Ohio Unemployment Employer Rate

If the contribution rate assigned to your enterprise is different than the tentative rate we will contact you regarding any necessary adjustments. By nearly all measures though the economy has been strengthening.

Covid 19 Unemployment Benefits Hamilton Ryker

Covid 19 Unemployment Benefits Hamilton Ryker

About Labor Force Employment Unemployment provides basic information on labor force data.

Ohio unemployment employer rate. Based on 2017 data these reports can help you understand where workers go for work where they come from and your workforce relationship with other counties. Taxable Wage Base The Taxable Wage Base is the amount of an employees wages upon which the employer is required to pay unemployment taxes each year. 1 day agoEliminating Ohios unemployment loan balance according to a statement from the Ohio Chamber of Commerce would stave off an employer tax increase in 2022 of more than 100 million and a subsequent 658 million in total tax increases over a.

1 day agoDuring March employers added 916000 jobs the most since August and the unemployment rate declined from 62 to 6. In February the pace of. Employers can learn more by going to unemploymentohiogovemployer and clicking on COVID-19 Return to Work Guidelines.

Report it by calling toll-free. Except for new employers in the construction industry who are subject to a significantly higher beginning rate. If an employers account is not eligible for an experience rating it will be assigned a standard new employer rate of 27 percent.

The taxable wage base may change from year to year. The taxable wage base for calendar year 2000 and after is 9000. Based on 2017 data these reports can help you understand where workers go for work where they come from and your workforce relationship with other counties.

The Local Area Unemployment Statistics LAUS program provides estimated labor force employment unemployment and unemployment rates for the United States Ohio metropolitan areas former economic development regions counties and selected cities. During March employers added 916000 jobs the most since August and the unemployment rate declined from 62 to 6. Worker Inflow Outflow.

The 2020 SUI taxable wage base reverts to 9000 down from 9500 for 2018 and 2019. According to the BLS current population survey CPS the unemployment rate for Ohio fell 03 percentage points in February 2021 to 50. The state unemployment rate was 12 percentage points lower than the national rate for the month.

The Ohio 2020 state unemployment insurance SUI tax rates will range from 03 to 94 up from the 2019 range of 03 to 92. Also as part of the process facts will be sought from both the employer and employee and each party will have an opportunity to appeal the decision to the Unemployment Compensation Review Commission. Effective the first quarter of 2020 Ohio employers will pay state unemployment taxes on the first 9000 in actual not prorated wages paid to each of their covered employees.

Employers with questions can call 614 466-2319. Employers state unemployment tax rates are based largely on their experience rating which is a measure of how much they have paid in taxes and been charged in benefits. Additional information about the Ohio Unemployment Tax can be obtained from our home page or by contacting the Division of Tax and Employer Service at.

Monthly forecast of employment growth for Ohio and its eight largest MSAs for the next six months. In recent years however it has been stable at 27. Suspect Fraud or Ineligibility.

The state UI tax rate for new employers also known as the standard beginning tax rate can change from one year to the next. Payments for the first quarter of 2020 will be due April 30. Report Suspected Fraud or Ineligibility.

9 rows New Employer Rate If an employers account is not eligible for an experience rate the. 1 day agoStates have struggled to clear backlogs of unemployment applications and suspected fraud has clouded the actual volume of job cuts. Report it by calling toll-free.

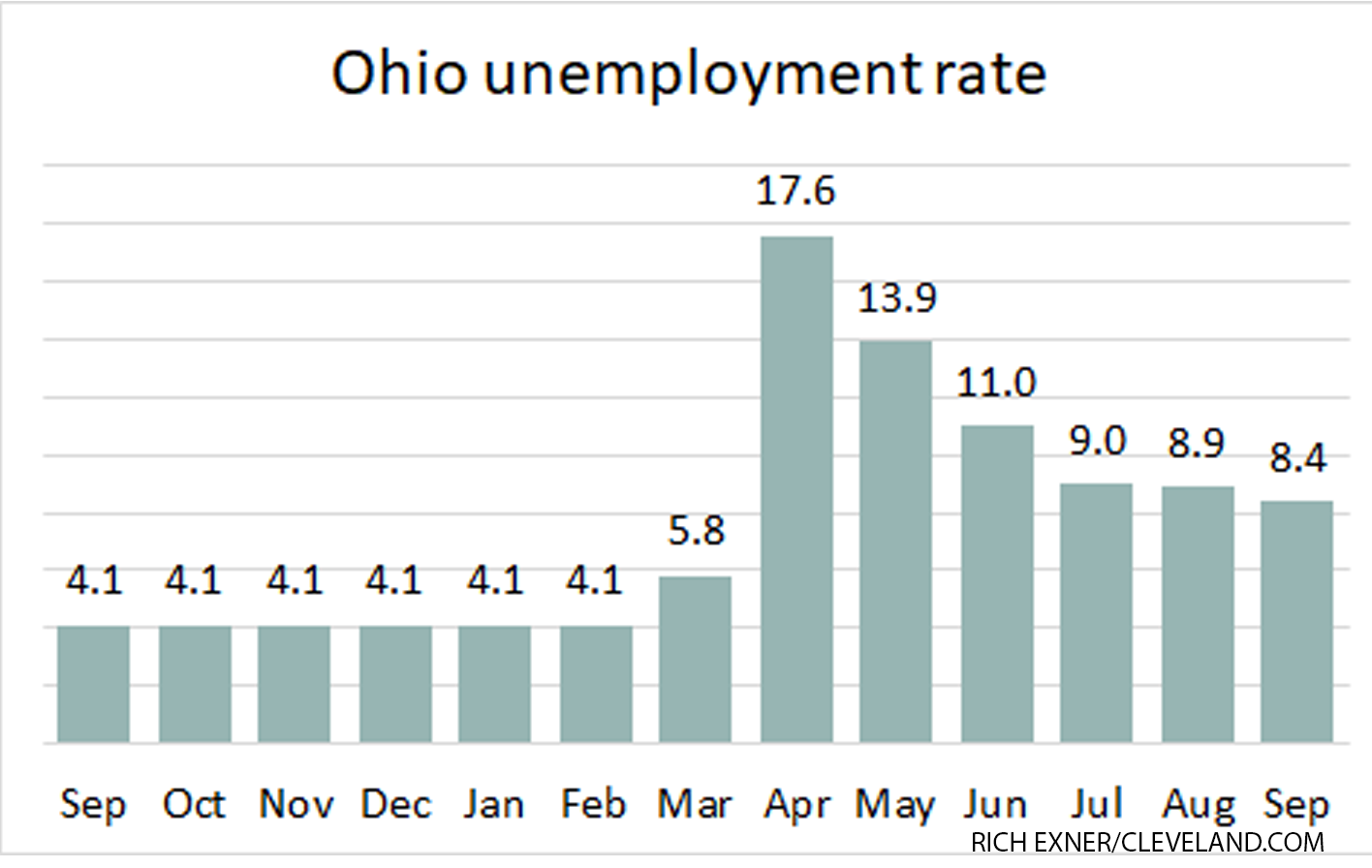

New employers except for those in the construction industry will continue to pay at 27. Monthly forecast of employment growth for Ohio and its eight largest MSAs for the next six months. The unemployment rate in Ohio peaked in April 2020 at 164 and is now 114 percentage points lower.

Worker Inflow Outflow.

Ohio S Unemployment Rate Nearly Unchanged At 8 9 For August Cleveland Com

Ohio S Unemployment Rate Nearly Unchanged At 8 9 For August Cleveland Com

Ohio S Unemployment Fund Goes Broke Today But Jobless Workers Will Still Get Aid

Ohio S Unemployment Fund Goes Broke Today But Jobless Workers Will Still Get Aid

Unemployment Benefits Comparison By State Fileunemployment Org

Unemployment Benefits Comparison By State Fileunemployment Org

Ohio S Unemployment Rate Dips To 8 4 In September Cleveland Com

Ohio S Unemployment Rate Dips To 8 4 In September Cleveland Com

In Face Of Coronavirus State Policymakers Can Bolster Unemployment Compensation System

In Face Of Coronavirus State Policymakers Can Bolster Unemployment Compensation System

Https Marketing Sedgwick Com Acton Ct 4952 P 023b Bct Ct12 0 1 D Sid Tv2 3abejyl3qts

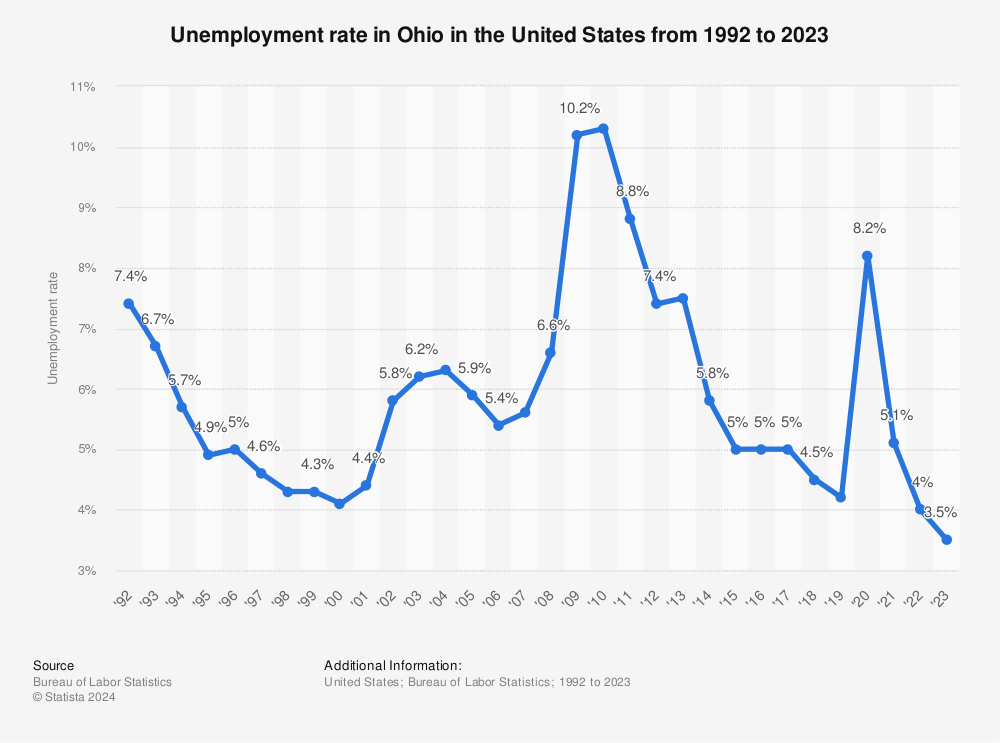

Ohio Unemployment Rate 2020 Statista

Ohio Unemployment Rate 2020 Statista

Logan County Chamber Of Commerce

Logan County Chamber Of Commerce

Odjfs Wants Businesses To Report Employees Who Refuse To Return To Work

Odjfs Wants Businesses To Report Employees Who Refuse To Return To Work

Ohio Unemployment Claims Fall But Remain Far Higher Than Normal

Ohio Unemployment Claims Fall But Remain Far Higher Than Normal

Ohio Kentucky Raise Unemployment Insurance Tax Rates On Employers Wkrc

Ohio Kentucky Raise Unemployment Insurance Tax Rates On Employers Wkrc

State Unemployment Insurance Sui Overview

State Unemployment Insurance Sui Overview

Ohio Kentucky Raise Unemployment Insurance Tax Rates On Employers Wkrc

Ohio Kentucky Raise Unemployment Insurance Tax Rates On Employers Wkrc

Https Jfs Ohio Gov Ouio Employeroutreach Employeroutreachwebinar September2019 Stm

Ohio Kentucky Raise Unemployment Insurance Tax Rates On Employers Wkrc

Ohio Kentucky Raise Unemployment Insurance Tax Rates On Employers Wkrc

Sui Sit Employment Taxes Explained Emptech Com

Sui Sit Employment Taxes Explained Emptech Com

Post a Comment for "Ohio Unemployment Employer Rate"