Ohio State Unemployment Tax Rate 2019

Oregon SUI Tax Rate. The taxable wage base for calendar year 2020 and subsequent years is 9000.

The Ohio 2022 2023 State Budget

The Ohio 2022 2023 State Budget

Date for 2019 rates.

Ohio state unemployment tax rate 2019. Payments for the first quarter of 2020 will be due April 30. Effective the first quarter of 2020 Ohio employers will pay state unemployment taxes on the first 9000 in actual not prorated wages paid to each of their covered employees. To calculate the amount of unemployment insurance tax payable TWC multiplies their amount of taxable wages by the employers tax rate.

Ohio new employer rate. 13 2019 file photo Ohio Gov. South Dakota SUI Tax Rate.

This applies to money you get through your state-administered unemployment program and the additional 600 weekly stipend some people are receiving. 1 2019 Ohios unemployment-taxable wage base is to be 9500 unchanged from 2018 the state Department of Job and Family Services said Nov. Our goal is to help make your every experience with our team and Ohios tax system a success Jeff McClain Tax Commissioner.

Unemployment taxes contributions must be paid on the first 9000 of an employees wages per year. Starting in 2021 Proposition 208 approved by. Employers with questions can call 614 466-2319.

17 hours agoIn this Dec. Oklahoma SUI Tax Rate. However new construction employers will pay a rate of 58 59 in 2019.

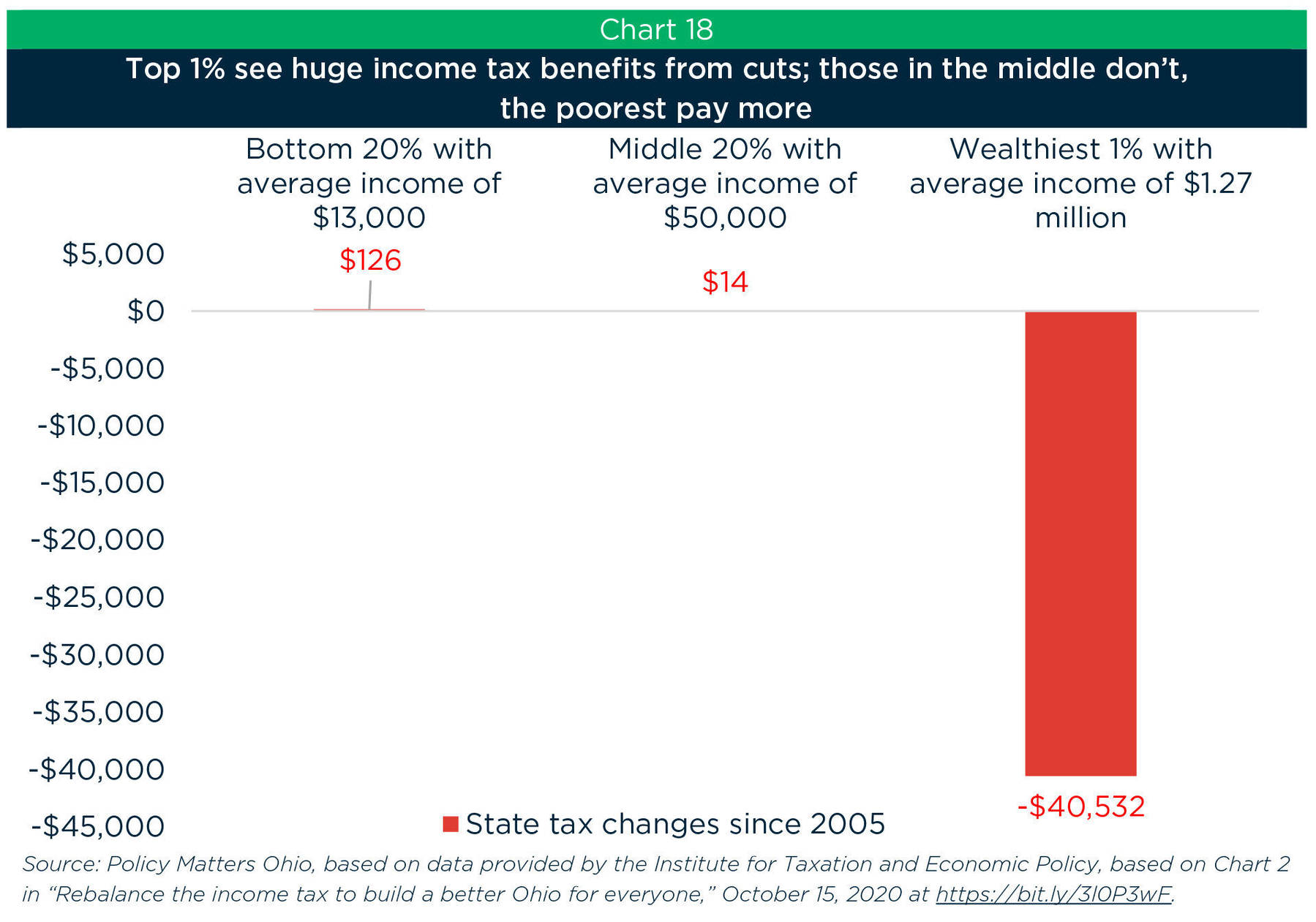

Unemployment tax rates for experienced employers are to range from 03 percent to 92 percent in 2019 compared with 03 percent to 9 percent for 2018. Changes in how unemployment benefits are taxed for tax year 2020. The Ohio 2020 state unemployment insurance SUI tax rates will range from 03 to 94 up from the 2019 range of 03 to 92.

326016 4413 of excess over 110650. The new employer rate will remain at 27. Ohio State Unemployment Insurance SUI Ohio Wage Base.

Ohio SUI Tax Rate. To check on your refund pay your taxes or file online visit TaxOhiogov. Of Jobs and Family Services said that the rates for experienced employers will range from 03 to 94 in 2020 from 03 to 92 in 2019.

94603 3326 of excess over 44250. The MSL tax revenue is split equally between the mutualized account and the employers account18 What happens if Ohios Unemployment Compensation Fund is unable to pay benefits. 45 on 327263 and over of taxable income for married joint filers and 163632 and over for single filers.

03 - 90. South Carolina SUI Tax Rate. Unemployment Benefits for Tax Year 2020.

The maximum amount of taxable wages per employee per calendar year is set by statute and is currently 9000. 03 to 92 for 2019. If an employers account is not eligible for an experience rate the account will be assigned a standard new employer rate of 27 unless the employer is engaged in the construction industry in which case the 2017 rate is 62 the 2018 rate is 60 the 2019 rate is 59.

New employers except for those in the construction industry will continue to pay at 27. The taxable wage base for calendar years 2018 and 2019 is 9500. Ohio SUI Rates range from.

Ohio new construction employer rate. 31618 2850 of excess over 22150. Despite all the features designed to.

New construction employers will pay at 58 for 2020 down from 59 for 2019. As a result there has been an across-the-board MSL tax increase for 2019 to help rebuild the Fund. 241612 3802 of excess over 88450.

52 rows SUI tax rate by state. An employers tax rate determines how much the employer pays in state Unemployment Insurance taxes. Pennsylvania SUI Tax Rate.

DeWine on Thursday proposed using some of Ohio. Our state and local governments and the tax practitioners in Ohio. 5 on its website.

Here is a list of the non-construction new employer tax. 2020 unemployment tax rates have been announced. Mike DeWine speaks during an interview at the Governors Residence in Columbus Ohio.

Rhode Island SUI Tax Rate. Ohio income tax update. Ohio 2019 Tax Rates.

Tennessee SUI Tax Rate. The taxable wage base may change from year to year. Complete list of Ohio local taxes.

The 2020 SUI taxable wage base reverts to 9000 down from 9500 for 2018 and 2019. The Ohio Department of Taxation will help you find answers to questions about Ohio income taxes including who needs to file a return how and when to file finding the right tax forms and information about Ohios sales tax holiday.

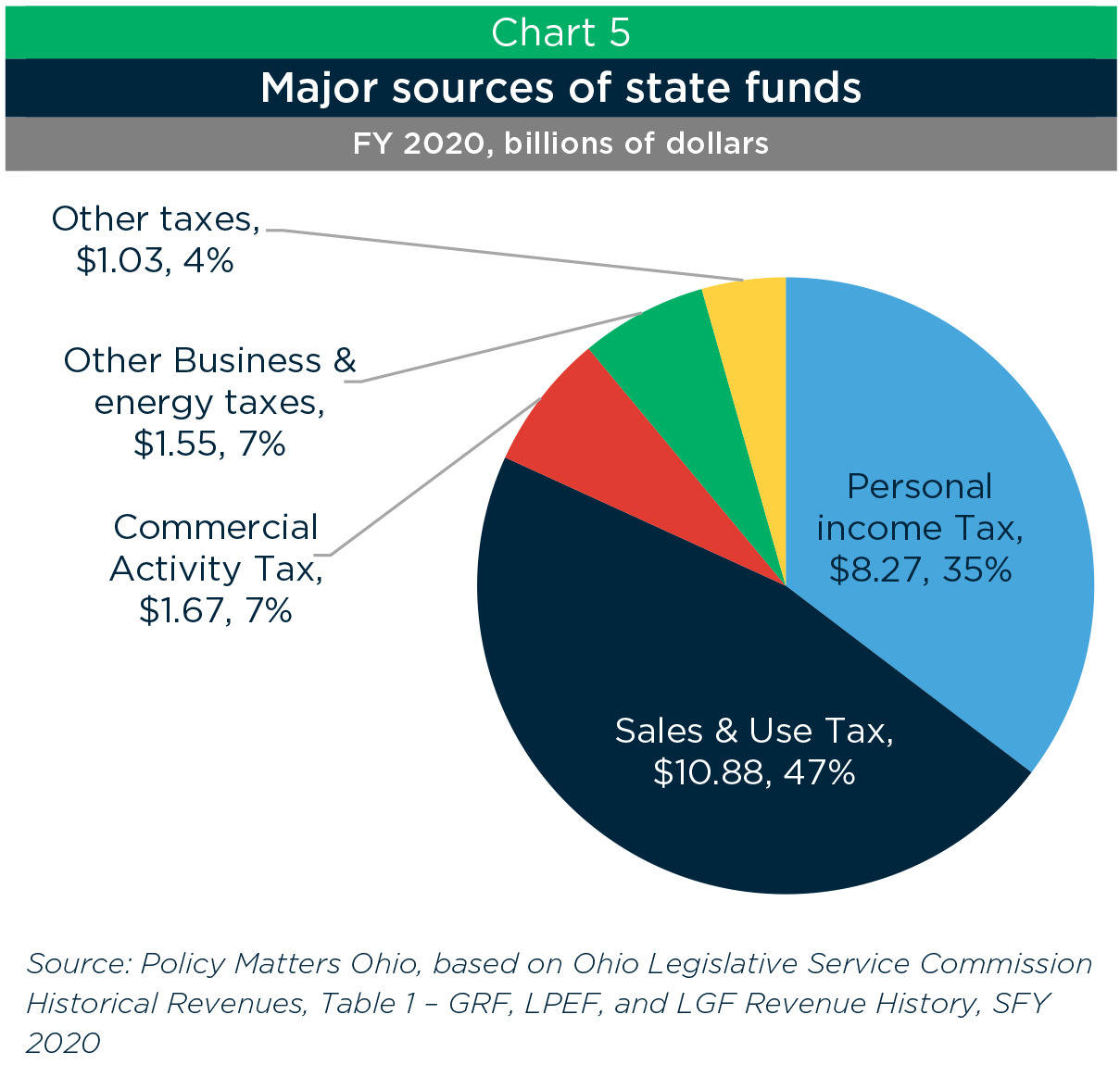

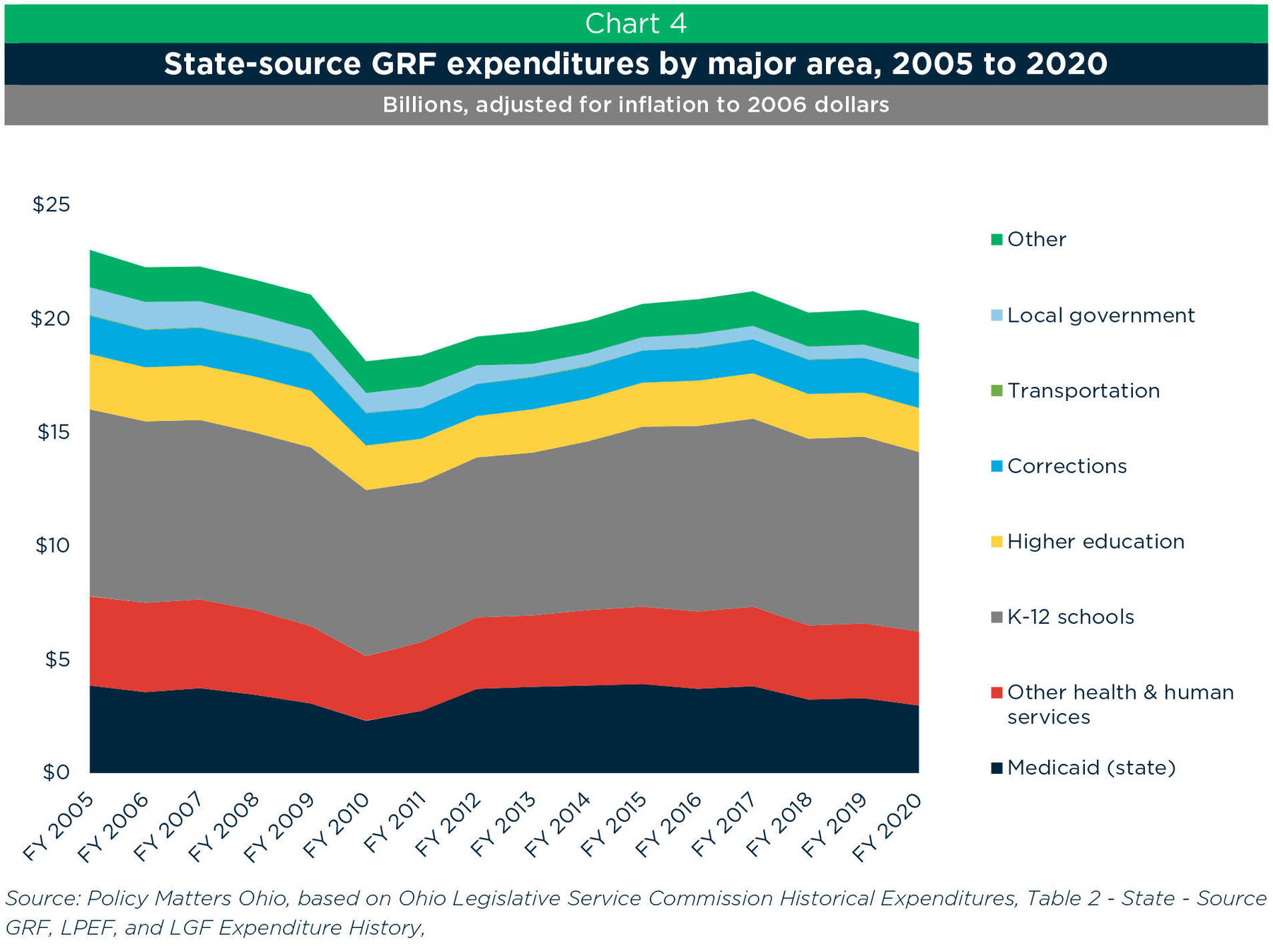

Ohio Budget 101 A Basic Overview

Ohio Budget 101 A Basic Overview

The Ohio 2022 2023 State Budget

The Ohio 2022 2023 State Budget

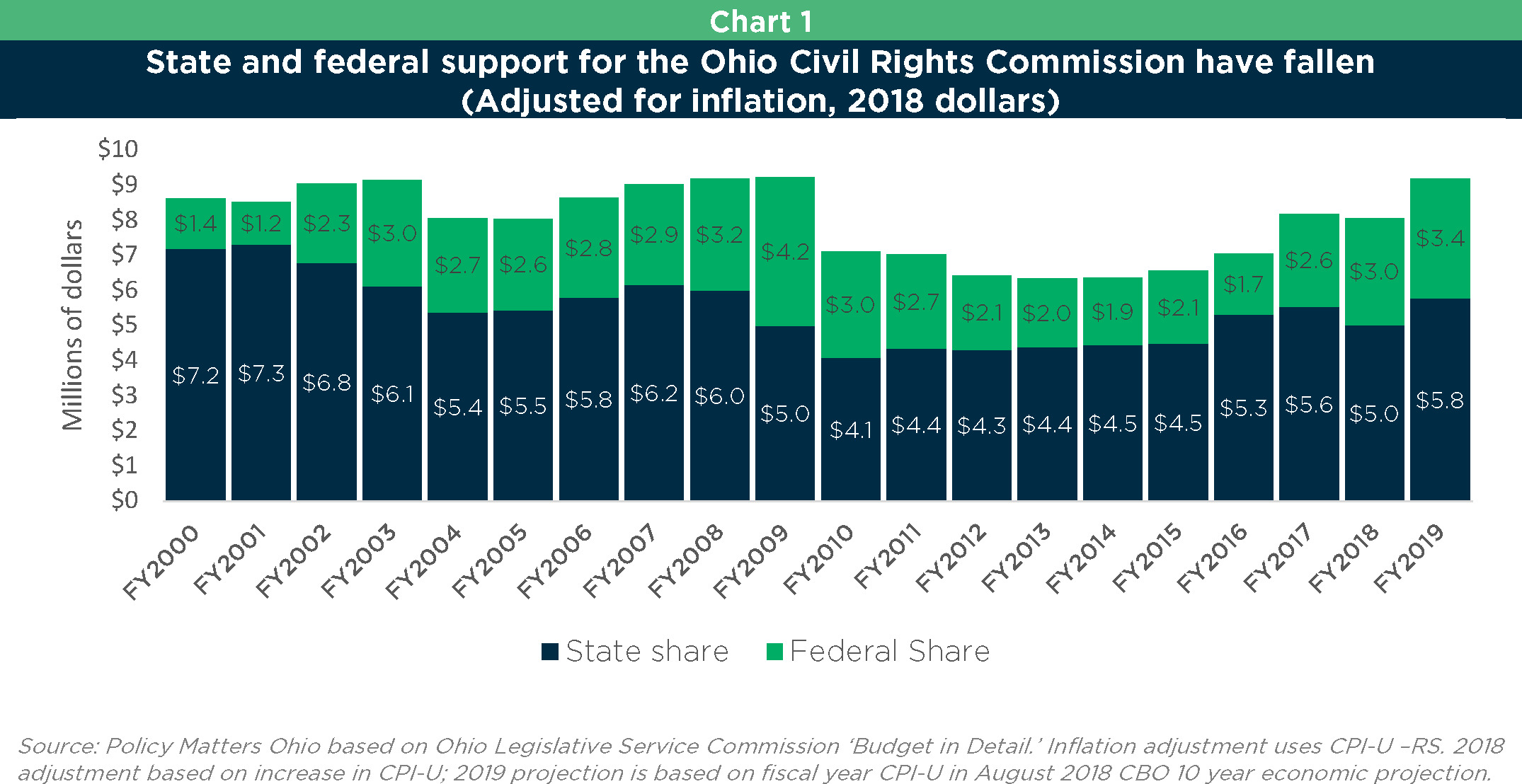

Ohio Civil Rights Commission Fighting Discrimination With Diminished State Support

Ohio Civil Rights Commission Fighting Discrimination With Diminished State Support

Ohio State And Local Government Debt 2025 Statista

Ohio State And Local Government Debt 2025 Statista

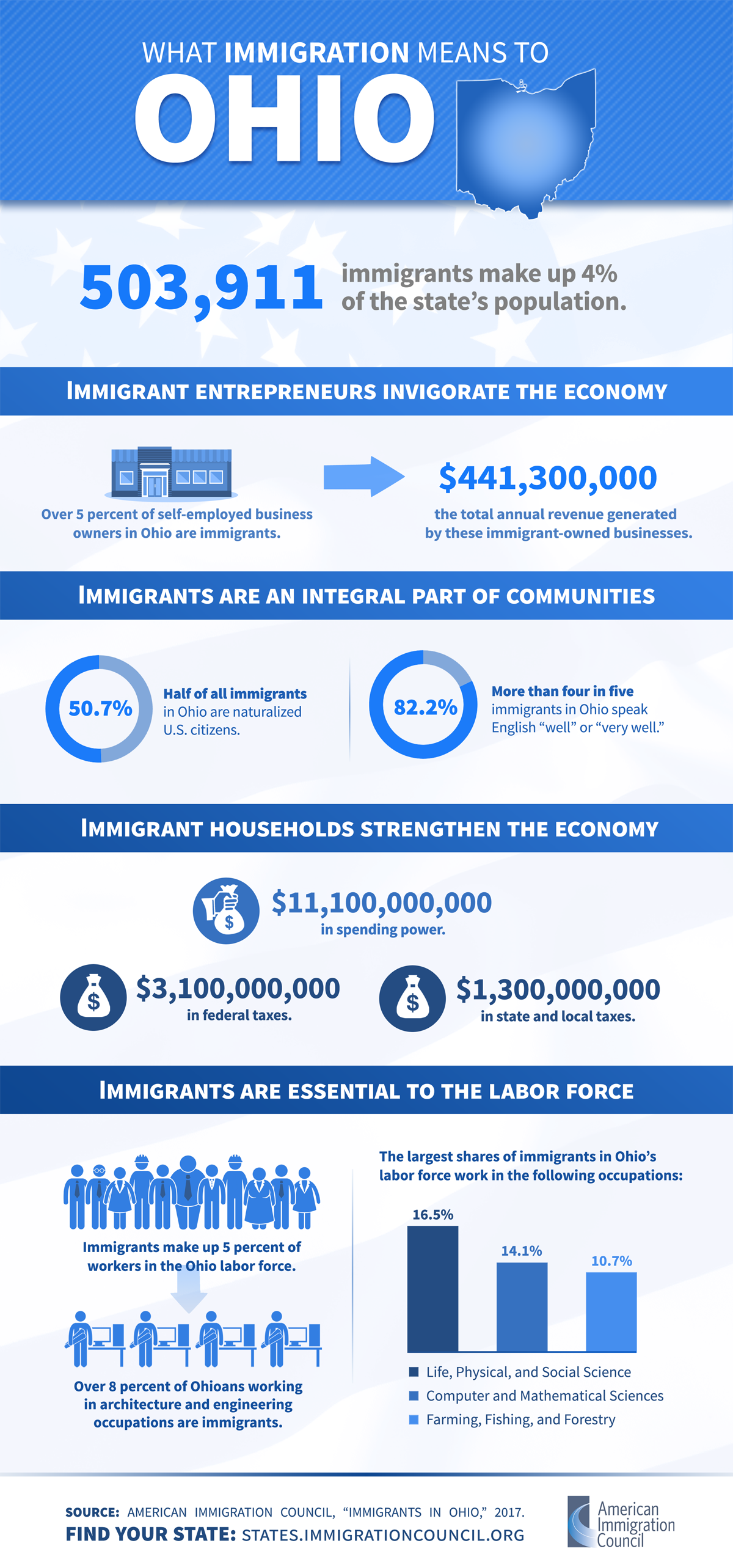

Immigrants In Ohio American Immigration Council

Immigrants In Ohio American Immigration Council

Ohio S Unemployment Rates By County Ohio Manufacturers Association

Ohio S Unemployment Rates By County Ohio Manufacturers Association

Ohio Budget 101 A Basic Overview

Ohio Budget 101 A Basic Overview

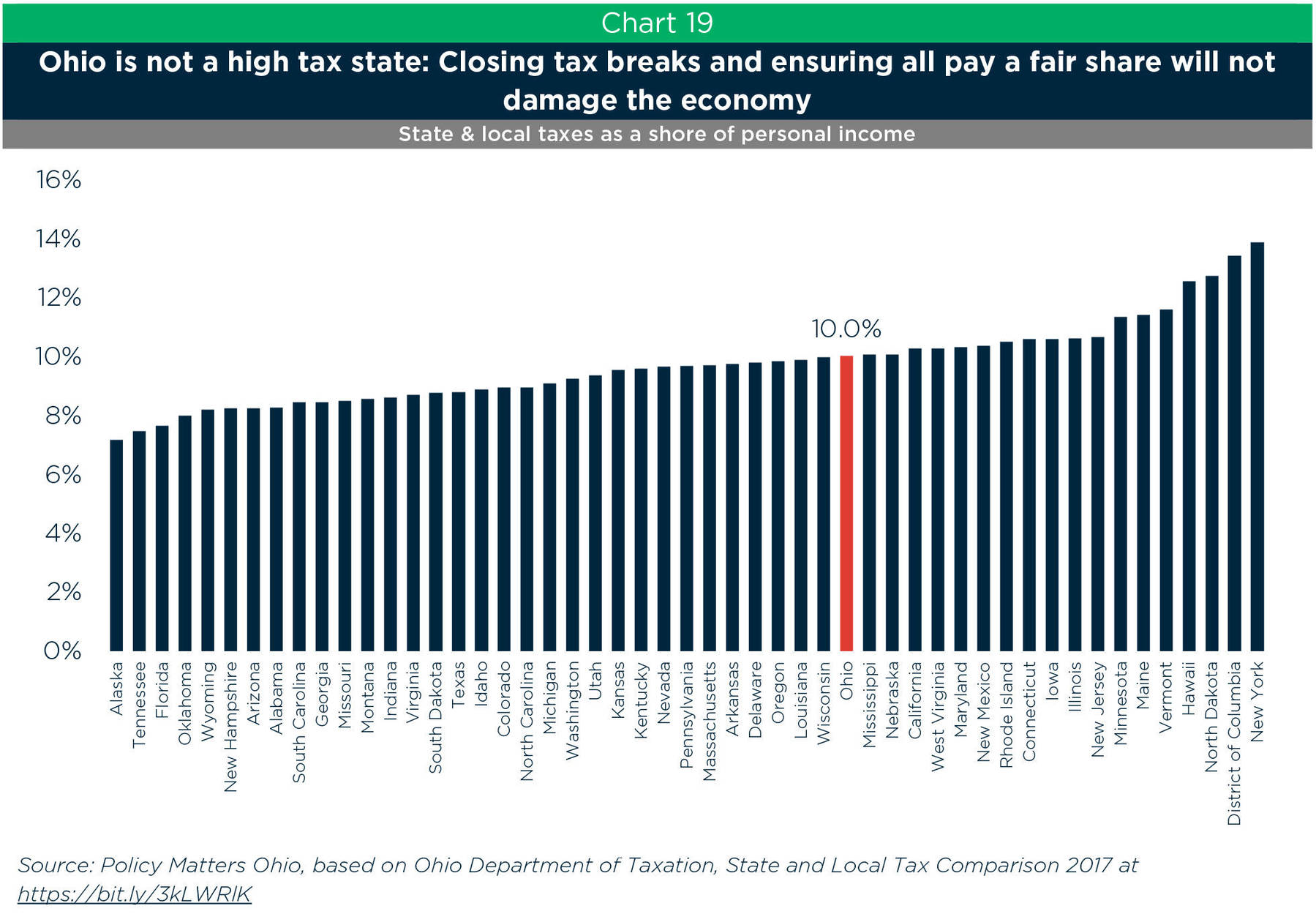

The Ohio 2022 2023 State Budget

The Ohio 2022 2023 State Budget

The Ohio 2022 2023 State Budget

The Ohio 2022 2023 State Budget

Https Oaa Osu Edu Sites Default Files Uploads Irp Economic Impact The Ohio State University Economic Impact Final Report 3 4 19 Pdf

The Ohio 2022 2023 State Budget

The Ohio 2022 2023 State Budget

Ohio State Employee Salaries Open The Books

Ohio State Employee Salaries Open The Books

Answers To Qualifying For Unemployment The 300 Payments And Disputed Ohio Claims That S Rich Q A Cleveland Com

Answers To Qualifying For Unemployment The 300 Payments And Disputed Ohio Claims That S Rich Q A Cleveland Com

Ohio Should Invest In Public Infrastructure To Build A Strong Economy Policy Matters Ohio March 19 2019

Ohio Should Invest In Public Infrastructure To Build A Strong Economy Policy Matters Ohio March 19 2019

Ohio Oh State Tax Refund Ohio Tax Brackets Taxact Blog

Ohio Oh State Tax Refund Ohio Tax Brackets Taxact Blog

2019 11 25 Benefits Confirmation Statements Now Available Online Human Resources At Ohio State

2019 11 25 Benefits Confirmation Statements Now Available Online Human Resources At Ohio State

.png)

Post a Comment for "Ohio State Unemployment Tax Rate 2019"