Do You Have To Report Stimulus Money To Unemployment

If a person earns any money while on unemployment she must report it on her weekly claims form to the Department of Labor. The standard and expanded unemployment benefits are considered taxable income by the federal government and many states consider it taxable as well although not all.

Taxes 2021 Everything New Including Deadline Stimulus Payments And Unemployment Cnet

Taxes 2021 Everything New Including Deadline Stimulus Payments And Unemployment Cnet

No you do not have to file for or claim a stimulus payment.

Do you have to report stimulus money to unemployment. The stimulus money does not need to be reported to the EDD and is not deductible from unemployment benefits because it is not. How to Get Your Stimulus Payment. You must still report your unemployment compensation on your tax return even if you dont receive a Form 1099-G for some reason.

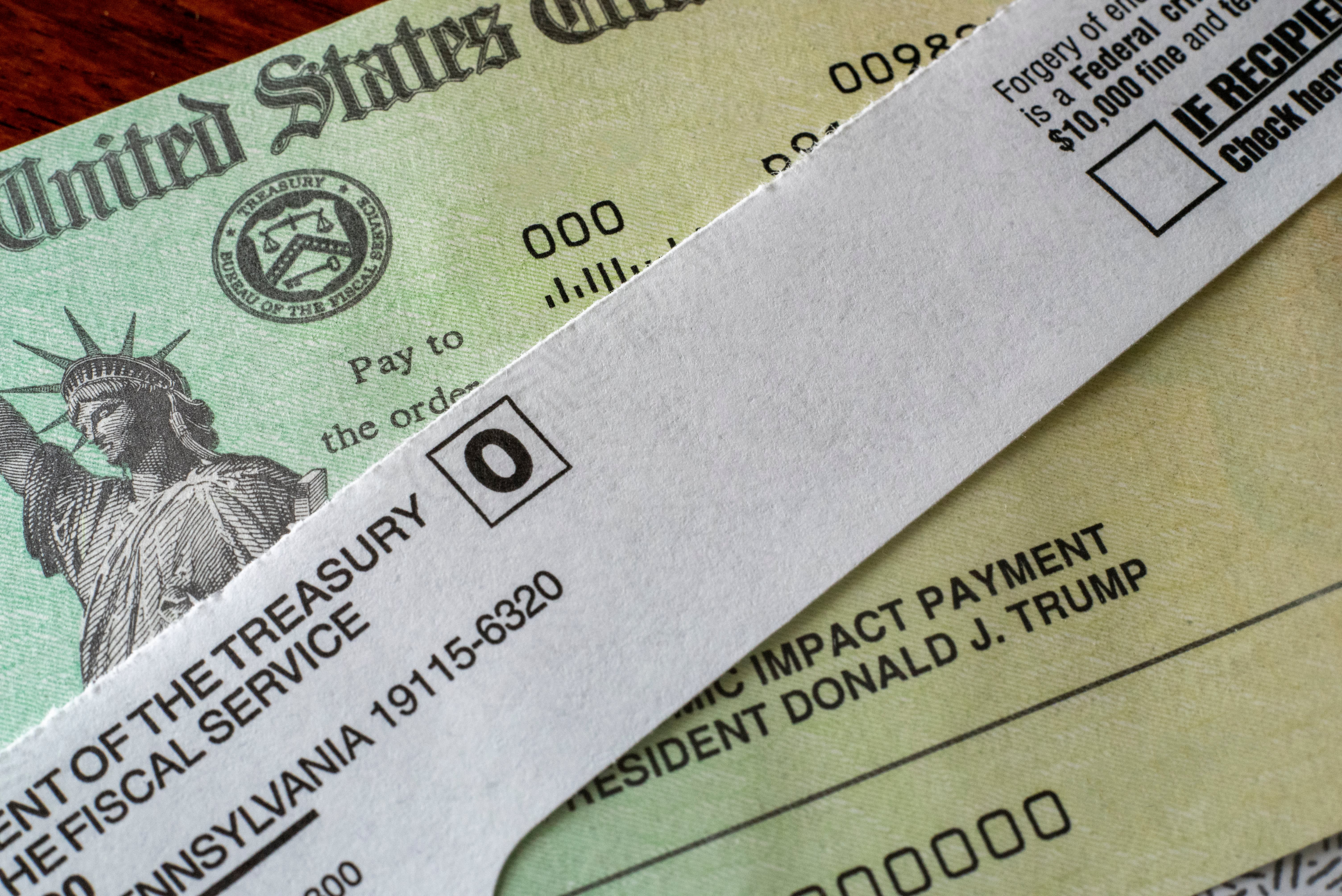

Most people wont have to do anything to receive their stimulus payment. In short you dont need to include any stimulus payments the federal 1200 600 and 1400 payments. Stimulus doesnt but you still need to report it unemployment does.

No you wont. Congress passed new legislation the CARES Coronavirus Aid Relief and Economic Security Act which provided a variety of government financial support to US. You will be taxed at the regular rate for any federal unemployment benefits above 10200.

You may need to take action if youre a non-filer or need to update your direct deposit details on the IRS website. If you were among the millions of Americans who were laid off last year and received unemployment during that time you do have to claim that income on your taxes. Officials managing unemployment claims factor the extra earnings into her benefits and deduct some.

You can look it up in Google if youd like and itll give you the same answer I did. At first it felt like doom and gloom says McClelland 35. You can take the tax break if you have an adjusted gross income of less than 150000.

I know this doesnt seem very official but trust me. You do need to include the 300 per week PUC except for Medi-Cal eligibility. Do you really have the right to choose how to spend that money.

A year into the coronavirus pandemic Megan McClelland is surprised by how steadily her credit and finances have improved. If you qualify and your banking information andor mailing information on file with the IRS is up-to-date the stimulus. Youll probably also owe state income taxes on the unemployment benefits unless you live in one of the nine states that dont have a state income tax or a few others that exempt jobless.

And Californias 600 Golden State Stimulus payment when you calculate your household income. If you were laid off the state unemployment office would calculate whether youd receive benefits for the 30000 via PUA or 20000 via unemployment insurance but. But the special pandemic unemployment benefits are treated like income and could.

The two rounds of direct stimulus payments that were sent to millions of Americans are tax-free. No we only report earnings. In late March 2020 the US.

Effect on Other Tax Benefits Taxable unemployment benefits include the extra 600 per week that was provided by the federal government in response to the coronavirus pandemic accountant Chip Capelli of Provincetown Massachusetts told The Balance. Therefore if you know your 2019 tax return will disqualify you from receiving the stimulus you should wait until you receive it to file. Turns out the government is allowed under federal law to withhold some or all of someones stimulus.

The answer in most cases is yes. This is a tax breakgiftwhatever you want to call it but it doesnt classify as an earning. Citizens including unemployment assistance and stimulus payments.

Or email EDD and theyll tell you the same thing. The first thing that you oughtta know is that the unemployment - federal and state -. Both unemployment and stimulus payments may usually come to consumers in the form of a direct account deposit a check sent in the.

However you do still have to list any stimulus money you receive on your tax forms. The IRS says that since the money is typically classified the same as the income you earn through work it is taxable.

What Are The Highlights Of The New Stimulus Package How To Get Money Student Loan Interest Business Assistance

What Are The Highlights Of The New Stimulus Package How To Get Money Student Loan Interest Business Assistance

600 A Week Unemployment Benefits Unlikely To Be Extended

600 A Week Unemployment Benefits Unlikely To Be Extended

300 Bonus Unemployment Checks How Many Are Left What You Should Know Cnet

300 Bonus Unemployment Checks How Many Are Left What You Should Know Cnet

Maine Gives 600 Stimulus Checks As Unemployment Benefits End And Federal Package Stalls

Maine Gives 600 Stimulus Checks As Unemployment Benefits End And Federal Package Stalls

What If My 1 400 Stimulus Check Never Comes What You Should And Shouldn T Do Cnet

What If My 1 400 Stimulus Check Never Comes What You Should And Shouldn T Do Cnet

How Unemployment Stimulus Payments Will Affect Your Taxes Abc10 Com

How Unemployment Stimulus Payments Will Affect Your Taxes Abc10 Com

What If My 1 400 Stimulus Check Never Comes What You Should And Shouldn T Do Cnet

What If My 1 400 Stimulus Check Never Comes What You Should And Shouldn T Do Cnet

Stimulus Bill Unemployment Benefits How A New Tax Break Could Save You Money Cnet

Stimulus Bill Unemployment Benefits How A New Tax Break Could Save You Money Cnet

300 Bonus Unemployment Checks When Do Payments Go Out Here S What You Should Know Cnet

300 Bonus Unemployment Checks When Do Payments Go Out Here S What You Should Know Cnet

Stimulus Bill Unemployment Benefits How A New Tax Break Could Save You Money Cnet

Stimulus Bill Unemployment Benefits How A New Tax Break Could Save You Money Cnet

Everything You Need To Know About The New Coronavirus Stimulus Checks

Everything You Need To Know About The New Coronavirus Stimulus Checks

4th Stimulus Check How You Could Get One Or More Payments In 2021 Cnet

4th Stimulus Check How You Could Get One Or More Payments In 2021 Cnet

If The Senate And House Can Agree To Send Another Economic Stimulus Payment To You And That S Not Guaranteed Th Incentives For Employees Cnet Tax Credits

If The Senate And House Can Agree To Send Another Economic Stimulus Payment To You And That S Not Guaranteed Th Incentives For Employees Cnet Tax Credits

Stimulus Bill Unemployment Benefits How A New Tax Break Could Save You Money Cnet

Stimulus Bill Unemployment Benefits How A New Tax Break Could Save You Money Cnet

You Could Have More Than 1 Stimulus Check Here S How You May Get 3 Payments Cnet

You Could Have More Than 1 Stimulus Check Here S How You May Get 3 Payments Cnet

300 Bonus Unemployment Checks How Many Are Left What You Should Know Cnet

300 Bonus Unemployment Checks How Many Are Left What You Should Know Cnet

Stimulus Checks Won T Be Taxed But Unemployment Benefits Will Be Coronavirus Fox5vegas Com

Stimulus Checks Won T Be Taxed But Unemployment Benefits Will Be Coronavirus Fox5vegas Com

Track Your 1 400 Stimulus Check Status Now Using This Irs Tool Cnet

Track Your 1 400 Stimulus Check Status Now Using This Irs Tool Cnet

Post a Comment for "Do You Have To Report Stimulus Money To Unemployment"