Unemployment Compensation Exclusion Worksheet Explained

New Exclusion of up to 10200 of Unemployment. Under the new exemption you should report the total amount of unemployment compensation you received on line 7 of Schedule 1.

Stimulus Bill Unemployment Benefits How A New Tax Break Could Save You Money Cnet

Stimulus Bill Unemployment Benefits How A New Tax Break Could Save You Money Cnet

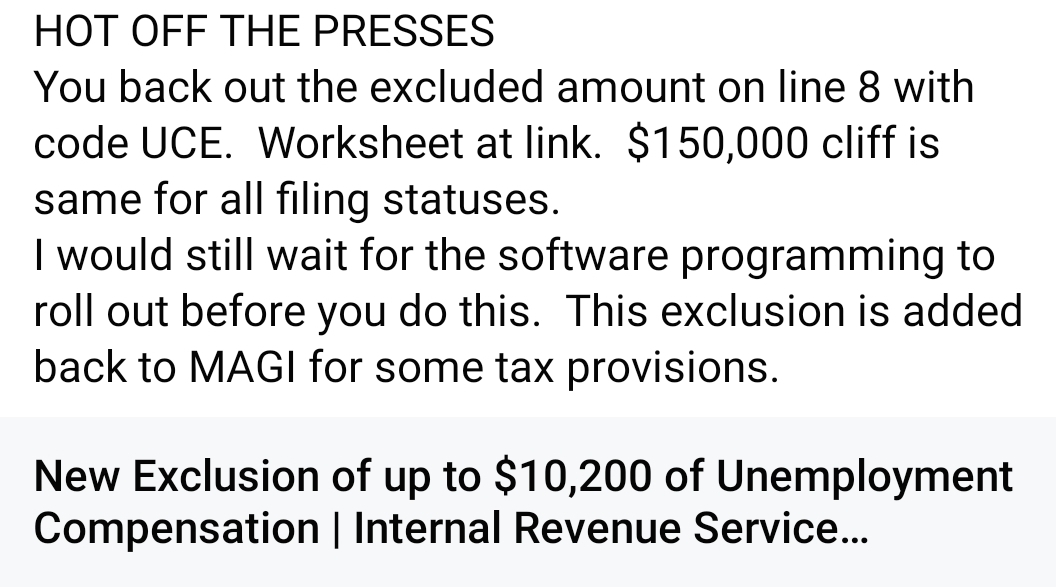

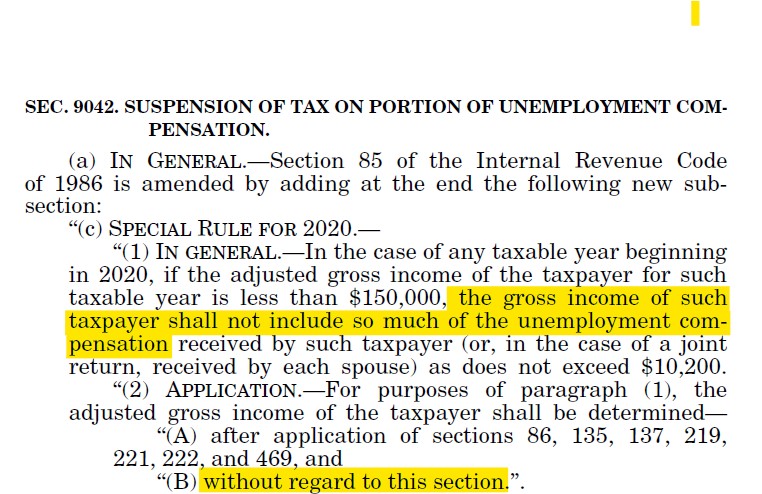

If your modified adjusted gross income AGI is less than 150000 the American Rescue Plan enacted on March 11 2021 excludes from income up to 10200 of unemployment compensation paid in 2020 which means you dont have to pay tax on unemployment compensation of up to.

Unemployment compensation exclusion worksheet explained. Student loan interest deduction. To determine if your unemployment is taxable see Are Payments I Receive for Being Unemployed Taxable. Taxpayers can use this worksheet to.

Irena has 15000 of unemployment income. On the dotted line next to line 8 taxpayers should show the literal UCE letters and the exclusion amount in parentheses. If your modified AGI is 150000 or more you cant exclude any unemployment compensation.

Use the Unemployment Compensation Exclusion Worksheet to figure your modified AGI and the amount you can exclude. On Line 7 and 8 of the form you include how much unemployment insurance you and your spouse received and add those numbers up. If you received unemployment compensation during the year you must include it in gross income.

Normally unemployment benefits are fully taxable and the exclusion is only available to taxpayers with modified adjusted gross incomes of less than 150000. The American Rescue Plan Act of 2021 provided for an exclusion of up to 10200 for unemployment benefits paid to taxpayers in 2020. Refer to this Post Release Changes to Forms article for information about the new exclusion of up to 10200 of unemployment compensation.

The agency recommended taxpayers and preparers use the updated instructions and an upcoming Unemployment Compensation Exclusion Worksheet to calculate their exclusion and the amount to be entered on Schedule 1 lines 7 and 8. Line 11 of that worksheet is Schedule 1 Line 8 minus the exclusion. Essentially the full amount of unemployment compensation is reported on line 7 of Schedule 1 as usual and the exclusion up to 10200 per individual is backed out on line 8.

If you are filing Form 1040-NR enter the total of lines 1a 1b and lines 2 through 7. Also youre not going to find any of the lines it mentions because the Unemployment Compensation Exclusion Worksheet doesnt seem to exist yet. Unemployment Compensation Worksheet A.

That being said here is some things to help clear it up. If using the 2020-331 version overrides are available on the Massachusetts Income Deductions worksheet Other deductions section Interview Form MA6A. If you are filing Form 1040 or 1040-SR enter the total of lines 1 through 7 of Form 1040 or 1040-SR.

The total number is the amount of unemployment compensation excluded from your income Spencer PlattGetty Images FILE. If you make more than 150000 you dont get the 10200. Use the Unemployment Compensation Exclusion Worksheet to figure your modified AGI and the amount to exclude.

The IRS recommends using that form to fill out the Form 1040 the standard tax worksheet. Tuition and fees deduction Form 8917 Deduction of up to 25000 for active participation in a passive rental real estate activity Form 8582 Exclusion of interest from certain bonds Form 8815 Exclusion. The 15200 excluded from income is all of the 5000 unemployment compensation paid to your spouse plus 10200 of the 20000 paid to you.

The amount from Line 11 of the worksheet is then transferred to Schedule 1 Line 8. 1 day agoThe first spouse can only exclude up to 10200 and the second spouse can exclude the full 6000 making the total unemployment benefits exclusion amount 16200 for the couple. If you made contributions to a governmental unemployment compensation program or to a governmental paid family leave program and you arent itemizing deductions reduce the amount you report on line 7 by those contributions.

Married not filing a joint return and lived with your spouse at any time during the year write -0-. Taxpayers should report the total unemployment compensation paid to them and reported on Form 1099-G Box 1 on Line 7 of Form 1040 Schedule 1 unreduced by any unemployment exclusion. Unemployment Compensation Exclusion Worksheet Schedule 1 Line 8 1.

Married filing a joint return write 18000 on line 3 below. The instructions for Schedule 1 Form 1040 line 7 Unemployment Compensation and line 8 on the worksheet have been updated to reflect the latest. Then use the Unemployment Compensation Exclusion Worksheet to.

Line 3 of that worksheet is Schedule 1 Line 8 before considering the exclusion. Ive dug around everywhere I can think of and cant find it posted anywhere yet. The latest MA unemployment compensation exclusion worksheet is available on the 2020-34 release scheduled for 425.

For those who hadnt filed their taxes before the unemployment exclusion was signed the IRS released an Unemployment Compensation Exclusion Worksheet. The following deductions and exclusions are still calculated using the full unemployment compensation your client received. There is supposed to be a worksheet created that will start with the amount received that will calculate the nontaxable and taxable portions so I think we will enter the amounts shown on the 1099G fo.

The amount of unemployment to show as an exclusion on line 8 other income. Taxable social security benefits. Unemployment Compensation Exclusion Unemployment Compensation Exclusion.

The exclusion is computed on a new worksheet the Unemployment Compensation Exclusion Worksheet.

Https Www Uc Pa Gov Documents Uc Forms Uc 2ins Pdf

Do You Know How To Meet Your Work Search Requirements While Receiving Unemployment Benefits Idaho Work

Do You Know How To Meet Your Work Search Requirements While Receiving Unemployment Benefits Idaho Work

Unemployment Update How To Get 10 200 Unemployment Tax Free Step By Step Youtube

Unemployment Update How To Get 10 200 Unemployment Tax Free Step By Step Youtube

10 200 Jobless Tax Break How To Cut Income Below The 150 000 Limit

10 200 Jobless Tax Break How To Cut Income Below The 150 000 Limit

10 200 Unemployment Tax Break Irs Makes More People Eligible

10 200 Unemployment Tax Break Irs Makes More People Eligible

Unemployment Compensation Exclusion General Chat Atx Community

Unemployment Compensation Exclusion General Chat Atx Community

Don T Miss The 10 200 Tax Exemption 2020 Unemployment Benefits 2020 Tax Return Youtube

Don T Miss The 10 200 Tax Exemption 2020 Unemployment Benefits 2020 Tax Return Youtube

Https Apps Irs Gov App Vita Content Globalmedia Teacher 13 Unemplymt Instructor Presentation Pdf

10 200 Tax Free Unemployment Update How To Report On Form 1040 Youtube

10 200 Tax Free Unemployment Update How To Report On Form 1040 Youtube

How To Get Rid Of Debt Money Infographic Infographics Finance Personalfinance Money Debt Debtfree Budget Debtsettle Finance Infographic Finance Debt

How To Get Rid Of Debt Money Infographic Infographics Finance Personalfinance Money Debt Debtfree Budget Debtsettle Finance Infographic Finance Debt

Do You Know How To Meet Your Work Search Requirements While Receiving Unemployment Benefits Idaho Work

Do You Know How To Meet Your Work Search Requirements While Receiving Unemployment Benefits Idaho Work

Expert Q A About The Unemployment Provisions Of The American Rescue Plan

Expert Q A About The Unemployment Provisions Of The American Rescue Plan

10 200 Jobless Tax Break How To Cut Income Below The 150 000 Limit

10 200 Jobless Tax Break How To Cut Income Below The 150 000 Limit

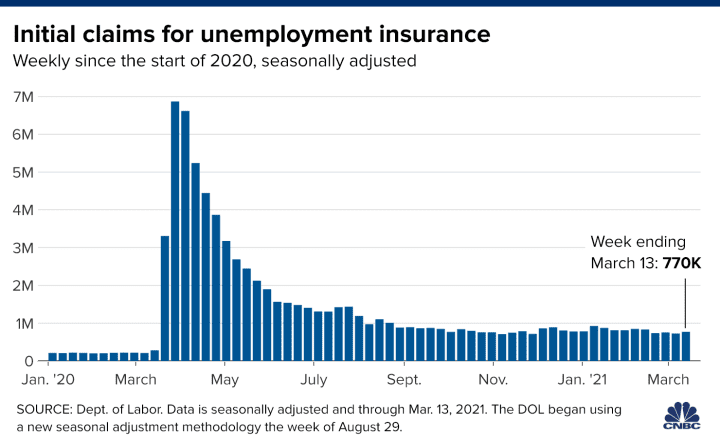

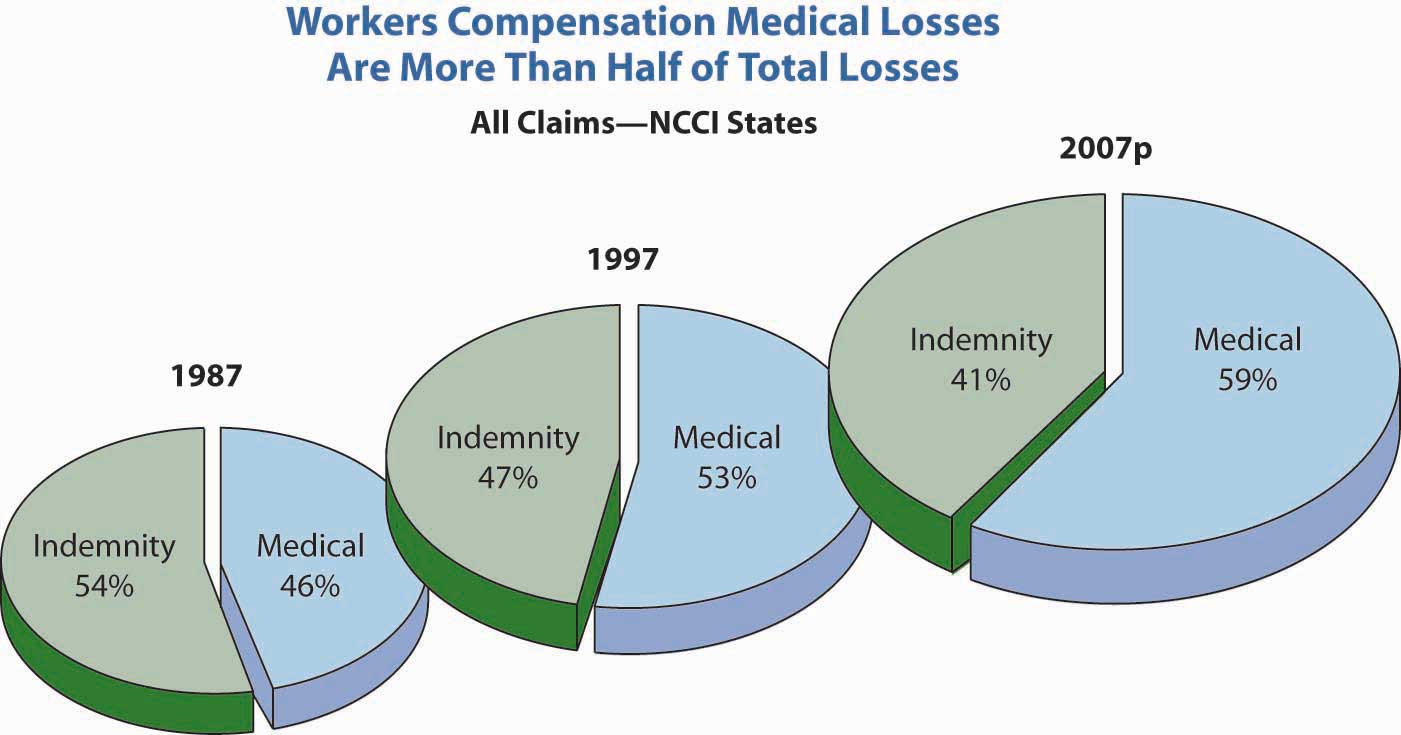

Risks Related To The Job Workers Compensation And Unemployment Compensation

Risks Related To The Job Workers Compensation And Unemployment Compensation

Unemployment Compensation Exclusion General Chat Atx Community

Unemployment Compensation Exclusion General Chat Atx Community

Irs Unemployment Exclusion Worksheet Now Live Youtube

Irs Unemployment Exclusion Worksheet Now Live Youtube

Unemployment Exclusion 2020 Walkthrough 10 200 Tax Free Unemployment Compensation Explained Youtube

Unemployment Exclusion 2020 Walkthrough 10 200 Tax Free Unemployment Compensation Explained Youtube

Pin On Mortgage Tips And Tricks

Pin On Mortgage Tips And Tricks

Post a Comment for "Unemployment Compensation Exclusion Worksheet Explained"