Ohio Unemployment Insurance For Employers

The state unemployment system is paid for through premiums paid by employers similar to an insurance plan. Highlighted below are two important pieces of information to help you register your business and begin reporting.

Https Jfs Ohio Gov Ouio Employeroutreach Employeroutreachwebinar September2019 Stm

Employers with questions can call 614 466-2319.

Ohio unemployment insurance for employers. In Ohio state UI tax is just one of several taxes that employers must pay. Ohio employers can manage their unemployment compensation accounts online. Report it by calling toll-free.

Using federal dollars strategically to shore up Ohios unemployment system will also contribute to Ohios year of recovery. Yes unemployment benefits will be available for eligible Ohioans who lose their job due to their employer shutting down operations or laying off workers as a. You have at least one employee in covered employment for some portion of a day in each of 20 different weeks within either the current or the preceding calendar year.

Employer Resource Hub If you are an Ohio employer who has completed or is planning a mass layoff or shutdown due to COVID-19 please review our key resource links and frequently asked questions to find out more about what. 1 day agoDeWine said paying off the debt would be a relief to Ohio businesses. In most situations you are considered a liable employer under the Ohio unemployment law if you meet either of the following requirements.

The UI tax funds unemployment compensation programs for eligible employees. How to Obtain an Employer Account Number. We first encourage employers to engage in dialogue with an employee who expresses reluctance to return to work about the measures that employers are taking to help employees feel safe.

Click below to access the desired unemployment compensation account. Payments for the first quarter of 2020 will be due April 30. True Coronavirus and Unemployment Insurance Benefits Resource Hubs Please review our employee and employer resource hubs for more information on unemployment benefits related to COVID-19.

Section 2103 of the federal Coronavirus Aid Relief and Economic Security CARES Act provides a 50 federal reimbursement for regular unemployment benefits paid by reimbursing employers through December 31 2020. 1 day agoDue to the COVID pandemic Ohio is already over 14 billion in unemployment compensation debt. Governor Mike DeWine recommended to the General Assembly that Ohio use a portion of its federal COVID relief and recovery dollars to pay off the Unemployment Insurance loan owed to the federal government.

If an employers account is not eligible for an experience rate the account will be assigned a standard new employer rate of 27 unless the employer is engaged in the construction industry in which case the 2017 rate is 62 the 2018 rate is 60 the 2019 rate is. To pay that back would be a huge cost to Ohio businesses who are trying desperately to recover. ODJFS is required by law to ensure that unemployment benefits are issued in accordance with established eligibility requirements.

Effective the first quarter of 2020 Ohio employers will pay state unemployment taxes on the first 9000 in actual not prorated wages paid to each of their covered employees. Other important employer taxes not covered here include federal UI tax and state and federal withholding taxes. Under the Ohio Unemployment Law most employers are liable to pay Unemployment taxes and report wages paid to their employees on a quarterly basis.

If your small business has employees working in Ohio youll need to pay Ohio unemployment insurance UI tax. If you receive an unemployment insurance overpayment because of unreported or underreported wagesearnings you must repay that debt to ODJFS within 60 days. If you do not the overpayment will be reported to the Ohio Attorney General for collection and any federal income tax refund owed to you could be intercepted.

Apply for Unemployment Now Employee 1099 Employee Employer. So paying off the. Taxes Benefits false Coronavirus and Unemployment Insurance Benefits.

To receive your Unemployment tax account number and contribution rate. A New Opportunity to Evaluate Potential Employees The Ohio Learn to Earn OLE program is a new statewide initiative developed by the Ohio Department of Job and Family Services.

Https Unemployment Ohio Gov Pdf New Workers Self Service User Guide Pdf

Ohio Reports 187 780 Jobless Claims For Previous Week Wrgt

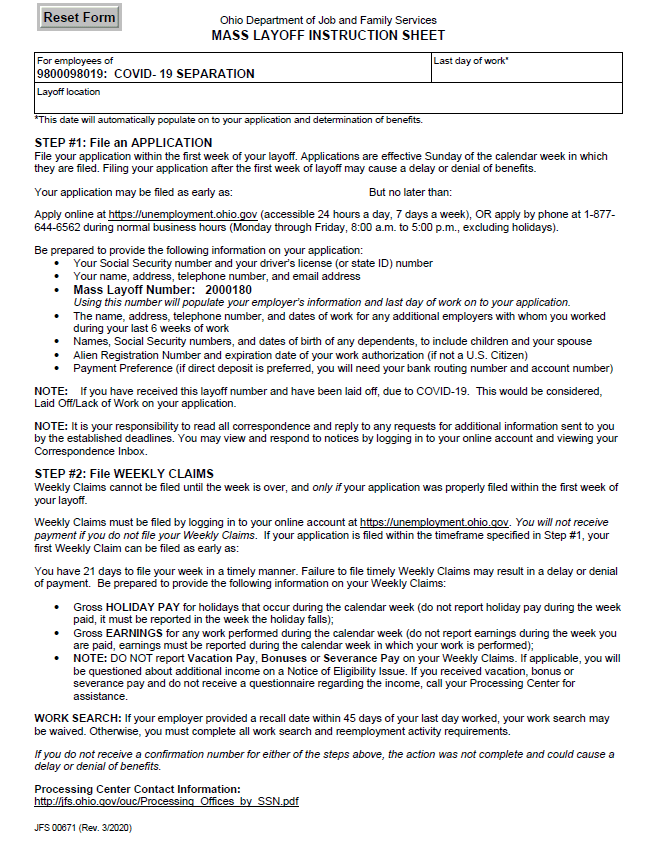

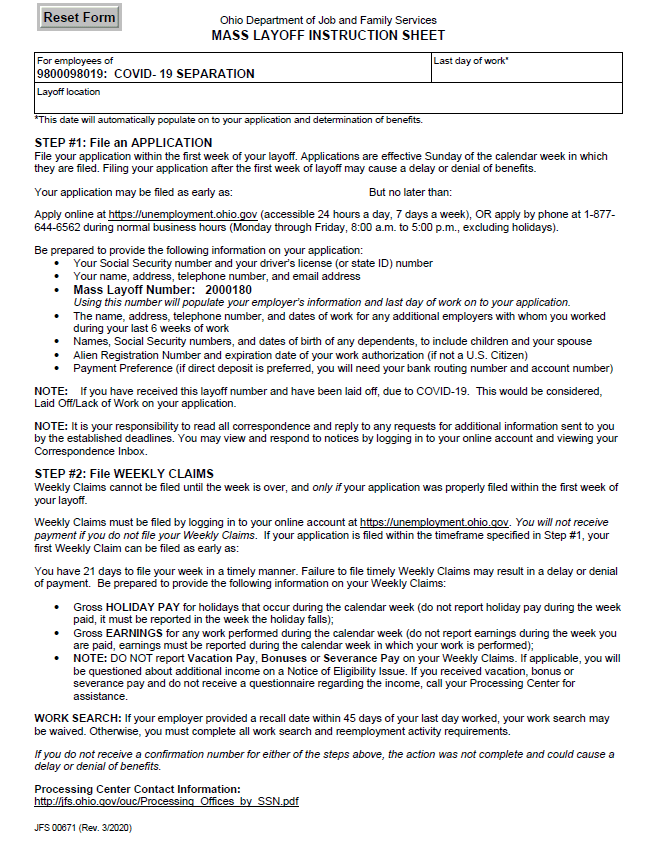

Respond To Employer Request For Separation Information Office Of Unemployment Insurance Operations Ohio Department Of Job And Family Services

Respond To Employer Request For Separation Information Office Of Unemployment Insurance Operations Ohio Department Of Job And Family Services

Https Unemployment Ohio Gov Pdf New Workers Self Service User Guide Pdf

Ohio Kentucky Raise Unemployment Insurance Tax Rates On Employers Wkrc

Ohio Kentucky Raise Unemployment Insurance Tax Rates On Employers Wkrc

Ohio Kentucky Raise Unemployment Insurance Tax Rates On Employers Wkrc

Ohio Kentucky Raise Unemployment Insurance Tax Rates On Employers Wkrc

Http Www Olc Org Pdf Internetfilingunemploymentcomp Pdf

Ohio Unemployment Help Wkyc Com

Ohio Unemployment Help Wkyc Com

Number Of Ohioans Who Filed For Unemployment Continues To Decline For 8th Straight Week

Number Of Ohioans Who Filed For Unemployment Continues To Decline For 8th Straight Week

Who In Ohio Is Qualified For Coronavirus Related Jobless Benefit Wfmj Com

Who In Ohio Is Qualified For Coronavirus Related Jobless Benefit Wfmj Com

Https Unemployment Ohio Gov Pdf New Workers Self Service User Guide Pdf

Https Unemployment Ohio Gov Pdf New Workers Self Service User Guide Pdf

Covid 19 Unemployment Benefits Hamilton Ryker

Covid 19 Unemployment Benefits Hamilton Ryker

Https Jfs Ohio Gov Ouio Employeroutreach Employeroutreachwebinar September2019 Stm

Odjfs Wants Businesses To Report Employees Who Refuse To Return To Work

Odjfs Wants Businesses To Report Employees Who Refuse To Return To Work

Covid 19 Pandemic Information For Employers Ohiomeansjobs Summit County

Covid 19 Pandemic Information For Employers Ohiomeansjobs Summit County

More Ohioans Learn Identities Were Stolen Used For Widespread Unemployment Fraud

More Ohioans Learn Identities Were Stolen Used For Widespread Unemployment Fraud

Post a Comment for "Ohio Unemployment Insurance For Employers"