How Does Ohio Unemployment Know How Much Money I Make

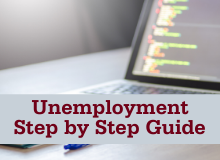

In addition to state benefits if you are eligible for PUA you will receive an additional 600 per week under the CARES Act. This program is available through Dec.

Https Unemployment Ohio Gov Pdf New Workers Self Service User Guide Pdf

Typically it amounts to around 40-50 of your typical earnings-- up to the state maximum.

How does ohio unemployment know how much money i make. State Taxes on Unemployment Benefits. The sheer size of the out-of-work population means many of those millions are likely navigating the unemployment process for the first time. The DJFS uses the information you report to decide how much of your benefits you can collect.

Bidens 19 trillion COVID-19 relief package will extend enhanced unemployment benefits until Sept. How many people you live and buymake food with. Unemployment takes place at the state level and each state has there own formula for determining unemployment.

Unfortunately theres no easy way to calculate exactly how much money youll receive through unemployment benefits or for how long youll be able to collect those benefits unless your state has an online unemployment calculator. Alabama does not tax unemployment benefits. Listed below are the methods available and information a claimant will need when submitting a repayment.

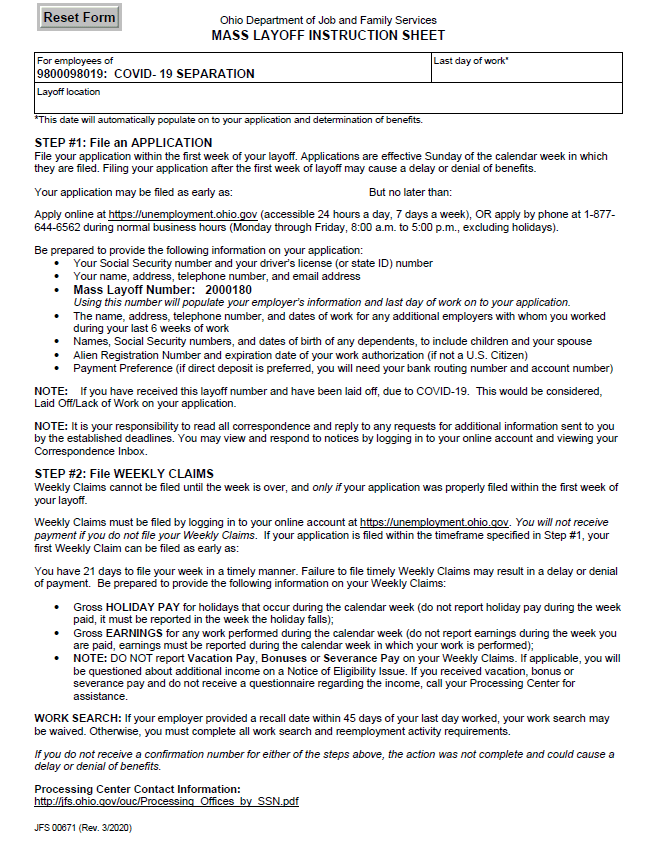

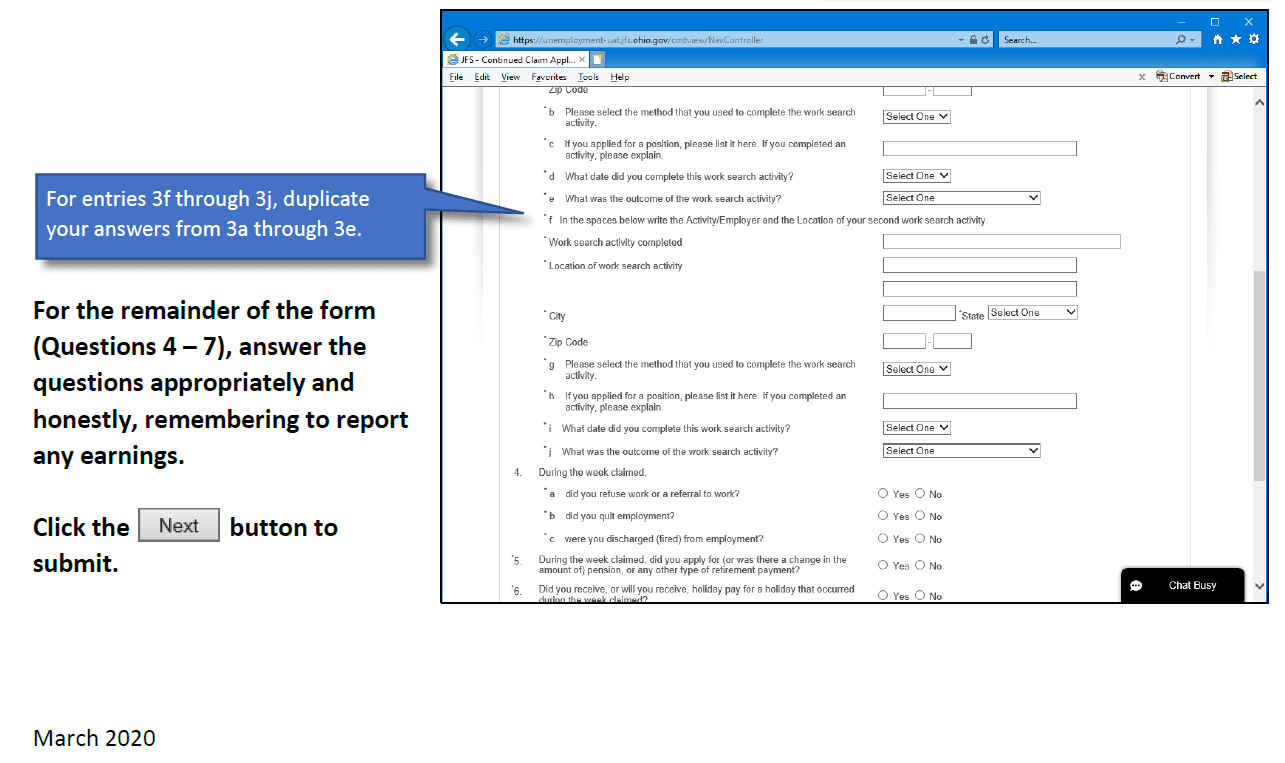

Reporting any earned income is a general requirement for any Ohio unemployment claimant but it takes on special significance for the partial unemployment system. If your application for unemployment benefits is allowed your actual weekly benefit amount will be determined after you certify your application. An example of how this is computed appears below.

To figure out if you qualify for food stamps Ohio needs to know your. Total earnings in week 20000. How much money would I get under Bidens plan.

However there are calculators you can use to estimate your benefits. State of Ohio unemployment benefits are capped at weekly payouts of 424 and are determined based on how much you earned with your last employer. More than 26 million people have filed unemployment claims in the past month a number that shatters previous records tenfold.

How much money your household makes. This depends how the employer reported the employees wages. The state uses this information to determine you are searching for work and failing to file them will end your benefits.

Extra money for unemployment ohio december 2020. Ohio law allows that 20 of your weekly benefit amount be exempted from any earnings you may receive before a deduction is made. If the employer reported tips as part of the employees wages it would be reflected on his or her tax reporting and therefore the unemployment benefit would be based on wages with tips.

You will receive written notification of your entitlement and this notification is usually provided within. 54 rows Each state runs its own unemployment insurance benefits program. A Second Stimulus Check Might Bring Some People More Money Does That Mean You Cnet.

If the weekly benefit amount is 40000 and weekly earnings are 20000. Unemployment benefits provide short-term income to unemployed workers who lose their jobs through no fault of their own and who are actively seeking work. COLUMBUS Ohio AP Ohio unemployment claimants would receive 300 in federal weekly unemployment assistance under an option provided by the White House that doesnt require.

This includes both earned income the money you make from jobs and unearned income cash assistance Social Security unemployment insurance and child support etc. To calculate the earnings deduction. It will also show whether or not --.

If the overpayment is certified to the Attorney General of Ohio for collection activity please contact them 888-246-0488 for repayment instructions or CLICK HERE. In addition the first 25000 received from an employer as severance pay unemployment compensation and the like. Ohio unemployment weekly claims are necessary to receive your benefits.

To see if you are eligible apply at unemploymentohiogov or call 877 644-6562. Repay Overpayment The claimant is required to immediately repay the overpaid benefits and any mandatory penalty. If you received unemployment insurance this year youll receive a Form 1099-G which shows how much money you received from unemployment benefits.

Https Unemployment Ohio Gov Pdf New Workers Self Service User Guide Pdf

Covid 19 Unemployment Benefits Hamilton Ryker

Covid 19 Unemployment Benefits Hamilton Ryker

Respond To Employer Request For Separation Information Office Of Unemployment Insurance Operations Ohio Department Of Job And Family Services

Respond To Employer Request For Separation Information Office Of Unemployment Insurance Operations Ohio Department Of Job And Family Services

What You Should Know About Unemployment Compensation

Unemployment Changes In Ohio Due To Covid 19 Equality Ohio

Unemployment Changes In Ohio Due To Covid 19 Equality Ohio

Jfs Ohio Unemployment Benefits Release Of Information

Jfs Ohio Unemployment Benefits Release Of Information

Ohio Update To Allow Thousands More To Claim Unemployment Benefits Wrgt

Ohio Update To Allow Thousands More To Claim Unemployment Benefits Wrgt

Odjfs Wants Businesses To Report Employees Who Refuse To Return To Work

Odjfs Wants Businesses To Report Employees Who Refuse To Return To Work

Covid 19 Unemployment Benefits Hamilton Ryker

Covid 19 Unemployment Benefits Hamilton Ryker

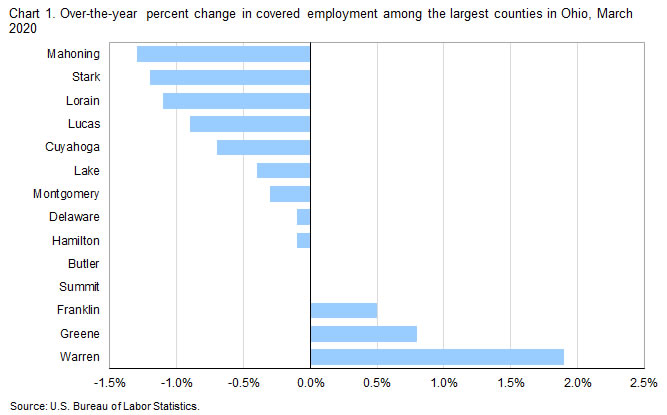

County Employment And Wages In Ohio First Quarter 2020 Midwest Information Office U S Bureau Of Labor Statistics

County Employment And Wages In Ohio First Quarter 2020 Midwest Information Office U S Bureau Of Labor Statistics

Unemployment Faqs Ohio Gov Official Website Of The State Of Ohio

Unemployment Faqs Ohio Gov Official Website Of The State Of Ohio

How To Apply For Unemployment Benefits Online In Ohio Youtube

How To Apply For Unemployment Benefits Online In Ohio Youtube

Ohio Thousands Must Repay Unemployment Overpayments

Ohio Thousands Must Repay Unemployment Overpayments

How To Apply For Ohio Unemployment Benefits Credit Karma

How To Apply For Ohio Unemployment Benefits Credit Karma

Who In Ohio Is Qualified For Coronavirus Related Jobless Benefit Wfmj Com

Who In Ohio Is Qualified For Coronavirus Related Jobless Benefit Wfmj Com

Https Jfs Ohio Gov Releases Pdf Odjfs News Release Federal Benefits Extension 1 11 21 Stm

Covid 19 Unemployment Benefits Hamilton Ryker

Covid 19 Unemployment Benefits Hamilton Ryker

Https Unemployment Ohio Gov Pdf New Workers Self Service User Guide Pdf

Https Unemployment Ohio Gov Pdf New Workers Self Service User Guide Pdf

Post a Comment for "How Does Ohio Unemployment Know How Much Money I Make"