Unemployment Tax Break In Ohio

The latest 19 trillion stimulus package created a new tax break for tens of millions of workers who received unemployment benefits last year. 2 days agoExpecting another refund after the IRS calculates the 10200 unemployment tax break.

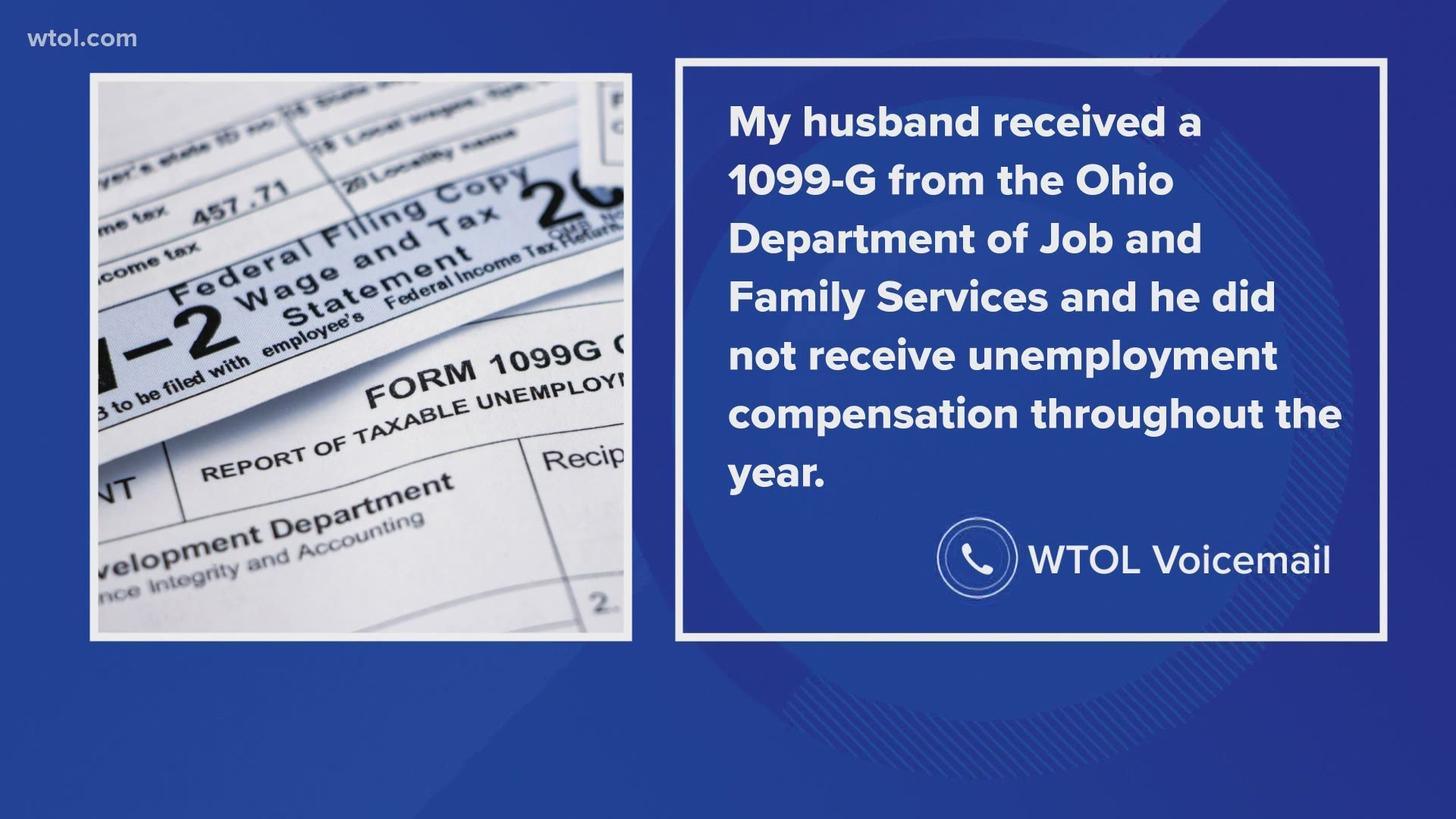

Did You Receive A 1099 G From The Ohio Department Of Taxation Or The Ohio Department Of Job And Family Services Department Of Taxation

Did You Receive A 1099 G From The Ohio Department Of Taxation Or The Ohio Department Of Job And Family Services Department Of Taxation

You might want to do more than just wait Last Updated.

Unemployment tax break in ohio. It is included in your federal adjusted gross income FAGI on your federal 1040. As of December 27 2020 an additional 300 in unemployment benefits will be added to. Its great that Americans wont have to pay taxes on 10200 of unemployment income.

Usually claimants would have to pay tax on this benefit. 2 days agoThe new tax break is essentially a waiver on the first 10200 of federal unemployment benefits each recipient received during 2020. Because Ohios income tax begins with federal adjusted gross income your unemployment compensation is also taxable to Ohio on your IT 1040 return.

The IRS considers unemployment compensation taxable income. The change in a bill signed by Gov. However only 13 states are excluding 10200 of federal unemployment benefits from their residents tax liability for 2020.

Signed on March 11 the 19 trillion American Rescue Plan exempts from federal tax up to 10200 of unemployment benefits received in 2020 or 20400 for married couples filing jointly for. The latest stimulus bill allows tax exemptions for up to 10200 in unemployment benefits paid in 2020. The Unemployment Tax Waiver Could Save You Thousands of Dollars This tax break could provide a tax savings of thousands of dollars depending on your tax situation.

Additionally if you live in a traditional tax base school district your unemployment compensation is. Arizona taxes unemployment compensation to the same extent as it is taxed under federal law. State Taxes on Unemployment Benefits.

The nearly 2 million Ohioans who collected unemployment benefits in 2020 are in line for a big break on their federal taxes under the 19 trillion. The American Rescue Plan a 19 trillion Covid relief bill waived. Mike DeWine Wednesday brought.

Prepare for a state tax bill. The IRS will then adjust returns for married couples filing a. As of March 29 13 states have not conformed with the federal unemployment tax break according to recent data from HR Block.

Unemployment benefits are not subject to municipal income taxes in Ohio so nothing changes there the Regional Income Tax Agency confirmed. This only applies to taxpayers whose Adjusted Gross Income AGI for 2020 is. That will be the case if a new tax break on up to 10200 of unemployment benefits makes them newly eligible for income-dependent tax credits and deductions like the earned income tax credit.

COLUMBUS Ohioans who received unemployment benefits in 2020 wont have to pay income taxes on the first 10200 they received. 1 day agoA good problem to fix. Thirteen states arent offering a tax break on unemployment benefits received last year according to data from HR Block.

If you got unemployment income last year and your state isnt offering a tax break on your first 10200 of benefits you may need to gear up for a tax bill when you. Three others Arizona Ohio and Vermont didnt officially adopt the federal standard but their tax forms do allow eligible residents. These states are requiring residents to pay taxes on unemployment.

That tax break will put a lot of extra. Unemployment checks in Ohio normally amount to no more than half the lost weekly income topping out at 480 for a single person or 647 for someone with at least three dependents. The agency will start with taxpayers eligible for a break on up 10200 of unemployment benefits.

Did You Receive A 1099 G From The Ohio Department Of Taxation Or The Ohio Department Of Job And Family Services Department Of Taxation

Did You Receive A 1099 G From The Ohio Department Of Taxation Or The Ohio Department Of Job And Family Services Department Of Taxation

Income School District Tax Department Of Taxation

Income School District Tax Department Of Taxation

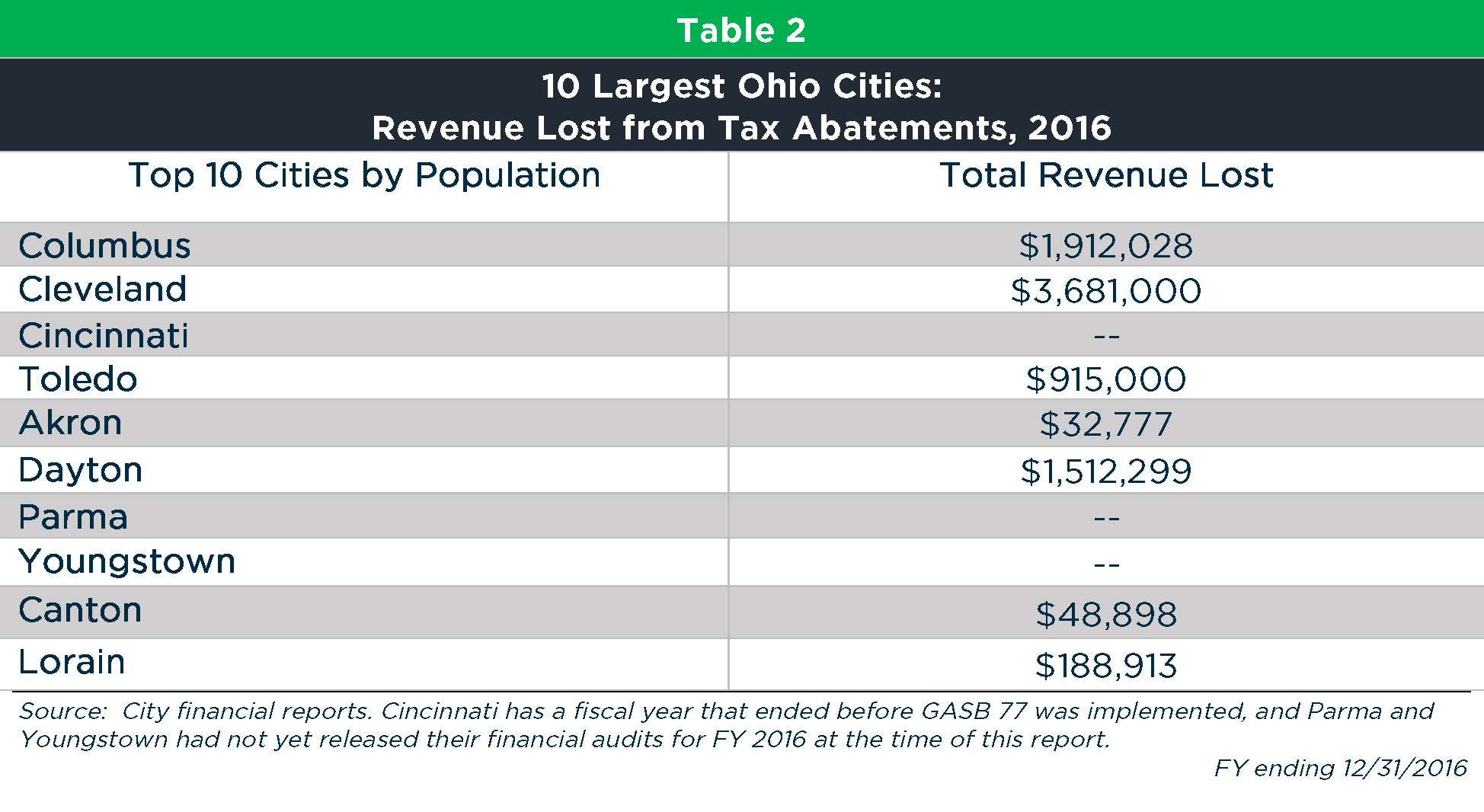

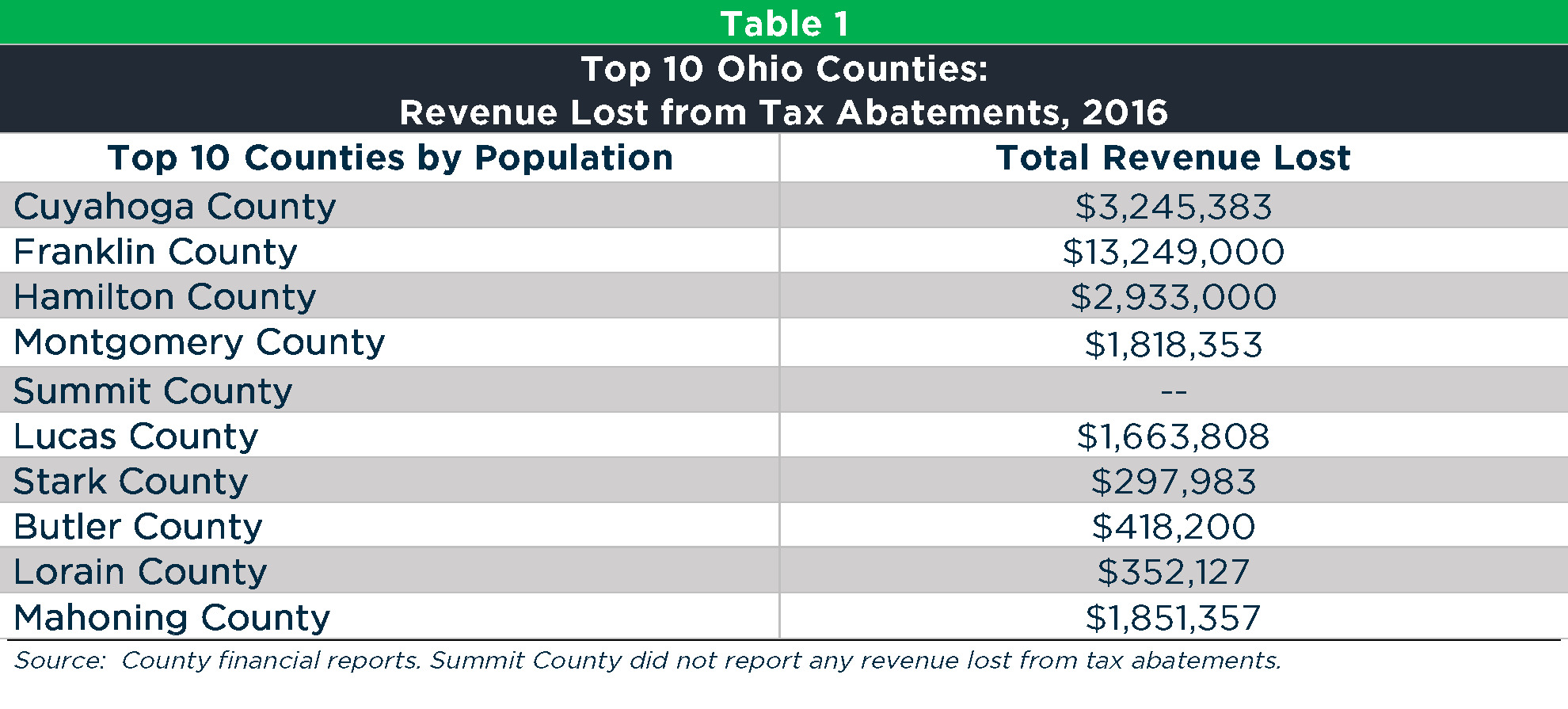

Local Tax Abatement In Ohio A Flash Of Transparency

Local Tax Abatement In Ohio A Flash Of Transparency

Did You Receive A 1099 G From The Ohio Department Of Taxation Or The Ohio Department Of Job And Family Services Department Of Taxation

Did You Receive A 1099 G From The Ohio Department Of Taxation Or The Ohio Department Of Job And Family Services Department Of Taxation

Expect 300 Retroactive Ohio Unemployment Supplemental Checks The Second Half Of September That S Rich Recap In 2020 Unemployment Student Loan Payment Federal Emergency Management Agency

Expect 300 Retroactive Ohio Unemployment Supplemental Checks The Second Half Of September That S Rich Recap In 2020 Unemployment Student Loan Payment Federal Emergency Management Agency

Follow The Rules And You Ll Walk Away Scot Free Taxtip Taxplanning Play Your Cards Right Tips Tax Free

Follow The Rules And You Ll Walk Away Scot Free Taxtip Taxplanning Play Your Cards Right Tips Tax Free

Did You Receive A 1099 G From The Ohio Department Of Taxation Or The Ohio Department Of Job And Family Services Department Of Taxation

Did You Receive A 1099 G From The Ohio Department Of Taxation Or The Ohio Department Of Job And Family Services Department Of Taxation

Oh The Places You Should Go Super Scholar Life After College Places Post Grad Life

Oh The Places You Should Go Super Scholar Life After College Places Post Grad Life

Not All Senior Citizens Still Qualify For Ohio Property Tax Discounts Homestead Savings Calculator Cleveland Com

Not All Senior Citizens Still Qualify For Ohio Property Tax Discounts Homestead Savings Calculator Cleveland Com

Did You Receive A 1099 G From The Ohio Department Of Taxation Or The Ohio Department Of Job And Family Services Department Of Taxation

Did You Receive A 1099 G From The Ohio Department Of Taxation Or The Ohio Department Of Job And Family Services Department Of Taxation

Ohio Postpones Tax Filing Deadline To May 17 Matching The Irs Revised Deadline For Federal Taxes Cleveland Com

Ohio Postpones Tax Filing Deadline To May 17 Matching The Irs Revised Deadline For Federal Taxes Cleveland Com

Did You Receive A 1099 G From The Ohio Department Of Taxation Or The Ohio Department Of Job And Family Services Department Of Taxation

Did You Receive A 1099 G From The Ohio Department Of Taxation Or The Ohio Department Of Job And Family Services Department Of Taxation

Ohio Unemployment Help Wkyc Com

Ohio Unemployment Help Wkyc Com

Did You Receive A 1099 G From The Ohio Department Of Taxation Or The Ohio Department Of Job And Family Services Department Of Taxation

Did You Receive A 1099 G From The Ohio Department Of Taxation Or The Ohio Department Of Job And Family Services Department Of Taxation

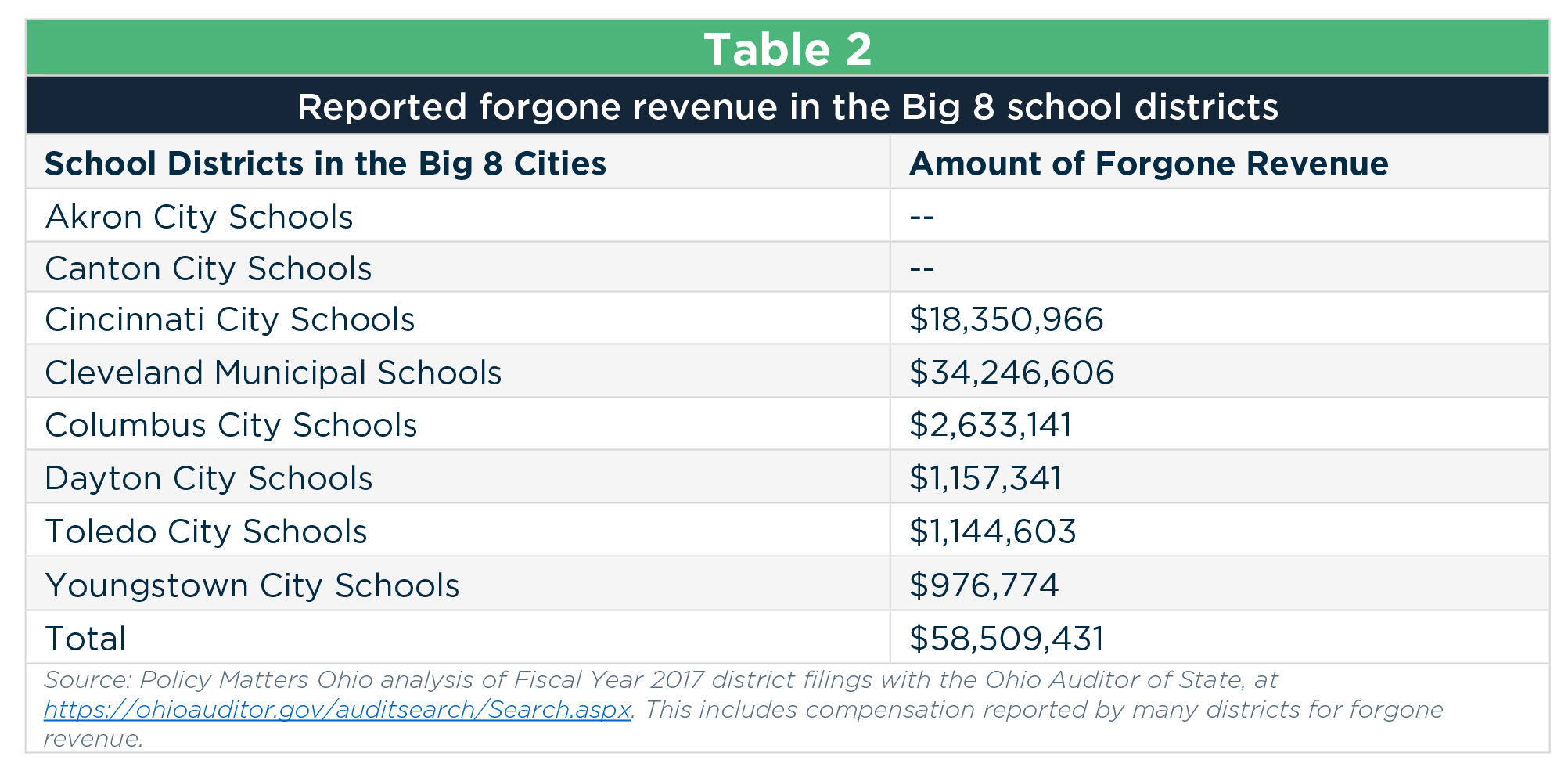

Tax Abatements Cost Ohio Schools At Least 125 Million

Tax Abatements Cost Ohio Schools At Least 125 Million

Standard Deduction Vs Itemized Tax Deduction What S Better Standard Deduction Deduction Tax Deductions

Standard Deduction Vs Itemized Tax Deduction What S Better Standard Deduction Deduction Tax Deductions

How Eliminating Certain Tax Deductions Will Affect Income Groups Tax Deductions Income Family Income

How Eliminating Certain Tax Deductions Will Affect Income Groups Tax Deductions Income Family Income

Local Tax Abatement In Ohio A Flash Of Transparency

Local Tax Abatement In Ohio A Flash Of Transparency

Post a Comment for "Unemployment Tax Break In Ohio"