Unemployment Tax Form Ga

The state of Georgia is automatically extending the 2020 individual income tax filing and payment deadline from April 15 2021 to May 17 2021 without penalties or interest. Georgia Unemployment Insurance UI program information.

Asked And Answered Filing Taxes While On Unemployment

Asked And Answered Filing Taxes While On Unemployment

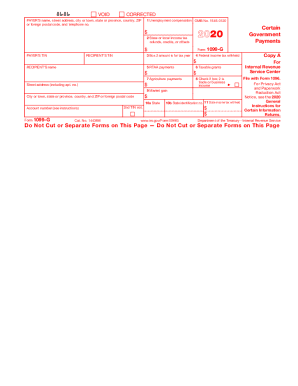

Reporting Unemployment Compensation You should receive a Form 1099-G Certain Government Payments showing the amount of unemployment compensation paid to you during the year in Box 1 and any federal income tax withheld in Box 4.

Unemployment tax form ga. File Partial Unemployment Insurance Claims. March 20 2021 at 941 am. The tax-able wage base in Georgia increased from 8500 to 9500 beginning 2013.

You must still report your unemployment compensation on your tax return even if you dont receive a Form 1099-G for some reason. We also send this information to the IRS. The 1099-INT statement is for non-incorporated businesses that were paid 600 or more in refund interest.

Effect on Other Tax Benefits Taxable unemployment benefits include the extra 600 per week that was provided by the federal government in response to the coronavirus pandemic accountant Chip Capelli of Provincetown Massachusetts told The Balance. For Businesses the 1099-INT statement will no longer be mailed. Form G4 is to be completed and submitted to your employer in order to have tax withheld from your wages.

Please contact the Georgia Department of Labor. You can collected Form 1099-G by calling your local unemployment office or contacting the IRS directly. Learn About Unemployment Taxes and Benefits.

For information related to unemployment income please read FAQ 3. File Tax and Wage Reports and Make Payments. Unemployment benefits must be reported on your federal tax return.

If you received unemployment benefits as well as the additional 600 per week in coronavirus relief any time during the year your tax return may be affected. Taxpayers must log into their Georgia Tax Center account to view their 1099-INT under the Correspondence tab. Tax rate calculations consider the history of both unemploy -.

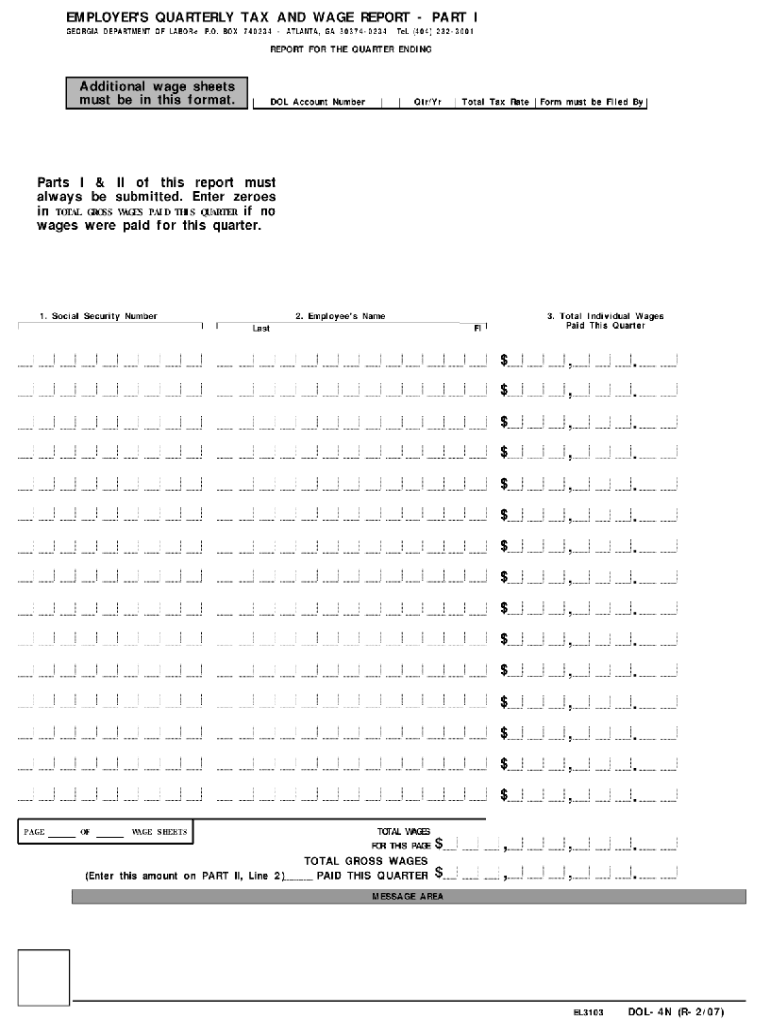

Annual Tax and Wage Report For Domestic Employment - DOL 4A 8748 KB Annual tax and wage report which domestic employers must file. Quarterly tax wage report and payment information for employers. Arizona taxes unemployment compensation to the same extent as it is taxed under federal law.

TSD_Employees_Withholding_Allowance_Certificate_G-4pdf 19647 KB Department of. The American Rescue Plan a 19 trillion Covid relief bill waived. Unemployment Compensation - This box includes the dollar amount paid in benefits to you during the calendar year.

The annual report and any payment due must be filed on or before January 31st of the following year to be considered timelyThis form is interactive and can be completed electronically and printed. If you have received unemployment income at any point during the year you will be required to complete and return IRS Form 1099-G. A Tax Rate Notice Form DOL-626 is mailed each year to all active employers indicating the tax rate for the following year.

Every year we send a 1099-G to people who received unemployment benefits. Thirteen states arent offering a tax break on unemployment benefits received last year according to data from HR Block. UI claims filed by employers for full-time employees who work less than full-time.

This document will accurately summarize your unemployment compensation and ensure that you are taxed appropriately. Many businesses in Georgia are liable for payment of unemployment insurance taxes to the Georgia Department of Labor even if they dont yet have employees. Newly liable employers are assigned a beginning tax rate of 270.

Adjustments - This box includes cash payments and income tax refunds used to pay back overpaid benefits. The 1099-G form is used to report taxable benefits when filing with the IRS for anyone who was paid unemployment benefits or Alternative Trade Adjustment Assistance payments during the calendar year January 1 to December 31. The information on the 1099-G tax form is provided as follows.

A record number of Americans are applying for unemployment compensation due to the COVID-19 Outbreak. State Taxes on Unemployment Benefits. All employers who are liable for unemployment insurance UI must file tax and wage reports for each quarter they are in business.

The Department of Labor has online tools to help you determine if you are liable and set up an account if you are. TaxWatch What to do if you already filed taxes but want to claim the 10200 unemployment tax break Last Updated. Find the IRS Form 1099G for Unemployment Insurance Payments which is issued by the Georgia Department of Labor.

The reports and any payment due must be filed on or before April 30th July 31st October 31st and January 31st if the due date falls on a weekend or a legal holiday reports are due by the next business day.

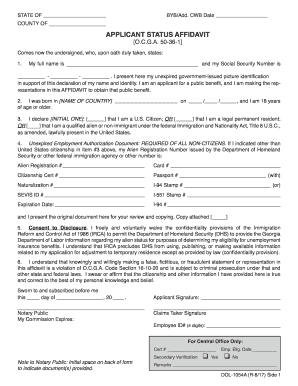

Applicant Status Affidavit Fill Out And Sign Printable Pdf Template Signnow

Applicant Status Affidavit Fill Out And Sign Printable Pdf Template Signnow

Https Dor Georgia Gov Document Instructions How Request 1099g Electronicallypdf Download

3 Simple Ways To File For Unemployment In Georgia Wikihow

3 Simple Ways To File For Unemployment In Georgia Wikihow

2005 2021 Form Ga Dol 800 Fill Online Printable Fillable Blank Pdffiller

2005 2021 Form Ga Dol 800 Fill Online Printable Fillable Blank Pdffiller

Asked And Answered Filing Taxes While On Unemployment

Asked And Answered Filing Taxes While On Unemployment

Georgia Dol Fill Online Printable Fillable Blank Pdffiller

Georgia Dol Fill Online Printable Fillable Blank Pdffiller

Georgia Am I Approved For Pua Or Not Unemployment

Georgia Am I Approved For Pua Or Not Unemployment

Ga How To E File Quarterly Tax And Wage Report Cwu

/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

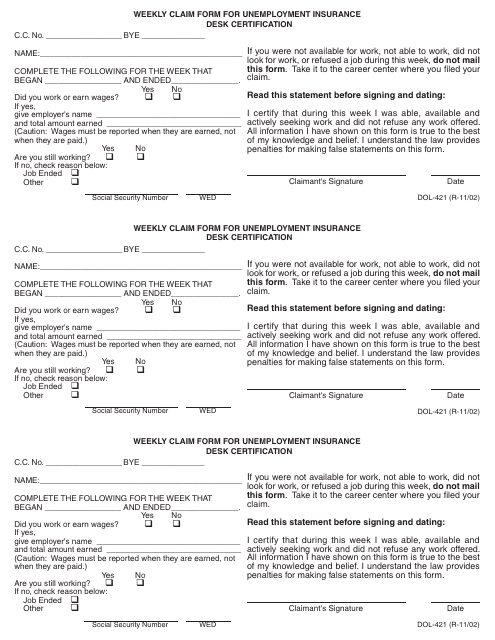

Form Dol 421 Download Printable Pdf Or Fill Online Weekly Claim Form For Unemployment Insurance Desk Certification Georgia United States Templateroller

Form Dol 421 Download Printable Pdf Or Fill Online Weekly Claim Form For Unemployment Insurance Desk Certification Georgia United States Templateroller

Https Dor Georgia Gov Document Instructions How Request 1099g Electronicallypdf Download

1099 G Tax Form Why It S Important

1099 G Tax Form Why It S Important

Asked And Answered Filing Taxes While On Unemployment

Asked And Answered Filing Taxes While On Unemployment

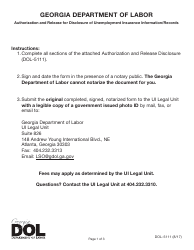

Form Dol 5111 Download Fillable Pdf Or Fill Online Authorization And Release For Disclosure Of Unemployment Insurance Information Records Georgia United States Templateroller

Form Dol 5111 Download Fillable Pdf Or Fill Online Authorization And Release For Disclosure Of Unemployment Insurance Information Records Georgia United States Templateroller

1099 Form Fileunemployment Org

1099 Form Fileunemployment Org

Https Dor Georgia Gov Document Instructions How Request 1099g Electronicallypdf Download

Georgia Unemployment Insurance Megathread Atlanta

Georgia Unemployment Insurance Megathread Atlanta

Https Dor Georgia Gov Document Instructions How Request 1099g Electronicallypdf Download

Post a Comment for "Unemployment Tax Form Ga"