Unemployment Tax Form Called

But one local woman says her 1099-G form is. You may also submit questions to uitaxsupportstatenmus.

:max_bytes(150000):strip_icc()/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

Report the amount shown in Box 1 on line 7 of Schedule 1 Form 1040 Additional Income and Adjustments to Income PDF and attach this to the Form 1040 or Form 1040-SR.

:max_bytes(150000):strip_icc()/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg)

Unemployment tax form called. If you collected unemployment insurance last year you will need the 1099-G form from IDES to complete your federal and state tax returns. The 1099-G form is used to report taxable benefits when filing with the IRS for anyone who was paid unemployment benefits or Alternative Trade Adjustment Assistance payments during the calendar year January 1 to December 31. The 1099-G is an IRS form that shows the total unemployment benefits you received and any taxes withheld during the previous calendar year.

For filing tax reports or tax and wage reports online. Every year we send a 1099-G to people who received unemployment benefits. You can collected Form 1099-G by calling your local unemployment office or contacting the IRS directly.

Copies of the 1099-G forms are also sent to the IRS and the Michigan Department of Treasury. In January 2021 unemployment benefit recipients should receive a Form 1099-G Certain Government Payments PDF from the agency paying the benefits. Your 1099-G Tax Form.

If you received unemployment benefits this year you can expect to receive a Form 1099-G Certain Government Payments that lists the total amount of compensation you received. Notice regarding federal income tax withholding debit cards and personal identification numbers WVUC-D-128 Form. The statements called 1099-G or Certain Government Payments are prepared by UIA and report how much individuals received in unemployment benefits and income tax withheld last year.

Disaster Unemployment Assistance FAQ. To view and print your current or previous year 1099-G. Key2Benefits Schedule of Card Fees.

The new stimulus package called the American Rescue Plan Act of 2021 makes tax-free a big chunk of unemployment benefits people received last year. The IRS considers unemployment compensation to be taxable incomewhich you. Use our free online service to file wage reports pay unemployment taxes view your unemployment tax account information eg statement of account chargeback details tax rate and adjust previously filed wage reports.

We also send this information to the IRS. You should receive a Form 1099-G Certain Government Payments showing the amount of unemployment compensation paid to you during the year in Box 1 and any federal income tax withheld in Box 4. Top 10 Things You should Know about Unemployment Compensation.

2 days agoIf you received unemployment benefits last year you will need to report that information on your tax return using a document called a 1099-G form. Unemployment Compensation Benefit Rate Table. If you have received unemployment income at any point during the year you will be required to complete and return IRS Form 1099-G.

Unemployment benefits are taxable and must be reported on federal and state tax returns. Use Employer Account Management Services EAMS or EAMS for Single Filers to file your tax reports or tax and. You will need this information when you file your tax return.

This document will accurately summarize your unemployment compensation and ensure that you are taxed appropriately. For Unemployment Insurance tax questions contact the UI Operations Center at 1-877-664-6984 Monday through Friday 800 am. If you received only regular state unemployment benefits Pandemic Emergency Unemployment Compensation PEUC or State Extended Benefits SEB during 2020 you should complete the Request Replacement 1099-G Form to request a copy of your 1099-G form by mail.

31 of the year after you collected benefits. Tax reports or tax and wage reports and unemployment tax payments can be filed and paid through our free and efficient online systems or by submitting our original paper forms. If you received unemployment your tax statement is called form 1099-G not form W-2.

The form will show the amount of unemployment compensation they received during 2020 in Box 1 and any federal income tax withheld in Box 4. Heres how it works. All individuals who received unemployment insurance UI benefits in 2020 will receive the 1099-G tax form.

If you received PUA benefits as well as regular state unemployment benefits PEUC or SEB the 1099-G form in your MyUI. Unemployment benefits including Federal Pandemic Unemployment Compensation FPUC Pandemic Unemployment Assistance PUA Pandemic Emergency Unemployment Compensation PEUC Lost Wages Assistance LWA and Extended Benefits EB are taxable income. The Department of Unemployment Assistance DUA will mail you a copy of your 1099-G by Jan.

Daycare Business Income And Expense Sheet To File Your Daycare Business Taxes Page 2 Taxtime Incom Starting A Daycare Childcare Business Daycare Business Plan

Daycare Business Income And Expense Sheet To File Your Daycare Business Taxes Page 2 Taxtime Incom Starting A Daycare Childcare Business Daycare Business Plan

/Clipboard02-a5156f9d1f374ac4bd6cea8b55ca7541.jpg) Form 1099 Int Interest Income Definition

Form 1099 Int Interest Income Definition

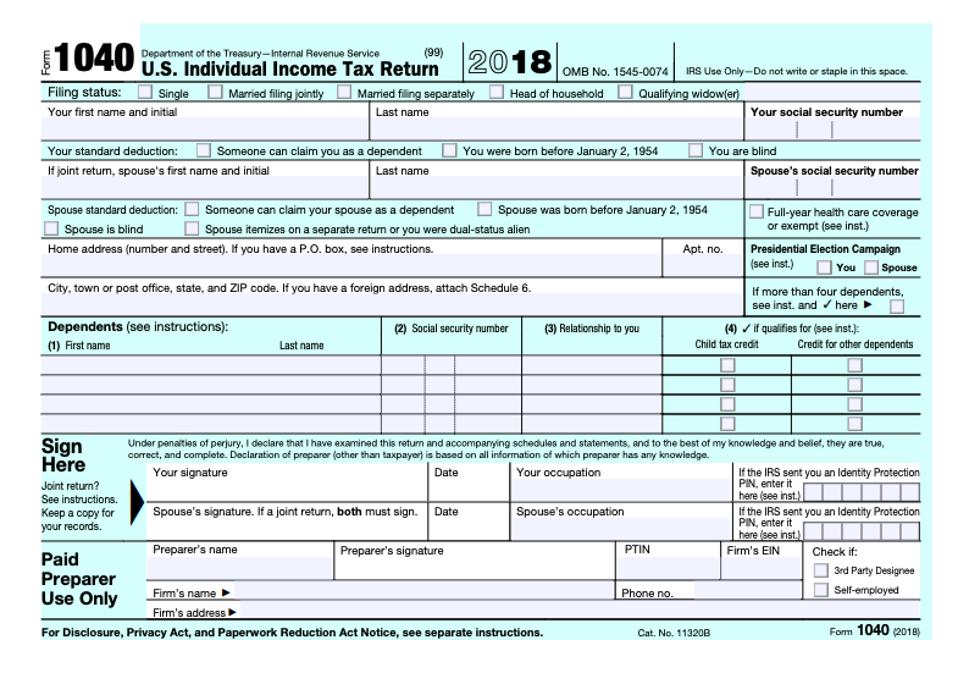

Irs Releases New Not Quite Postcard Sized Form 1040 For 2018 Plus New Schedules

Irs Releases New Not Quite Postcard Sized Form 1040 For 2018 Plus New Schedules

/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg) 10 Things You Should Know About Form 1099

10 Things You Should Know About Form 1099

3 21 3 Individual Income Tax Returns Internal Revenue Service

3 21 3 Individual Income Tax Returns Internal Revenue Service

:max_bytes(150000):strip_icc()/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

Paying Taxes On Unemployment Checks Everything You Need To Know Cnet

Paying Taxes On Unemployment Checks Everything You Need To Know Cnet

3 12 154 Unemployment Tax Returns Internal Revenue Service

3 12 154 Unemployment Tax Returns Internal Revenue Service

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

Form Irs 1099 Misc 2013 Irs Forms Irs Form

Form Irs 1099 Misc 2013 Irs Forms Irs Form

Faqs Benefits Kansas Department Of Labor

Faqs Benefits Kansas Department Of Labor

If You Receive Unemployment Benefits Expect To Receive Form 1099 G Don T Mess With Taxes

Deadlines For The 2018 Tax Year W 2 And 1099 Misc Forms Irs Tax Forms Federal Taxes Tax Deadline

Deadlines For The 2018 Tax Year W 2 And 1099 Misc Forms Irs Tax Forms Federal Taxes Tax Deadline

Employment And Unemployment Macroeconomics Employment 02 2018 Uk Employment Tribunal Decisions Emplo Business Tax Small Business Tax Opening A Business

Employment And Unemployment Macroeconomics Employment 02 2018 Uk Employment Tribunal Decisions Emplo Business Tax Small Business Tax Opening A Business

:max_bytes(150000):strip_icc()/Clipboard02-a5156f9d1f374ac4bd6cea8b55ca7541.jpg) Form 1099 Int Interest Income Definition

Form 1099 Int Interest Income Definition

Post a Comment for "Unemployment Tax Form Called"