Unemployment Pay Rate Formula

Of Unemployed Persons No. As of October 4 2020 the maximum weekly benefit amount is 855 per week.

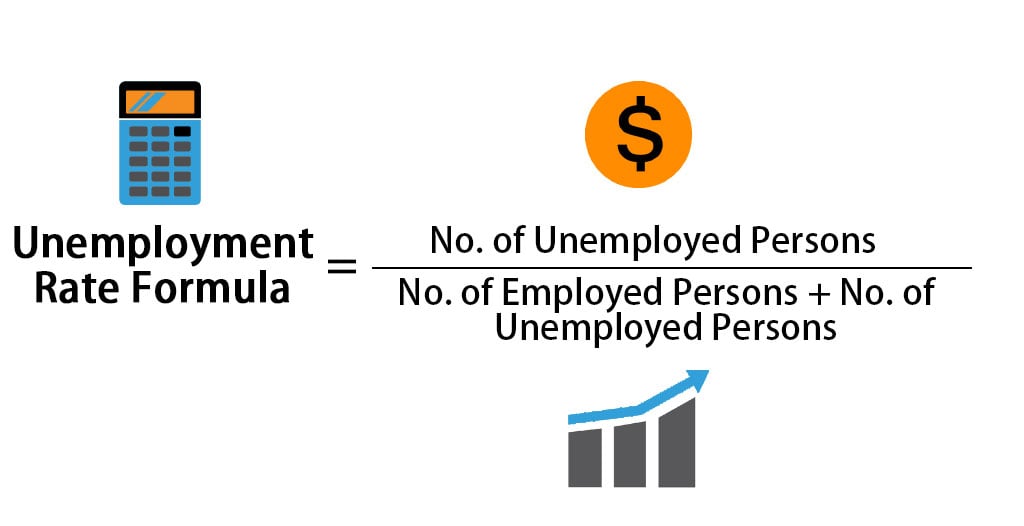

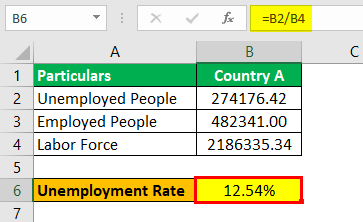

Unemployment Rate Formula Calculator Examples With Excel Template

Unemployment Rate Formula Calculator Examples With Excel Template

Unemployment insurance is taxable income and must be reported on your IRS federal income tax return.

Unemployment pay rate formula. The federal government applies a standard 6 FUTA tax rate across industries and it does not change based on how many former employees file for unemployment benefits. Multiply this amount by four percent to determine your weekly unemployment pay. This includes the enhanced and extended benefits provided in 2020.

Ultimately the onus is on the state government to balance the checkbook so the state has to decide the benefits maximum amount duration and eligibility to receive the benefits. Weekly Benefit Amounts Your Weekly Check. This calculator helps you estimate your benefits.

Each state has a different rate and benefits vary based on your earnings record and the date you became unemployed. A worker must be older than age 16 and have been able and available to work full-time in the last four weeks to be considered unemployed by BLS standards. To estimate how much you might be eligible to receive add together the gross wages in the two highest quarters during that period divide by 2 and then multiply by 00385 to get your weekly benefit amount.

The weekly benefit rate is subject to a minimum of 50 and a maximum of 390. Your local state unemployment agency will send you form 1099-G to file with your tax return see due dates. Using a calculator enter the amount you earned for the quarter with the highest gross income out of all four quarters.

It thereafter declared an overpayment in compensation based on the incorrect pay rate during the. This form is. How much will you weekly unemployment check be.

Unemployment Rate is calculated using the formula given below Unemployment Rate No. On April 30 2014 OWCP noted that appellants base pay was 4737800. If you are eligible to receive unemployment the weekly benefit rate in Indiana is 47 of your average weekly wage to come up with your average weekly wage divide your total wages during the base period by 52.

While unemployment rates measure the percentage of those in the labor force who are not working another measure of labor market health is the percentage of the. It is only advisory. The total amount of benefits potentially payable on your claim is found by taking the smaller of.

Firefighter pay rate formula until her return to modified work for eight hours a day on March 3 2014. You may receive benefits for a maximum of 26 weeks. If youre not sure about your eligibility check with your state unemployment.

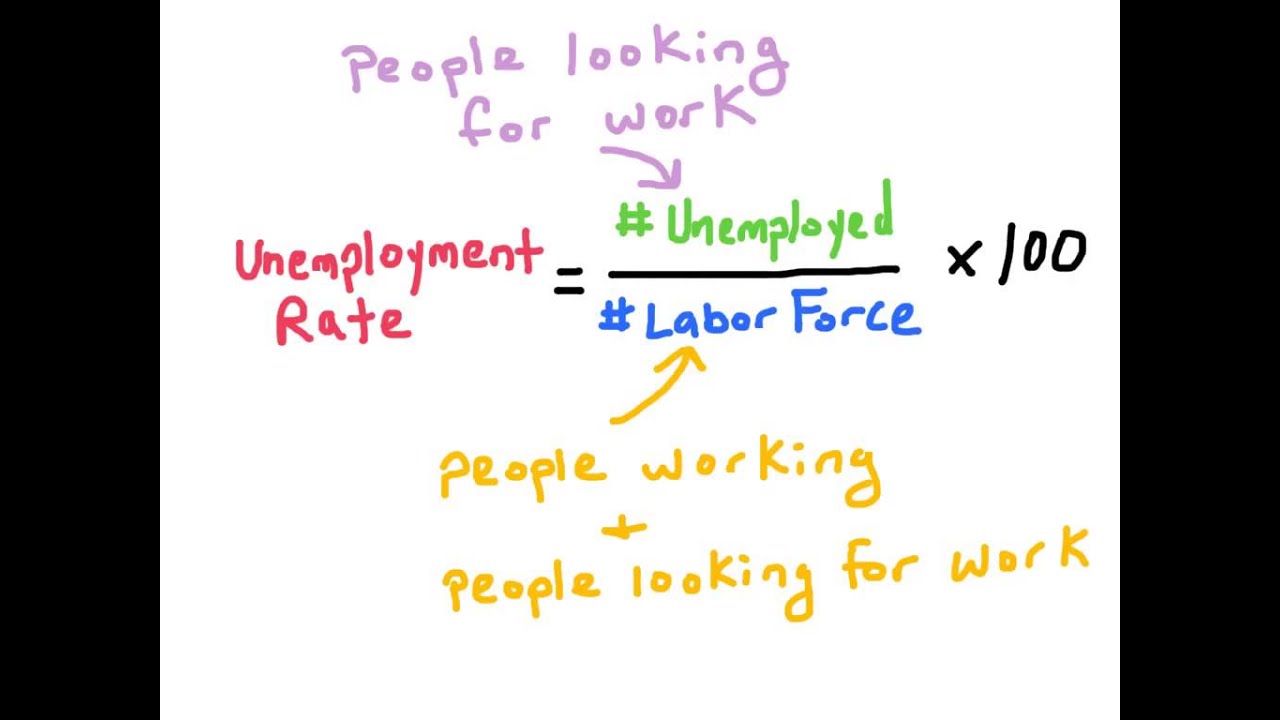

The labor force is the sum of unemployed and employed persons. Of Employed Persons No. 2005 participation rates are calculated using average monthly employment through September.

The unemployment rate formula is the number of unemployed workers divided by the available civilian labor force at that time. Of Unemployed Persons Unemployment Rate 6983 153337 6983 Unemployment Rate 436. Unemployment Rate Number of Unemployed Persons Labor Force.

Will I have to pay taxes on my Unemployment Benefits. Once you find out whether you are eligible you can file a claim for unemployment benefits. This chart will show you how the payment amount is calculated based on your wages in the base period and the percentage of earnings for which you qualify.

Once you file your claim the EDD will verify your eligibility and wage information to determine your weekly benefit amount WBA. The Unemployment Insurance UI benefit calculator will provide you with an estimate of your weekly UI benefit amount which can range from 40 to 450 per week. If your calculated pay is below your states minimum weekly benefit rate you will receive the minimum unemployment pay.

By dividing the number of individuals whom are unemployed by labor force youll find the labor force participation or unemployment rate. The formula for unemployment rate is. Unemployment insurance programs are governed by state governments and are funded by state federal and private companies that pay employment tax.

If you are eligible to receive Unemployment Insurance UI benefits you will receive a weekly benefit amount of approximately 50 of your average weekly wage up to the maximum set by law. 26 times your weekly benefit amount or.

How To Calculate Unemployment Pay Rate Rating Walls

How To Calculate Unemployment Pay Rate Rating Walls

Worked Free Response Question On Unemployment Video Khan Academy

Worked Free Response Question On Unemployment Video Khan Academy

Coupon Rate Formula Calculator Excel Template

Coupon Rate Formula Calculator Excel Template

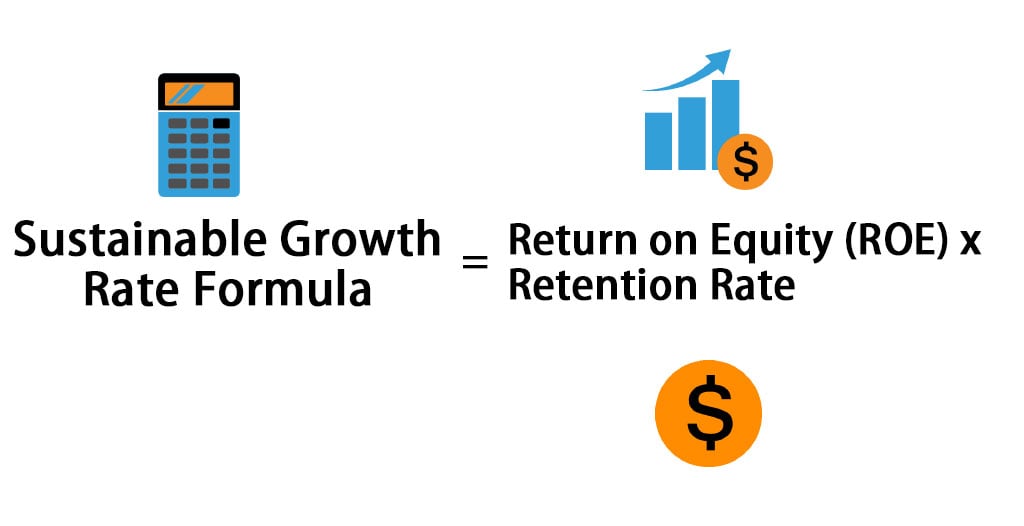

Sustainable Growth Rate Formula Calculator Excel Template

Sustainable Growth Rate Formula Calculator Excel Template

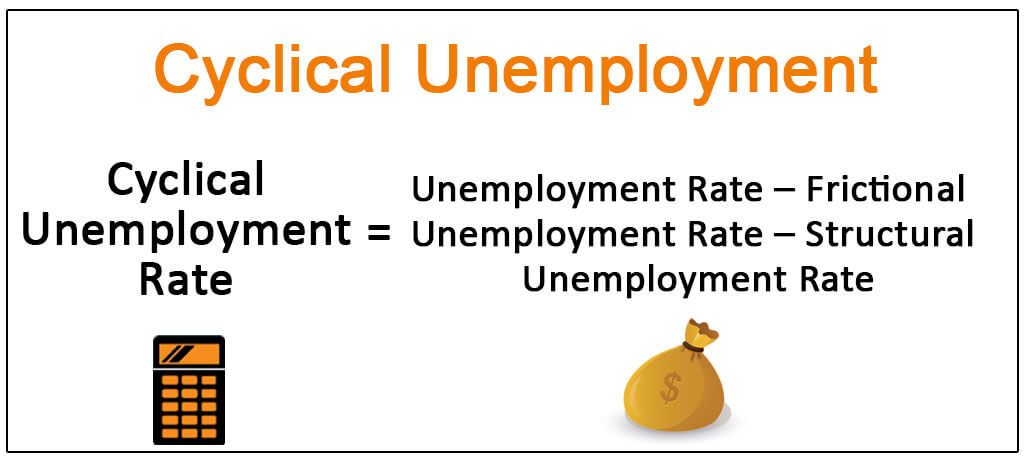

Cyclical Unemployment Definition Example How To Calculate

Cyclical Unemployment Definition Example How To Calculate

How To Calculate Unemployment Pay Rate Rating Walls

How To Calculate Unemployment Pay Rate Rating Walls

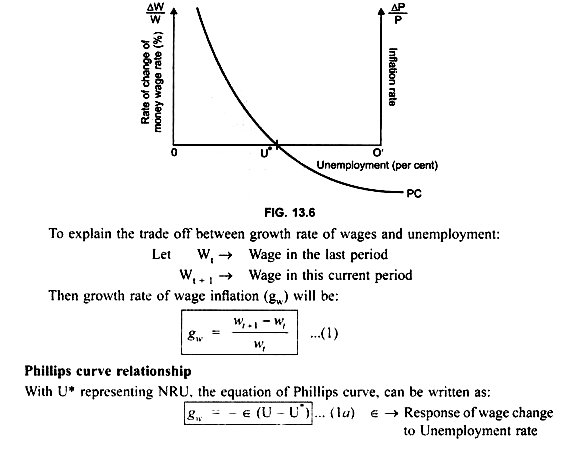

The Phillips Curve Explained With Diagram

The Phillips Curve Explained With Diagram

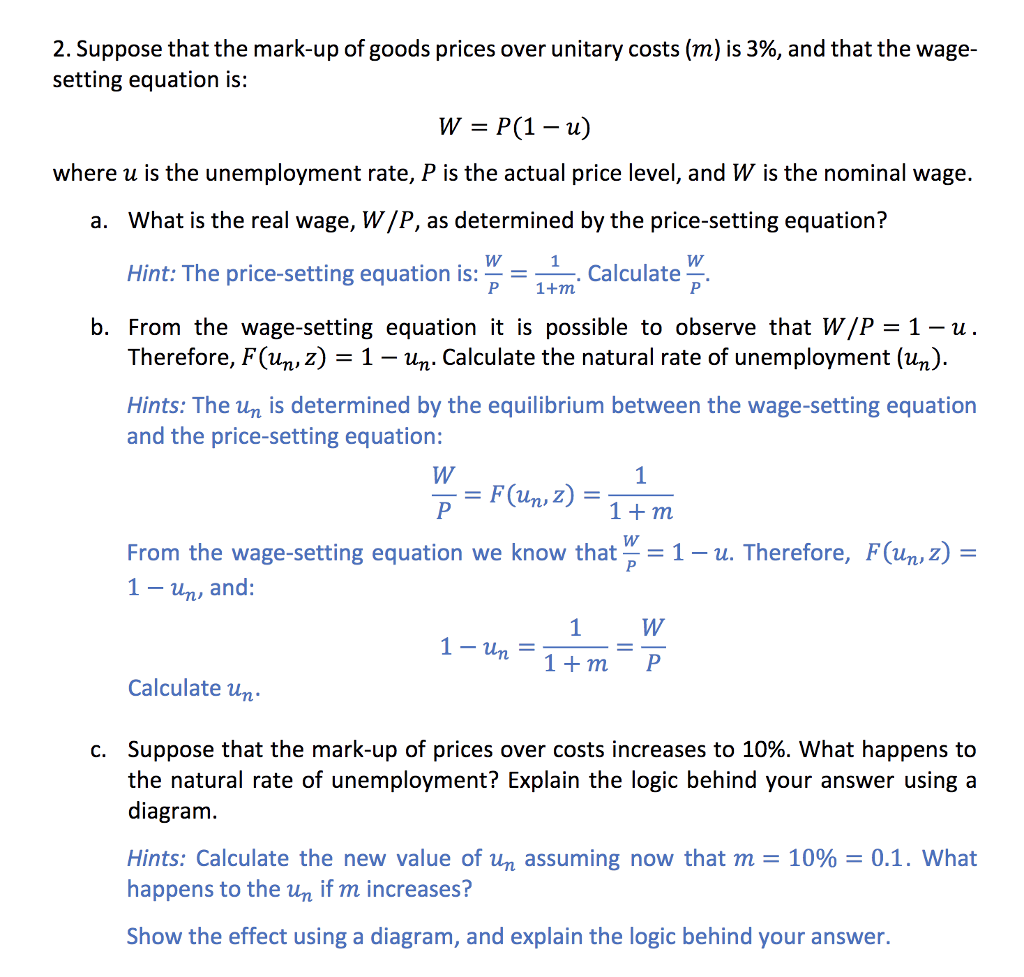

Solved 1 Derive The Natural Rate Of Unemployment In The Chegg Com

Solved 1 Derive The Natural Rate Of Unemployment In The Chegg Com

Payroll Formula Step By Step Calculation With Examples

Payroll Formula Step By Step Calculation With Examples

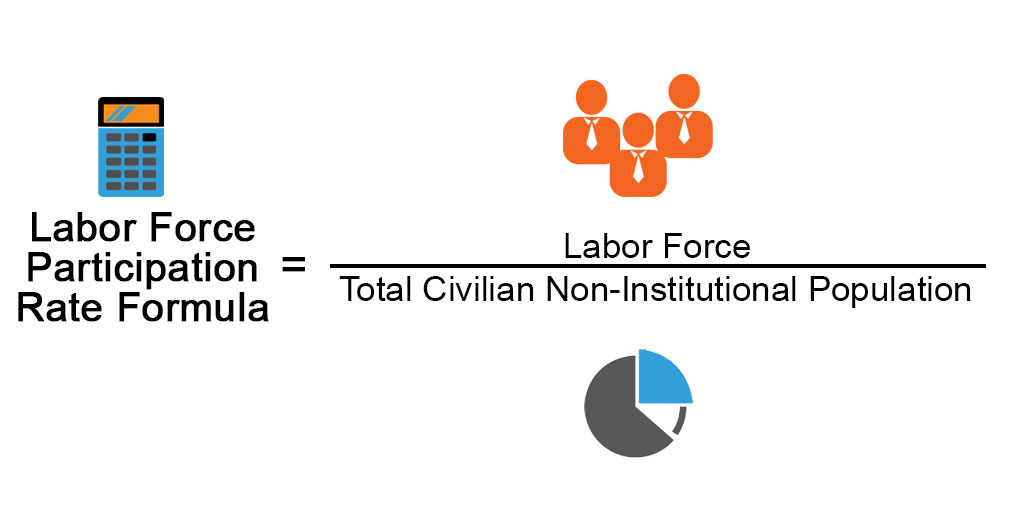

Labor Force Participation Rate Formula Examples With Excel Template

Labor Force Participation Rate Formula Examples With Excel Template

Effective Annual Rate Formula Calculator Examples Excel Template

Effective Annual Rate Formula Calculator Examples Excel Template

How Is The Unemployment Rate Calculated Quora

How Is The Unemployment Rate Calculated Quora

How To Calculate Unemployment Rate 10 Steps With Pictures

How To Calculate Unemployment Rate 10 Steps With Pictures

Discount Rate Formula How To Calculate Discount Rate With Examples

Discount Rate Formula How To Calculate Discount Rate With Examples

Nb2 How To Calculate The Unemployment Rate Youtube

Nb2 How To Calculate The Unemployment Rate Youtube

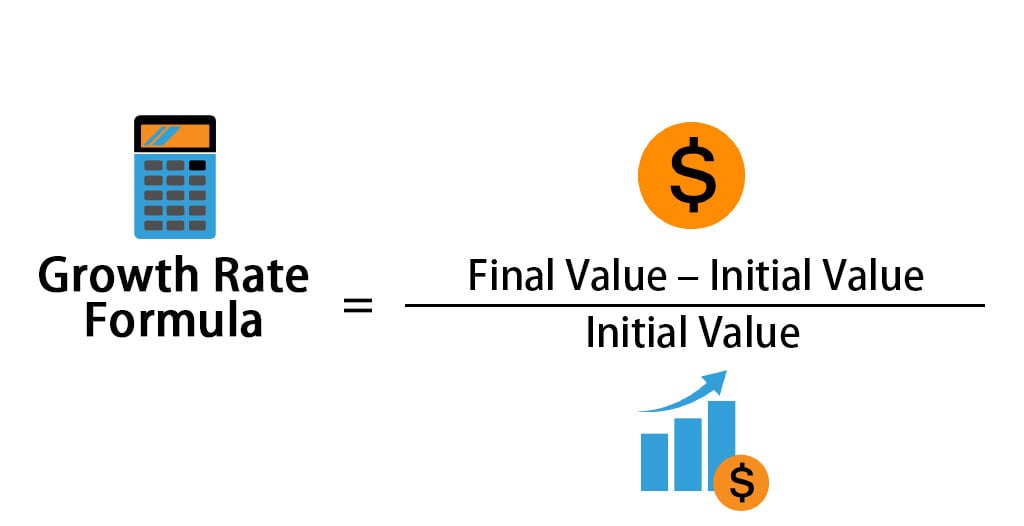

Growth Rate Formula Calculator Examples With Excel Template

Growth Rate Formula Calculator Examples With Excel Template

Worked Free Response Question On Unemployment Video Khan Academy

Worked Free Response Question On Unemployment Video Khan Academy

Post a Comment for "Unemployment Pay Rate Formula"