Unemployment Part Time Workers Ohio

The extra 300 a week as well as additional weeks of unemployment probably wont be enough for many jobless workers to dig themselves out of debt Stettner. Your application is not filed until you receive a confirmation number.

Unemployment Benefits Comparison By State Fileunemployment Org

Unemployment Benefits Comparison By State Fileunemployment Org

You may also be eligible to receive added benefits is you have allowable dependents on your claim.

Unemployment part time workers ohio. While you can only collect a portion of your benefits it can provide a supplemental income while you search for. The online initial application takes about 25 minutes. COLUMBUS Ohio AP Ohio unemployment claimants would receive 300 in federal weekly unemployment assistance under an option provided by the White House that doesnt require extra state spending.

Partial unemployment provisions help those who may be working but are still experiencing a loss of work. If you are disconnected use your username and PIN to log back on and resume the application process. You will need to file a new claim if you have not applied for unemployment benefits at any time in the past 12 months.

Eligible workers will receive supplemental payments and extra weeks of unemployment compensation. OHIO PEUC and part time job Ohio Question I have been recieving UI on and off since last March 5 weeks during the initial shut down then went back to work with reduced hours Since we went from 40hrs to 30hrs a week I have been receiving partial UI and the PEUC. All hours worked from the 16 th to the end.

OHIO Self-employed part-time workers and independent contractors filing 1099 forms for taxes will be able to begin the process to apply for unemployment benefits Friday the Ohio Department of. You must have worked full-time or part-time at least 20 weeks during the base period see the first chart below for any number of employers who pay unemployment contributions. Per Section 411315 of the Ohio Revised Code an employer must pay employees at least twice per month.

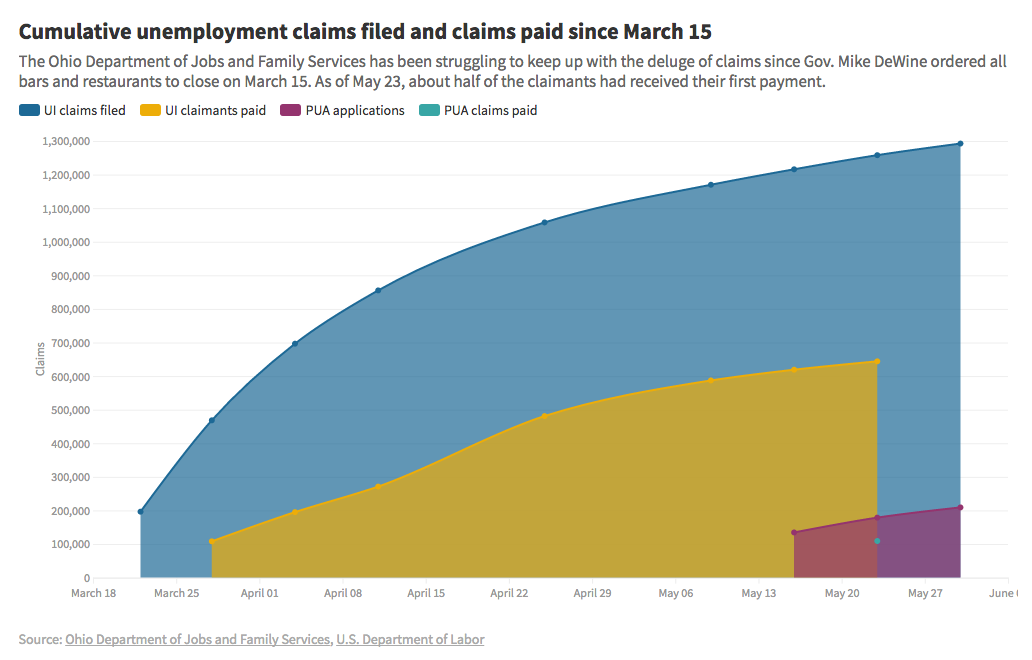

Expanded Eligibility Resource Hub The federal Pandemic Unemployment Assistance or PUA program provides benefits for many individuals ineligible for state unemployment benefits including self-employed workers 1099 tax filers and part-time workers. A week may be established with any. Congress expanded unemployment benefits to self-employed workers and part-time employees as part of the federal stimulus package passed late March.

Coronavirus and Unemployment Insurance. Typically your benefit amount is reduced by the income you receive from working part-time. Ohio is one of the states that allows partial unemployment but you have to meet the minimum requirements of the Department of Jobs and Family Services DJFS to participate.

Please visit unemploymentohiogov click on the Report Identity Theft button and complete the form so that we can investigate the claim that was filed and take appropriate actionsThis can include correcting the 1099-G form that you were sent. Your Ohio unemployment amount may be affected if you worked part time and earned less than your benefit amount. Ohioans who are self-employed 1099 workers or part-time can now apply for pandemic unemployment assistance The new federal program covers.

This may occur a lot. How Ohios Unemployment Insurance Benefit Amounts Are Calculated Minimum number of weeks worked. Since then those workers have been waiting for.

TOLEDO Ohio Self-employed and part-time workers in Ohio can now apply for unemployment through the federal stimulus package state officials said Wednesday. Office of Unemployment Compensation Employer Seasonal Status A Seasonal Employer is an employer whose operations and business are substantially all in an industry in which it is customary to operate because of climatic conditions or because of the seasonal nature of such industry on. Eligibility for Unemployment When You Work Part-Time Expanded unemployment benefits are available for laid-off workers due to the coronavirus pandemic.

51 rows It is possible to work part time and still receive unemployment. All hours worked from the 1 st to the 15 th of month must be paid by the 1 st of the following month. Ohio Department of Job and Family Services ONLINE.

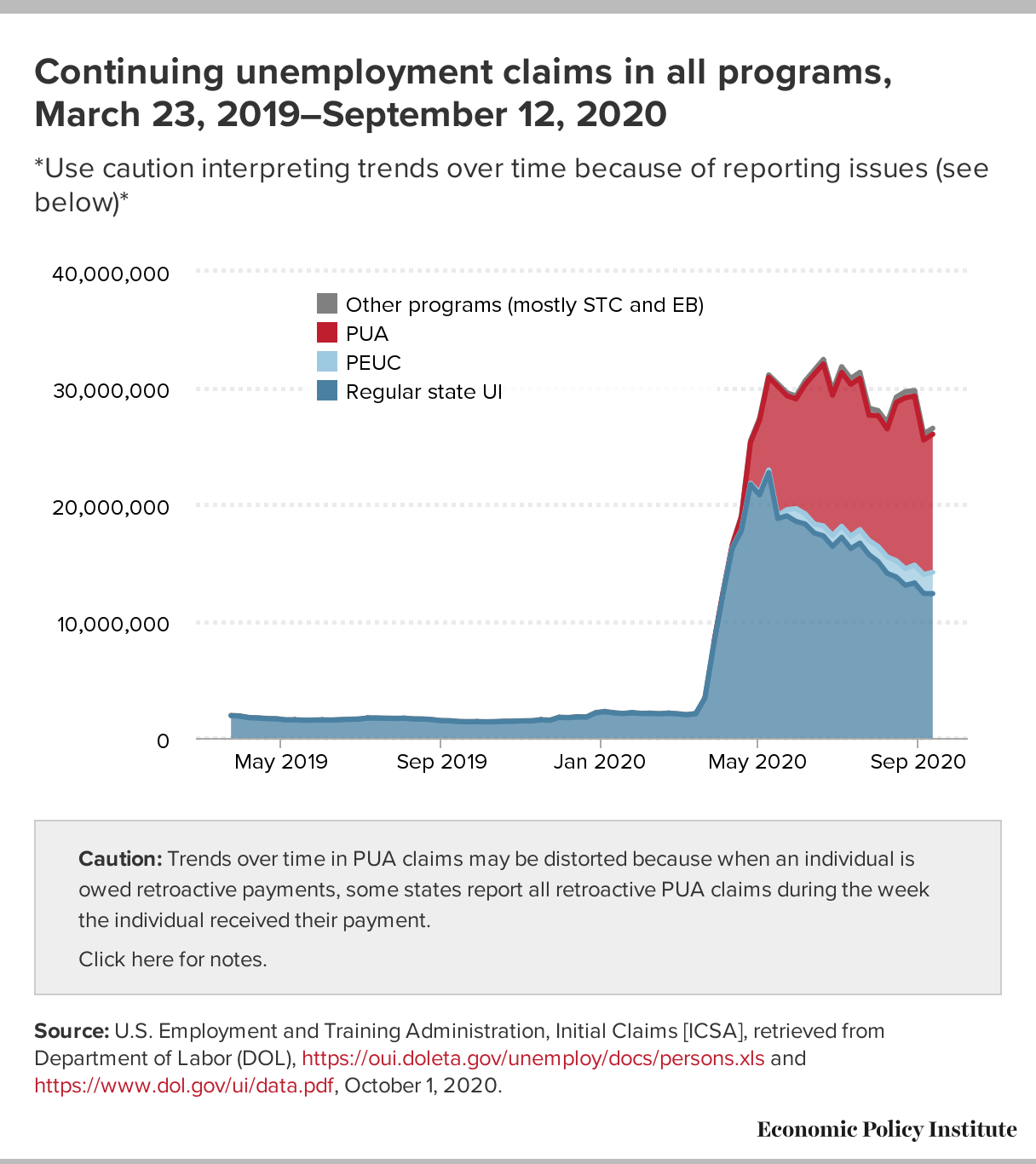

With Millions Of Workers Receiving Unemployment Benefits And No End In Sight For The Covid 19 Pandemic Congress Must Act Economic Policy Institute

With Millions Of Workers Receiving Unemployment Benefits And No End In Sight For The Covid 19 Pandemic Congress Must Act Economic Policy Institute

What You Should Know About Unemployment Compensation

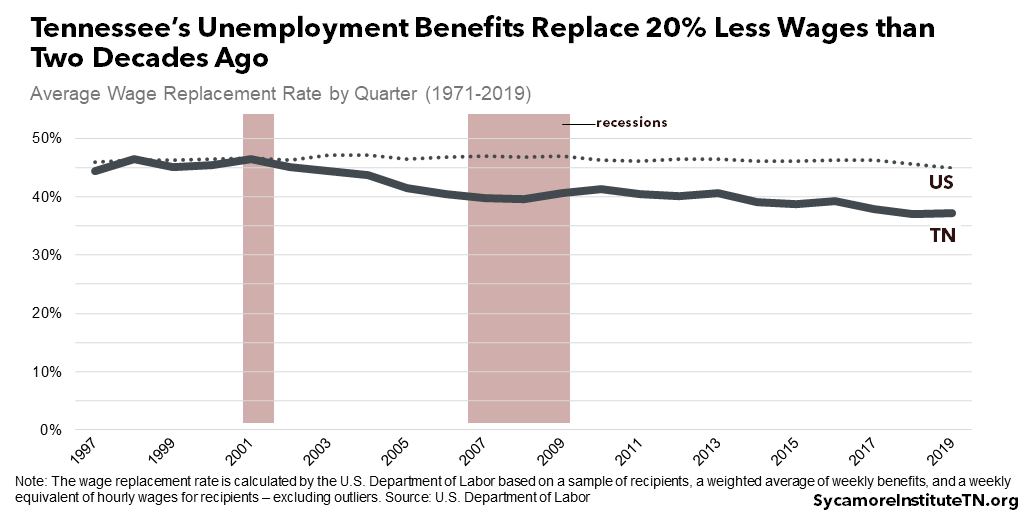

Unemployment Insurance In Tennessee How It Works

Unemployment Insurance In Tennessee How It Works

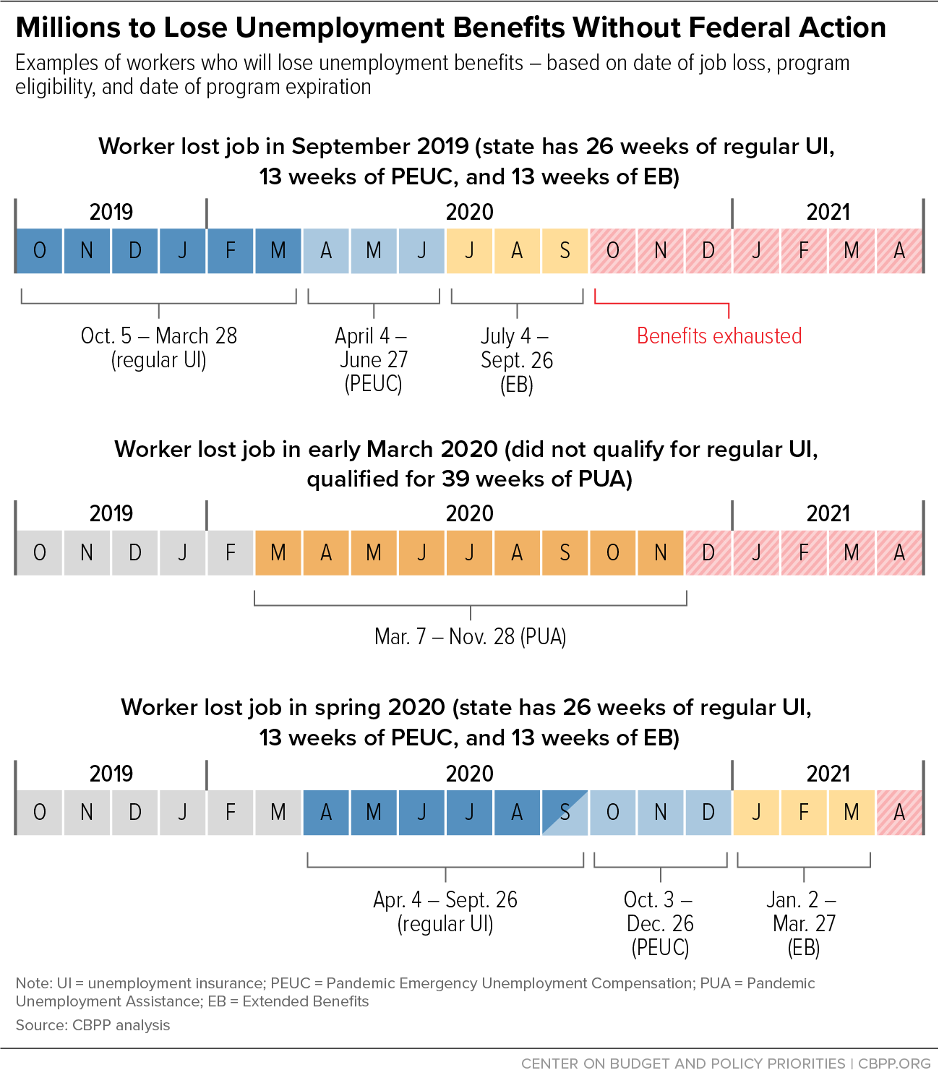

Many Unemployed Workers Will Exhaust Jobless Benefits This Year If More Weeks Of Benefits Aren T In Relief Package Center On Budget And Policy Priorities

Many Unemployed Workers Will Exhaust Jobless Benefits This Year If More Weeks Of Benefits Aren T In Relief Package Center On Budget And Policy Priorities

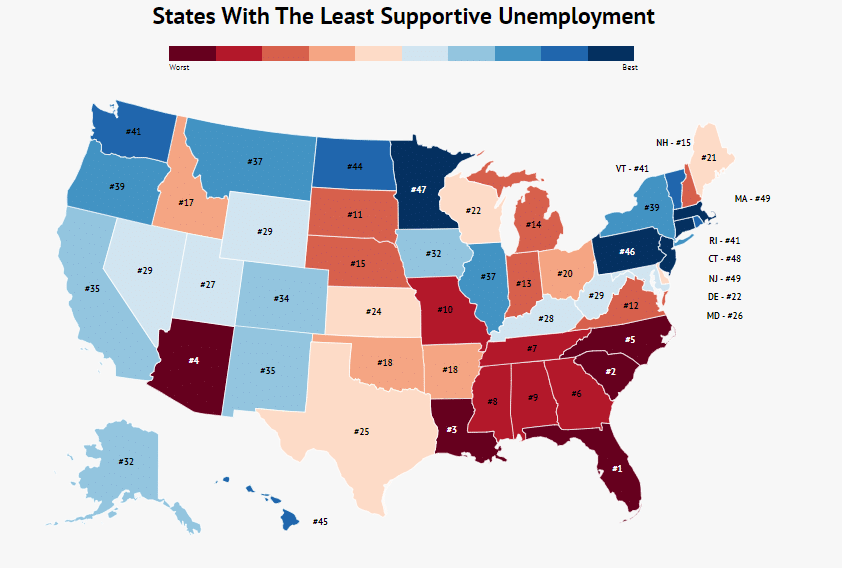

Here Are The States With The Least Supportive Unemployment Systems Zippia

Here Are The States With The Least Supportive Unemployment Systems Zippia

Ohio Unemployment Help Wkyc Com

Ohio Unemployment Help Wkyc Com

Unemployment Insurance In Tennessee How It Works

Unemployment Insurance In Tennessee How It Works

How Unemployment Benefits Are Calculated By State Bench Accounting

How Unemployment Benefits Are Calculated By State Bench Accounting

How To Get Unemployment Benefits Even If You Quit Your Job Student Loan Hero

How To Get Unemployment Benefits Even If You Quit Your Job Student Loan Hero

Tens Of Thousands Of Ohioans Told To Repay Unemployment Benefits Scene And Heard Scene S News Blog

Tens Of Thousands Of Ohioans Told To Repay Unemployment Benefits Scene And Heard Scene S News Blog

Chart Shows Non Employment Index Nei And The Unemployment Rate Employment Economic Research Index

Chart Shows Non Employment Index Nei And The Unemployment Rate Employment Economic Research Index

Unemployment Changes In Ohio Due To Covid 19 Equality Ohio

Unemployment Changes In Ohio Due To Covid 19 Equality Ohio

As New Data Shows Early Signs Of Economic Recovery Black Workers Are Being Left Out Bus Driver Worker Data Show

As New Data Shows Early Signs Of Economic Recovery Black Workers Are Being Left Out Bus Driver Worker Data Show

Speeding The Recovery Of Unemployment Insurance

Speeding The Recovery Of Unemployment Insurance

Food Stamps And Unemployment Compensation In The Covid 19 Crisis Research Highlights Upjohn Institute

Food Stamps And Unemployment Compensation In The Covid 19 Crisis Research Highlights Upjohn Institute

Unemployment Insurance In Tennessee How It Works

Unemployment Insurance In Tennessee How It Works

States Are Telling Some People To Pay Back Unemployment Benefits Marketplace

States Are Telling Some People To Pay Back Unemployment Benefits Marketplace

Lost Wages Assistance Pays Up To 1 800 In Extra Unemployment Benefits

Lost Wages Assistance Pays Up To 1 800 In Extra Unemployment Benefits

Post a Comment for "Unemployment Part Time Workers Ohio"