Unemployment Tax Form Sent To Wrong Address

Effect on Other Tax Benefits Taxable unemployment benefits include the extra 600 per week that was provided by the federal government in response to the coronavirus pandemic accountant Chip Capelli of. How do I fix this.

People Now Receiving Tax Form Tied To Fake Unemployment Claims

People Now Receiving Tax Form Tied To Fake Unemployment Claims

The Statement for Recipients of Certain Government Payments 1099-G tax forms are now available for New Yorkers who received unemployment benefits in calendar year 2020.

Unemployment tax form sent to wrong address. Visit Ask EDD and select the Form 1099G category or call 1-866-401-2849 during regular business hours. Youll need your Personal Identification Number PIN to access your 1099-G info through the automated claims line. You must update your mailing address by updating your personal information in the BEACON portal on the Maryland Unemployment Insurance for Claimants mobile app or by contacting a Claims Agent at 667- 207-6520.

Seeing a lot of people tell others to amend their tax returns if they have already filed due to the part of the bill that makes up to 10200 in unemployment income from 2020 tax free. What is the 1099G form used for. 31 2020 you wont get a 1099G for the 2020 tax year.

All of your benefit payments were made after Dec. My w2 form was sent to an old address what should I do. Unfortunately you cant change your address if your return has already been accepted by the IRS.

It contains information about the benefit payments you. 31 2021 all individuals who received unemployment benefits in 2020 will receive an IRS Form 1099-G from the Division of Employment Security. If you believe you didnt receive your 1099-G because your address on file was incorrect please enter the correct address in the form click the update box under the address field and submit the report.

Any unemployment benefits you collected box 2 Any unemployment benefits you repaid in calendar year 2020 box 3 If you received a 1099G form and you did not file for or collect unemployment benefits please report this to us immediately this may mean you are a victim of identity theftWe will investigate if we find you are a victim of ID theft we will reissue the 1099G as soon as possible. When are the 1099-G forms mailed. WCAX - Vermont Labor Department officials remain on damage control a day after revealing a massive data breach involving tens of thousands of 1099-G unemployment tax forms sent to.

The Benefit Payment Control BPC unit is unable to update your mailing address for you. We mailed you a paper Form 1099G if you have opted into paper mailing or are a telephone filer. Postal Service will not forward the 1099-G unless they have a change of address on file.

Advice-of-rights form questionnaires about your job separation and other requests for information to determine your eligibility for benefits Unemployment Insurance Imaging PO. If your return is rejected for any reason you can go back and change the address then. I entered the wrong address on my tax forms.

The 1099-G is the tax form the department issues in January for the purposes of filing your taxes. If you moved without updating your address with us your 1099G was sent to your old address. Instead youll get a 1099G for the 2021 tax year.

You should call your employer and verify the address they have on file. They are made available by January 31st for the prior tax year. You can change your address through MyUI.

If they sent it to the wrong address update your information and have them re-send the W-2. The bill was just signed into law we have no idea what the process is going to be. Postal Service will forward the Form 1099-G if a current forwarding order is on file.

The 1099-G will detail the amount of benefits paid to you during a specific year as well as any amounts withheld and paid to the IRS. Otherwise we keep the returned Form 1099-G and automatically mail it again once you submit an address change. If you received Arizona Unemployment Insurance UI or Pandemic Unemployment Assistance PUA and you do not receive a 1099-G form by February 27 2021 please submit a report to the Department.

You must still report your unemployment compensation on your tax return even if you dont receive a Form 1099-G for some reason. If your Form 1099-G is mailed to an address other than your current address the US. We mail the 1099-G to the address we have on record as of mid-January when the forms are printed.

What is the IRS Form 1099-G for unemployment benefits. Box 19019 Olympia WA 98507-0019 Fax. If you believe the Total Payment or Tax Withheld on Form PUA-1099G is incorrect please complete the PUA-1099G Inquiry Form to report a possible discrepancy.

If you receive a Form 1099G but you did not file a claim for benefits or think that someone else filed a claim using your name address or Social Security number contact us to report fraud. If you are getting a paper check in the mail the check will be returned to the IRS and you will need to change your address with them. We sent 1099Gs to the address we have on record for each person who received unemployment benefits.

1099G form is needed to complete your state and federal tax returns if you received unemployment insurance benefits last year. For income tax purposes UC benefits including PUA are reported in the calendar year in which they are paid regardless of when the application or claim for benefits was filed. If we find you were a victim of fraud we will remove the claim from your Social Security number and send you an updated.

1099-G forms are delivered by email or mail and. This tax form provides the total amount of money you were paid in benefits from NYS DOL in 2020 as well as any adjustments or tax withholding made to your benefits.

Unemployment Benefits And Taxes Here S What To Do About Incorrect Tax Forms And Other Issues The Denver Post

Unemployment Benefits And Taxes Here S What To Do About Incorrect Tax Forms And Other Issues The Denver Post

:max_bytes(150000):strip_icc()/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

Denver Man Receives Tax Form Showing His Deceased Wife Received Unemployment Benefits

Denver Man Receives Tax Form Showing His Deceased Wife Received Unemployment Benefits

If You Receive Unemployment Benefits Expect To Receive Form 1099 G Don T Mess With Taxes

Unemployment Insurance Tax Information Rhode Island Department Of Labor And Training

Unemployment Insurance Tax Information Rhode Island Department Of Labor And Training

:max_bytes(150000):strip_icc()/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg) 10 Things You Should Know About Form 1099

10 Things You Should Know About Form 1099

People Now Receiving Tax Form Tied To Fake Unemployment Claims

People Now Receiving Tax Form Tied To Fake Unemployment Claims

Income Tax Task Cards Activity Financial Literacy Math For Kids Filing Taxes

Income Tax Task Cards Activity Financial Literacy Math For Kids Filing Taxes

What Is Irs Form W 9 Turbotax Tax Tips Videos

What Is Irs Form W 9 Turbotax Tax Tips Videos

Faqs Benefits Kansas Department Of Labor

Faqs Benefits Kansas Department Of Labor

Unemployment Taxes Are Due Expect A Form To Arrive In The Mail Kvue Com

Unemployment Taxes Are Due Expect A Form To Arrive In The Mail Kvue Com

1099 G Tax Form Why It S Important

1099 G Tax Form Why It S Important

Interest Income Form 1099 Int What Is It Do You Need It

Interest Income Form 1099 Int What Is It Do You Need It

The Differences Between Major Irs Tax Forms H R Block

The Differences Between Major Irs Tax Forms H R Block

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

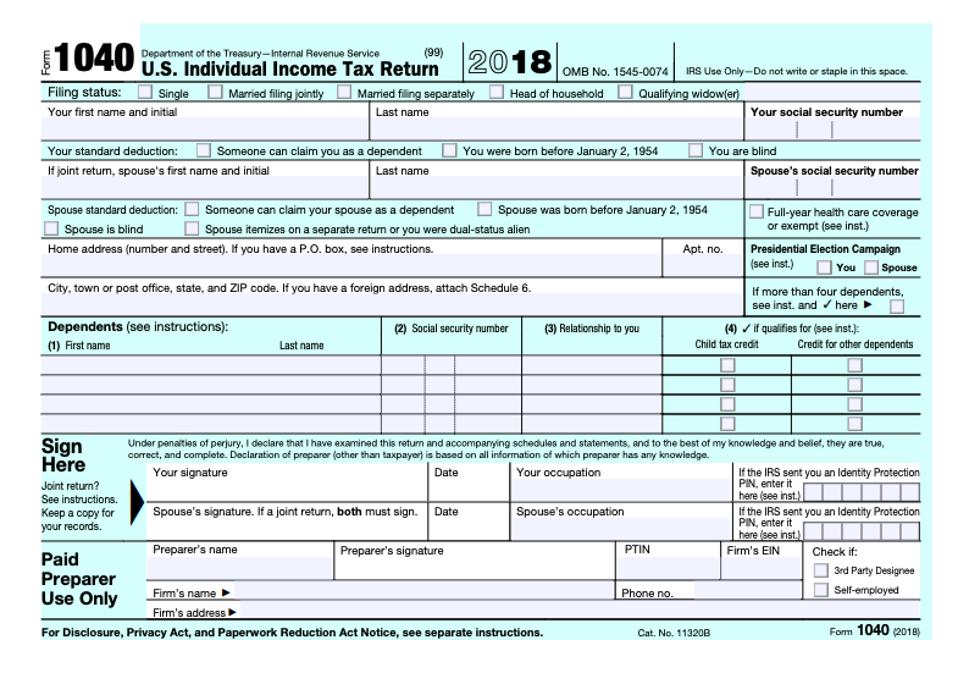

Irs Releases New Not Quite Postcard Sized Form 1040 For 2018 Plus New Schedules

Irs Releases New Not Quite Postcard Sized Form 1040 For 2018 Plus New Schedules

3 21 3 Individual Income Tax Returns Internal Revenue Service

3 21 3 Individual Income Tax Returns Internal Revenue Service

Post a Comment for "Unemployment Tax Form Sent To Wrong Address"