Unemployment Ma Maximum Benefit

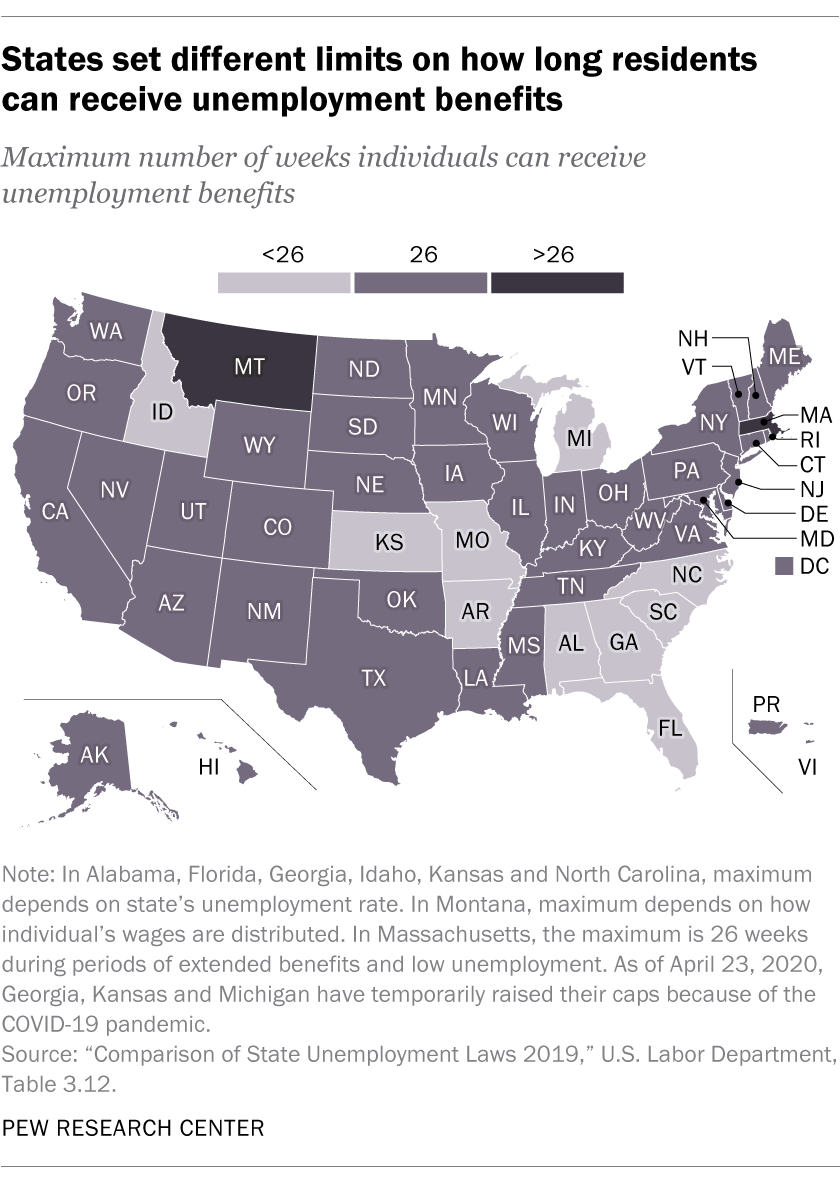

If you have been approved to receive funds your Massachusetts unemployment amountthe weekly payment you receivewill be determined by how much you made at your previous employer. The maximum number of weeks you can receive full unemployment benefits is 30 weeks capped at 26 weeks during periods of extended benefits and low unemployment.

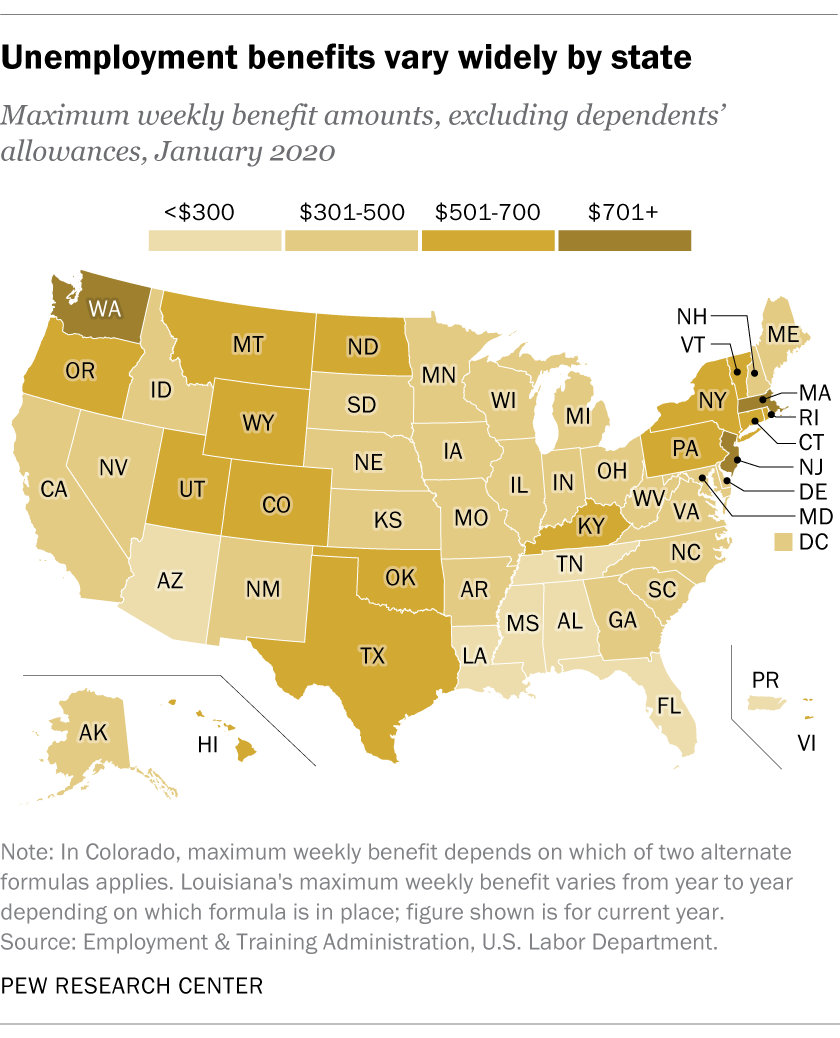

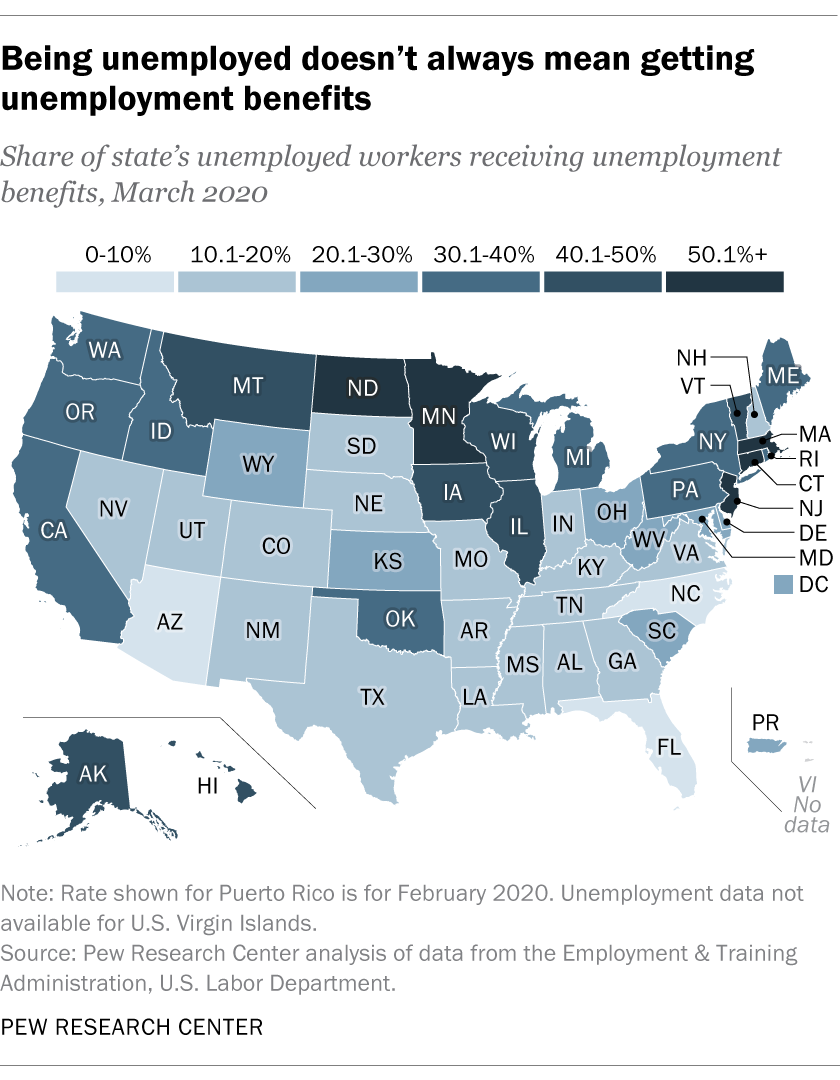

In Some States Very Few Unemployed People Get Unemployment Benefits Pew Research Center

In Some States Very Few Unemployed People Get Unemployment Benefits Pew Research Center

MA Labor and Workforce Development.

Unemployment ma maximum benefit. Subject employers are required by law to make quarterly UI contributions to the state UI Trust Fund. As of October 4 2020 the maximum benefit rate is 855 a week. Policies and benefits vary by state.

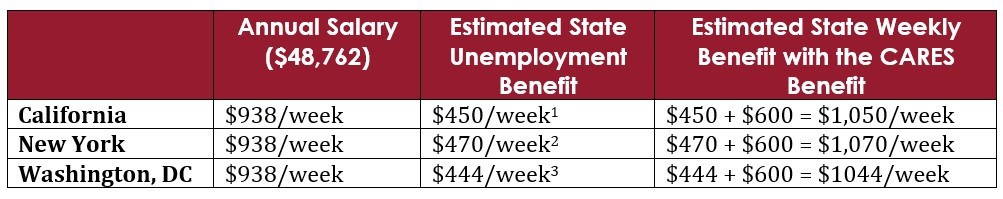

As of October 2019. MN Department of Employment and Economic Development. 54 rows Jobless workers in every state get this extra 600 a week through July 31.

PUA benefits may not be more than the states maximum weekly benefit rate for regular unemployment benefits which is 85500 in Massachusetts. Some taxpayers who collected unemployment benefits in 2020 and filed their returns in the early days of tax season may have to file an amended return to get their maximum refund. If you are eligible to receive unemployment your weekly benefit in Massachusetts will be half of your average weekly wage during the two highest paid quarters of the base period or the highest paid quarter only if you worked during only two quarters of the base period.

However many individuals qualify for less than 30 weeks of coverage. Typically the maximum amount of time you may receive full unemployment benefits in Massachusetts is 30 weeks. For more information about current contribution rates learn about unemployment insurance UI contributions.

However in times of economic crisis states may choose to revise their benefits and the federal government may help fund extended state benefits during such times. 35 rows receive 325 per week in unemployment benefits. Your duration of benefitsthe maximum number of weeks you are eligible to receive benefits is determined by dividing your benefit rate into your benefit credit.

1 day agoThe solvency fund assessment one of several factors used to calculate a business owners unemployment insurance contribution rate jumped from 058 to 923 for 2021. Of 235 per week while Massachusetts has the highest at 823. The legislation also provides an extra 600 of federal money per week on top of the state benefit covering unemployment through July 25 2020 or July 26 2020 for people affected by the.

If you are eligible to receive unemployment benefits you will receive a weekly benefit amount of approximately 50 of your average weekly wage up to the maximum set by law. MT Department of Labor and. The most you can receive per week is.

In 2020 regular unemployment benefit. Your maximum benefit credit is 10860 and your weekly benefit amount is 362. Unemployed workers can receive up to a maximum of 79 - 86 weeks of unemployment compensation depending on location the unemployment rate in your state extended unemployment benefits and eligibility.

Those benefits include a combination of unemployment insurance programs including additional weeks of benefits extended benefits and a supplemental weekly payment. The maximum amount is 823 per week for up to 39 weeks. Wait for your benefits approval letter.

Small business owners with certain forgiven federal loans during the COVID-19 pandemic can now exclude those funds from their gross taxable income in Massachusetts. Mississippi has the lowest maximum unemployment benefits in the US. North Carolina and Florida offer unemployment benefits for the shortest length of time with a maximum of 12 weeks.

362 wdependents Michigan UIA. MO Department of Labor and Industrial Relations. Unemployment insurance UI contributions are used to fund the unemployment insurance program in Massachusetts.

MS Department of Employment Security. Currently the maximum number of weeks a claimant can receive regular UI benefits is 26 weeks. How can I qualify for Massachusetts unemployment benefits.

The following examples show how to determine your duration of benefits. Charlie Baker signed into law Thursday afternoon legislation that makes enables pass-through entities with forgiven Paycheck Protection Program loans to get the same tax benefits that corporations do. That will be the case if a new tax break on up to 10200 of unemployment benefits makes them newly eligible for income-dependent tax breaks like the earned income tax.

600 Unemployment Benefit End Date Is Likely July 31

600 Unemployment Benefit End Date Is Likely July 31

Why Experts Say The Unemployment System Is Broken

Why Experts Say The Unemployment System Is Broken

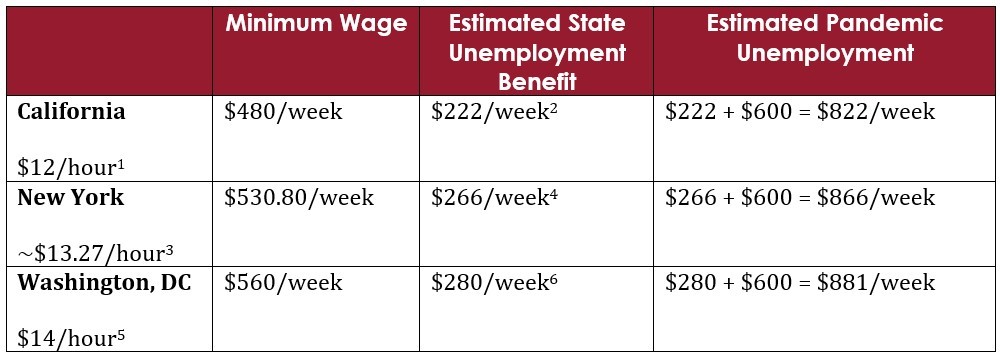

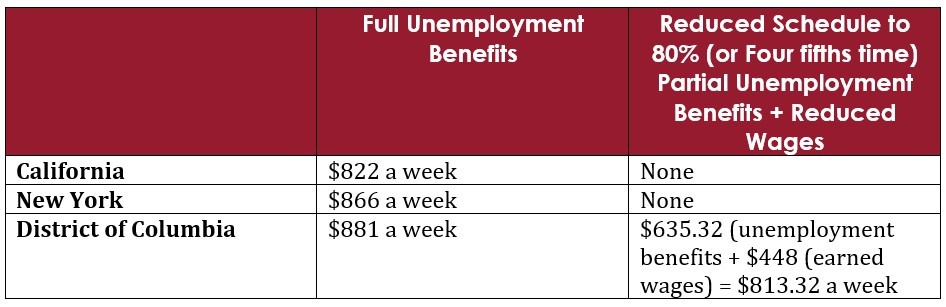

Who Cares Unemployment Benefits For Reduced Hours And Furloughed Employees Steptoe Johnson Llp

Who Cares Unemployment Benefits For Reduced Hours And Furloughed Employees Steptoe Johnson Llp

Https Www Cbpp Org Sites Default Files Atoms Files Policybasics Uiweeks Pdf

Massachusetts Implements Pandemic Emergency Unemployment Compensation Peuc Mass Gov

Massachusetts Implements Pandemic Emergency Unemployment Compensation Peuc Mass Gov

In Some States Very Few Unemployed People Get Unemployment Benefits Pew Research Center

In Some States Very Few Unemployed People Get Unemployment Benefits Pew Research Center

Who Cares Unemployment Benefits For Reduced Hours And Furloughed Employees Steptoe Johnson Llp

Who Cares Unemployment Benefits For Reduced Hours And Furloughed Employees Steptoe Johnson Llp

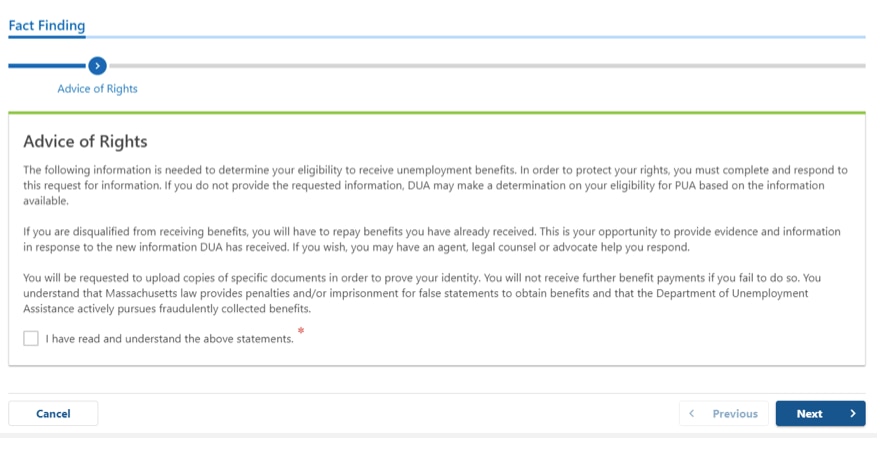

Pua Identity Verification Instructions Mass Gov

Pua Identity Verification Instructions Mass Gov

Covid 19 Unemployment Benefits Massachusetts Afl Cio

Covid 19 Unemployment Benefits Massachusetts Afl Cio

Unemployment Benefits In The Covid 19 Pandemic Public Policy Institute Of California

Unemployment Benefits In The Covid 19 Pandemic Public Policy Institute Of California

Who Cares Unemployment Benefits For Reduced Hours And Furloughed Employees Steptoe Johnson Llp

Who Cares Unemployment Benefits For Reduced Hours And Furloughed Employees Steptoe Johnson Llp

How Unemployment Benefits Are Calculated By State Bench Accounting

How Unemployment Benefits Are Calculated By State Bench Accounting

Https Www Mass Gov Doc The Employers Guide To Unemployment Insurance 2 Download

Enhanced Unemployment Benefits During The Coronavirus Crisis Smartasset

Enhanced Unemployment Benefits During The Coronavirus Crisis Smartasset

In Some States Very Few Unemployed People Get Unemployment Benefits Pew Research Center

In Some States Very Few Unemployed People Get Unemployment Benefits Pew Research Center

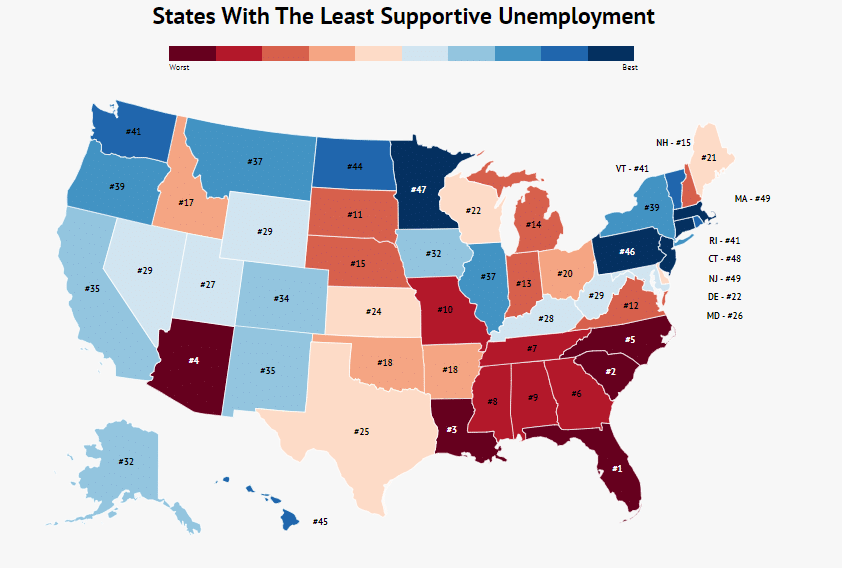

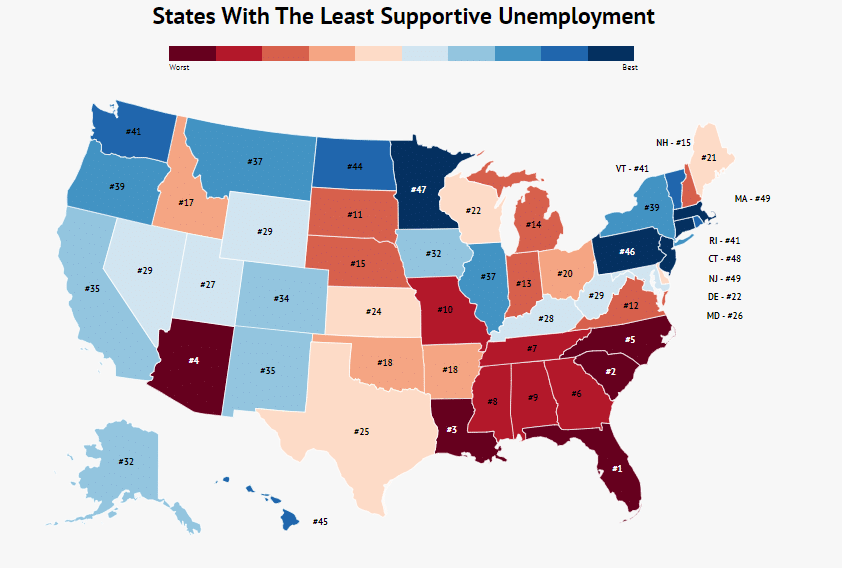

Here Are The States With The Least Supportive Unemployment Systems Zippia

Here Are The States With The Least Supportive Unemployment Systems Zippia

Unemployment Insurance In Tennessee How It Works

Unemployment Insurance In Tennessee How It Works

Unemployment Benefits In The Covid 19 Pandemic Public Policy Institute Of California

Unemployment Benefits In The Covid 19 Pandemic Public Policy Institute Of California

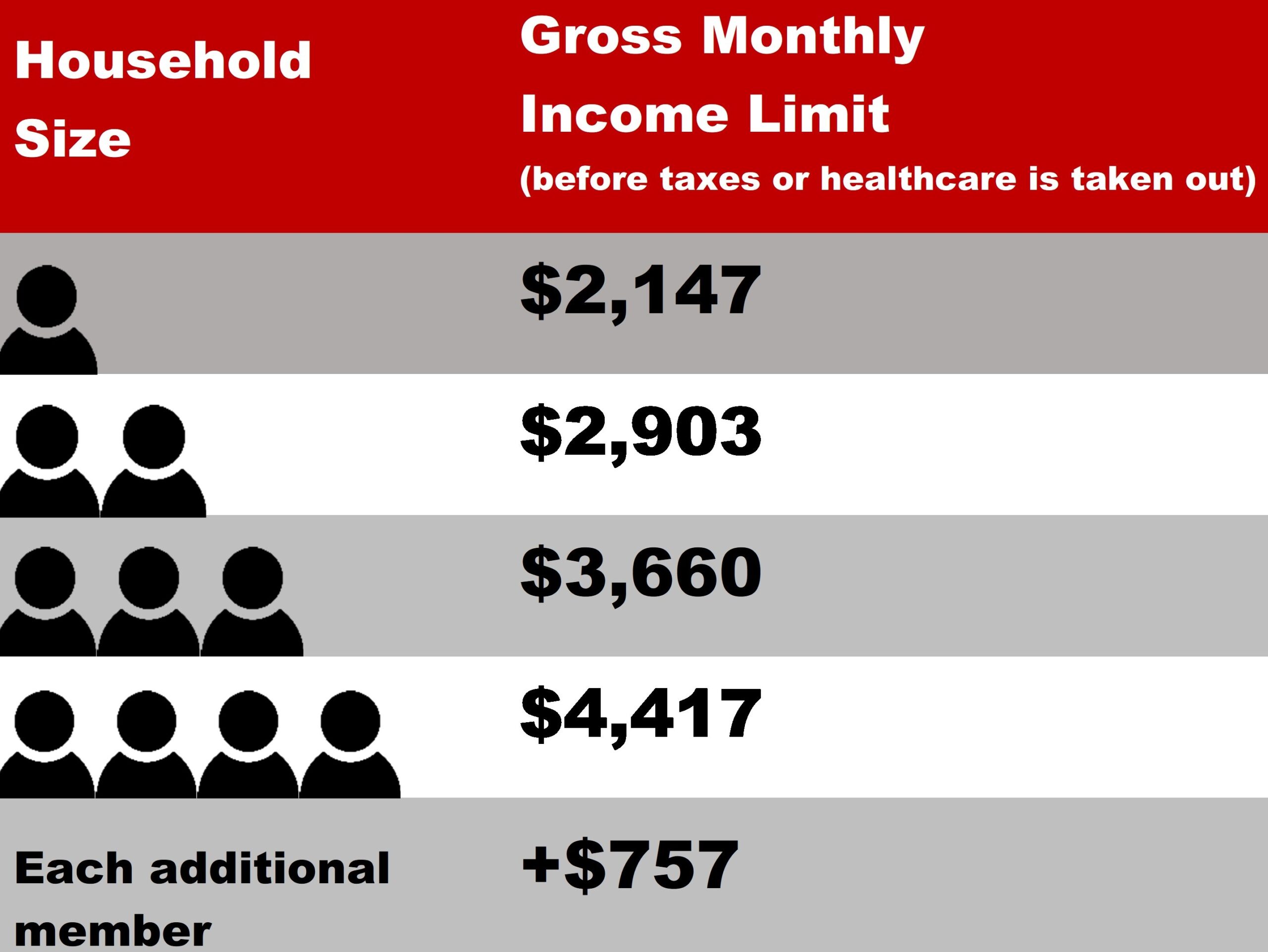

Snap Food Program The Greater Boston Food Bank

Snap Food Program The Greater Boston Food Bank

Post a Comment for "Unemployment Ma Maximum Benefit"