How Do I Calculate Partial Unemployment

When you claim your weekly benefit you will let us know if you worked that week. You would earn 210 per week.

Esdwagov Calculate Your Benefit

Esdwagov Calculate Your Benefit

Others use the applicants average earnings in the highest paid quarter of the base period.

How do i calculate partial unemployment. In every state however benefit amounts are based on prior earnings. For example if you worked a 40-hour week you. Earnings are to be reported in the week they are earned and not the week they are paid.

25 of weekly benefit. To be eligible for partial benefits you cannot work more than 80 percent of the hours normally worked in the job. Get an estimate of your unemployment benefits when you work and earn wages or receive holiday vacation or severance pay in a week.

How are partial Unemployment Compensation Benefits computed. Weekly Benefit Rate Calculator. This calculator computes only an estimate based on the wage information you entered and does not guarantee any benefit amount or even if you will be eligible for unemployment benefits.

Do not wait to receive paystubs. 75 of weekly benefit rate. For further details refer unemployment benefits article.

How we calculate partial Unemployment Insurance benefits. 5 10 hours of work 1 day worked. Some states use the applicants average earnings over a one-year period to calculate benefits.

Partial unemployment insurance claims may be filed by employers for full-time employees who work less than full-time during a pay period due to lack of work only. Your weekly earnings are less than twice your weekly benefit amount. How to File a Partial Claim.

During any week you earn less than your weekly benefit amount because of a lack of work your employer is required to give you a Statement of Partial Unemployment Form VEC-B. The employees must still be attached to the employer and must have earned wages that do not exceed the weekly benefit amount plus 5000. Your payment for partial benefits will be figured by taking two-thirds of your gross earnings for the week claimed and deducting that amount from your Weekly Benefit Rate.

If you are on temporary layoff or work reduction you may be eligible for benefits under Californias partial benefit program. You can estimate the net payable amount of Unemployment Insurance benefits by taking into consideration different deductions. You include your weekly earnings in your payment requests.

And others use another method. Eligibility and benefit amounts depend on a number of factors so if you do receive unemployment. You are still looking for full-time work each week.

Any earnings greater than 13 of your weekly benefit amount known as your earnings disregard will be deducted dollar-for-dollar from your weekly benefit payment. The unemployment program processes all weeks as Sunday through Saturday. If you work part-time hours during weeks in which you request Unemployment Insurance UI benefits you may still be paid benefits if your gross wages total wages before taxes are deducted are less than your weekly benefit amount.

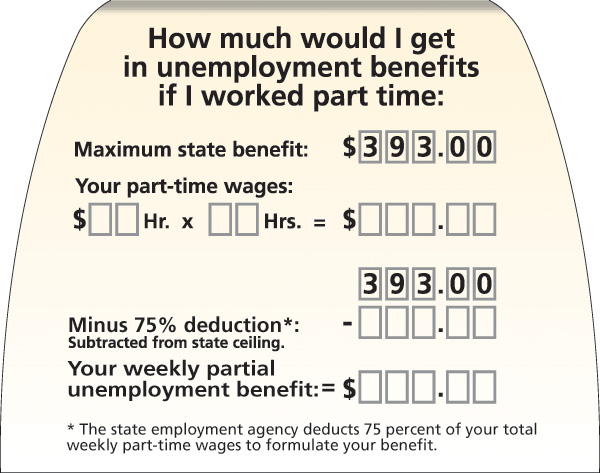

No reduction in weekly benefit rate. To calculate your reduced benefit you subtract 25 of your wages then subtract that amount from your maximum benefit. Weekly Benefit Rate Calculator.

450 minus 75 of 320 240 210. Based on this formula the state would take her earnings of 250 and subtract 70 one-fifth of her earnings is 50 plus 20. Partial UI Benefits Calculator.

Get an estimate of your Unemployment Insurance Weekly Benefit Rate should you become unemployed. Do not use any other combination of days to calculate your earnings. To estimate your partial benefit amount enter your regular weekly benefit amount and your anticipated weekly gross before tax earnings.

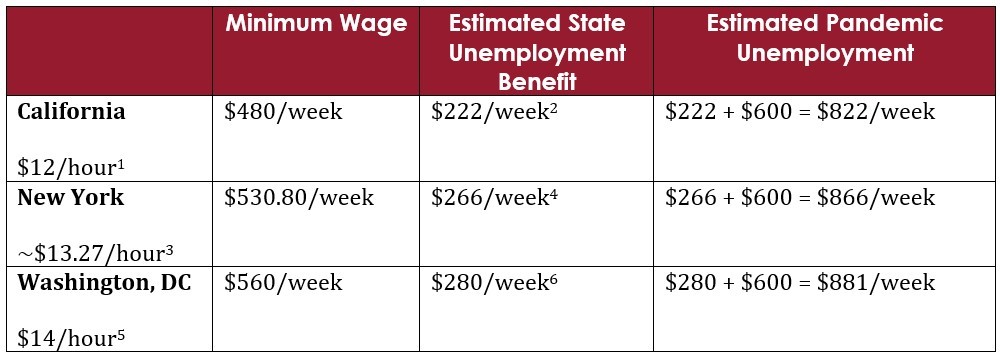

We will ask how many hours you worked and how much you earned gross for that week. 51 rows In general as long as you are entitled to at least 1 of unemployment benefits you will. The District of Columbia disregards one-fifth of her earnings plus 20 in calculating partial unemployment benefits.

4 or fewer hours of work 0 days worked. You will have to verify with your states unemployment office to see what the highest payout for your state is. 21 30 hours of work 3 days worked.

If your work hours are reduced you may be eligible for partial benefits provided. To properly report earnings. Each state has its own formula for calculating unemployment benefits including partial benefits.

50 of weekly benefit rate. You benefits are reduced when you work and earn wages or receive holiday vacation or severance pay in a week or receive a monthly pension payment. Use the calculator below to estimate the unemployment benefits for which you may be eligible when working part-time.

11 20 hours of work 2 days worked. Unemployment is computed and one half of what your weekly pay was at the time of the discharge up to your states maximum benefit.

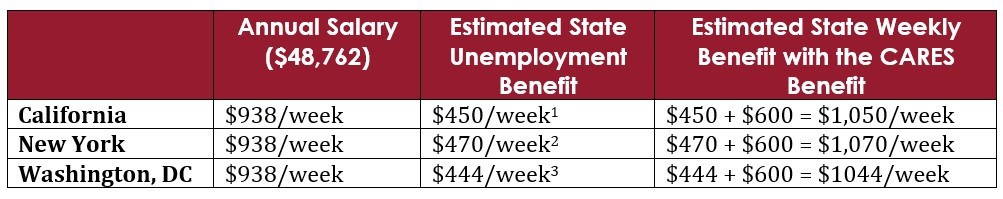

Enhanced Unemployment Benefits During The Coronavirus Crisis Smartasset

Enhanced Unemployment Benefits During The Coronavirus Crisis Smartasset

Esdwagov Calculate Your Benefit

Esdwagov Calculate Your Benefit

Partial Unemployment Benefits For Hour And Pay Cuts

Partial Unemployment Benefits For Hour And Pay Cuts

Labor And Economic Opportunity Can A Person Work Part Time And Still Collect Ui Benefits

Labor And Economic Opportunity Can A Person Work Part Time And Still Collect Ui Benefits

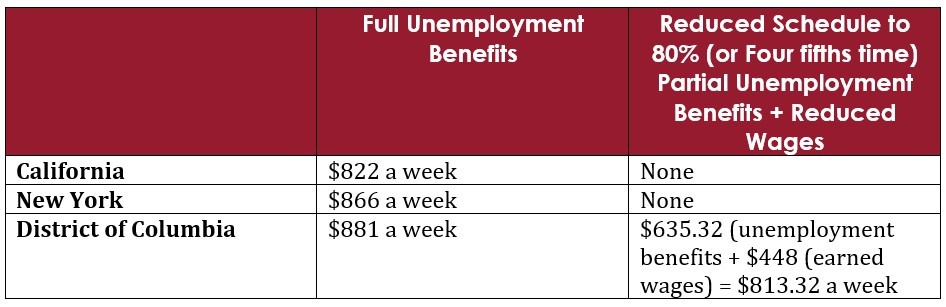

Who Cares Unemployment Benefits For Reduced Hours And Furloughed Employees Steptoe Johnson Llp

Who Cares Unemployment Benefits For Reduced Hours And Furloughed Employees Steptoe Johnson Llp

Maryland Unemployment Information Benefits Eligibility Etc Aboutunemployment Org

Maryland Unemployment Information Benefits Eligibility Etc Aboutunemployment Org

Cozen O Connor Covid 19 And Texas Unemployment Insurance Benefits Key Issues And Critical Updates Alert

Cozen O Connor Covid 19 And Texas Unemployment Insurance Benefits Key Issues And Critical Updates Alert

Who Cares Unemployment Benefits For Reduced Hours And Furloughed Employees Steptoe Johnson Llp

Who Cares Unemployment Benefits For Reduced Hours And Furloughed Employees Steptoe Johnson Llp

How To Calculate Amount Of Unemployment In Ohio 9 Steps

How To Calculate Amount Of Unemployment In Ohio 9 Steps

How To Calculate Amount Of Unemployment In Ohio 9 Steps

How To Calculate Amount Of Unemployment In Ohio 9 Steps

Unemployment Insurance Information Yates County Ny

How Unemployment Benefits Are Calculated By State Bench Accounting

How Unemployment Benefits Are Calculated By State Bench Accounting

Jobless Benefits Possible For Part Timers Las Vegas Review Journal

Jobless Benefits Possible For Part Timers Las Vegas Review Journal

How To Calculate Amount Of Unemployment In Ohio 9 Steps

How To Calculate Amount Of Unemployment In Ohio 9 Steps

Claims And Benefits Employer Handbook Employers Kdol

Claims And Benefits Employer Handbook Employers Kdol

Who Cares Unemployment Benefits For Reduced Hours And Furloughed Employees Steptoe Johnson Llp

Who Cares Unemployment Benefits For Reduced Hours And Furloughed Employees Steptoe Johnson Llp

What Are Partial Unemployment Benefits Bench Accounting

What Are Partial Unemployment Benefits Bench Accounting

Total And Partial Unemployment Tpu 460 55 Pension Or Retirement Pay

Total And Partial Unemployment Tpu 460 55 Pension Or Retirement Pay

Pennsylvania How Unemployment Payments Are Considered

Pennsylvania How Unemployment Payments Are Considered

Post a Comment for "How Do I Calculate Partial Unemployment"