Unemployment Tax Rate Definition

You may use either EAMS or ePay to pay your taxes. The UI rate schedule and amount of taxable wages are determined annually.

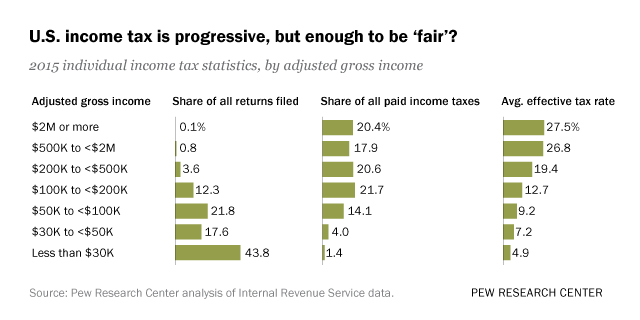

Who Pays U S Income Tax And How Much Pew Research Center

Who Pays U S Income Tax And How Much Pew Research Center

New employers pay 34 percent 034 for a period of two to three years.

Unemployment tax rate definition. The first component of the tax rate is the experience-based tax which is based on the amount of unemployment benefits paid to former employees over the past four years. 10 That extra 600 is also taxable after the first 10200. There are 40 experience rate classes and businesses move up or down those classes based on their past experience.

You might be alright if you arranged to have income tax withheld from your benefits but federal law caps withholding on benefits at 10. Most employers pay both a Federal and a state unemployment tax. The Federal Unemployment Tax Act FUTA is legislation that imposes a payroll tax on any business with employees.

Consequently the effective rate works out to 06 0006. To use EAMS or EAMS for Single Filers you will need to be sure to set up your online account in advance. The overall average unemployment tax rate will drop by 13 percent.

Most employers receive a maximum credit of up to 54 0054 against this FUTA tax for allowable state unemployment tax. If an employer has no paid taxable payroll during the four-year period ending June 30th of the prior year they are assigned the maximum base tax rate of 62. The FUTA tax is 6 0060 on the first 7000 of income for each employee.

An employers tax rate determines how much the employer pays in state Unemployment Insurance taxes. For the 77338 employers that have had no lay-offs in the past four years the tax rate will plummet by 71 percent. It is a lagging indicator meaning that it generally rises or falls in the wake of.

The unemployment rate is the percent of the labor force that is jobless. Use Employer Account Management Services EAMS or EAMS for Single Filers to file your tax reports or tax and wage reports online. This means that the employer has not paid the tax due on the payroll on or before the September 30th prior to the computation year.

As of 2021 the FUTA tax. The stability of our unemployment benefits fund and tax system is the envy of many other. The resulting tax payment goes into a state-managed fund that is used to compensate people who have been terminated from their jobs.

UI is paid by the employer. The state unemployment tax is a rate charged by state governments to employers on a tranche of each employee s pay. Rate notices for calendar year 2020 were mailed to employers on Oct.

To calculate the amount of unemployment insurance tax payable TWC multiplies their amount of taxable wages by the employers tax rate. Lower unemployment tax rates in 2012 than what they pay now. If you have questions regarding your rate or need a replacement rate notice please contact the Reemployment Assistance Tax Unit at 6056262312.

The tax is applied to the Federal or FUTA wage base. Reemployment Assistance Unemployment Insurance and COVID-19. The revenue raised is used to fund unemployment benefits.

52 rows State unemployment tax is a percentage of an employees wages. The federal employment tax is legislated by the Federal Unemployment Tax Act and is known as the FUTA tax. The wage base for calendar year 2020 will remain at 15000.

For paying unemployment taxes. The EDD notifies employers of their new rate each December. The Federal Unemployment Tax Act FUTA with state unemployment systems provides for payments of unemployment compensation to workers who have lost their jobs.

The maximum amount of taxable wages per employee per calendar year is set by statute and is currently 9000. Tax-rated employers pay a percentage on the first 7000 in wages paid to each employee in a calendar year. It provided an additional 600 per week in unemployment compensation per recipient through July 2020.

Therefore the tax is applicable to the first 7000 that is compensated towards the wages of each hired employee for a calendar year. Employers may access their current rates through e-Services for Business select View your Payroll Tax Rates under More Online Services Refer to How to Determine Taxable Wages for additional information on determining the taxable wages to be used in the calculation. The current Federal or FUTA base wage is 7000.

There are two components of the state unemployment tax. Employers who submit state tax reports and pay state tax contributions on a timely basis receive from the IRS a 90 percent offset credit against the federal employment tax that they owe. The current FUTA tax rate is 6 percent.

You must pay federal unemployment tax based on employee wages or salaries. For filing tax reports or tax and wage reports online.

How Do Taxes Affect Income Inequality Tax Policy Center

How Do Taxes Affect Income Inequality Tax Policy Center

What Is The Federal Unemployment Tax Rate In 2020

What Is The Federal Unemployment Tax Rate In 2020

What Is The Futa Tax 2021 Tax Rates And Info Onpay

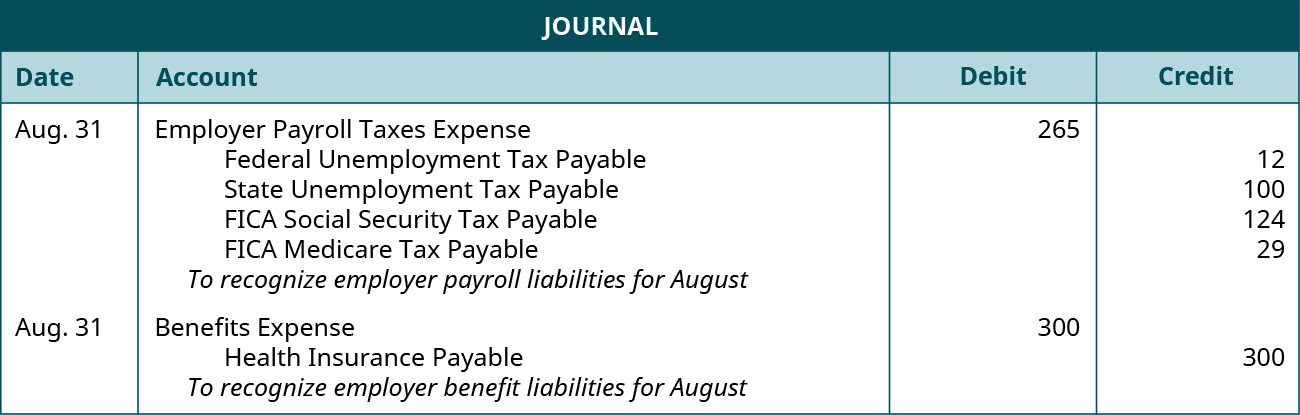

Record Transactions Incurred In Preparing Payroll Principles Of Accounting Volume 1 Financial Accounting

Record Transactions Incurred In Preparing Payroll Principles Of Accounting Volume 1 Financial Accounting

Sui Definition And How To Keep Your Sui Rate Low Bench Accounting

Sui Definition And How To Keep Your Sui Rate Low Bench Accounting

Fica Tax Guide 2020 Payroll Tax Rates Definition Smartasset

Fica Tax Guide 2020 Payroll Tax Rates Definition Smartasset

How Should Progressivity Be Measured Tax Policy Center

How Should Progressivity Be Measured Tax Policy Center

What Is The Federal Unemployment Tax Futa Cleverism

What Is The Federal Unemployment Tax Futa Cleverism

What Are Employee And Employer Payroll Taxes Ask Gusto

What Are Employee And Employer Payroll Taxes Ask Gusto

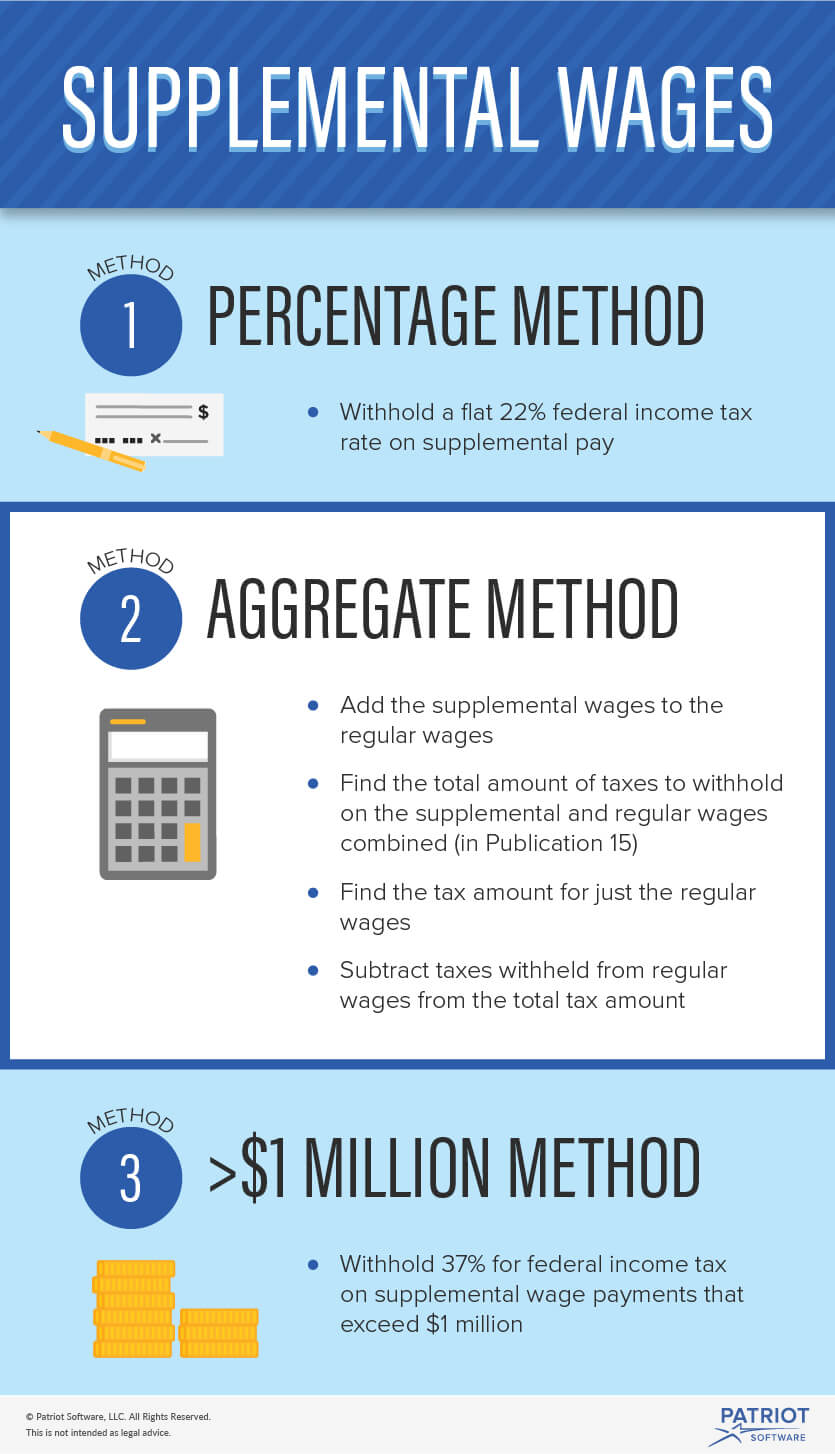

Supplemental Wages Definition And Tax Withholding Rules

Supplemental Wages Definition And Tax Withholding Rules

What Is Futa Tax 2021 Tax Rates And Information

What Is Futa Tax 2021 Tax Rates And Information

What Is Futa Tax Rate Due Dates More

What Is Futa Tax Rate Due Dates More

Sui Sit Employment Taxes Explained Emptech Com

Sui Sit Employment Taxes Explained Emptech Com

How Do Marginal Income Tax Rates Work And What If We Increased Them

How Do Marginal Income Tax Rates Work And What If We Increased Them

Sui Sit Employment Taxes Explained Emptech Com

Sui Sit Employment Taxes Explained Emptech Com

What Is The Federal Unemployment Tax Rate In 2020

What Is The Federal Unemployment Tax Rate In 2020

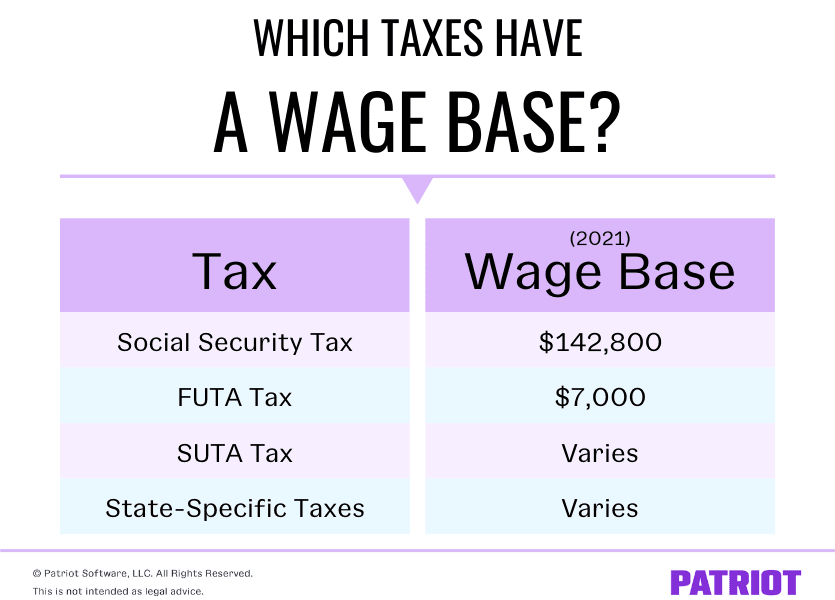

What Is A Wage Base Definition Taxes With Wage Bases More

What Is A Wage Base Definition Taxes With Wage Bases More

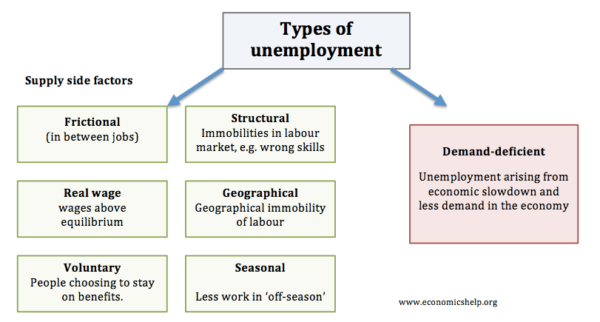

Definition Of Unemployment Economics Help

Definition Of Unemployment Economics Help

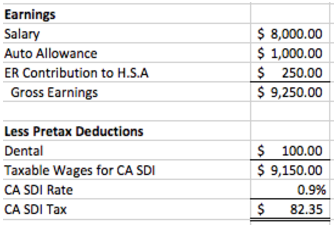

How Are State Disability Insurance Sdi Payroll Taxes Calculated

How Are State Disability Insurance Sdi Payroll Taxes Calculated

Post a Comment for "Unemployment Tax Rate Definition"