How Often Do You Have To File For Unemployment In Ohio

When prompted log in using your Social Security number and existing PIN. You should apply for unemployment benefits as soon as you become unemployed.

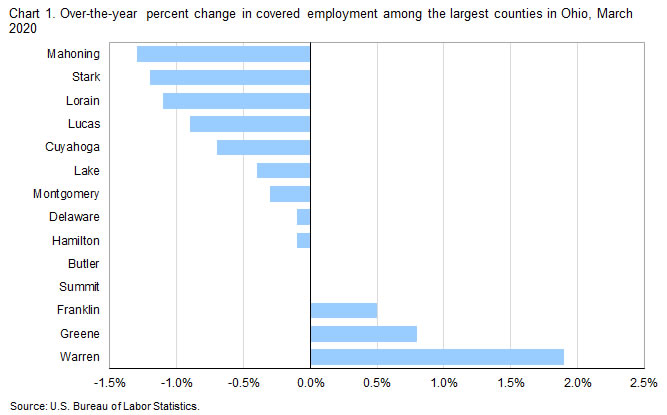

County Employment And Wages In Ohio First Quarter 2020 Midwest Information Office U S Bureau Of Labor Statistics

County Employment And Wages In Ohio First Quarter 2020 Midwest Information Office U S Bureau Of Labor Statistics

You have one year -- 52 weeks --.

How often do you have to file for unemployment in ohio. We encourage you to let your employees know about the identity theft reporting portal and other resources available at unemploymentohiogov. Your claim will begin the Sunday of the calendar week your application is filed. You must have worked at 20 weeks or more in covered employment during what is called the base period.

Emergency and extended unemployment could extend this. The total number of initial jobless claims filed in Ohio. You will need to file a new claim if you have not applied for unemployment benefits at any time in the past 12 months.

You will not be paid for weeks that you dont submit your claim on time. To do this visit unemploymentohiogov click on Get Started Now and answer the questions. The Ohio Governors executive order waives the usual one-week unpaid waiting period so you can collect unemployment benefits for the first week you are out of work.

As soon as you become unemployed you need to file a claim for benefits. However even if you meet one of these exceptions if you have a school district income tax liability SD 100 line 2 you are required to file the Ohio IT 1040. Once your benefit year expires if you are not already receiving extended benefits you should file a new application.

Per Section 411315 of the Ohio Revised Code an employer must pay employees at least twice per month. It can take up to three weeks for your application to be approved so in that time you should continue to file for unemployment benefits every week. For example an unemployment payments base year may consist of four of the last five completed calendar quarters before the week in which you apply for unemployment benefits.

Your application is not filed until you receive a confirmation number. If you opt to receive correspondence via mail then you will file bi-weekly. Your claim begins on the Sunday of the week that you file.

As such if you have worked 20 weeks in the last year you will typically satisfy this requirement. After three weeks you will need to claim every week via internet unless you select to receive correspondence by US mail. You can file weekly or biweekly unemployment claims in Ohio.

- For a step-by-step guide to filing your weekly claims online click here. Learn more about unemployment. Both individuals and employers can report identity theft to ODJFS and access other resources by clicking on the Report Identity Theft button at unemploymentohiogov.

If you are disconnected use your username and PIN to log back on and resume the application process. In an effort to streamline claims processing and expedite payments the Ohio Department of Job and Family Services ODJFS has a new weekly claim filing process for Ohioans who have been approved to receive unemployment benefits. 2 days agoHere in Ohio 44985 initial jobless claims were filed last week according to statistics ODJFS reported to the US.

Waiting more than a week to apply will delay the start of your claim and no benefits will be paid for weeks of unemployment that pass before the week you file. All hours worked from the 1 st to the 15 th of month must be paid by the 1 st of the following month. Telephone Call toll-free 1-877-644-6562 or TTY 1-614-387-8408 excluding holidays.

If your federal adjusted gross income is greater than 24550 the Department of Taxation recommends that you file an Ohio IT 1040 or IT 10 even if you do not owe any tax to. If you are unemployed due to the coronavirus pandemic more information can be found at unemploymenthelpohiogov. All hours worked from the 16 th to the end.

Ohio pays regular unemployment benefits for 26 weeks -- if you collected full benefits every week your regular unemployment would last 26 weeks. Ohio Unemployment Insurance BENEFITS CHART - 2021 If your application for unemployment benefits is allowed your actual weekly benefit amount will be determined after you certify your application. Benefit amounts are approximately 60-70 percent of wages and range from 50-1300 a week depending on your income.

You will receive written notification of your entitlement and this notification is usually provided within a few days of your filing. Your benefit year begins the day you file for unemployment. Simplified the base period means the last four calendar quarters.

- Log in to your account at unemploymentohiogov to file weekly claims. If there is a delay in your Ohio unemployment claim filing by more than a week you will not receive benefits for that week. In order to be paid you must file weekly claims for each week that you are unemployed or make less than your weekly benefit amount.

Report it by calling toll-free.

Who In Ohio Is Qualified For Coronavirus Related Jobless Benefit Wfmj Com

Who In Ohio Is Qualified For Coronavirus Related Jobless Benefit Wfmj Com

Answers To Qualifying For Unemployment The 300 Payments And Disputed Ohio Claims That S Rich Q A Cleveland Com

Debunking Myths About Covid 19 Relief S Unemployment Insurance On Steroids

Debunking Myths About Covid 19 Relief S Unemployment Insurance On Steroids

Https Jfs Ohio Gov Releases Pdf Odjfs News Release Federal Benefits Extension 1 11 21 Stm

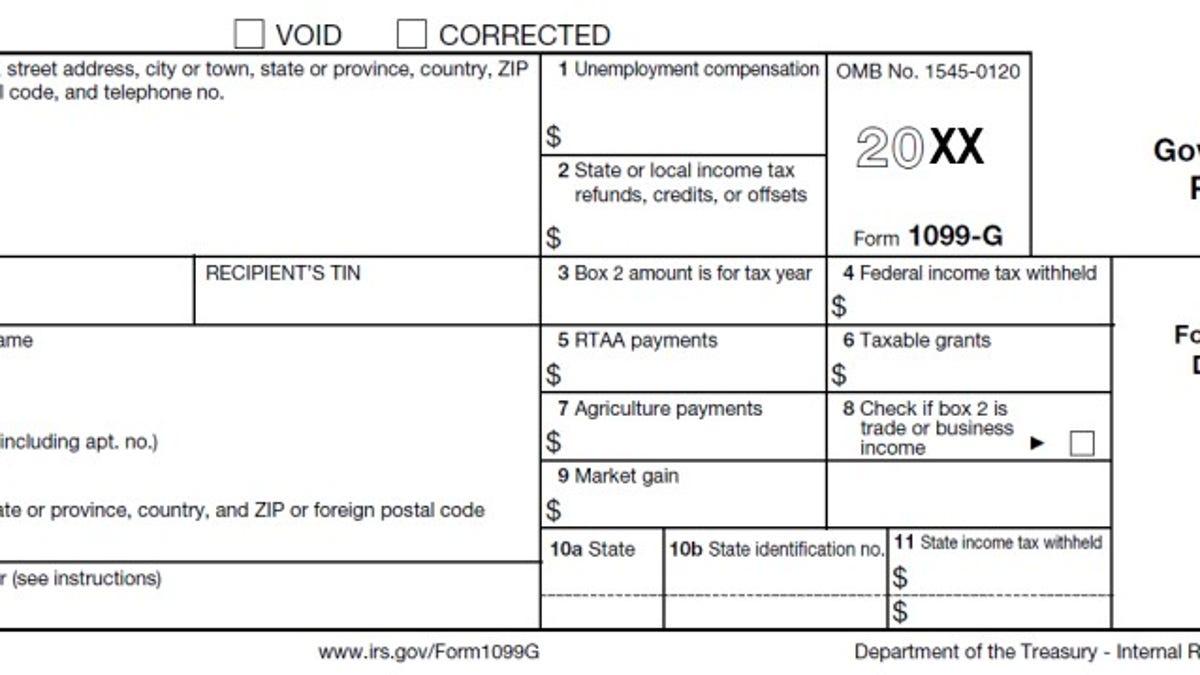

What You Should Know About Unemployment Compensation

Many Out Of Work Due To Coronavirus Aren T Eligible For Unemployment Benefits Cleveland Com

Many Out Of Work Due To Coronavirus Aren T Eligible For Unemployment Benefits Cleveland Com

Many Out Of Work Due To Coronavirus Aren T Eligible For Unemployment Benefits Cleveland Com

Many Out Of Work Due To Coronavirus Aren T Eligible For Unemployment Benefits Cleveland Com

As A Record Number Of Ohio Unemployment Applicants Express Frustration State Officials Say They Re Working On Solutions Scene And Heard Scene S News Blog

As A Record Number Of Ohio Unemployment Applicants Express Frustration State Officials Say They Re Working On Solutions Scene And Heard Scene S News Blog

Ohio Update To Allow Thousands More To Claim Unemployment Benefits Wrgt

Ohio Update To Allow Thousands More To Claim Unemployment Benefits Wrgt

Unemployment Fraud Reports Running Rampant In Central Ohio

Unemployment Fraud Reports Running Rampant In Central Ohio

Unemployment Changes In Ohio Due To Covid 19 Equality Ohio

Unemployment Changes In Ohio Due To Covid 19 Equality Ohio

Ohio Postpones Tax Filing Deadline To May 17 Matching The Irs Revised Deadline For Federal Taxes Cleveland Com

Ohio Postpones Tax Filing Deadline To May 17 Matching The Irs Revised Deadline For Federal Taxes Cleveland Com

Pandemic Unemployment Assistance Covid 19 Checklist Covid 19

Pandemic Unemployment Assistance Covid 19 Checklist Covid 19

Https Jfs Ohio Gov Ouio Employeroutreach Employeroutreachwebinar September2019 Stm

270k Unemployment Claims On Hold Amid Concerns About Fraud

270k Unemployment Claims On Hold Amid Concerns About Fraud

Https Jfs Ohio Gov Ouio Employeroutreach Employeroutreachwebinar September2019 Stm

Https Jfs Ohio Gov Ouio Employeroutreach Employeroutreachwebinar September2019 Stm

Q A Your Most Common Unemployment Questions The Lima News

Q A Your Most Common Unemployment Questions The Lima News

Post a Comment for "How Often Do You Have To File For Unemployment In Ohio"