Can You Print Unemployment W2 Online

The Form 1099-G reports the total taxable unemployment benefits paid to you from the Tennessee Department of Labor Workforce Development for a calendar year and the federal income tax. If you see a 0 amount on your 2020 form call 1-866-401-2849 Monday through Friday from 8 am.

Free Employment Income Verification Letter Template Pdf Word Eforms Free Fillable Forms Letter Of Employment Employment Letter Sample Employment Form

Free Employment Income Verification Letter Template Pdf Word Eforms Free Fillable Forms Letter Of Employment Employment Letter Sample Employment Form

Pacific time except on state holidays.

:max_bytes(150000):strip_icc()/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg)

Can you print unemployment w2 online. After you are logged in you can also request or discontinue federal and state income tax withholding from each unemployment benefit payment. If you are married each spouse receiving unemployment compensation doesnt have to pay tax on unemployment compensation of up to 10200. When you apply for unemployment insurance benefits you can choose to have 10 of your weekly benefit amount withheld for federal income taxes andor 6 for state income taxes.

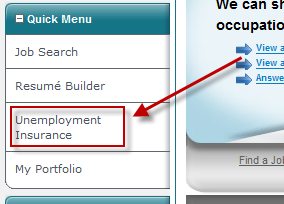

To enter it on your tax return go to FederalWages IncomeUnemployment Government benefits on Form 1099G There are some employers who make W-2s available for import to TurboTax but not all do. Please use our Quick Links or access one of the images below for additional information. Your local unemployment office may be able to supply these numbers by phone if you cant.

Certify for benefits for each week you remain unemployed as soon as you receive notification to do so. This is also the number for our collections unit. This means if you cant print the information out youll simply need to note the pertinent number to plug into the unemployment compensation block as well as any refunds or credits that apply.

Select option 5 for questions about 1099-G forms. Although some states will enable you to download your unemployment W2 form and the 1099-G form that is also required you should be aware that downloading the necessary documentation online isnt always possibleDepending on how advanced your states online infrastructure is youll either receive a private message with the forms you need to fill in or there will be a section on the. To access your form online log in to labornygovsignin click Unemployment Services select 2020 from the dropdown menu and click ViewPrint Your 1099-G If you do not have an online account with NYS DOL you may call 1-888-209-8124 to request 1099.

You can also print additional copies if needed. If you received unemployment benefits. SAVE TO MY SERVICES SAVED.

Usually you need to go to the states unemployment web site to get it and print it out. Regardless of the initial method of delivery all claimants can access copies of their 1099-G form in multiple ways. Email alerts will be sent to the claimants that elected to receive electronic notifications advising that they can view and print their 1099G online.

Please be sure to include your Social Security Number and remember to indicate which tax year you need in your request. How to Get Your 1099-G online. We will mail you a paper Form 1099G if you do.

In addition to receiving a hard copy in the mail in January you will be able to log into the UI Tax Claims System and view your 1099G. If you are unsure of your eligibility after completing the checklist apply anyway. You can access your Form 1099G information in your UI Online SM account.

The 1099-G form for calendar year 2020 will be available in your online account at labornygovsignin to download and print by the end of January 2021. The 1099G form reports the gross. If you have additional questions about accessing your 1099-G form please call IDES at 800 244-5631.

If you have received unemployment insurance payments last year you will need to report the total amount as found on your 1099-G on your federal taxes. The 1099s reflecting unemployment benefits paid in 2020 will be mailed to the last address on file no later than January 29 2021. If you were laid off as a result of COVID-19 you are likely eligible for regular unemployment benefits.

To access this form please follow these instructions. The address shown below may be used to request forms for prior tax years. Please note that Unemployment Insurance is available to Hoosiers whose employment has been interrupted or ended due to COVID-19 you should file for UI and your claim.

By January 31 all 1099-Gs will be mailed out to individuals who had claimed Unemployment Insurance UI benefits in the previous calendar year. We will post an update on this page when the forms are mailed out and when UI Benefit payment information for 2020 can be viewed online. Complete the application as best you can and we will follow up with you as soon as possible.

After agreeing to the terms of usage select the Claimant option then follow the appropriate prompts. If you do not have an online account with NYSDOL you may call. Amounts over 10200 for each individual are still taxable.

If your modified AGI is 150000 or more you cant exclude any unemployment compensation. Every January we send a 1099-G form to people who received unemployment benefits during the prior calendar year. You have reached Indianas one stop shop for Unemployment Insurance needs - for Individuals who are Unemployed and for Employers.

Log on using your username and password then go to the Unemployment Services menu to access your 1099-G tax formsIf you have questions about your user name and password see our frequently asked questions for accessing online benefit services. File a claim online to receive temporary income while you search for a job. Certify for Weekly Unemployment Insurance Benefits.

What You Need to Know. If you would like to inquire about a missing CAA-related payment or regarding a 1099-G form please report it to the Virtual Agent on the OESC HomepageWhen you enter the homepage click on the Virtual Agent icon on the bottom right of the screen. 1099G is a tax form sent to people who have received unemployment insurance benefits.

1099 G Tax Form Why It S Important

1099 G Tax Form Why It S Important

Instant W2 Form Generator Create W2 Easily Form Pros

Instant W2 Form Generator Create W2 Easily Form Pros

E File Form 1099 With Your 2020 2021 Online Tax Return

E File Form 1099 With Your 2020 2021 Online Tax Return

How To Find Your Unemployment Tax Documents For Filing Season

How To Find Your Unemployment Tax Documents For Filing Season

Blank W2 Form 2016 W 2 Laser 3 Up Horizontal Employee Sheet For 2018 Employee Tax Forms Irs Forms Resume Examples

Blank W2 Form 2016 W 2 Laser 3 Up Horizontal Employee Sheet For 2018 Employee Tax Forms Irs Forms Resume Examples

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

New Mexico Department Of Workforce Solutions Unemployment Unemployment For An Individual Unemployment Tax Forms 1099

New Mexico Department Of Workforce Solutions Unemployment Unemployment For An Individual Unemployment Tax Forms 1099

:max_bytes(150000):strip_icc()/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

Unemployment Taxes Are Due Expect A Form To Arrive In The Mail Kvue Com

Unemployment Taxes Are Due Expect A Form To Arrive In The Mail Kvue Com

Dd Form 1750 Example Figure 2 2 Da Form 5748 R Shipment Unit Packing List And Doctors Note Template Word Template Word Free

Dd Form 1750 Example Figure 2 2 Da Form 5748 R Shipment Unit Packing List And Doctors Note Template Word Template Word Free

Faqs Benefits Kansas Department Of Labor

Faqs Benefits Kansas Department Of Labor

Ui Online Access Tax Information Form 1099g Using Ui Online Youtube

Ui Online Access Tax Information Form 1099g Using Ui Online Youtube

What To Do If You Get A 1099 G Unemployment Tax Form From Ides Youtube

What To Do If You Get A 1099 G Unemployment Tax Form From Ides Youtube

Employment Verification Form Samples Awesome 15 Letter Of Employment Templates Doc Pdf Letter Of Employment Job Letter Letter Template Word

Employment Verification Form Samples Awesome 15 Letter Of Employment Templates Doc Pdf Letter Of Employment Job Letter Letter Template Word

Unemployment Insurance Tax Information Rhode Island Department Of Labor And Training

Unemployment Insurance Tax Information Rhode Island Department Of Labor And Training

Understanding Your Tax Forms The W 2 Tax Forms W2 Forms Tax Time

Understanding Your Tax Forms The W 2 Tax Forms W2 Forms Tax Time

Labor And Economic Opportunity How To Request Your 1099 G

Labor And Economic Opportunity How To Request Your 1099 G

Post a Comment for "Can You Print Unemployment W2 Online"