Is Unemployment Received During Covid Taxable

If affected by COVID-19 you may be eligible to claim compensation for some unemployment benefits charges which could lower 2021 tax rate. The tax hikes are needed to replenish the state unemployment trust fund which has fallen from 47 billion to 28 billion since March 1 after paying out benefits to so many laid-off workers.

Are Unemployment Insurance Benefits Taxable A Guide On Ui Taxes

Are Unemployment Insurance Benefits Taxable A Guide On Ui Taxes

Refer to Form W-4V Voluntary Withholding Request and Tax Withholding.

Is unemployment received during covid taxable. Unlike Medicare and Social Security benefits both the US. Terranova Associates LLC strives to keep our clients up to date during these unprecedented times with the fluid Government COVID - 19 tax changes that will affect you. May be required to make quarterly estimated tax payments or Can choose to have federal income tax withheld from your unemployment compensation.

And last updated 452 PM Feb 10 2021 NASHVILLE Tenn. Nine states dont impose. For employers who pay unemployment tax If you paid unemploymentbenefits the first two quarters of 2020 you can solicit a relief of charges.

The federally funded 300 weekly payments like state unemployment insurance benefits are taxable at the federal level. The short answer is no. Unemployment insurance is generally subject to federal as well as state income tax though there are exceptions.

Visit the COVID-19 page for the latest information. Of the 40 states that tax income only five California New Jersey Oregon Pennsylvania and Virginia fully exempt UI benefits. By law unemployment compensation is taxable and must be reported on a 2020 federal income tax return.

Unemployment benefits have always been subject to federal taxes and potentially state and local taxes depending on where you live but. Taxable benefits include any of the special unemployment compensation authorized under the Coronavirus Aid Relief and Economic Security CARES Act enacted this spring. Massachusetts Unemployment compensation received during the Covid-19 pandemic Thank you for taking the time to respond but this is the same answer someone else gave above to which I responded that I am under the 200 Federal guideline and the reference says that AGI is.

Please try not to call our Unemployment Claims Center with questions as call volume remains very high. WTVF The IRS will start accepting tax returns Friday February 12 but the COVID-19. Some workers received additional unemployment benefits in 2020 due to provisions in federal and state laws as a result of the coronavirus pandemic.

This reduction applies to unemployment benefits paid. Those additional benefits are also taxable income. Jobless Americans get a tax waiver of up to 10200 on unemployment benefits.

If you received unemployment compensation you. The federal stimulus bill that extends CARES Act unemployment benefits was signed into law. Here is the press release from Governor Bakers office.

Government and almost every single individual state taxes. Most states tax UI benefits as well. On April 1 2021 Governor Baker signed legislation which allows taxpayers with household income up to 200 of the federal poverty level to deduct up to 10200 of.

If you received extra unemployment in 2020 it also counts as part of your income and you will owe income taxes on that too. COVID-19 stimulus package.

That Extra 600 A Week In Unemployment Benefits Is Taxable Weareiowa Com

That Extra 600 A Week In Unemployment Benefits Is Taxable Weareiowa Com

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

Yes Your Extra 600 In Unemployment Is Taxable Income

Yes Your Extra 600 In Unemployment Is Taxable Income

Collecting Unemployment Take These Steps To Avoid A Tax Bill Next Year

Collecting Unemployment Take These Steps To Avoid A Tax Bill Next Year

Paying Taxes On Unemployment Checks Everything You Need To Know Cnet

Paying Taxes On Unemployment Checks Everything You Need To Know Cnet

Taxes On Unemployment Checks May Surprise Some

Taxes On Unemployment Checks May Surprise Some

Is Unemployment Taxed H R Block

Is Unemployment Taxed H R Block

Will My Unemployment Benefits Be Taxed Coronavirus Oleantimesherald Com

Will My Unemployment Benefits Be Taxed Coronavirus Oleantimesherald Com

Covid Bill Provides Tax Waiver On Up To 10 200 Of Unemployment Benefits

Covid Bill Provides Tax Waiver On Up To 10 200 Of Unemployment Benefits

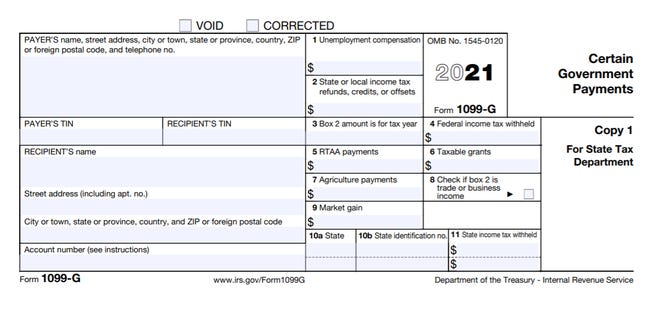

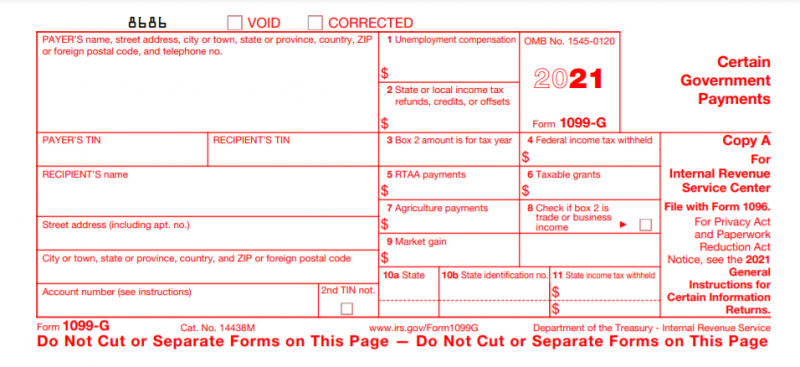

Unemployment Claimants To Receive 1099 G Tax Form By End Of Month Penbay Pilot

Unemployment Claimants To Receive 1099 G Tax Form By End Of Month Penbay Pilot

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Top 3 Tax Tips For Unemployment Benefits

Top 3 Tax Tips For Unemployment Benefits

Is Unemployment Taxable During A Pandemic Credit Karma Tax

Is Unemployment Taxable During A Pandemic Credit Karma Tax

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Enhanced Unemployment Benefits During The Coronavirus Crisis Smartasset

Enhanced Unemployment Benefits During The Coronavirus Crisis Smartasset

Senate Bill Indicates A Portion Of Unemployment Compensation May Not Be Taxable In 2020

Senate Bill Indicates A Portion Of Unemployment Compensation May Not Be Taxable In 2020

If You Receive Unemployment Benefits Expect To Receive Form 1099 G Don T Mess With Taxes

How To Avoid Tax On Up To 10 200 Of Unemployment Benefits Smart Change Personal Finance Tucson Com

How To Avoid Tax On Up To 10 200 Of Unemployment Benefits Smart Change Personal Finance Tucson Com

Coronavirus Unemployment Payments Are Taxable Be Prepared By Withholding Cpa Practice Advisor

Coronavirus Unemployment Payments Are Taxable Be Prepared By Withholding Cpa Practice Advisor

Post a Comment for "Is Unemployment Received During Covid Taxable"