Ohio Unemployment Information For Employers

Ohio sets up new ways for workers employers to report unemployment benefits fraud Updated Feb 02 2021. The SOURCE State of Ohio Unemployment Resource for Claimants and Employers.

Respond To Employer Request For Separation Information Office Of Unemployment Insurance Operations Ohio Department Of Job And Family Services

Respond To Employer Request For Separation Information Office Of Unemployment Insurance Operations Ohio Department Of Job And Family Services

Ohio will soon have a new unemployment insurance system.

Ohio unemployment information for employers. The following screens are intended for the explicit use of Employers and their Representatives for the purpose of conducting Unemployment Compensation business. Employers with questions can call 614 466-2319. 4 to verify your eligibility for unemployment compensation and other public assistance benefits.

And 5 as otherwise required or permitted under applicable federal or state law including Chapter 4141 of the Ohio. Posted Feb 02 2021 The Ohio Department of Job and Family Services homepage has a place for. Federal Unemployment Tax Act FUTA tax is an employer-only tax.

Due to COVID-19 please email ALL WARNs to rapdrespjfsohiogov until further notice. It is 6 on the first 7000 each employee earns in a year meaning you will pay a maximum of 420 per employee per year. ODJFS will use your social security number 1 to report your unemployment compensation to the Internal Revenue Service as potentially taxable income.

Come Here for legislation updates and filing news. If ODJFS has been notified that your company is authorized to act on behalf of one or more employers for matters pertaining to Unemployment Compensation Benefits your company may access the accounts of those employers online. Applying online is the quickest way to start receiving unemployment benefits.

Highlighted below are two important pieces of information to help you register your business and begin reporting. Report it by calling toll-free. Whether you are an individual looking to take your career to the next level a business looking for top talent or an educator wanting to shape Ohios future curriculum for the better Ohios Top Jobs can provide you with valuable insights to help guide you along the way.

3 for statistical purposes. 1 day agoEliminating Ohios outstanding federal unemployment loan balance and shoring up the states trust fund will prevent employers from facing an estimated tax increase in 2022 of over 100 million and could save employers as much as 658 million in tax increases over a three-year period said Ohio Chamber of Commerce President and CEO Andrew E. How to Obtain an Employer Account Number.

Report it by calling toll-free. To receive your Unemployment tax account number and contribution rate immediately please visit the Employer Resource Information. Ohio Labor Market Information LMI website.

1 day agoDuring March employers added 916000 jobs the most since August and the unemployment rate declined from 62 to 6. Effective the first quarter of 2020 Ohio employers will pay state unemployment taxes on the first 9000 in actual not prorated wages paid to each of their covered employees. 1 day agoEliminating Ohios unemployment loan balance according to a statement from the Ohio Chamber of Commerce would stave off an employer tax increase in 2022 of more than 100 million and a subsequent 658 million in total tax increases over a.

Under the Ohio Unemployment Law most employers are liable to pay Unemployment taxes and report wages paid to their employees on a quarterly basis. Most employers receive a tax credit of up to 54 meaning your FUTA tax rate would be 06. 2 as a record index for processing your claim.

In February the pace of. Understanding Key Unemployment Messages. To apply online employees should go to unemploymentohiogov.

The individual your company designates as the account administrator must register. These reports and payments are used to pay benefits to unemployed workers. If employees dont have access to a computer they can apply by phone by calling 877-644-6562.

Learn about Ohio unemployment benefits from the Ohio Department of Job and Family Services. And no matter what you are looking for were confident. While registering through the OJI Employer Self-Service website if you or your third party administrator elected to receive your correspondence via e-mail you will be expected to complete the online Request for Separation Information by logging in at httpsunemploymentohiogovEmployerChoicehtml and opening the Request for Separation Information item in your Correspondence Inbox.

These taxes fund your states unemployment insurance program. Information requested for eligibility of unemployment claims is required pursuant to Ohio Revised Code Section 414120. Ohios unemployment fund has paid more than 227 million to more than 271000 claimants over the last four weeks the ODJFS said.

The information that is submitted is not open to the public. The SOURCE will provide a user-friendly. Click here for a step-by-step guide to applying online.

Payments for the first quarter of 2020 will be due April 30. Thank you to all employers who are able to file and pay their quarterly reports and taxes on time.

Pin By Brian J Boskovitch On Unoy Tetri In 2020 Activities Day Ohio

Pin By Brian J Boskovitch On Unoy Tetri In 2020 Activities Day Ohio

Pin By Brian J Boskovitch On Unoy Tetri In 2020 Activities Day Ohio

Pin By Brian J Boskovitch On Unoy Tetri In 2020 Activities Day Ohio

Https Jfs Ohio Gov Ocomm Pdf 020221 Employer Id Theft News Release Stm

Http Www Olc Org Pdf Internetfilingunemploymentcomp Pdf

Covid 19 Pandemic Information For Employers Ohiomeansjobs Summit County

Covid 19 Pandemic Information For Employers Ohiomeansjobs Summit County

Https Unemployment Ohio Gov Pdf New Workers Self Service User Guide Pdf

Https Ccao Org Wp Content Uploads Sharedwork Ohio Program And Cares Act Program Overview1 Pdf

Several Of Cincinnati S Top Employers Are In Health Services Grocery And Merchandise And Financial Services Industries Cincinnati Federal Agencies Employment

Several Of Cincinnati S Top Employers Are In Health Services Grocery And Merchandise And Financial Services Industries Cincinnati Federal Agencies Employment

Free Ohio Unemployment Compensation Labor Law Poster 2021

Free Ohio Unemployment Compensation Labor Law Poster 2021

Who In Ohio Is Qualified For Coronavirus Related Jobless Benefit Wfmj Com

Who In Ohio Is Qualified For Coronavirus Related Jobless Benefit Wfmj Com

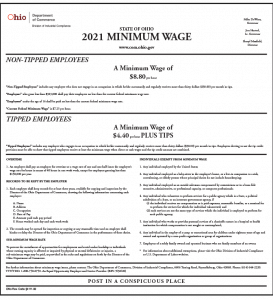

Ohio Employers It S Time To Update The Ohio 2021 Minimum Wage Posting Has Released Compliance Poster Company

Ohio Employers It S Time To Update The Ohio 2021 Minimum Wage Posting Has Released Compliance Poster Company

Https Jfs Ohio Gov Ouio Employeroutreach Employeroutreachwebinar September2019 Stm

Http Www Policymattersohio Org Wp Content Uploads 2014 11 Uc Es Pdf

Https Unemployment Ohio Gov Pdf New Workers Self Service User Guide Pdf

Jfs Ohio Unemployment Compensation Employers

Jfs Ohio Unemployment Compensation Employers

Https Unemployment Ohio Gov Pdf New Workers Self Service User Guide Pdf

Https Clients Ohiosbdc Ohio Gov Documentmaster Aspx Doc 2630

Odjfs Wants Businesses To Report Employees Who Refuse To Return To Work

Odjfs Wants Businesses To Report Employees Who Refuse To Return To Work

Post a Comment for "Ohio Unemployment Information For Employers"