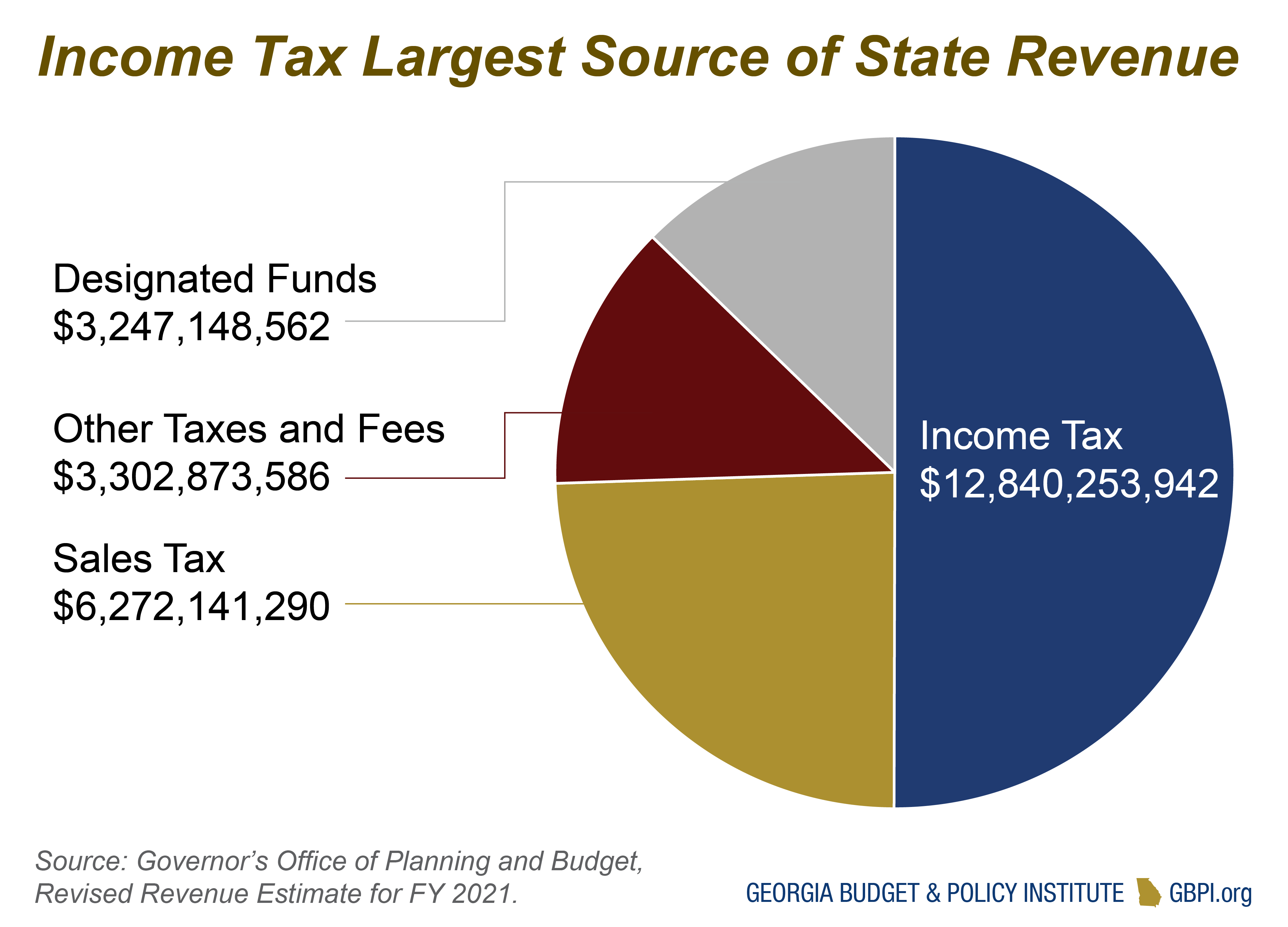

Georgia Revenue Primer For State Fiscal Year 2021 Georgia Budget And Policy Institute

Georgia Revenue Primer For State Fiscal Year 2021 Georgia Budget And Policy Institute

Georgia Unemployment Calculator Fileunemployment Org

Georgia Unemployment Calculator Fileunemployment Org

How To Calculate Child Support In Georgia 2018 How Much Payments

How To Calculate Child Support In Georgia 2018 How Much Payments

Georgia State Budget Overview For Fiscal Year 2019 Georgia Budget And Policy Institute

Georgia State Budget Overview For Fiscal Year 2019 Georgia Budget And Policy Institute

State By State Guide To Taxes On Retirees Kiplinger Retirement Locations Income Tax Retirement Planning

State By State Guide To Taxes On Retirees Kiplinger Retirement Locations Income Tax Retirement Planning

Georgia State Budget Overview For Fiscal Year 2019 Georgia Budget And Policy Institute

Georgia State Budget Overview For Fiscal Year 2019 Georgia Budget And Policy Institute

23 States Change Unemployment Insurance Taxable Wage Base For 2019 501 C Agencies Trust

23 States Change Unemployment Insurance Taxable Wage Base For 2019 501 C Agencies Trust

The Cheapest Car Insurance In The Uk Is Just 270 On Average But Motorists Are Seeing A Rise In How M Cheap Car Insurance Car Insurance Affordable Car Insurance

The Cheapest Car Insurance In The Uk Is Just 270 On Average But Motorists Are Seeing A Rise In How M Cheap Car Insurance Car Insurance Affordable Car Insurance

Georgia Food Stamps Income Limit 2021 Georgia Food Stamps Help

Georgia Food Stamps Income Limit 2021 Georgia Food Stamps Help

Georgia Revenue Primer For State Fiscal Year 2021 Georgia Budget And Policy Institute

Georgia Revenue Primer For State Fiscal Year 2021 Georgia Budget And Policy Institute

Unemployment Benefits For The Jobless

Unemployment Benefits For The Jobless

Georgia Food Stamps Income Limit 2021 Georgia Food Stamps Help

Georgia Food Stamps Income Limit 2021 Georgia Food Stamps Help

Georgia Paycheck Calculator Smartasset

Georgia Paycheck Calculator Smartasset

Unemployment Benefits Comparison By State Fileunemployment Org

Unemployment Benefits Comparison By State Fileunemployment Org

Georgia Paycheck Calculator Smartasset

Georgia Paycheck Calculator Smartasset

Georgia State Budget Overview For Fiscal Year 2019 Georgia Budget And Policy Institute

Georgia State Budget Overview For Fiscal Year 2019 Georgia Budget And Policy Institute

Post a Comment for "Georgia Unemployment Tax Calculator"