Can U File Unemployment If You Are Self Employed

On March 11 federal law extended Pandemic Unemployment Assistance PUA benefits until Sept. As of Jan.

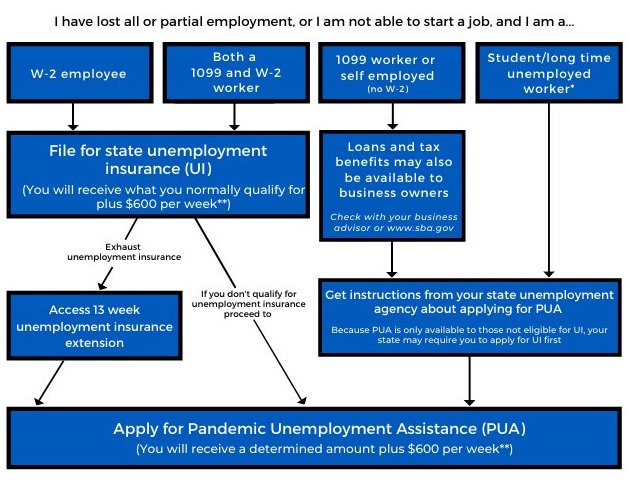

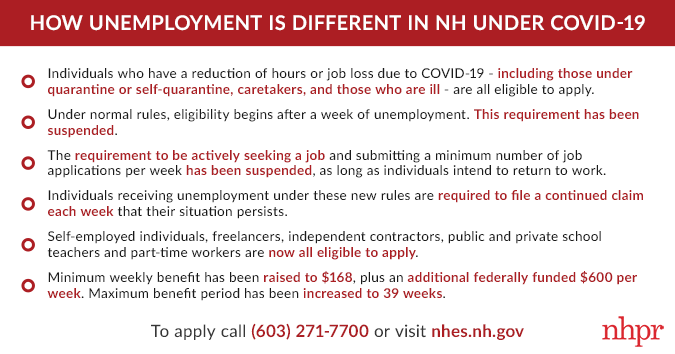

Not eligible for unemployment benefits in any state including self-employed workers independent workers gig workers otherwise able and available to work except that they are unemployed partially unemployed or unable or unavailable to work due to a COVID-19 qualifying reason and.

Can u file unemployment if you are self employed. You may be ineligible for benefits if you are self-employed setting up a business or have ownership interest in a business. If you are self-employed an independent contractor or a farmer you may now be eligible and can file for benefits online. If you are self-employed or a 1099 then you likely cannot use your PPP funds to pay yourself and continue to collect unemploymentbecause the payment you make to yourself counts as income which in most cases will disqualify you from continuing to receive unemployment.

In this article we cover the types of self-employment you may identify as along with several available financial support programs for collecting unemployment when youre self-employed. How self-employed can file for unemployment insurance benefits This video tutorial shows how self-employed individuals can apply for unemployment insurance benefits under the CARES Act COVID-19. Youll typically file in the state where you worked.

If youre one of the millions of Americans who are out of a job as a result of the coronavirus crisis you can apply for unemployment insurance. You can search for a states unemployment. But if you live in one state and work in one or more other states your home states unemployment agency should be able to guide you on how to file.

Self-employed individuals filing unemployment claims should indicate none when asked for states in which they have worked unless they have worked for an employer in the last 18 months. If youre self-employed and seeking unemployment benefits during the pandemic youll need to file a claim with your state unemployment office. New applicants have 21 days to.

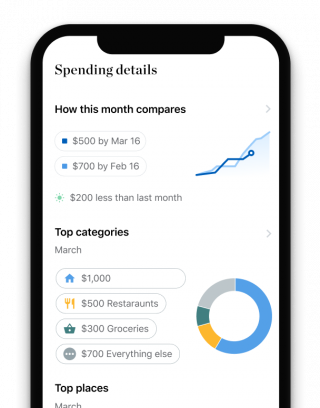

The amount of financial help varies. For instance with new plans like disaster relief funds and other unemployment aid becoming available you. Disaster Unemployment Assistance DUA provides unemployment benefits for individuals who lost their jobs or self-employment or who are no longer working as a direct result of a major disaster for which a disaster assistance period is declared and who applied but.

Self-Employment During the Base Year Services performed in self-employment do not qualify as base year employment and will not be used to establish financial eligibility for benefits. The minimum benefit rate is 50 of the average weekly benefit amount available in your. The amount you recieve is based on your previous income and may vary based on where you live and your benefit guidelines.

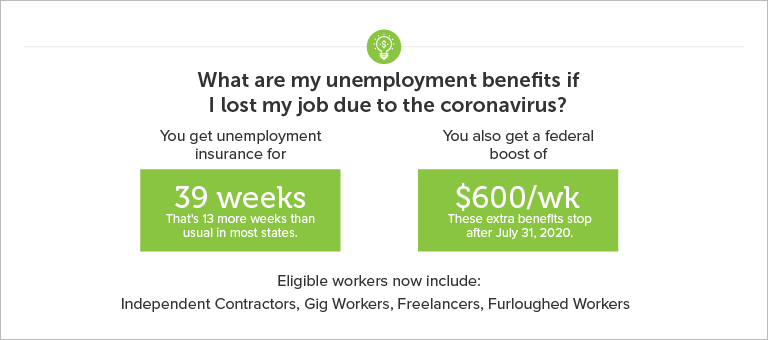

31 2021 you need to provide proof of prior employment including self-employment in order to receive federal unemployment benefits. Traditionally self-employed professionals are ineligible for unemployment benefits because they generally do not make contributions to the unemployment taxes that these benefits come from. Under the 2 trillion Coronavirus Aid Relief and Economic Security or CARES Act self-employed workers now qualify for 600 in weekly Pandemic Unemployment Assistance PUA.

If youre a self-employed worker whos lost income in this crisis you may now qualify for unemployment benefits. With new unemployment and relief benefits for self-employed professionals under the CARES Act you may be eligible to apply for unemployment benefits. Millions of workers who self-employed freelancers or independent contractors are qualified for a new unemployment program set up under the.

This Pandemic Unemployment Assistance or PUA provides up to 39 weeks of benefits to qualifying individuals who are unable to work due to. Provide unemployment benefits to self-employed workers who dont traditionally qualify. But if you have a side business or are.

With the recent introduction of new unemployment and relief benefits for self-employed professionals though your eligibility may change.

Filing For Coronavirus Unemployment If You Re Self Employed Nerdwallet

Filing For Coronavirus Unemployment If You Re Self Employed Nerdwallet

Government Benefits Retail Wholesale And Department Store Union

Government Benefits Retail Wholesale And Department Store Union

New Irs Form For Self Employed To Track And Claim Covid 19 Sick And Family Leave Tax Credits Cpa Practice Advisor

New Irs Form For Self Employed To Track And Claim Covid 19 Sick And Family Leave Tax Credits Cpa Practice Advisor

Here Are Key Tax Due Dates If You Are Self Employed Forbes Advisor

Here Are Key Tax Due Dates If You Are Self Employed Forbes Advisor

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

Enhanced Unemployment Benefits During The Coronavirus Crisis Smartasset

Enhanced Unemployment Benefits During The Coronavirus Crisis Smartasset

Https Unemployment Ohio Gov Pdf New Workers Self Service User Guide Pdf

Unemployed Contractors Self Employed Virginians Can Now File Weekly Claims Through Gov2go App Youtube

Unemployed Contractors Self Employed Virginians Can Now File Weekly Claims Through Gov2go App Youtube

Can I Get Unemployment If I M Self Employed Credit Karma

Can I Get Unemployment If I M Self Employed Credit Karma

Unemployment Benefits Workforce Solutions

Unemployment Benefits Workforce Solutions

Covid 19 Resources American Federation Of Musicians

Covid 19 Resources American Federation Of Musicians

Filing For Coronavirus Unemployment If You Re Self Employed Nerdwallet

Filing For Coronavirus Unemployment If You Re Self Employed Nerdwallet

Des Covid 19 Information For Individuals

Des Covid 19 Information For Individuals

Help For Self Employed Coronavirus Relief For Self Employed Individuals

Help For Self Employed Coronavirus Relief For Self Employed Individuals

As Unemployment Surges In N H An Update On Changes To Benefits New Hampshire Public Radio

As Unemployment Surges In N H An Update On Changes To Benefits New Hampshire Public Radio

Self Employed How To Claim 600 Week Unemployment Youtube

Self Employed How To Claim 600 Week Unemployment Youtube

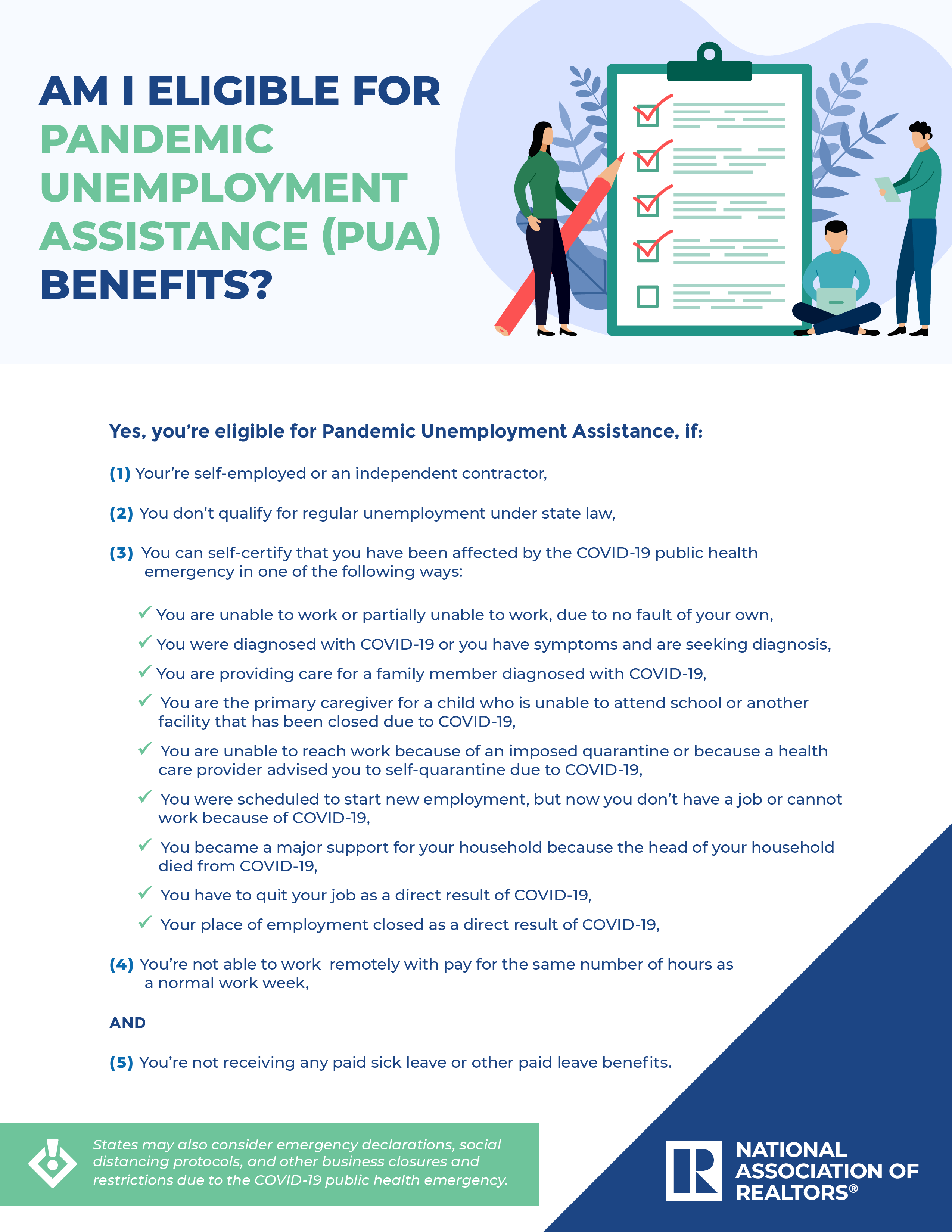

Pandemic Unemployment Assistance Pua Benefits Checklist

Pandemic Unemployment Assistance Pua Benefits Checklist

Frequently Asked Questions About Unemployment Benefits For The Self Employed Cares Act Nav

Frequently Asked Questions About Unemployment Benefits For The Self Employed Cares Act Nav

Https Www Louisianaworks Net Hire Admin Gsipub Htmlarea Uploads Pandemic Unemployment Assistance Pua Portal Claimants Guide Pdf

Post a Comment for "Can U File Unemployment If You Are Self Employed"