What Is Unearned Income For Kiddie Tax

The whole purpose of kiddie tax was to tax at parents rate for investments that were earning interest unearned income in kids bank accounts mostly parents deposits. For tax years after 2019 the unearned income above a certain amount is taxed at the parents rate.

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

I only have 700 in earned income.

What is unearned income for kiddie tax. All unearned income over the threshold is taxed at the parents marginal income tax rate rather than the lower childs tax rate. It seems unfair to pay kiddie tax unemployment income. As under prior law the kiddie tax applies to a childs net unearned income if the child is under age 19 or is a full-time student under age 24 has at least one living parent has unearned income above a threshold amount 2200 for 2020 and doesnt file a joint return with a spouse for the year.

The Kiddie Tax is the tax levied on the portion of your childs unearned income that exceeds 2200. Once dependent have unearned income that exceeds 11000 they are required to file their own separate return. Of a child less than nineteen years old or less than twenty-four years and a full-time student.

Client has 3 sons ages 18 19 21 Parents income about 13MChildren have capital gains and dividends of 32995 29526 and 23521Am I calculating the kiddie tax for any of these children. Anything above 2200 however is taxed at the marginal tax rate of the parent s which usually is higher than the childs rate. Children who only had earned income from a job or self-employment dont make enough money to be required to file or are filing jointly with their spouses are exempt from the Kiddie Tax.

Under these rules children pay tax at their own income tax rate on unearned income they receive up to a threshold amount--for 2020 the threshold is 2200. The next 1100 is taxed at the childs income tax rate for 2020. This tax treatment has gained a.

The remaining 12800 is subject to the kiddie tax. All unearned income that kids receive above the threshold amount is taxed at their parents highest income tax rate if higher than the childs rate. It applies to all children who are 18 years of age or underor.

Under the Kiddie Tax rule unearned income less than 2200 will be taxed at the childs tax rate. The law known as the Tax Cuts and Jobs Act amended the rules for the tax on childrens unearned income commonly called the kiddie tax so that it no longer is calculated at the parents top marginal rate and is instead calculated at modified trust and estate tax rates. Eloise will have to file her 2020 tax return as a dependent and complete Form 8615 Tax for Certain Children Who Have Unearned Income to calculate the kiddie tax based on her parents tax rates.

For tax years 2018 and 2019 the unearned income of certain children was taxed using the brackets and tax rates of estates and trusts. In general in 2020 the first 1100 worth of a childs unearned income is tax-free. IRA contributions or additional child tax credit.

Remember that the kiddie tax only applies to unearned income in excess of 2200. Yes I have been told 30000 is a lot but university housing is extremely expensive I was always told I would pay some tax on my scholarship and I withheld for unemployment but upon entering my info to TurboTax I was made aware of the Kiddie Tax. Now with Covid 19 these college kids are getting unemployment.

But income from 2200 to 11000 is taxed at the parents rate. It means that if your child has unearned income more than 2200 some of it will be taxed at estate and trust tax rates for tax years 2018 and 2019 or at the parents highest marginal tax rate beginning in 2020. Scholarships are a hybrid between earned and unearned income.

Kiddie Tax is a tax law prevalent in the United States of America and it imposes a tax on unearned passive income such as interest dividend rentals capital gains etc. It is not earned income for other purposes EIC. Regular tax rates apply to the first 2200 which is exempt from the kiddie tax.

Before the SECURE Act a much lower AMT exemption applied to children subject to kiddie tax. My total unearned income as far as I know would be 36000. When does the Kiddie Tax kick in.

0 Earned Income 3500 Unearned Income 1100 Standard Deduction. Kiddie tax rules apply to unearned income that belongs to a child. The AMT exemption is 72900 for 2020 for single filers.

Heres another example of how a child with 15000 of unearned income in 2020 would be taxed under the new law. For example if a dependent child has no earned income and 3500 of unearned income 1300 would be subject to the Kiddie Tax and is taxed at their parents marginal federal income tax rate. It is earned income for purposes of the 12400 filing requirement and the dependent standard deduction calculation earned income 350 and the kiddie tax.

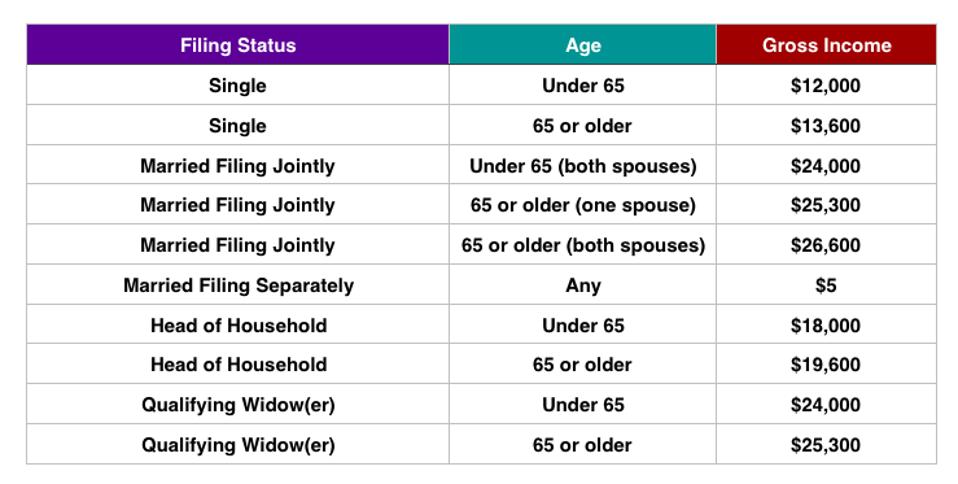

Do I Need To File A 2017 Tax Return Taxact Blog

Do I Need To File A 2017 Tax Return Taxact Blog

4 Ways The Kiddie Tax Can Work For You And Your Family Her Wealth

4 Ways The Kiddie Tax Can Work For You And Your Family Her Wealth

Pin By Sri Kriti On Read Turbotax Cheap Fundraising Tax Software

Pin By Sri Kriti On Read Turbotax Cheap Fundraising Tax Software

Taking Advantage Of Eitc Earned Income Tax Credit Your Money Line

Taking Advantage Of Eitc Earned Income Tax Credit Your Money Line

Avoid Penalty Increase By Filing Tax Return By Thursday Https Www Irstaxapp Com Avoid Penalty Increase By Filing Tax Filing Taxes Tax Return Tax Exemption

Avoid Penalty Increase By Filing Tax Return By Thursday Https Www Irstaxapp Com Avoid Penalty Increase By Filing Tax Filing Taxes Tax Return Tax Exemption

How To File A Zero Income Tax Return 11 Steps With Pictures

How To File A Zero Income Tax Return 11 Steps With Pictures

The Kiddie Tax Changes Again Putnam Investments

The Kiddie Tax Changes Again Putnam Investments

The Winners And Losers From The New Kiddie Tax Winners And Losers Loser Tax

The Winners And Losers From The New Kiddie Tax Winners And Losers Loser Tax

Earned Income Credit H R Block

Earned Income Credit H R Block

Does A Dependent Child Have To File A 2020 Federal Tax Return

Does A Dependent Child Have To File A 2020 Federal Tax Return

What Does Tax Exempt Mean Tax Deductions Tax Tax Exemption

What Does Tax Exempt Mean Tax Deductions Tax Tax Exemption

What S The Difference Between A Tax Return And A Refund What About Between Earned And Unearned Income Reference Irs Publication Tax Refund Tax Help Tax Prep

What S The Difference Between A Tax Return And A Refund What About Between Earned And Unearned Income Reference Irs Publication Tax Refund Tax Help Tax Prep

Earned And Unearned Income For Calculating The Eic Usa Income Disability Benefit Earnings

Earned And Unearned Income For Calculating The Eic Usa Income Disability Benefit Earnings

What S The Difference Between A Tax Return And A Refund What About Between Earned And Unearned Income Reference Federal Income Tax Tax Preparation Income Tax

What S The Difference Between A Tax Return And A Refund What About Between Earned And Unearned Income Reference Federal Income Tax Tax Preparation Income Tax

Do You Need To File A Tax Return In 2019

Do You Need To File A Tax Return In 2019

What You Need To Know About The Earned Income Tax Credit In 2021 Forbes Advisor

What You Need To Know About The Earned Income Tax Credit In 2021 Forbes Advisor

Kiddie Tax On Unearned Income H R Block

Kiddie Tax On Unearned Income H R Block

Post a Comment for "What Is Unearned Income For Kiddie Tax"