Unemployment Money Where Does It Come From

This money is paid from the trust funds which belong to the government and each state. Only three statesAlaska New Jersey and Pennsylvaniaassess unemployment taxes on employees and its a small portion of the overall cost.

How Does Unemployment Insurance Work And How Is It Changing During The Coronavirus Pandemic

How Does Unemployment Insurance Work And How Is It Changing During The Coronavirus Pandemic

A companys UC rate called their Experience rate is based on the number of past layoffs.

Unemployment money where does it come from. The taxes are part of the often-discussed payroll taxes all employers pay. This includes people who are not ordinarily eligible such as self-employed independent contractor and gig workers. Where does the money come from.

Eligibility will vary by state. The amount of taxes are discussed with the employer and there are even discounts for those who pay salary on time. In 2019 the national average unemployment payment was 370 per week and the national average salary for unemployment recipients was 970 per week.

The federal unemployment insurance UI trust fund finances the costs of administering unemployment insurance programs loans made to state unemployment insurance funds and half of extended benefits during periods of high unemployment. Unemployment comes only from the employer. In January 2021 unemployment benefit recipients should receive a Form 1099-G Certain Government Payments PDF from the agency paying the benefits.

The federal tax is 62 percent on the first 7000 in annual wages to each employee. Where does unemployment money come from. The form will show the amount of unemployment compensation they received during 2020 in Box 1 and any federal income tax withheld in Box 4.

The package also reduces the tax burden on the unemployment money for households earning less than 150000 a year. Of course the government relief package has relaxed unemployment requirements. The recently-signed 19 trillion American Rescue Plan did a.

Employees pay nothing for unemployment despite what David Ecale and Marianne Kooiman have posted. With Mixed Earner Unemployment Compensation a person who made more money from self-employment or a contracting job -- that requires a 1099 form -- could receive an extra 100 a week. The act does a lot of things people wish the government had done a long time ago.

Unemployed workers who accept. It provides free coronavirus testing for everyone extends unemployment benefits by 13 weeks and loosens the requirements for collecting unemployment. Unemployment insurance programs are run as federal-state partnerships financed through payroll taxes.

Its raised through state and federal unemployment insurance taxes on employers. Unemployment is almost entirely funded by employers. Expanded unemployment insurance benefits are now available to millions of Americans who are out of work for reasons related to the COVID-19 pandemic under the Coronavirus Aid Relief and Economic Security CARES Act.

Employers pay certain percentage of the employees salary to fulfill that unemployment fund. How soon youll receive your first unemployment check also varies by state. When it comes to federal income taxes the general answer is yes.

Unemployment is funded by multiplying pay period taxable wages by the companies tax rate. This 600 weekly boost for unemployed workers comes courtesy of the Federal Pandemic Unemployment Compensation program that was put in place as part of the CARES Act. Employers pay federal taxes of 6 percent on the first 7000 in annual income earned by every employee.

The IRS will automatically refund filers who are entitled to an unemployment tax break but that money wont come for a while. For most states you need to have paid into the unemployment fund which means you were an employee rather than an independent contractor or self-employed person. Uncle Sam taxes unemployment benefits as if they were wages although up to 10200 of unemployment compensation received in 2020.

The idea behind a 600 payment was simple. Department of Labors Unemployment Insurance program is funded through unemployment insurance taxes paid by employers and collected by the state and federal government. The regular pre-pandemic program is funded by taxes on employers including state taxes which vary by state and the Federal Unemployment Tax Act FUTA.

Unemployment compensationalso known as unemployment insurance or unemployment benefitsis money paid by the states to unemployed workers who have lost their jobs due to layoffs or their employers need to reduce costs in response to economic difficulty. The new law renewed the weekly 300 federal unemployment checks which wouldve. Unemployment is funded and taxed at both the federal and state level.

23 Million Americans Could Face Eviction In Coming Months Senior Programs Learning Gaps Lost My Job

23 Million Americans Could Face Eviction In Coming Months Senior Programs Learning Gaps Lost My Job

Essential Workers Are Making Less Money Than Those On Unemployment In 2020 Essential Oil Diffuser Recipes Unemployment Modern Boho Decor

Essential Workers Are Making Less Money Than Those On Unemployment In 2020 Essential Oil Diffuser Recipes Unemployment Modern Boho Decor

What To Do When An Employer Lies To Unemployment So They Do Not Have To Pay Out Benefits In 2020 Unemployment Employment Agency Employment

What To Do When An Employer Lies To Unemployment So They Do Not Have To Pay Out Benefits In 2020 Unemployment Employment Agency Employment

300 Bonus Unemployment Checks When Do Payments Go Out Here S What You Should Know Cnet

300 Bonus Unemployment Checks When Do Payments Go Out Here S What You Should Know Cnet

What You Should Know About Unemployment Compensation

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

How Unemployment Benefits Are Calculated By State Bench Accounting

How Unemployment Benefits Are Calculated By State Bench Accounting

Discover How You Can Keep Your Bills Paid And Fridge Full Paying Bills Finding A New Job Job Hunting

Discover How You Can Keep Your Bills Paid And Fridge Full Paying Bills Finding A New Job Job Hunting

Jobless Claims Were Worse Than Expected Amid Slowdown In Hiring Unemployment Financial News Dow Jones

Jobless Claims Were Worse Than Expected Amid Slowdown In Hiring Unemployment Financial News Dow Jones

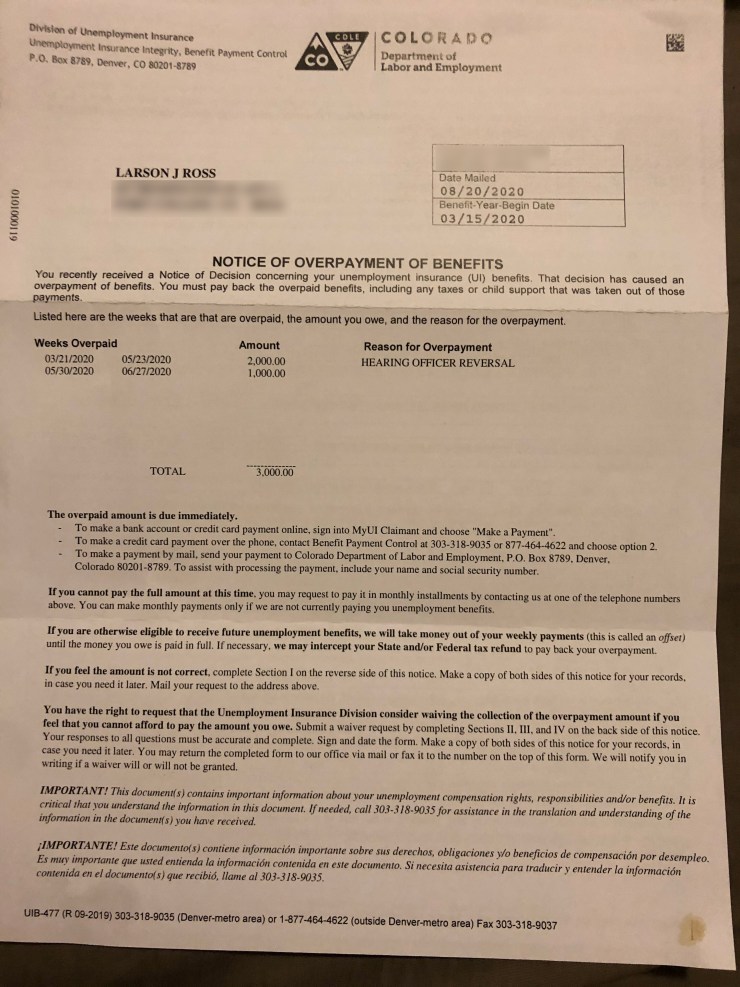

States Are Telling Some People To Pay Back Unemployment Benefits Marketplace

States Are Telling Some People To Pay Back Unemployment Benefits Marketplace

Free Unemployment Verification Letter Sample With Benefits Plus In Proof Of Unemployment Letter Template Business Letter Template Lettering Letter Templates

Free Unemployment Verification Letter Sample With Benefits Plus In Proof Of Unemployment Letter Template Business Letter Template Lettering Letter Templates

Surviving Unemployment With Images Unemployment Job Hunting Money Saving Tips

Surviving Unemployment With Images Unemployment Job Hunting Money Saving Tips

Pin On Personal Money Management

Pin On Personal Money Management

How To Survive Unemployment We Ve Had 4 Layoffs In The Last Decade We Ve Had 4 Layoffs In The Last Decade In 2021 Frugal Living Tips Couples Money Money Strategy

How To Survive Unemployment We Ve Had 4 Layoffs In The Last Decade We Ve Had 4 Layoffs In The Last Decade In 2021 Frugal Living Tips Couples Money Money Strategy

My Unemployment Says I Have A Break In My Claim What Does That Mean In 2020 Meant To Be Serious Problem Sayings

My Unemployment Says I Have A Break In My Claim What Does That Mean In 2020 Meant To Be Serious Problem Sayings

States Are Telling Some People To Pay Back Unemployment Benefits Marketplace

States Are Telling Some People To Pay Back Unemployment Benefits Marketplace

Unemployment Benefits Id Card New York State 1945 Vintage Etsy In 2020 New York State New York Travel New York

Unemployment Benefits Id Card New York State 1945 Vintage Etsy In 2020 New York State New York Travel New York

Enhanced Unemployment Benefits During The Coronavirus Crisis Smartasset

Enhanced Unemployment Benefits During The Coronavirus Crisis Smartasset

300 Bonus Unemployment Checks How Many Are Left What You Should Know Cnet

300 Bonus Unemployment Checks How Many Are Left What You Should Know Cnet

Post a Comment for "Unemployment Money Where Does It Come From"