How Long Do You Have To Work At A Job To Collect Unemployment In Tennessee

How long can I collect unemployment benefits. Following this the base period would be the first four of the last five quarters of the year.

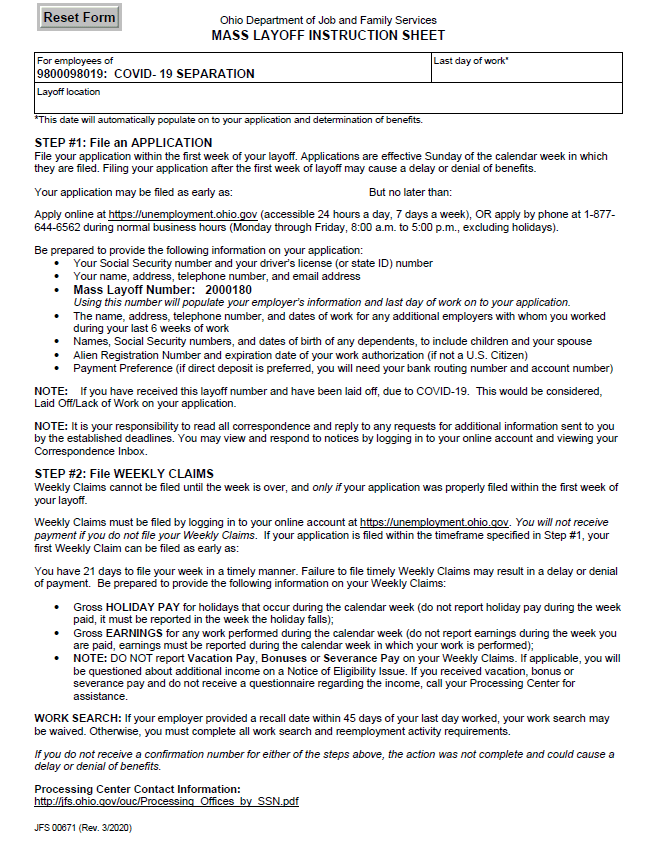

Covid 19 Unemployment Benefits Hamilton Ryker

Covid 19 Unemployment Benefits Hamilton Ryker

If you were laid-off you will qualify for unemployment.

How long do you have to work at a job to collect unemployment in tennessee. The state has waived the waiting period and work search requirement for unemployed people affected by COVID-19. If you qualified for benefits on a prior claim you must have earned six times your new weekly benefit amount since that time. You cannot begin to receive unemployment benefits until after you file for them no matter how long ago you lost your job.

Save 25 when you join AARP and enroll in Automatic Renewal for first year. If you have worked in Tennessee within the last 18 months and lost your job through no fault of your own you may be eligible for TUC. Generally for every week you worked during your base year period you may be entitled to a week of benefits up to a maximum of 26 times your Weekly Benefit Rate.

Again this varies by. Employees who have been laid off have reduced hours or are required to self-isolate or quit their job because of COVID-19 may be eligible for unemployment insurance. You must not make more than your weekly wage allowance.

If youve earned sufficient wages during this time frame the wages earned will then be used to calculate your weekly benefit amount and the number of weeks you may receive benefits. How Benefits are Calculated. Working part-time usually extends the number of weeks you can draw benefits.

This includes determining that you have earned enough wages during your base period that you became unemployed through no fault of your own and that you are ready able and willing to accept a suitable job offer. His Maximum Benefit Amount will be 200 times 20 weeks 4000. An individual worked 20 weeks during the base year period.

If you are eligible you will be advised on how to collect when your regular unemployment benefits end. If you did not work more than 17 hours in any week in your base period you may need to look for only part-time work. You have worked and earned a minimum amount of wages in work covered by unemployment tax during the past 18 months.

You have wages in more than one of the four base period calendar quarters. A base period is a timeframe of employment before applying for and collecting unemployment. To have a payable claim you must meet all of the following requirements.

To qualify for unemployment benefits in Oklahoma you must have a total base period level of earnings of at least 1500 and you must have worked at least 2 quarters or 6 months of the base period. Be sure to check with your state agency to find out what you need to do to receive PEUC. This is in addition to other qualification requirements.

What is the maximum benefit I can receive through Unemployment Insurance. Long-term unemployed workers who have already exhausted state unemployment benefits may also be eligible for additional weeks of benefits. You must be actively looking for a job and keeping a record of your job search.

You must have earned an average of 78001 in each of 2 quarters of a time frame called the Base Period and the second highest quarter must be over 900 or 6 times the weekly benefit amount. In addition you must have worked and received wages in at least two quarters of your Base Period and earned at least 780 in the highest quarter of the Base Period. Or it could be an additional form you have to complete on your states unemployment website.

Virtually all states look at your recent work history and earnings during a one-year base period to determine your eligibility for unemployment. Its best to start this process as soon as possible after losing your job. If you have exhausted unemployment benefits.

Additional earnings also may help you qualify for a new claim when your benefit year ends. Shared Work is a program that allows you to collect partial unemployment. Base period requirements.

Your total base period wages are at least 37 times your weekly benefit amount. Employment of all claimants. You must have worked and been paid wages for work in at least two calendar quarters in your base period AND For claims filed in 2019 you must have been paid at least 2400 in wages in one of the calendar quarters this amount increases to 2600 for.

Articles 18 25-B 25-C of the Unemployment Insurance Law Search through articles 18 25-B 25-C of the Unemployment. You have lost your job through no fault of your own. In some cases you will be able to work while collecting unemployment - but.

In order to receive unemployment benefits in Tennessee you must follow these rules. The minimum weekly benefit you can collect is 30 and the maximum you can collect is 275. If you file a claim but it is determined that you do not have enough wages to qualify for benefits you can apply again after quarter changes if you are still unemployed.

The unemployment officer may ask for proof like recent pay stubs or your social security card. You can collect unemployment benefits in Tennessee for up. In Tennessee as in most states the base period is the earliest four of the five complete calendar quarters before you filed your benefits claim.

How Long Do I Have to Work to Collect Oklahoma Unemployment Benefits. His Weekly Benefit Rate is 200. You must file a weekly certification.

You must be able to work and are not disabled. You must meet all requirements to be eligible to collect unemployment insurance in Tennessee. A claimants benefit rate is based on the recent wages heshe earned from hisher employers over the.

While each states base period varies most consider a base period of one year for unemployment benefits.

Https Www Jobs4tn Gov Admin Gsipub Htmlarea Uploads Pandemic Unemployment Assistance Pua Portal Claimants Guide Pdf

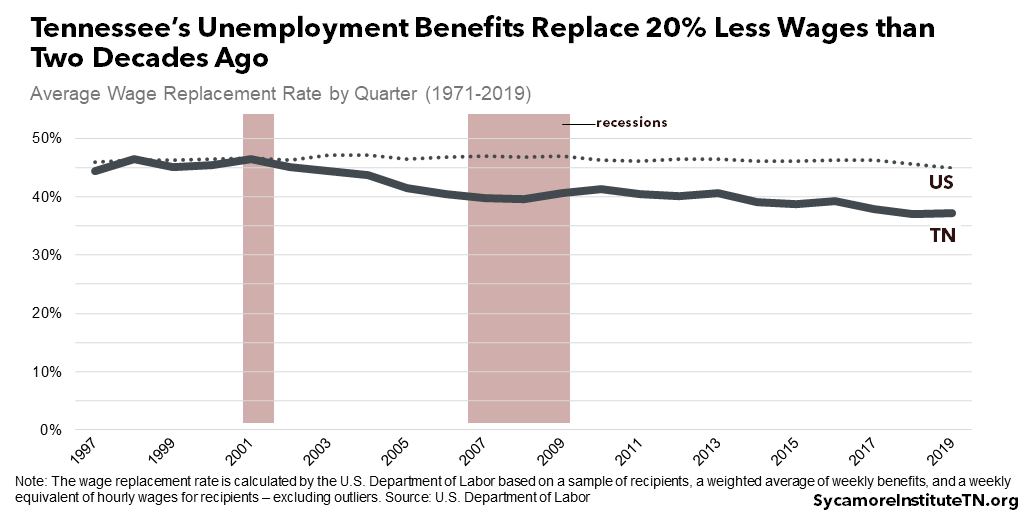

Unemployment Insurance In Tennessee How It Works

Unemployment Insurance In Tennessee How It Works

Unemployment Insurance In Tennessee How It Works

Unemployment Insurance In Tennessee How It Works

Covid 19 Unemployment Benefits Hamilton Ryker

Covid 19 Unemployment Benefits Hamilton Ryker

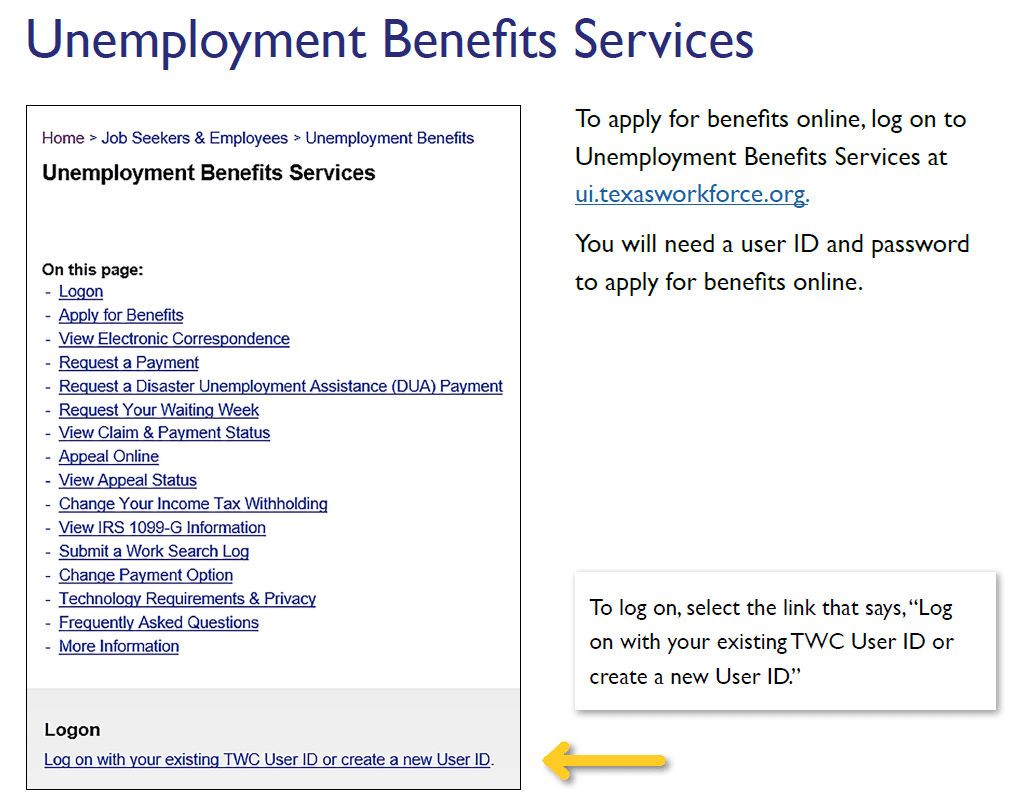

How Do I Check The Status Of My Claim Tennessee Department Of Labor And Workforce Development

How Do I Check The Status Of My Claim Tennessee Department Of Labor And Workforce Development

Https Www Jobs4tn Gov Admin Gsipub Htmlarea Uploads Uibenefitrightsinformation Pdf

Covid 19 Unemployment Benefits Hamilton Ryker

Covid 19 Unemployment Benefits Hamilton Ryker

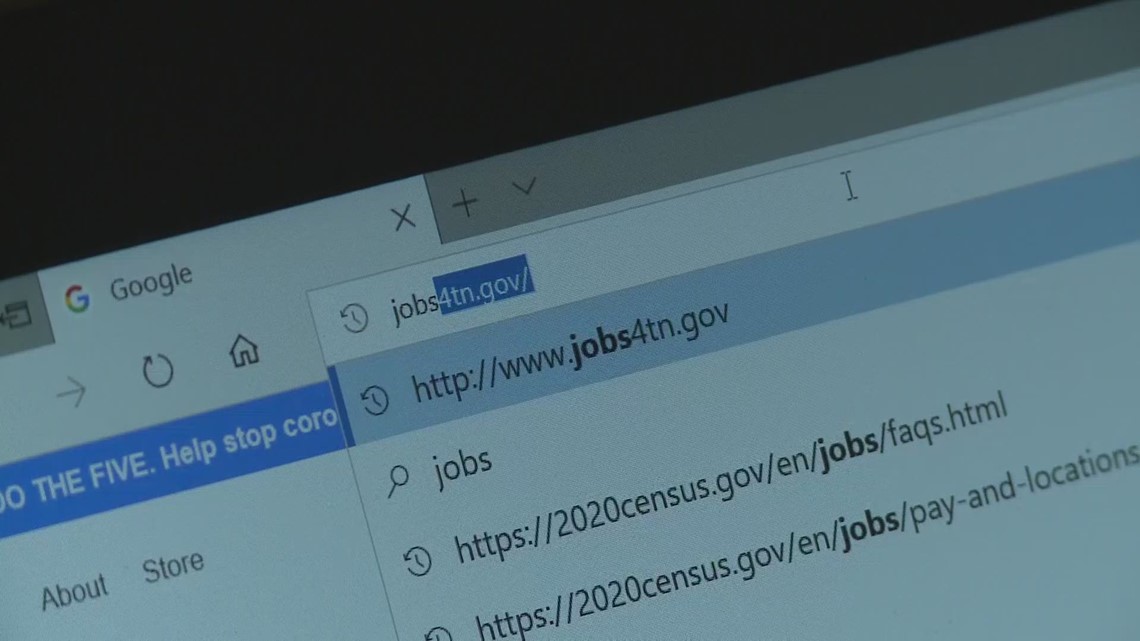

Why Is It Taking So Long For Many Tennesseans To Get Unemployment Localmemphis Com

Why Is It Taking So Long For Many Tennesseans To Get Unemployment Localmemphis Com

Https Www Tullahomatn Gov Wp Content Uploads 2020 03 Tn Unemployment Faqs Pdf

Unemployment Insurance In Tennessee How It Works

Unemployment Insurance In Tennessee How It Works

Covid 19 Unemployment Benefits Hamilton Ryker

Covid 19 Unemployment Benefits Hamilton Ryker

Unemployment Insurance In Tennessee How It Works

Unemployment Insurance In Tennessee How It Works

Jobs4tn Website Sees Massive Traffic Increase Causing Technical Issues Call 4 Action Wsmv Com

Jobs4tn Website Sees Massive Traffic Increase Causing Technical Issues Call 4 Action Wsmv Com

Https Www Jobs4tn Gov Admin Gsipub Htmlarea Uploads Pandemic Unemployment Assistance Pua Portal Claimants Guide Pdf

What Should I Do If Unable To Log Into My Jobs4tn Account Tennessee Department Of Labor And Workforce Development

What Should I Do If Unable To Log Into My Jobs4tn Account Tennessee Department Of Labor And Workforce Development

How Do I File A Wage Protest Tennessee Department Of Labor And Workforce Development

How Do I File A Wage Protest Tennessee Department Of Labor And Workforce Development

Tennessee Unemployment Rate 2020 Statista

Tennessee Unemployment Rate 2020 Statista

Https Las Org Wp Content Uploads 2018 12 Unemploymentweb9 18 Pdf

Unemployment Insurance In Tennessee How It Works

Unemployment Insurance In Tennessee How It Works

Post a Comment for "How Long Do You Have To Work At A Job To Collect Unemployment In Tennessee"