Unemployment Tax Form In Va

Unemployment Compensation - This box includes the dollar amount paid in benefits to you during the calendar year. Tax Filing Registration.

Https Www Vec Virginia Gov Printpdf 377 Mini 2013 05

The Department completed electronically processing 1099-G Tax Forms for all claimants on January 17 2021.

/Clipboard02-a5156f9d1f374ac4bd6cea8b55ca7541.jpg)

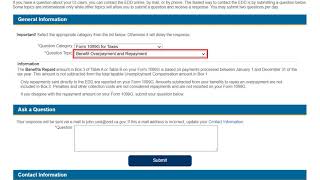

Unemployment tax form in va. Call Customer Service at 8043678031. Unemployment compensation has its own line Line 7 on Schedule 1 which accompanies your 1040 tax return. Virginia Tax Online Services for Businesses.

That will be the case if a new tax break on up to 10200 of unemployment benefits makes them newly eligible for income-dependent tax breaks like the earned income tax. 575 on taxable income. These instructions apply for claimants across all programs eg.

State Taxes on Unemployment Benefits. 2 on up to 3000 of taxable income. Go to the IRS website.

If you change addresses you must give the VEC the new address to receive your 1099G. Youll transfer the amount in Box 1 of Form 1099-G to Line 7 of Schedule 1 then the withholding amount in Box 4 of the 1099-G if any goes directly onto your 1040 tax return on Line 25b. Instructions for the form can be found on the IRS website.

So if you did receive a 1099-G from the VEC make sure you dont claim any state withholding when youre filling out your return. Right click on link go down to Save Target As and save it to your computer. As taxable income these payments must be reported on your state and federal tax return.

The Form 1099G is a report of the income you received from the Virginia Department of Taxation. To look up your 1099GINT youll need your adjusted gross income from your most recently filed Virginia income tax return Line 1 or the sum of both columns of Line 1 for a part-year return. The American Rescue Plan a 19 trillion Covid relief bill waived.

866-832-2363 815am to 430pm Monday - Friday and 9am to 1pm on Saturday closed Sunday and state holidays Mailing Address PO. Online Employer Tax FilingRegistration - iFileiReg. Update Your Business Profile.

The information on the 1099-G tax form is provided as follows. Look up your 1099G1099INT. Some taxpayers who collected unemployment benefits in 2020 and filed their returns in the early days of tax season may have to file an amended return to get their maximum refund.

Line 1 Adjusted Gross Income from your last filed 760 760PY or 763 Virginia return. The 1099-G form is available as of January 2021. Anonymously report Unemployment Insurance Fraud to the VEC by calling 1-800-782-4001.

Thirteen states arent offering a tax break on unemployment benefits received last year according to data from HR Block. Employer Quarterly FC2021 EZ-Form. 2020 Individual Income Tax Information for Unemployment Insurance Recipients Form 1099G reports the total taxable income we issue you in a calendar year and is reported to the IRS.

Download the VEC FC-27 Report to Determine Liability for State Unemployment Tax and instruction page. All claimants should have access to their 1099-G Tax Form. This document will accurately summarize your unemployment compensation and ensure that you are taxed appropriately.

If you collected unemployment insurance last year you will need the 1099-G form from IDES to complete your federal and state tax returns. State Income Tax Range. While the total benefits are reported in Box 1 of the Form 1099-G you will only need to report a partial amount on your Schedule 1 of the Form 1040 tax return if.

Box 26441 Richmond VA 23261-6441. Enter FC 21 Payroll reports online and FC20 Tax Reports. The 1099-G tax form is commonly used to report unemployment compensation.

Register a new business Online. Virginia Relay call 711 or 800-828-1120. Adjustments - This box includes cash payments and income tax refunds used to pay back overpaid benefits.

If you have received unemployment income at any point during the year you will be required to complete and return IRS Form 1099-G. The Virginia Employment Commission will send you and the IRS Form 1099G at the years end detailing the benefits you received plus any federal tax withholdings elected. This 1099-G does not include any information on unemployment benefits received last year.

There are no taxes on unemployment benefits in Virginia. The VEC offers several ways to file your Unemployment Insurance Tax Reports and pay your Unemployment Insurance Taxes. There is a selection oval on your individual income tax form to opt out of receiving a paper Form 1099G each year.

Get Your Form 1099-G Now. You can collected Form 1099-G by calling your local unemployment office or contacting the IRS directly. Regular UI and PUA.

And as a reminder because Virginia does not tax unemployment benefits the VEC does not withhold Virginia taxes from any unemployment payments. Additional FAQs are available here.

State Tax Department No Longer Sending 1099s Wvpb

State Tax Department No Longer Sending 1099s Wvpb

Va Fc 20 Wage Report Can Be Printed Or E Filed Cwu2014 Cwu 2014 Virginia Vec Fc 20 And Vec Fc 21 Web Upload Or Paper File The Virginia Employment Commission Vec Permits Electronic Web Upload Or Paper Filing Of An Employer S

:max_bytes(150000):strip_icc()/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

What Is Futa Tax 2021 Tax Rates And Information

What Is Futa Tax 2021 Tax Rates And Information

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

:max_bytes(150000):strip_icc()/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

If You Receive Unemployment Benefits Expect To Receive Form 1099 G Don T Mess With Taxes

Ui Online Access Tax Information Form 1099g Using Ui Online Youtube

Ui Online Access Tax Information Form 1099g Using Ui Online Youtube

3 12 154 Unemployment Tax Returns Internal Revenue Service

3 12 154 Unemployment Tax Returns Internal Revenue Service

1099 G Tax Form Why It S Important

1099 G Tax Form Why It S Important

Vec Continues To Send Mistaken Unemployment Tax Forms Chesapeake Retiree Gets 18k Statement Wavy Com

Vec Continues To Send Mistaken Unemployment Tax Forms Chesapeake Retiree Gets 18k Statement Wavy Com

Kansas Department Of Labor Announces Unemployment Tax Related Call Center Begins To Mail Irs Form 1099 G Information To Claimants For 2020 Wibw News Now

Kansas Department Of Labor Announces Unemployment Tax Related Call Center Begins To Mail Irs Form 1099 G Information To Claimants For 2020 Wibw News Now

/Clipboard02-a5156f9d1f374ac4bd6cea8b55ca7541.jpg) Form 1099 Int Interest Income Definition

Form 1099 Int Interest Income Definition

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

:max_bytes(150000):strip_icc()/Clipboard02-a5156f9d1f374ac4bd6cea8b55ca7541.jpg) Form 1099 Int Interest Income Definition

Form 1099 Int Interest Income Definition

Are You Interested In Attending A Free Tax Preparation Please Contact 804 775 6433 To Reserve A Time Slot Today Tax Preparation Tax Free Preparation

Are You Interested In Attending A Free Tax Preparation Please Contact 804 775 6433 To Reserve A Time Slot Today Tax Preparation Tax Free Preparation

Ky Unemployment W2 Forms Vincegray2014

Ky Unemployment W2 Forms Vincegray2014

Va Refund 1099g Taxes Zip Code Schedule Northern Virginia Virginia City Data Forum

Va Refund 1099g Taxes Zip Code Schedule Northern Virginia Virginia City Data Forum

Post a Comment for "Unemployment Tax Form In Va"