Unemployment Tax Rate Tennessee

Businesses would have had to pay high taxes to push it. Tennessee Department of Labor and Workforce Development.

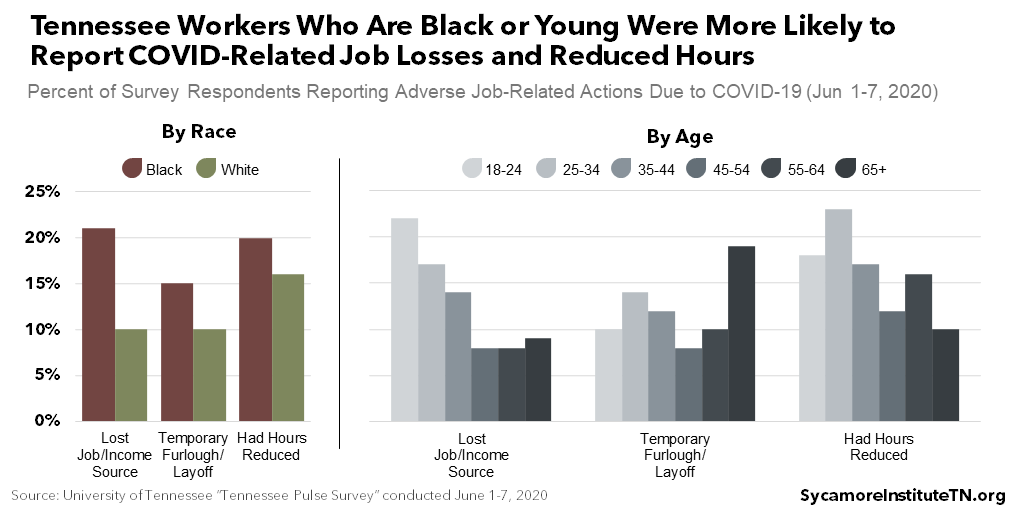

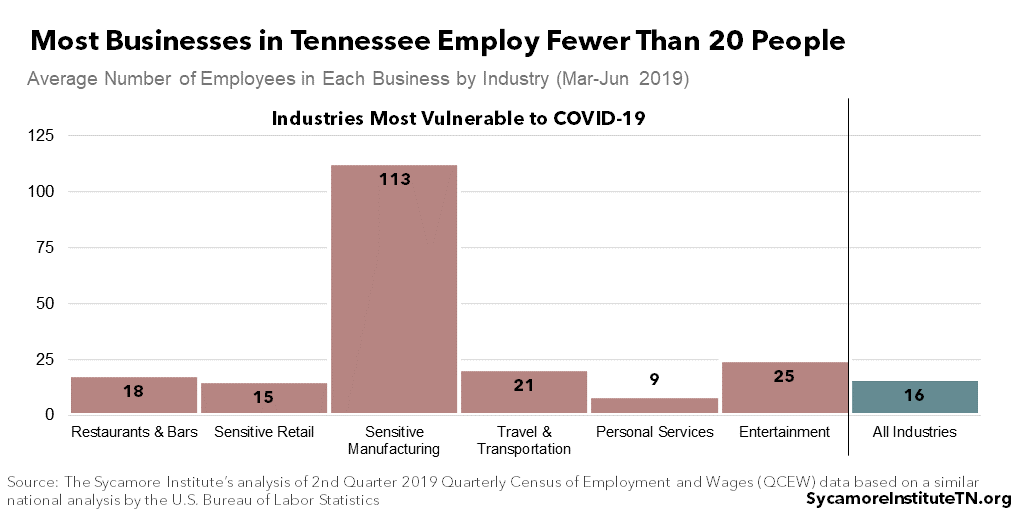

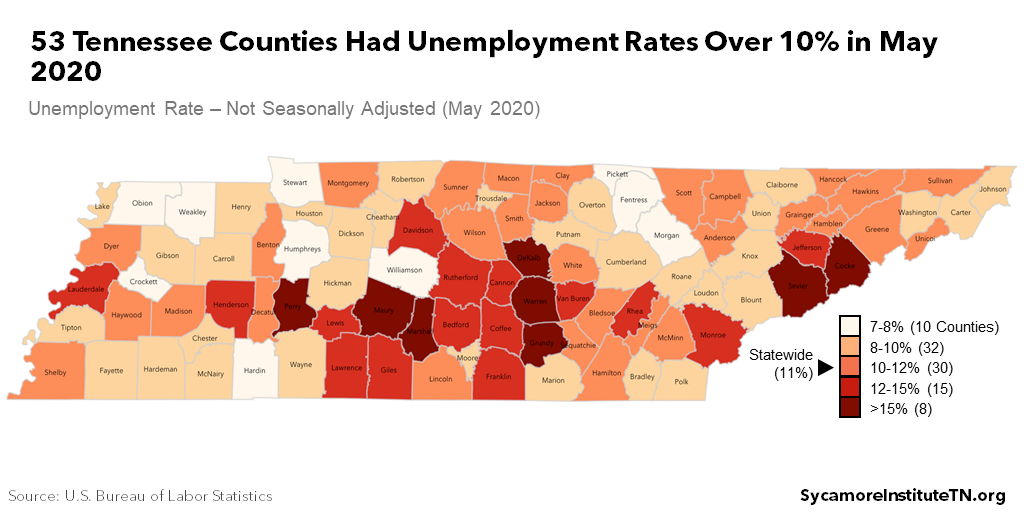

Coronavirus Recession Tn S Most Vulnerable People Places Employers

Coronavirus Recession Tn S Most Vulnerable People Places Employers

45 on 327263 and over of taxable income for married joint filers and 163632 and over for single filers.

Unemployment tax rate tennessee. And some states have much higher tax rates. Starting in 2021 Proposition 208 approved by. The reserve ratio is the balance in an employers UI account premiums paid less benefits paid for all years liable divided by their average taxable payroll for the three most recent years.

131 Notice Explanation. The details are complicated but for most new employers in recent years the net result is a beginning rate of 27. Submit a request Sign in.

The unemployment tax rate for the rest of 2021 will be decided in June. 10 That extra 600 is also taxable after the first 10200. 13 hours agoTennessees unemployment rate reached 155 amid the shutdown when more than 355000 filed claims.

The average unemployment rate from 1967 through. Here is a list of the non-construction new employer tax. For the calendar year 2021 Tennessee unemployment insurance rates range from 01 to 10 with a taxable wage base of up to 7000 per employee per year.

Employer Tax Rate Changes. New employers pay a flat rate of 27. Tennessee is one of 31 states that use the reserve-ratio formula to determine employer premium rates.

An employing unit that is liable under the Federal Unemployment Tax Act FUTA and has at least one employee in Tennessee regardless of the number of weeks employed or amount of payroll. Tennessee Department of Labor and Workforce Development. The Unemployment Trust Fund is called a trust fund because people trust itll be there when they need it.

Effective July 1 2020 Tennessees experienced-employer unemployment tax rates will range from 001 percent to 100 percent. Unemployment tax credit. The federal government applies a standard 6 FUTA tax rate across industries and it does not change based on how many former employees file for unemployment benefits.

Tennessee is one of four states that generally determines unemployment tax rates on a fiscal-year basis. Tennessees fund took a big lick in 2020 when the unemployment rate skyrocketed to more than 15 during the height of the COVID-19 pandemic as non-essential businesses were required to shut down. Colorado for example charges a tax rate of 463 so for 10200 in unemployment benefits thats a 472 payment.

20 hours agoTennessees annual average unemployment rate seldom rose above 9 according to a Tennessean analysis based on data from the Department of Labor. It provided an additional 600 per week in unemployment compensation per recipient through July 2020. Each employers tax rate is determined by a schedule of 144 possible scenarios that consider employer-specific circumstances and the size of the states trust fund.

You might be alright if you arranged to have income tax withheld from your benefits but federal law caps withholding on benefits at 10. Prepare for a state tax bill. Tennessees income tax is simple with a flat rate of 1.

Fate uncertain for unemployment tax rates on Tennessee businesses. Tennessee however uses the average tax rate for each of these kinds of businesses industries as part of the process of assigning a UI tax rate to new employers. Tennessee Department of Labor and Workforce Development.

Companies that pay employees in Tennessee must register with the Tennessee Department of Labor Workforce Development for an Employer Number for Unemployment taxes. An employing unit that pays 1500 or more in total gross wages in a calendar quarter or has at least one employee during twenty different weeks in the. If you got unemployment income last year and your state isnt offering a tax break on your first 10200 of benefits you may need to gear up for a tax bill when you.

Tennessees unemployment payroll tax rate ranges from 001 to 10 depending on circumstances. The new-employer tax rate will also remain unchanged at 270. Factors Affecting Your Premium Rate.

FInd out answers on how to establish an account and pay unemployment taxes. 52 rows SUI tax rate by state. Wednesday February 3rd 2021.

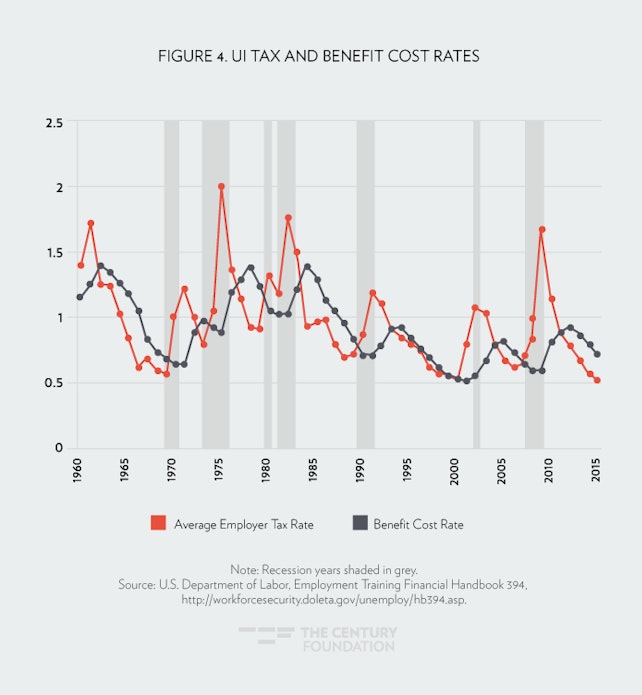

Speeding The Recovery Of Unemployment Insurance

Speeding The Recovery Of Unemployment Insurance

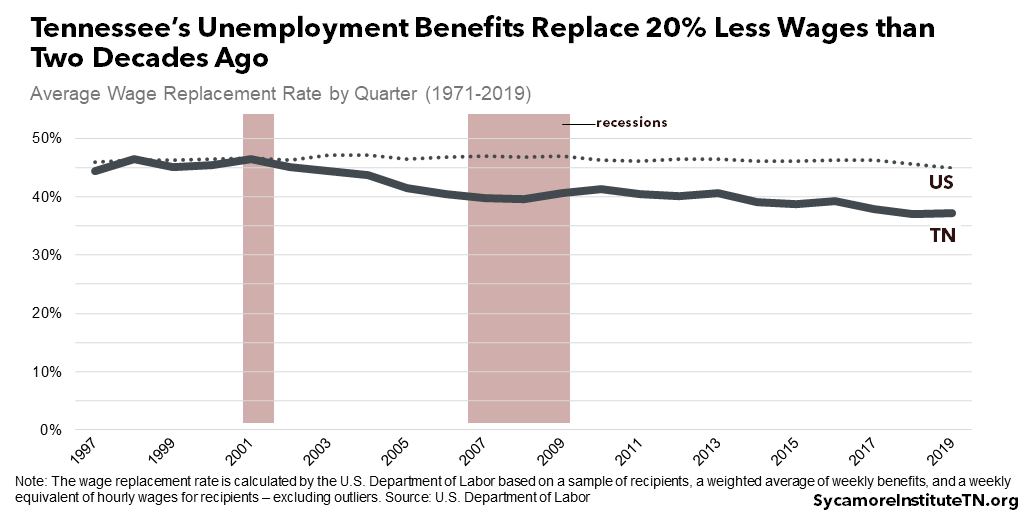

Unemployment Insurance In Tennessee How It Works

Unemployment Insurance In Tennessee How It Works

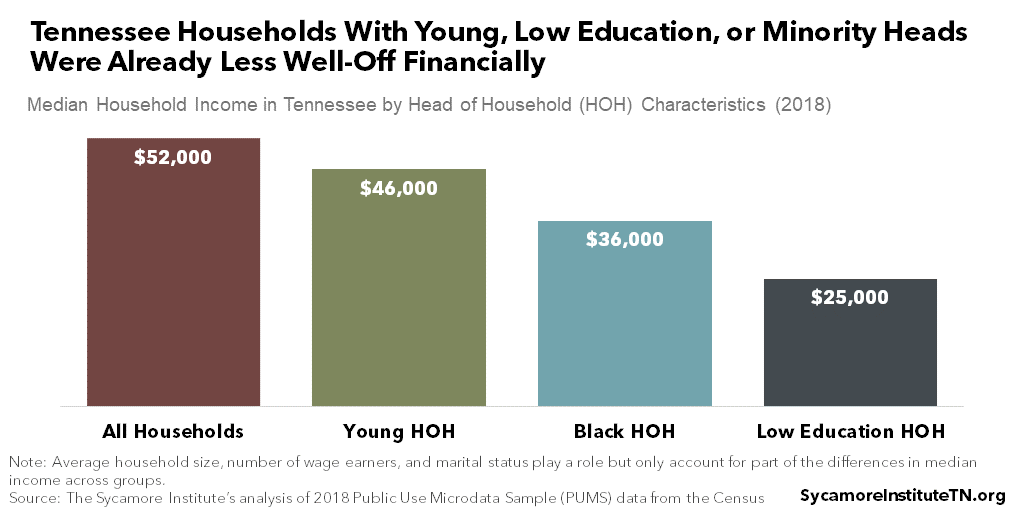

Coronavirus Recession Tn S Most Vulnerable People Places Employers

Coronavirus Recession Tn S Most Vulnerable People Places Employers

Unemployment Insurance In Tennessee How It Works

Unemployment Insurance In Tennessee How It Works

Unemployment Insurance In Tennessee How It Works

Unemployment Insurance In Tennessee How It Works

Coronavirus Recession Tn S Most Vulnerable People Places Employers

Coronavirus Recession Tn S Most Vulnerable People Places Employers

Unemployment Insurance In Tennessee How It Works

Unemployment Insurance In Tennessee How It Works

What To Know About Filing For Unemployment In Tennessee Wrcbtv Com Chattanooga News Weather Amp Sports

What To Know About Filing For Unemployment In Tennessee Wrcbtv Com Chattanooga News Weather Amp Sports

Unemployment Insurance In Tennessee How It Works

Unemployment Insurance In Tennessee How It Works

Coronavirus Recession Tn S Most Vulnerable People Places Employers

Coronavirus Recession Tn S Most Vulnerable People Places Employers

Unemployment Insurance In Tennessee How It Works

Unemployment Insurance In Tennessee How It Works

Tennessee Experiences Highest Unemployment Rate In State History During Covid 19 Crisis

Tennessee Experiences Highest Unemployment Rate In State History During Covid 19 Crisis

Historical Tennessee Tax Policy Information Ballotpedia

Historical Tennessee Tax Policy Information Ballotpedia

Https Www Tn Gov Content Dam Tn Workforce Documents Majorpublications Reports Tennesseeeconomygrowthfalldocument2019 2020 Pdf

Sui Sit Employment Taxes Explained Emptech Com

Sui Sit Employment Taxes Explained Emptech Com

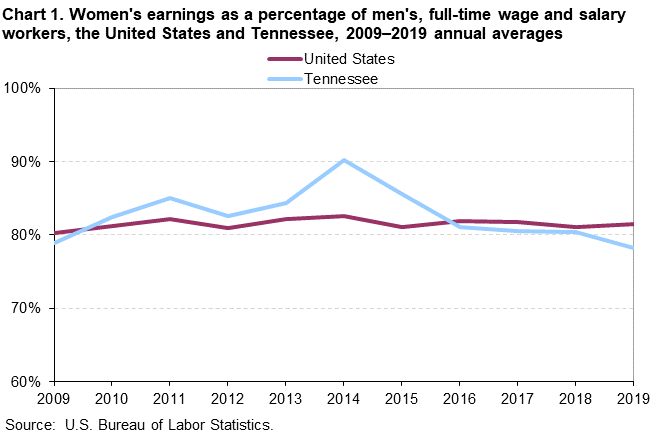

Women S Earnings In Tennessee 2019 Southeast Information Office U S Bureau Of Labor Statistics

Women S Earnings In Tennessee 2019 Southeast Information Office U S Bureau Of Labor Statistics

Tennessee Paycheck Calculator Smartasset

Tennessee Paycheck Calculator Smartasset

Coronavirus Recession Tn S Most Vulnerable People Places Employers

Coronavirus Recession Tn S Most Vulnerable People Places Employers

Post a Comment for "Unemployment Tax Rate Tennessee"