How Do I Pay Back Unemployment Overpayment In Nj

To utilize the E-payment service you will need the following items. You may choose to pay online.

You may be asked to send a check for the balance of the overpayment.

How do i pay back unemployment overpayment in nj. The state said she should have been receiving benefits from New Jersey. If you do not repay in one lump sum or make a payment plan the. Your Social Security Number.

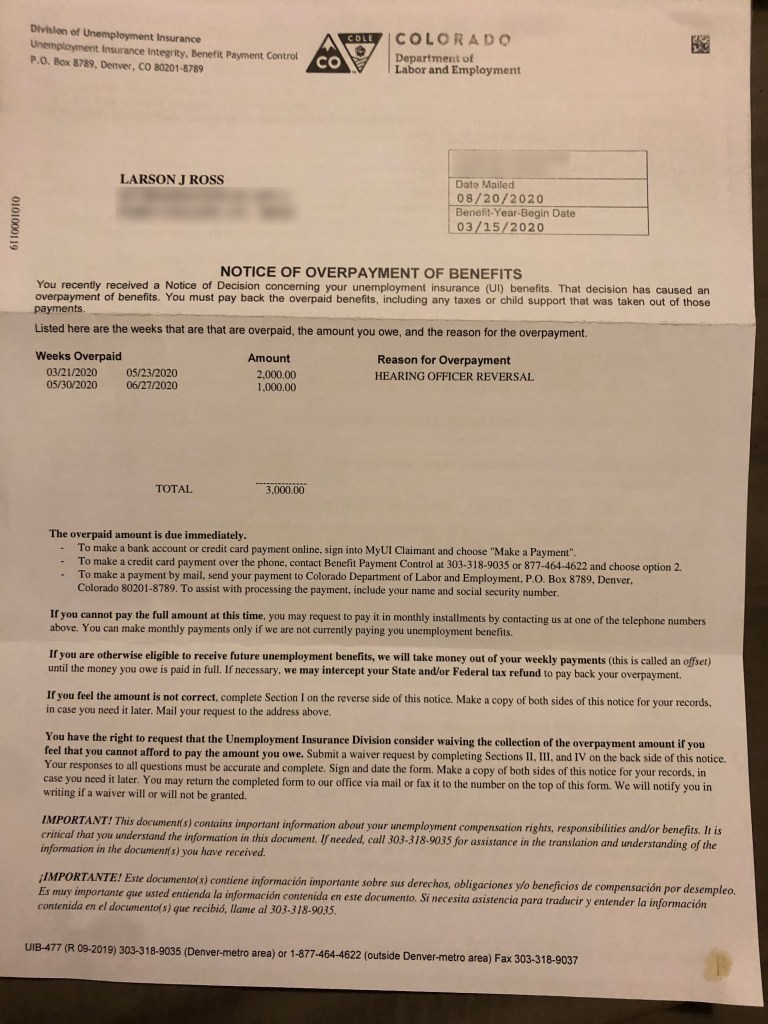

People around the country have received overpayment of benefits notices and are facing the prospect of having to repay some or all of their unemployment benefits. You can pay the amount in full or make a payment plan with the Department of Labor. Check Payments - Please mail a check payment to the address below.

Make the check or money order payable to NJ Dept. Millions May Have to Pay Back Benefits If They Miss This Deadline Share on. However it didnt allow states to forgive money paid to workers by mistake meaning states had to recoup these overpayments even if a worker wasnt at fault or able to pay the money back.

These laws may provide relief if you currently have an Overpayment on your account for unemployment benefits you received under certain federal programs. Overpayments Refunds If you receive any Unemployment Insurance benefits to which you are not entitled you will be required to return those benefits. PUA wasnt set up in this way but the latest language in the.

A valid credit card or bank account. If you cant repay it all at once you may be able to negotiate a payment plan. 6 youll still have access to regular unemployment insurance for the remainder of your benefit year.

If the agency issues you an Overpayment it is important that you appeal it and request a waiver. The overpayment seems to be stemming from issues with the Pandemic Unemployment Assistance PUA program according to an earlier government report. Sometimes the Commission will agree to deduct the amount out of any future unemployment benefits.

NextAdvisor added that overpayment recovery procedures also vary including offset of future. If you didnt repay overpayment of unemployment benefits in the same year Include the benefits in income for the year they were paid. You can mail a payment for all or a portion of the amounts that was overpaid.

Claimant ID number found under your name on the LWD payment coupon attached to your. You may choose to set up a repayment schedule by contacting our Benefit Payment Control office at 609-292-0030. If you cant repay the amount you owe all at once the unemployment commission will usually set up an unemployment overpayment payment plan for you and youll be asked to sign a repayment.

If the overpayment was a mistake you will have to pay interest at 1 per month starting one year after the overpayment is established. If you repaid the overpayment of unemployment benefits in the same year you received them Subtract the amount of unemployment repayment from the total taxable amount you received. File an appeal or overpayment waiver with your state In almost all of those cases especially if you are not to blame for the overpayment you should still look into filing an appeal or an.

If benefits were paid to you in error you will receive a notice stating the amount you were overpaid and why you were not entitled to the benefits. This rule doesnt apply if youre on PUA or Extended Benefits the federally funded program that triggers on for select states during times of high unemployment. New Jersey Department of Labor and Workforce Development Refund Processing Section PO Box 951 Trenton NJ 08625-0951 Please include your claimant ID number and a daytime telephone number where you may be reached with any correspondence you submit.

In some cases if a state mistakenly overpays an unemployment recipient they can waive the requirement that excess funds be returned. Report the difference as unemployment compensation. You may send a check or money order cash will not be accepted to the address listed below.

Please make your check payable to the Florida Department of Economic Opportunity and provide your claimant ID number in the memo line. For those in other states dont spend the money and hold onto the. These options are listed below.

In most cases you will be asked to repay the overpayment. Meg Patrick of Montclair said shes been told to repay nearly 11000 in unemployment benefits to New York. Otherwise if you are entitled to further benefits you may be able to use those benefits to repay the overpayment.

You have the option to pay back overpayments multiple ways. There are time limits to do this so it is important that you do this right away. After your PEUC expires at the latest by Sept.

Bamboozled Here S Your 17 000 In Unemployment Benefits Now Pay It All Back Nj Com

Bamboozled Here S Your 17 000 In Unemployment Benefits Now Pay It All Back Nj Com

Which States Are Asking To Repay The Overpaid Unemployment Benefits

Which States Are Asking To Repay The Overpaid Unemployment Benefits

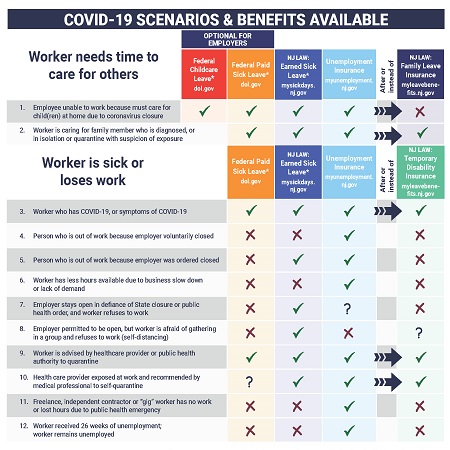

Division Of Unemployment Insurance Nj Workers Frequently Asked Questions During The Coronavirus Emergency

Division Of Unemployment Insurance Nj Workers Frequently Asked Questions During The Coronavirus Emergency

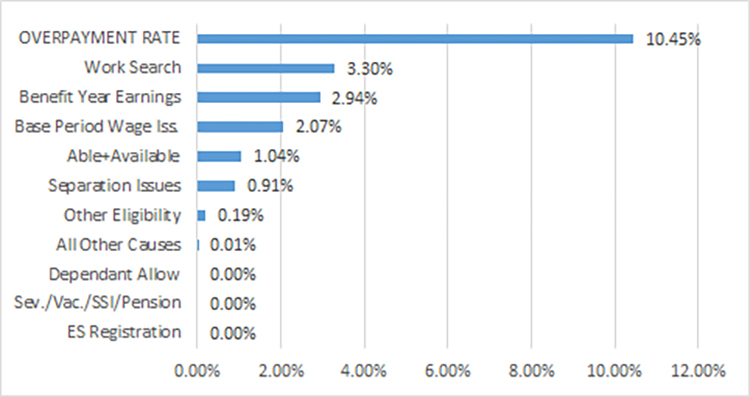

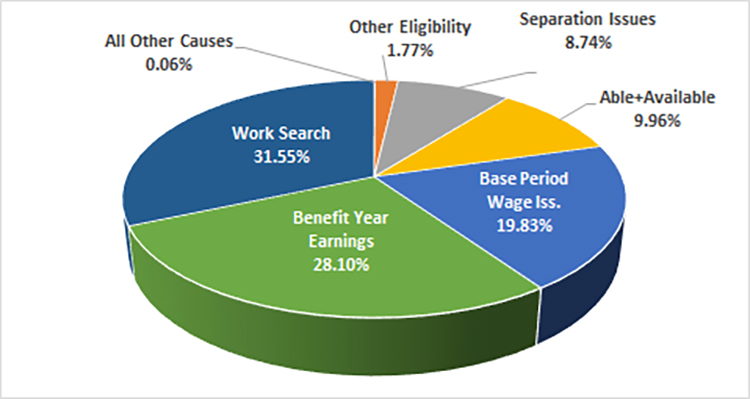

New Jersey U S Department Of Labor

New Jersey U S Department Of Labor

New Jersey U S Department Of Labor

New Jersey U S Department Of Labor

Division Of Temporary Disability And Family Leave Insurance Were You Overpaid Benefits

Division Of Temporary Disability And Family Leave Insurance Were You Overpaid Benefits

Extra 300 Fpuc Unemployment Compensation Covid Stimulus Relief Slow Rollout Out By States Aving To Invest

Extra 300 Fpuc Unemployment Compensation Covid Stimulus Relief Slow Rollout Out By States Aving To Invest

Division Of Unemployment Insurance Overpayments Refunds

Division Of Unemployment Insurance Overpayments Refunds

Division Of Unemployment Insurance Federal Income Taxes On Unemployment Insurance Benefits

Division Of Unemployment Insurance Federal Income Taxes On Unemployment Insurance Benefits

Division Of Temporary Disability And Family Leave Insurance Were You Overpaid Benefits

Division Of Temporary Disability And Family Leave Insurance Were You Overpaid Benefits

Lsnjlaw An Overview Of The Unemployment Appeals Process

Lsnjlaw An Overview Of The Unemployment Appeals Process

States Are Telling Some People To Pay Back Unemployment Benefits Marketplace

States Are Telling Some People To Pay Back Unemployment Benefits Marketplace

Overpayment Of Unemployment Benefits And Penalties

Overpayment Of Unemployment Benefits And Penalties

States Are Telling Some People To Pay Back Unemployment Benefits Marketplace

States Are Telling Some People To Pay Back Unemployment Benefits Marketplace

Post a Comment for "How Do I Pay Back Unemployment Overpayment In Nj"