Unemployment Taxes Covid Relief

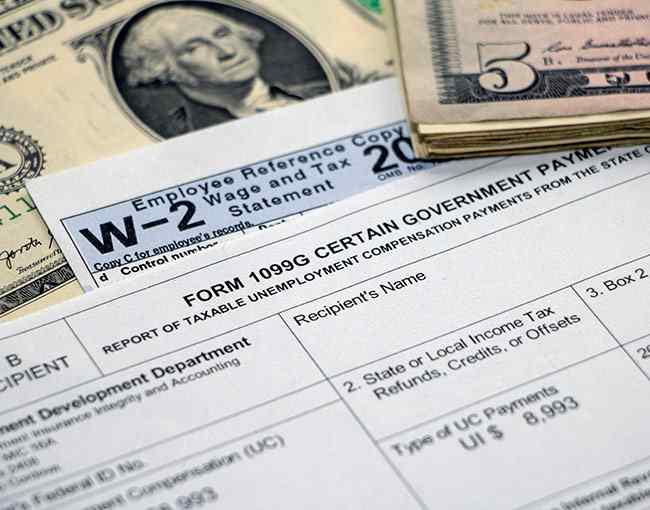

On Saturday the Senate passed a version of the Covid bill that included a provision to waive taxes on the first 10200 in unemployment insurance benefits. To use EAMS or EAMS for Single Filers you will need to be sure to set up your online account in advance.

Supplemental Unemployment Benefit Plans A Tool For Employers Responding To The Covid 19 Crisis

Supplemental Unemployment Benefit Plans A Tool For Employers Responding To The Covid 19 Crisis

The American Rescue Plan -- the sweeping 19 trillion coronavirus relief.

Unemployment taxes covid relief. State Department of Revenue COVID-19 Relief Information. American Rescue Plan Act of 2021 Were reviewing the tax provisions of the American Rescue Plan Act of 2021 signed into law on March 11 2021. The American Rescue Plan passed last month included a tax relief provision that waives taxes on up to 10200 of unemployment benefits meaning more.

Currently more than 22 million people are collecting unemployment benefits much of which is a direct result of the country shutdown. Use Employer Account Management Services EAMS or EAMS for Single Filers to file your tax reports or tax and wage reports online. Get details in this announcement.

Internal Revenue Service announcement. For filing tax reports or tax and wage reports online. Married couples who.

8 hours agoCHARLOTTE NC. Filing a 2020 tax return will also give the IRS the information it needs to send you the third. The new coronavirus relief bill exempts unemployment income at the federal level.

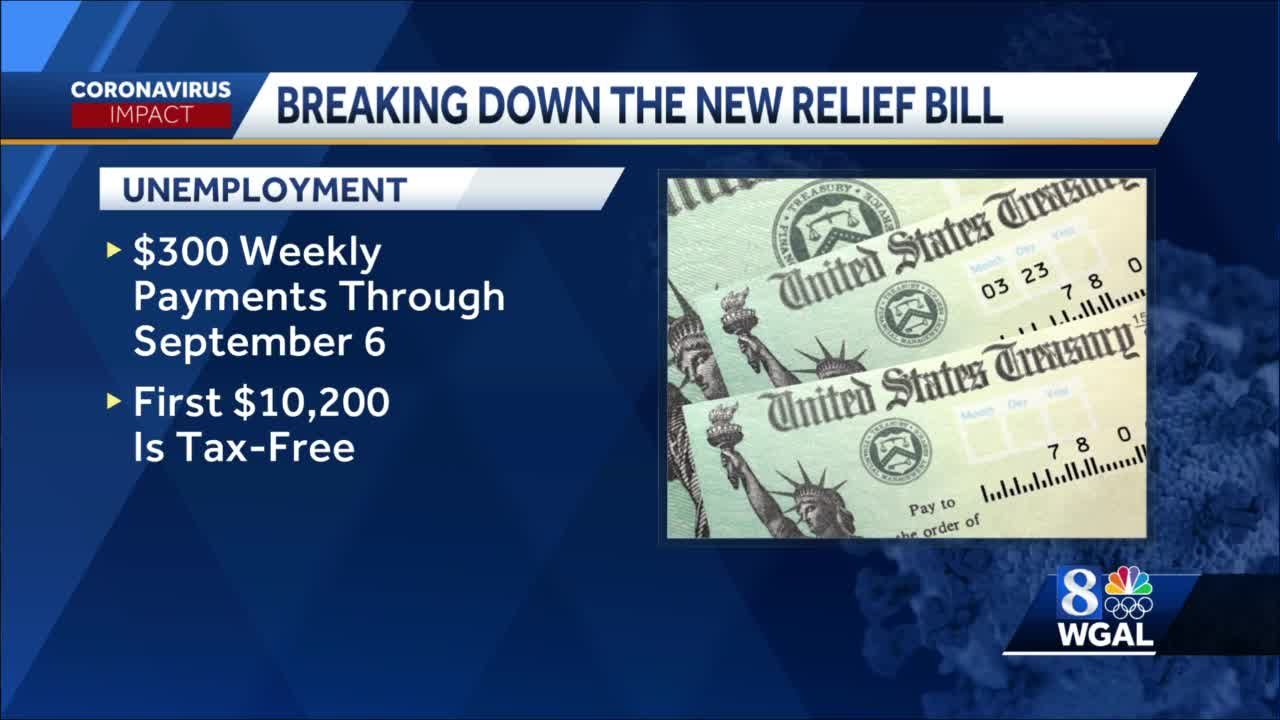

In addition to extending federal 300 unemployment benefits through September the American Rescue Plan allows tax exemptions for up to 10200 in unemployment benefits paid in 2020. If you havent received the first and second COVID-19 stimulus payments or havent claimed the full amount for which you are eligible you must file a 2020 tax return and claim the Recovery Rebate Credit in order to claim those payments. If your modified adjusted gross income AGI is less than 150000 the American Rescue Plan enacted on March 11 2021 excludes from income up to 10200 of unemployment compensation paid in 2020 which means you dont have to pay tax on unemployment compensation of up to 10200.

The tax break isnt available to those who earned 150000 or more. The first 10200 of your unemployment income may now be tax-free based on the recently passed American Rescue Plan. For paying unemployment taxes.

You may use either EAMS or ePay to pay your taxes. If youve already filed you dont need. The deadlines for individuals to file and pay most federal income taxes are extended to May 17 2021.

COVID-19 Unemployment Benefits and Your Taxes Income Personal Finance Tax Planning Taxes The economic downturn of the coronavirus pandemic that struck back in March left millions of Americans without jobs. If you are married each spouse receiving unemployment compensation doesnt have to pay tax on unemployment compensation. The American Rescue Plan waives federal tax on up to 10200 of unemployment benefits per person in 2020.

Latest Updates on Coronavirus Tax Relief Tax Deadlines Changed. The American Rescue Plan the sweeping 19 trillion coronavirus relief bill that was signed into law in mid-March came with a host of provisions designed to. A new provision waives federal taxes on the first 10200 of unemployment benefits you received in 2020.

States are a different story. The federal Internal Revenue Service has announced an extension of the April 15 tax filing and payment deadline to July 15 regardless of the amount owed. Married couples who file jointly and both collected unemployment insurance benefits.

Help For Self Employed Coronavirus Relief For Self Employed Individuals

Help For Self Employed Coronavirus Relief For Self Employed Individuals

Lawmakers Urge Democratic Leaders To Waive Taxes On Jobless Benefits In Covid Relief Bill

Lawmakers Urge Democratic Leaders To Waive Taxes On Jobless Benefits In Covid Relief Bill

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

Covid 19 And Taxes New Evidence Exposes Unemployment Relief Fraudsters Npr

Covid 19 And Taxes New Evidence Exposes Unemployment Relief Fraudsters Npr

Iowa Rep Cindy Axne Introduces Covid Unemployment Tax Relief Bill Kgan

Iowa Rep Cindy Axne Introduces Covid Unemployment Tax Relief Bill Kgan

States Are Telling Some People To Pay Back Unemployment Benefits Marketplace

States Are Telling Some People To Pay Back Unemployment Benefits Marketplace

Governor Larry Hogan Official Website For The Governor Of Maryland

Governor Larry Hogan Official Website For The Governor Of Maryland

Collecting Unemployment Take These Steps To Avoid A Tax Bill Next Year

Collecting Unemployment Take These Steps To Avoid A Tax Bill Next Year

Congress Wants To Waive Taxes On Unemployment Some States May Not

Congress Wants To Waive Taxes On Unemployment Some States May Not

That Extra 600 A Week In Unemployment Benefits Is Taxable Weareiowa Com

That Extra 600 A Week In Unemployment Benefits Is Taxable Weareiowa Com

Workers Who Lost Jobs In 2020 Get Unexpected 10 200 Tax Break From Federal Covid Relief Plan Cbs Chicago

Workers Who Lost Jobs In 2020 Get Unexpected 10 200 Tax Break From Federal Covid Relief Plan Cbs Chicago

Taxes 2021 Everything New Including Deadline Stimulus Payments And Unemployment Cnet

Taxes 2021 Everything New Including Deadline Stimulus Payments And Unemployment Cnet

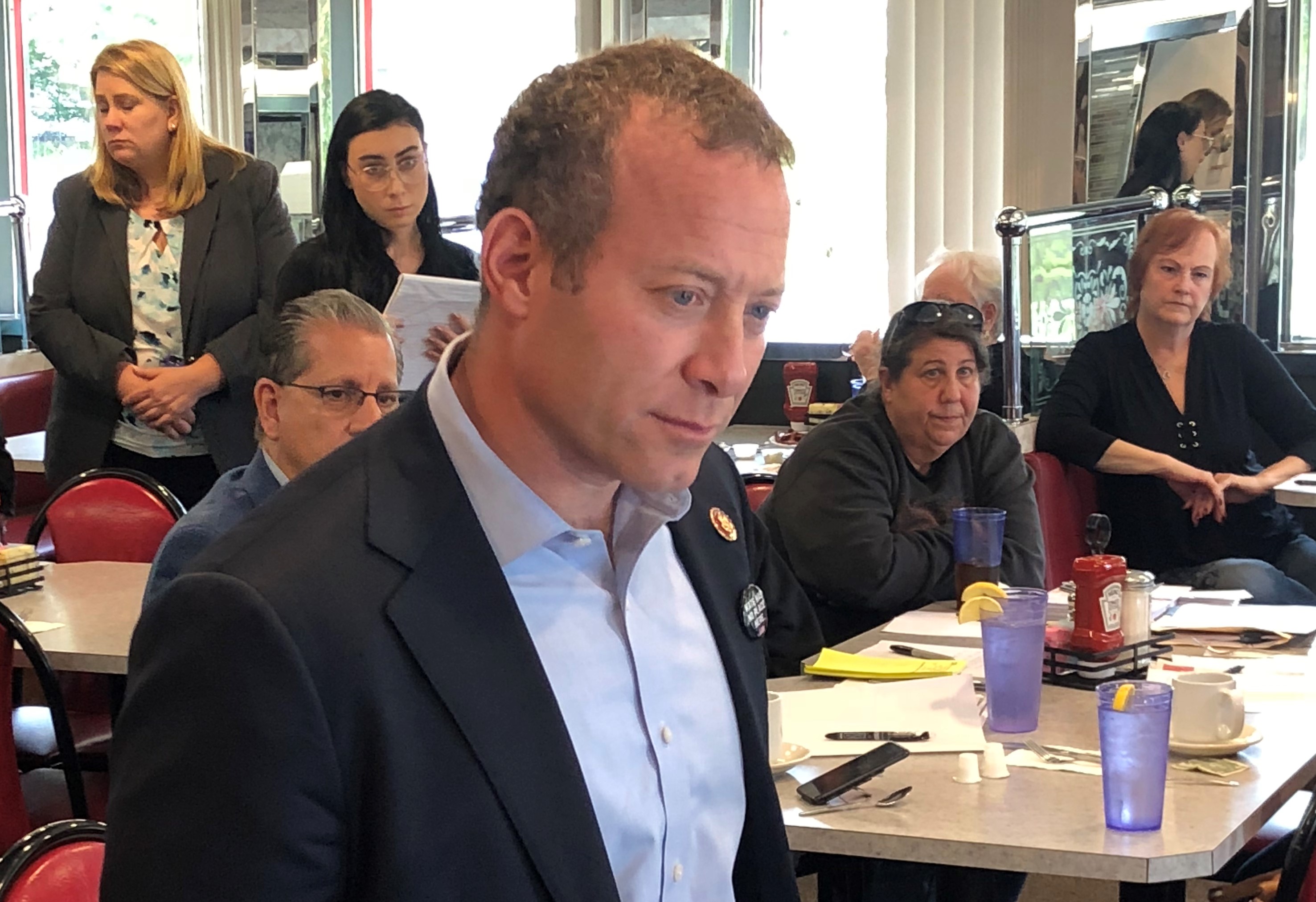

Gottheimer Urges House Leadership To Include Unemployment Tax Relief In New Covid 19 Aid Package To Help Cut Taxes For North Jersey Families Insider Nj

Gottheimer Urges House Leadership To Include Unemployment Tax Relief In New Covid 19 Aid Package To Help Cut Taxes For North Jersey Families Insider Nj

Unemployment 1 400 Stimulus Checks Extended Benefits Slated In House Covid Relief Deadline

Unemployment 1 400 Stimulus Checks Extended Benefits Slated In House Covid Relief Deadline

Enhanced Unemployment Benefits During The Coronavirus Crisis Smartasset

Enhanced Unemployment Benefits During The Coronavirus Crisis Smartasset

More Unemployment Money Included In New Covid 19 Relief Bill

More Unemployment Money Included In New Covid 19 Relief Bill

Covid Bill Provides Tax Waiver On Up To 10 200 Of Unemployment Benefits

Covid Bill Provides Tax Waiver On Up To 10 200 Of Unemployment Benefits

Coronavirus Covid 19 Tax Relief Taxpayer Advocate Service

Coronavirus Covid 19 Tax Relief Taxpayer Advocate Service

Federal Income Taxes Your Unemployment Benefits Oficina De Musica De Texas Oficina Del Gobernador De Texas Greg Abbott

Federal Income Taxes Your Unemployment Benefits Oficina De Musica De Texas Oficina Del Gobernador De Texas Greg Abbott

Post a Comment for "Unemployment Taxes Covid Relief"