Unemployment In Ohio For 1099

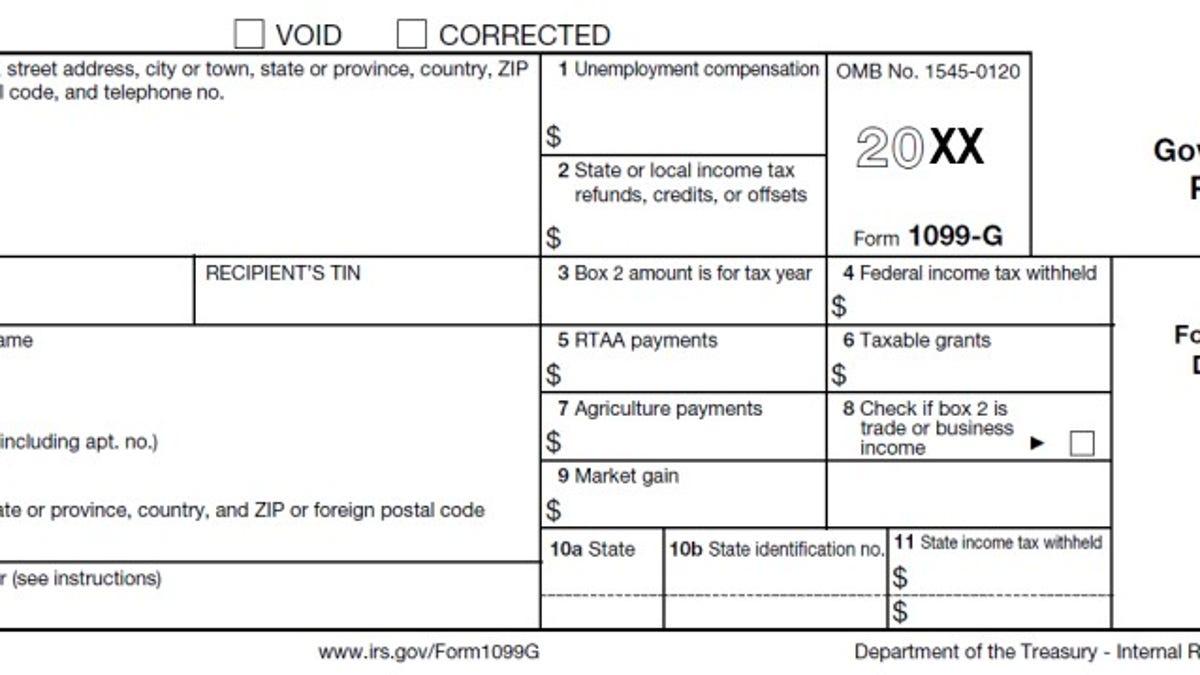

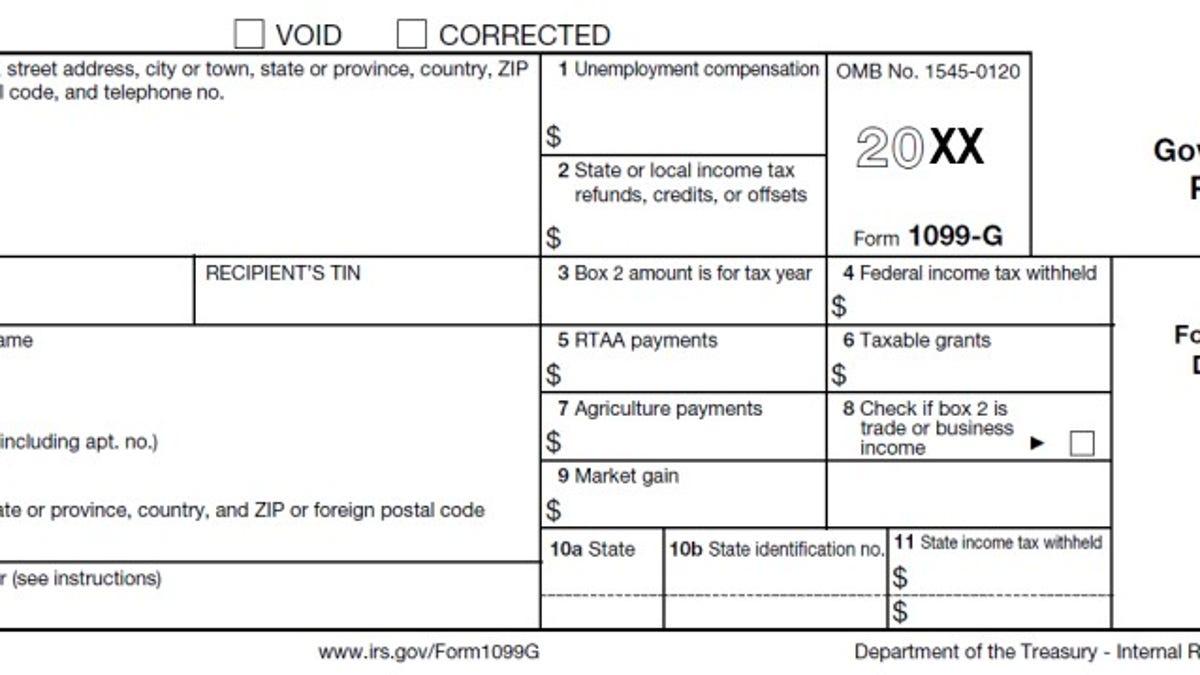

Many Ohioans have become victims and their identities used to file fraudulent unemployment claims in both the traditional unemployment and Pandemic Unemployment Assistance programs. If you received unemployment in 2020 you will be receiving a 1099-G tax form in the mail sometime this month which is used to file your tax returns.

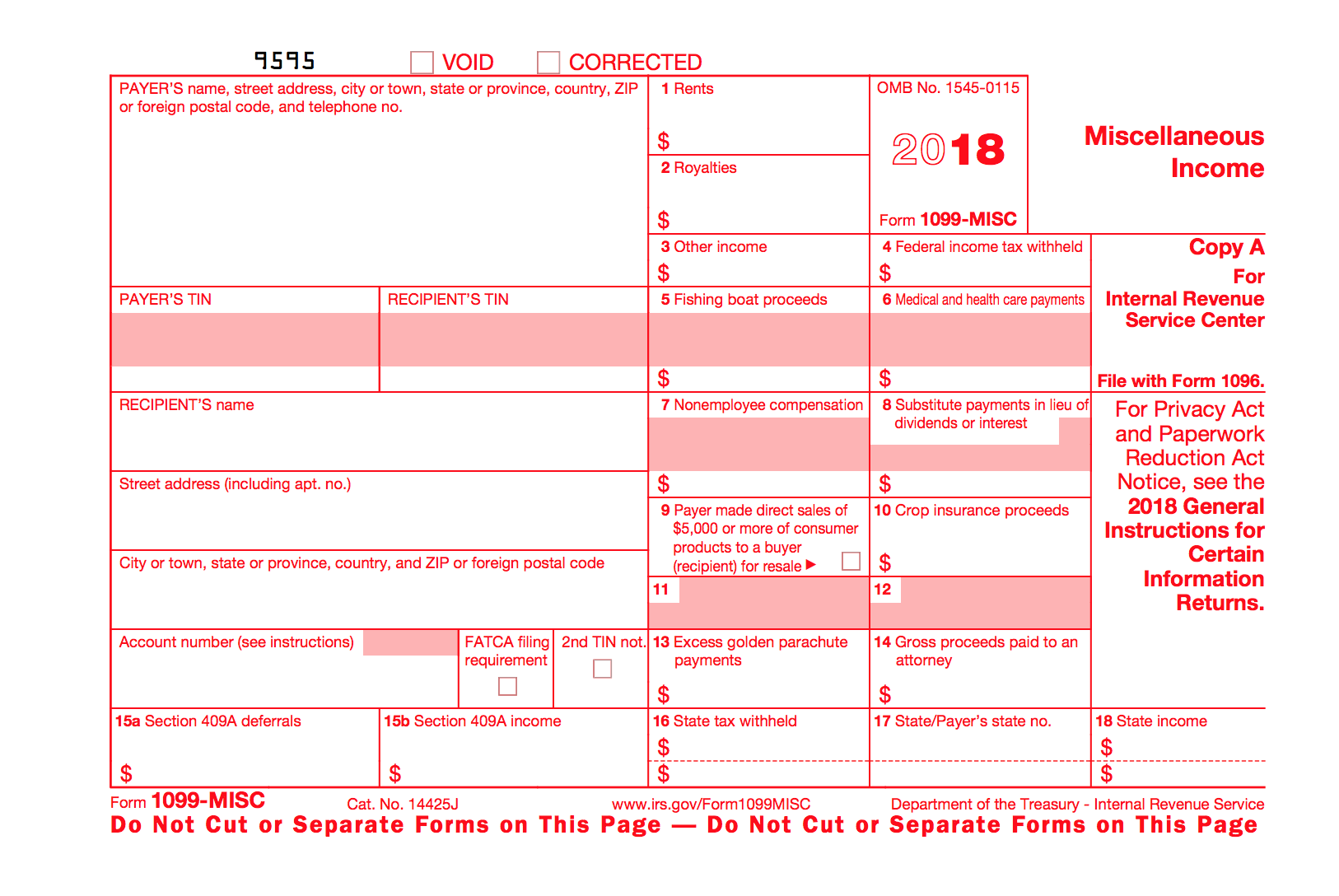

2018 Forms 1099 Misc Due January 31 2019 Miami Cpa Bay Pllc

2018 Forms 1099 Misc Due January 31 2019 Miami Cpa Bay Pllc

Heres what you can do.

Unemployment in ohio for 1099. 1099 Upload Frequently Asked Questions. True Coronavirus and Unemployment Insurance Benefits Resource Hubs Please review our employee and employer resource hubs for more information on unemployment benefits related to COVID-19. The state said it will be issuing a record 17.

The exclusion is 10200 per person so spouses filing a joint return can avoid paying taxes on up to 20400. 1099Gs are available to view and print online through our Individual Online Services. Questions regarding the W-21099 Upload Feature can be directed to the Employment Tax Division at.

False Identity Theft and Unemployment Benefits Unfortunately identity theft is a widespread national challenge. Unemployment claimants will receive an Internal Revenue Service 1099 form at the end of January for the previous years benefits. All 1099Gs Issued by the Ohio Department of Taxation will be mailed by January 31st.

If you DID NOT apply to receive unemployment benefits. ODJFS issues IRS 1099-G tax forms to recipients of unemployment benefits so they can report this income when filing their annual tax returns. Please visit unemploymentohiogov and click on the Report Identity Theft button to report the names of affected employees and access other resources.

Some of my employees have received 1099-G forms indicating that they received unemployment benefits in 2020 but they did not. How do I reset my unemployment PIN. The Ohio Department of Job and Family Services ODJFS has been made aware of a scam targeting individuals filing applications for unemployment benefits.

The state has paid. Normally self-employed and 1099 earners such as sole independent contractors freelancers gig workers and sole proprietors do not qualify for unemployment benefits. The Ohio Department of Job and Family Services ODJFS this month is issuing 17 million 1099-G tax forms because of a federal law that requires reporting of unemployment benefits.

Unemployment benefits are taxable pursuant to federal and Ohio law. Many Ohioans are also about to receive a 1099-G tax form in the mail stating that they received unemployment benefits in 2020 when in fact they did not. IncomeStatementsEWTtaxstateohus or by calling.

Identity Theft and 1099 Resources for Individuals If you suspect that your personal information has been stolen andor if you received a 1099-G tax form from the Ohio Department of Job and Family Services ODJFS and did not apply for unemployment benefits in 2020 the agency needs to hear from you immediately. ODJFS issues IRS 1099-G tax forms to recipients of unemployment benefits so they can report this income when filing their annual tax returns. The federal Pandemic Unemployment Assistance or PUA program provides benefits for many individuals ineligible for state unemployment benefits including self-employed workers 1099 tax filers and part-time workers.

Updated W-21099 Upload Feature NOW LIVE on the Ohio Business Gateway. There will be a number of Ohioans who. This will allow us to investigate the claims that were filed and take appropriate.

Unemployment benefits are taxable pursuant to federal and Ohio law. COLUMBUS OHIO The Ohio Department of Job and Family Services ODJFS will be issuing 17 million 1099-G tax forms throughout the month of January pursuant to federal law that requires reporting of unemployment benefits. Nearly every Ohioan who received unemployment benefits about 94 made less.

You can elect to be removed from the next years mailing by signing up for email notification. You can reset your PIN online or by calling the PIN reset hotline at 866 962-4064. W-2 Upload Frequently Asked Questions.

What should they do. However the federal government created new provisions that allow 1099 earners to tap into unemployment benefits during the ongoing COVID-19 pandemic. Apply for Unemployment Now Employee 1099 Employee Employer.

Report it by calling toll-free. The state reports 109369 people filed for unemployment benefits in the last week bringing the five-week total to 964556. Visit the IRS website here for specific information.

The email states that the persons application for benefits was received but not completed and it provides links that it says will complete the unemployment.

/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

Did You Receive A 1099 In Error From Ohio Djfs Regarding Unemployment Wilmington News Journal

Did You Receive A 1099 In Error From Ohio Djfs Regarding Unemployment Wilmington News Journal

Unemployment Fraud Chicago Man Receives Ohio Unemployment Tax Form Despite Never Living There Abc7 Chicago

Unemployment Fraud Chicago Man Receives Ohio Unemployment Tax Form Despite Never Living There Abc7 Chicago

If You Receive Unemployment Benefits Expect To Receive Form 1099 G Don T Mess With Taxes

1099 Form Fillable What Is Irs Form 1099 Q Turbotax Tax Tips Videos 1099 Tax Form Tax Forms Irs Forms

1099 Form Fillable What Is Irs Form 1099 Q Turbotax Tax Tips Videos 1099 Tax Form Tax Forms Irs Forms

Unemployment Tax Troubles Wrong 1099 G Amounts Benefits Id Theft Don T Mess With Taxes

1099 Form Fileunemployment Org

1099 Form Fileunemployment Org

Fha Loan With 1099 Income Fha Lenders

Fha Loan With 1099 Income Fha Lenders

Faqs Benefits Kansas Department Of Labor

Faqs Benefits Kansas Department Of Labor

Petition Unemployment Relief For Independent Workers With Mixed Income Types Change Org

Petition Unemployment Relief For Independent Workers With Mixed Income Types Change Org

2020 Tax Changes For 1099 Independent Contractors Updated For 2020

2020 Tax Changes For 1099 Independent Contractors Updated For 2020

Ohio Unemployment Help Wkyc Com

Ohio Unemployment Help Wkyc Com

Income 1099 G And 1099 Int From The Department Of Taxation Department Of Taxation

Income 1099 G And 1099 Int From The Department Of Taxation Department Of Taxation

:max_bytes(150000):strip_icc()/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

1099 Workers Other Jobless Ohioans Not Previously Eligible Can Pre File For Benefits Friday The Statehouse News Bureau

1099 Workers Other Jobless Ohioans Not Previously Eligible Can Pre File For Benefits Friday The Statehouse News Bureau

Unemployment Benefits Are Taxable Look For A 1099 G Form Wkyc Com

Unemployment Benefits Are Taxable Look For A 1099 G Form Wkyc Com

Form 1099 Nec Now Used To Report Non Employee Compensation Ohio Dairy Industry Resources Center

Form 1099 Nec Now Used To Report Non Employee Compensation Ohio Dairy Industry Resources Center

Unemployment Fraud Reports Running Rampant In Central Ohio

Unemployment Fraud Reports Running Rampant In Central Ohio

Post a Comment for "Unemployment In Ohio For 1099"