Ohio Unemployment Tax Break 2020

Ohio income and school district income tax estimated payments for the first and second quarter of 2020 are due on July 15 2020. On March 31 2021 Governor DeWine signed into law Sub.

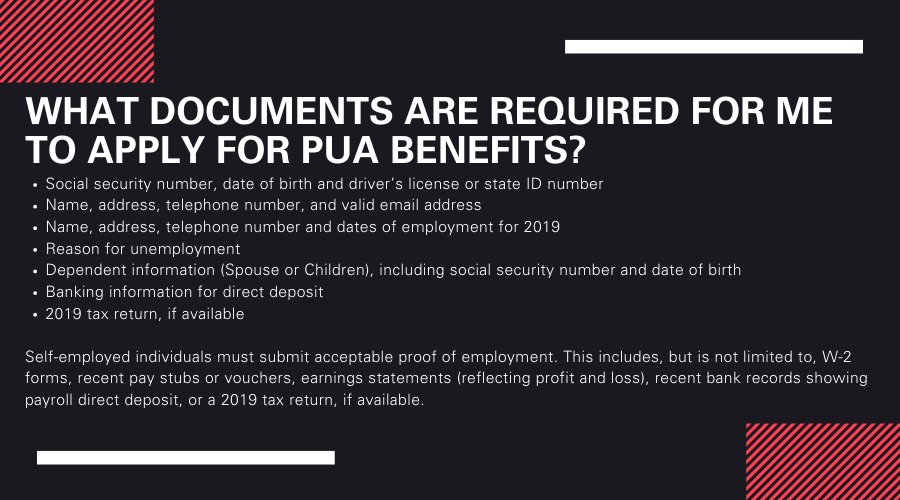

Ohiojfs On Twitter What Documents Are Required For Me To Apply For Pua Benefits For Answers To More Faq S Visit Https T Co Eummtiixu4 Inthistogetherohio Everyclaimisimportant Covid19 Https T Co 6okwzpzqdr

Ohiojfs On Twitter What Documents Are Required For Me To Apply For Pua Benefits For Answers To More Faq S Visit Https T Co Eummtiixu4 Inthistogetherohio Everyclaimisimportant Covid19 Https T Co 6okwzpzqdr

Signed on March 11 the 19 trillion American Rescue Plan exempts from federal tax up to 10200 of unemployment benefits received in 2020 or 20400 for married couples filing jointly for.

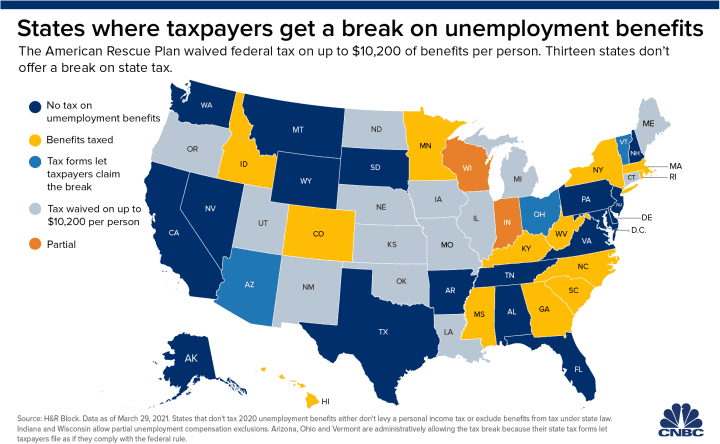

Ohio unemployment tax break 2020. The tax break may make some households eligible for tax breaks that they hadnt qualified for based on their income when theyd originally filed their taxes. Three others Arizona Ohio and Vermont didnt officially adopt the federal standard but their tax forms do allow eligible residents to claim the. In fact a number of states wont let tax-filers exclude that 10200 from their 2020.

18 which incorporates recent federal tax changes into Ohio law effective immediately. Under the American Rescue Plan individuals who received unemployment benefits. The change in a bill signed by Gov.

State Income Tax Range. Despite Relief Bill Some States Wont Give Jobless Workers a Tax Break on Unemployment Benefits. But unemployment benefits are subject to Ohio income.

The American Rescue Plan waived federal tax. Will the IRS create a new form 1040. Mike DeWine Wednesday brought Ohio in line with federal tax lawUnder the American Rescue Plan individuals who received unemployment benefits and earned.

However only 13 states are excluding 10200 of federal unemployment benefits from their residents tax liability for 2020. If your unemployment compensation payments do not reflect Ohio income tax withheld you may need to make Ohio income and school district income tax estimated payments using form IT 1040ES for Ohio income tax and SD 100ES for school district income tax to avoid a balance due when you file your 2020 Ohio IT 1040 and SD 100 returns. But passing a tax break for 2020 when the tax filing season has already begun raises some questions.

If you chose to withhold. A new tax break in the American Rescue Plan Act makes the first 10200 of unemployment benefits received in 2020 non-taxable for households with incomes under 150000. Mike DeWine Wednesday brought Ohio in line with federal tax law.

The unemployment benefits that many taxpayers received for months are tax-free up to 10200. That represents a lot of Americans who will find themselves grappling with taxes on their unemployment benefits when the filing season rolls around in 2021 for 2020 tax returns. 285 on taxable income.

Households with income of less than 150000 will be able to deduct up to 10200 unemployment benefits from their 2020 income in filing their taxes. A late addition to the 19 trillion stimulus package exempted the first 10200 of 2020 unemployment compensation from federal income tax for households earning less than 150000 a year. As a result any unemployment compensation received in 2020 up to 10200 exempt from federal income tax is not subject Ohio income tax.

After that point unemployment benefits are taxable income. The change in a bill signed by Gov. For Tax Year 2020.

The nearly 2 million Ohioans who collected unemployment benefits in 2020 are in line for a big break on their federal taxes under the 19 trillion relief plan signed into law last week. Specifically federal tax changes related to unemployment benefits in the federal American Rescue Plan Act ARPA of 2021 will impact some individuals who have already filed or. As Americans file their tax returns for 2020 -- a year riddled with job insecurity -- millions who relied on unemployment insurance during the pandemic will find that up to 10200 of those benefits will be exempt from taxes.

That means taxpayers will need to pay state tax on benefits they received last year absent any forthcoming changes to state law. Under the American Rescue Plan those who received federal unemployment benefits in 2020 will receive a 10200 tax break when they file a federal income tax return this year.

10 200 Unemployment Tax Break 13 States Aren T Giving The Waiver

10 200 Unemployment Tax Break 13 States Aren T Giving The Waiver

Irs Will Automatically Send Refunds For Unemployment Tax Breaks

Irs Will Automatically Send Refunds For Unemployment Tax Breaks

10 200 Unemployment Tax Break 13 States Aren T Giving The Waiver

10 200 Unemployment Tax Break 13 States Aren T Giving The Waiver

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

State By State Coronavirus Guidelines Tax Unemployment Resources

State By State Coronavirus Guidelines Tax Unemployment Resources

Top 3 Tax Tips For Unemployment Benefits

Top 3 Tax Tips For Unemployment Benefits

Coronavirus Updates Policy Matters Ohio Cleveland Oh

Coronavirus Updates Policy Matters Ohio Cleveland Oh

What To Watch For When Filing 2020 Tax Returns The Blade

What To Watch For When Filing 2020 Tax Returns The Blade

Income School District Tax Department Of Taxation

Income School District Tax Department Of Taxation

Https Jfs Ohio Gov Ocomm Pdf 031221 Revised Stimulus Bill Update News Release Stm

Ohio Offers Employers Relief For Covid 19 Related Work Disruptions

Ohio Offers Employers Relief For Covid 19 Related Work Disruptions

More Ohioans Learn Identities Were Stolen Used For Widespread Unemployment Fraud

More Ohioans Learn Identities Were Stolen Used For Widespread Unemployment Fraud

If You Receive Unemployment Benefits Expect To Receive Form 1099 G Don T Mess With Taxes

Irs Sending You More Money Unemployment Refunds Coming 10tv Com

Irs Sending You More Money Unemployment Refunds Coming 10tv Com

Unemployment Fraud Chicago Man Receives Ohio Unemployment Tax Form Despite Never Living There Abc7 Chicago

Unemployment Fraud Chicago Man Receives Ohio Unemployment Tax Form Despite Never Living There Abc7 Chicago

Guidance On The 600 Federal Weekly Benefit And Other Unemployment Benefits Apple Growth Partners

Guidance On The 600 Federal Weekly Benefit And Other Unemployment Benefits Apple Growth Partners

Ohio Unemployment Help Wkyc Com

Ohio Unemployment Help Wkyc Com

More Ohioans Learn Identities Were Stolen Used For Widespread Unemployment Fraud

More Ohioans Learn Identities Were Stolen Used For Widespread Unemployment Fraud

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Post a Comment for "Ohio Unemployment Tax Break 2020"