Is The Extra $600 Unemployment Counted As Income

Recently however the family received notice that the 600 added to the unemployment check from the stimulus bill made them ineligible for SNAP. Individuals dont need to do anything extra to receive the 300.

Extra 600 Unemployment Benefits Will Start Flowing As Early As This Week For A Lucky Few Coronavirus Fox5vegas Com

Extra 600 Unemployment Benefits Will Start Flowing As Early As This Week For A Lucky Few Coronavirus Fox5vegas Com

However regular unemployment payments issued by the state that are not part of the CARES Act stimulus package are counted as income and should be reported to the housing authority.

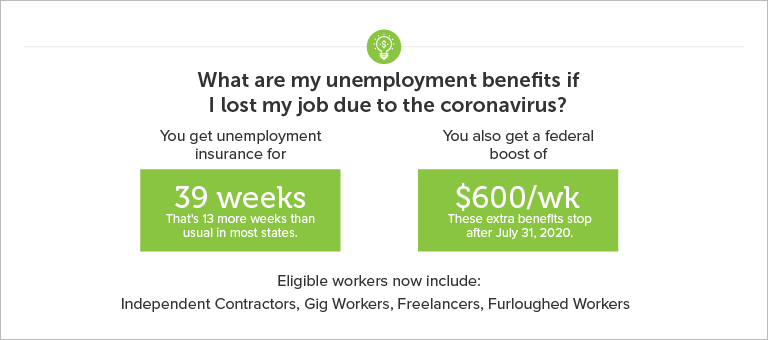

Is the extra $600 unemployment counted as income. But the 600 a week in extra federal unemployment stimulus created by the CARES Act and available through July 31 doesnt count as income in determining Medicaid eligibility. Continue to file biweekly claims benefits will be automatically paid to qualified individuals. For individuals qualifying for regular unemployment the CARES act established an additional weekly payment of 600 until July 31 2020.

Expect to see mistakes. Unemployment is counted as income for these purposes he said. According to a document from USDA the pandemic unemployment payments authorized under the CARES act are not excluded from income by law and therefore must be counted as income for SNAP.

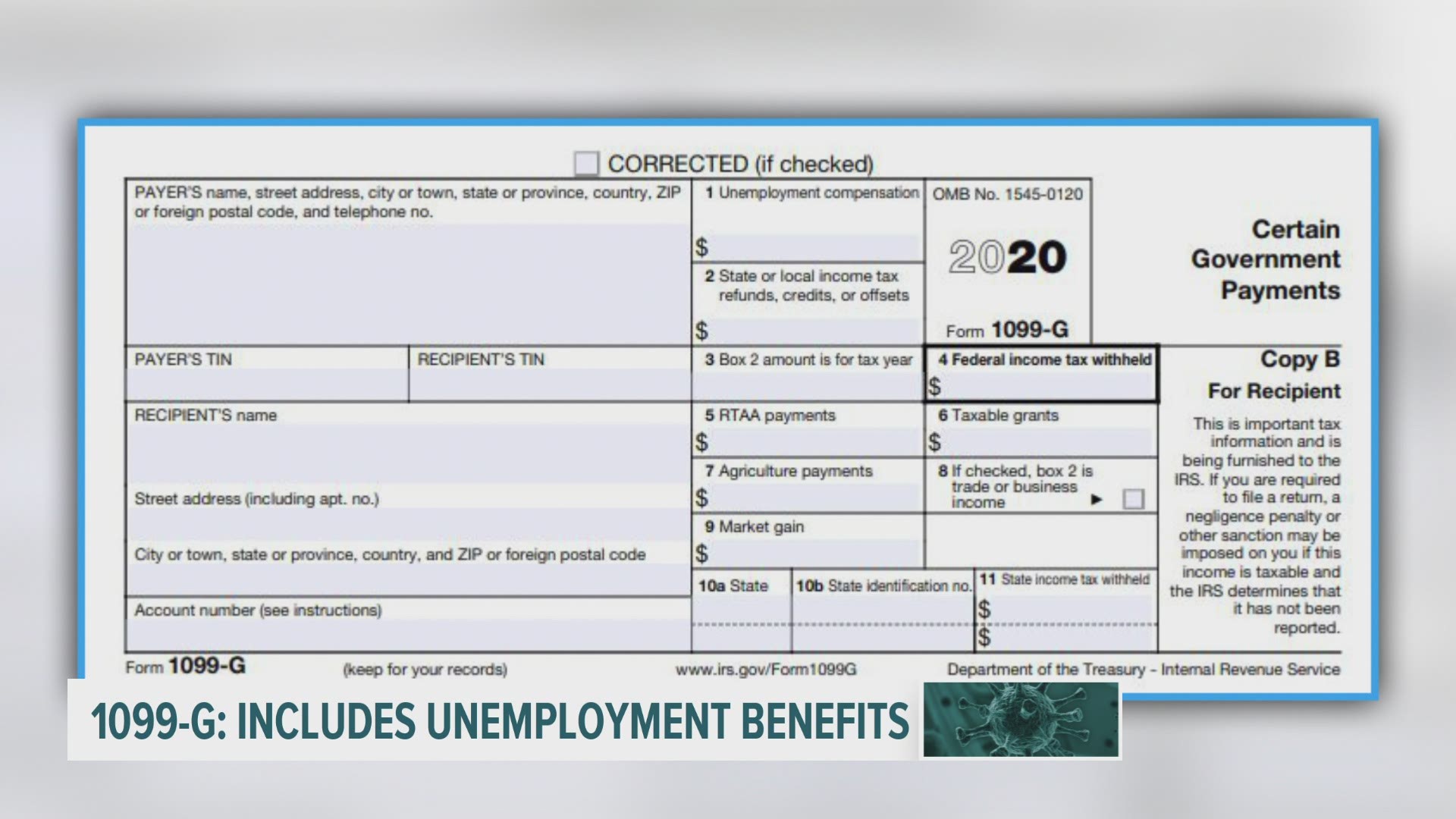

Individuals will receive a 300 FPUC payment for all weeks for which they receive an underlying unemployment benefit from the week ending January 2 2021 through the week ending. By law unemployment compensation is taxable and must be reported on a 2020 federal income tax return the tax agency said in a memo issued. This federal unemployment compensation is included in income eligibility determinations for ACA marketplace eligibility but not for Medicaid and CHIP eligibility.

This means these payments are NOT taxable and will not be counted as income for Medicaid CHIP or financial assistance in the Marketplace. Include these in your household income while using the. It provided an additional 600 per week in unemployment compensation per recipient through July 2020.

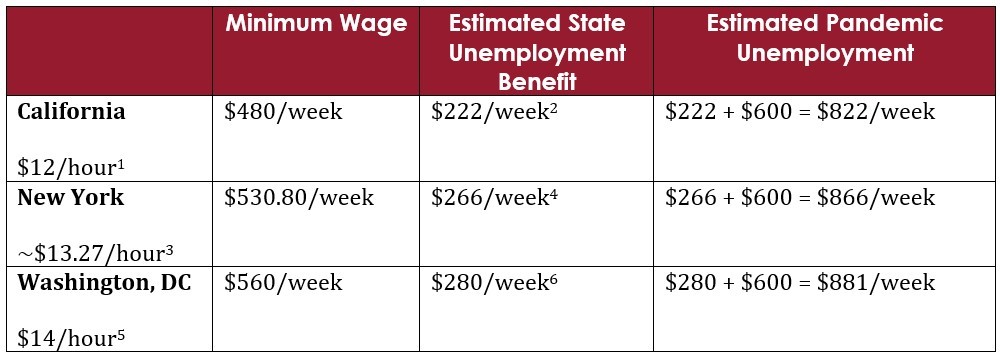

Subsidies will be assessed based on your modified adjusted gross income for the year you are covered he said. The extra 600 in weekly payments works out to 8400 in taxable income if you received the benefit for 14 weeks and remember this money is offered on. Household stimulus payments of up to 1200 which is technically an advance tax credit and the temporary 600 per week federal enhancement to unemployment.

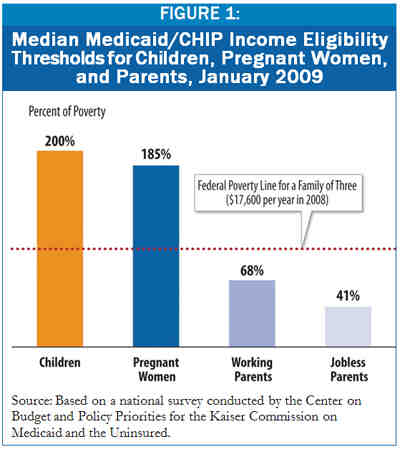

For Medicaid the additional 600 per week of PUC is not countable and should be excluded in determining eligibility but other UI benefits are counted. Regular unemployment benefits also count as income for SNAP and TANF. States have flexibility for treatment of income under TANF.

The added 600 per week unemployment authorized by the CARES Act does not count for MassHealth --it should not be entered as current unemployment income. But it does count for the Health Connector--it should be included as part of estimated yearly income for 2020. You might be alright if you arranged to have income tax withheld from your benefits but federal law caps withholding on benefits at 10.

That extra 600 is also taxable after the first 10200. All unemployment benefits including the extra 300 per week PUC payment are included in your taxable gross income and Modified Adjusted Gross Income for purposes of eligibility for financial help available through Covered California. Those benefits including the additional weekly 600 of Federal Pandemic Unemployment Compensation and the extra 300 weekly through the Lost Wages Assistance program are considered taxable.

If you earned 18240 and received the extra 600 in COVID unemployment benefits for six months 3600 it will be subject to federal income tax but it will not reduce your Social Security. Most states count the full amount of UI but some states are excluding the additional 600 per week of PUC. DistilINFO Healthplan Monthly Intelligence Report January 2021.

USDA guidance question 2 also provides that the extra 600week is considered unearned income for the purposes of determining a households SNAP eligibility and benefit amount. HUD updated its FAQ document to include some clarifications about the treatment of households stimulus payments as well as the temporary enhancement of unemployment insurance when calculating household income and program eligibility. The unemployment bump of 600 per week is a different story.

At present vulnerable workers who become unemployed can receive 600 in additional federal income for 16 weeks. No the temporary federal enhancement to unemployment 600 weekly provided by the CARES Act is not included as annual income for Section 8 Housing Choice Voucher and Public Housing tenants.

Coronavirus In Ohio Your Covid 19 Money Questions Answered

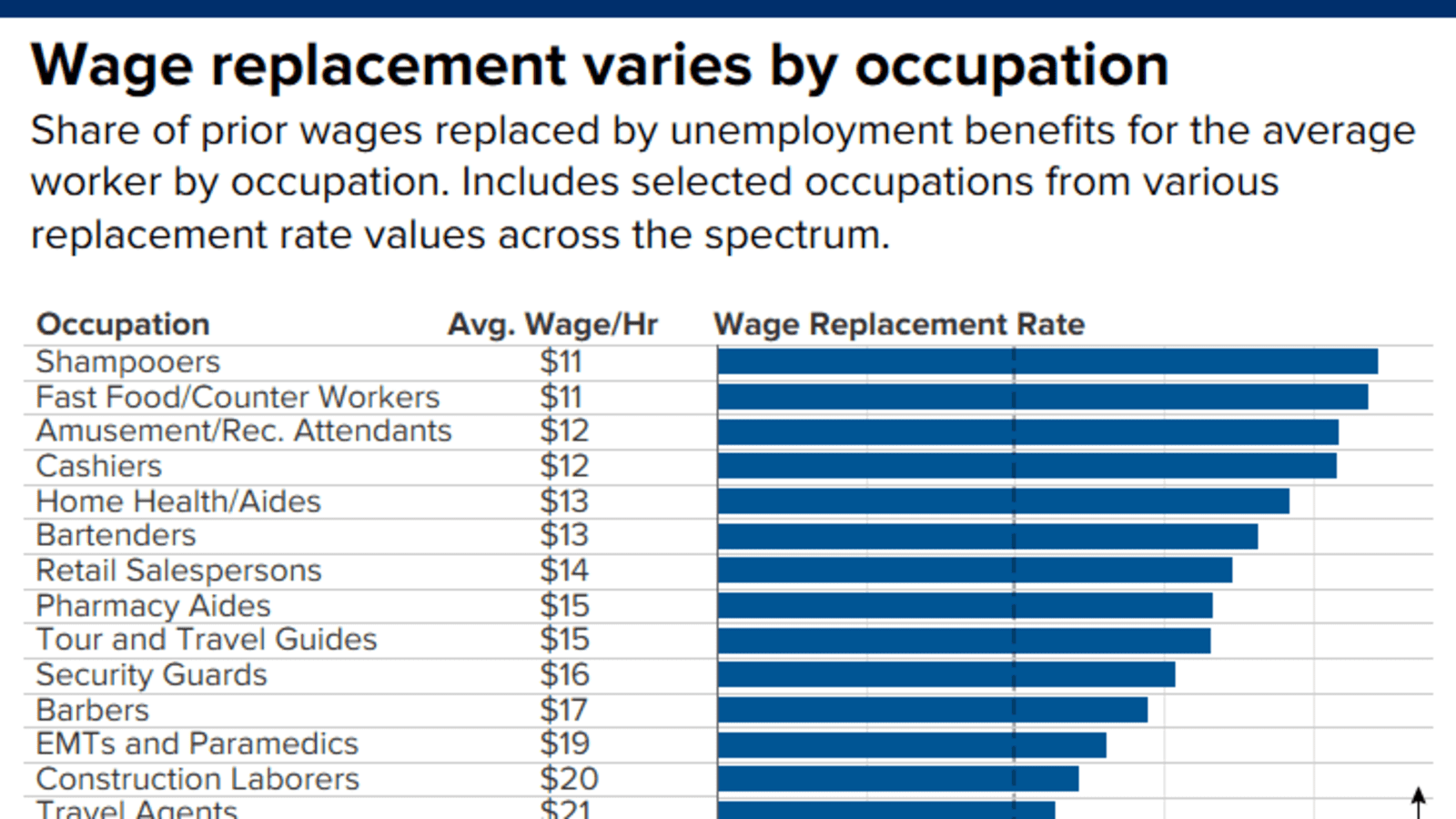

It Pays To Stay Unemployed That Might Be A Good Thing

It Pays To Stay Unemployed That Might Be A Good Thing

Enhanced Unemployment Benefits During The Coronavirus Crisis Smartasset

Enhanced Unemployment Benefits During The Coronavirus Crisis Smartasset

Rules Roundup Supplemental Unemployment Benefits And Their Impact On Public Assistance Programs Making Justice Real

Rules Roundup Supplemental Unemployment Benefits And Their Impact On Public Assistance Programs Making Justice Real

Medicaid And Chip Eligibility Is Protected For Jobless Families That Receive Boost In Unemployment Benefits Center On Budget And Policy Priorities

Medicaid And Chip Eligibility Is Protected For Jobless Families That Receive Boost In Unemployment Benefits Center On Budget And Policy Priorities

What The 600 Unemployment Benefit Means In Your State Marketplace

What The 600 Unemployment Benefit Means In Your State Marketplace

It Pays To Stay Unemployed That Might Be A Good Thing

It Pays To Stay Unemployed That Might Be A Good Thing

Who Cares Unemployment Benefits For Reduced Hours And Furloughed Employees Steptoe Johnson Llp

Who Cares Unemployment Benefits For Reduced Hours And Furloughed Employees Steptoe Johnson Llp

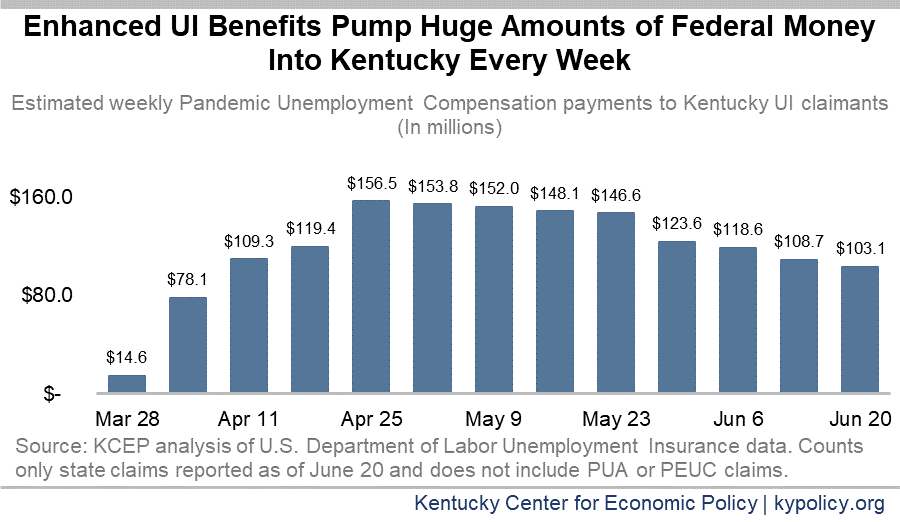

Letting Enhanced Unemployment Insurance Benefits Expire In A Month Would Harm Families And Weaken Kentucky S Economy Kentucky Center For Economic Policy

Letting Enhanced Unemployment Insurance Benefits Expire In A Month Would Harm Families And Weaken Kentucky S Economy Kentucky Center For Economic Policy

Expert Q A About The Unemployment Provisions Of The American Rescue Plan

Expert Q A About The Unemployment Provisions Of The American Rescue Plan

Extra 600 Unemployment Benefits Will Start Flowing As Early As This Week For A Lucky Few Coronavirus Fox5vegas Com

Extra 600 Unemployment Benefits Will Start Flowing As Early As This Week For A Lucky Few Coronavirus Fox5vegas Com

State Expect Extra 600 In Unemployment Payments By April 17 Wral Com

State Expect Extra 600 In Unemployment Payments By April 17 Wral Com

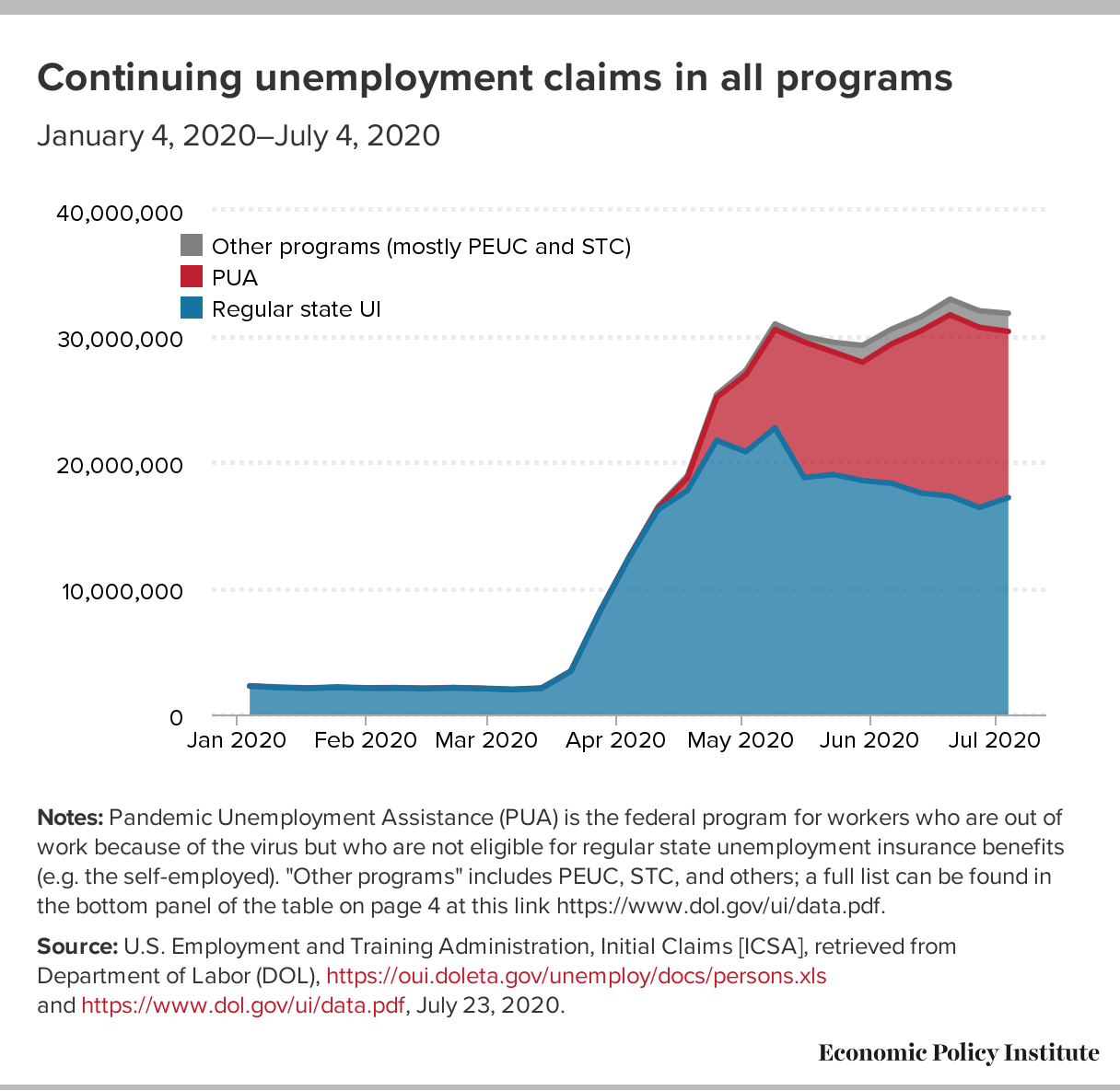

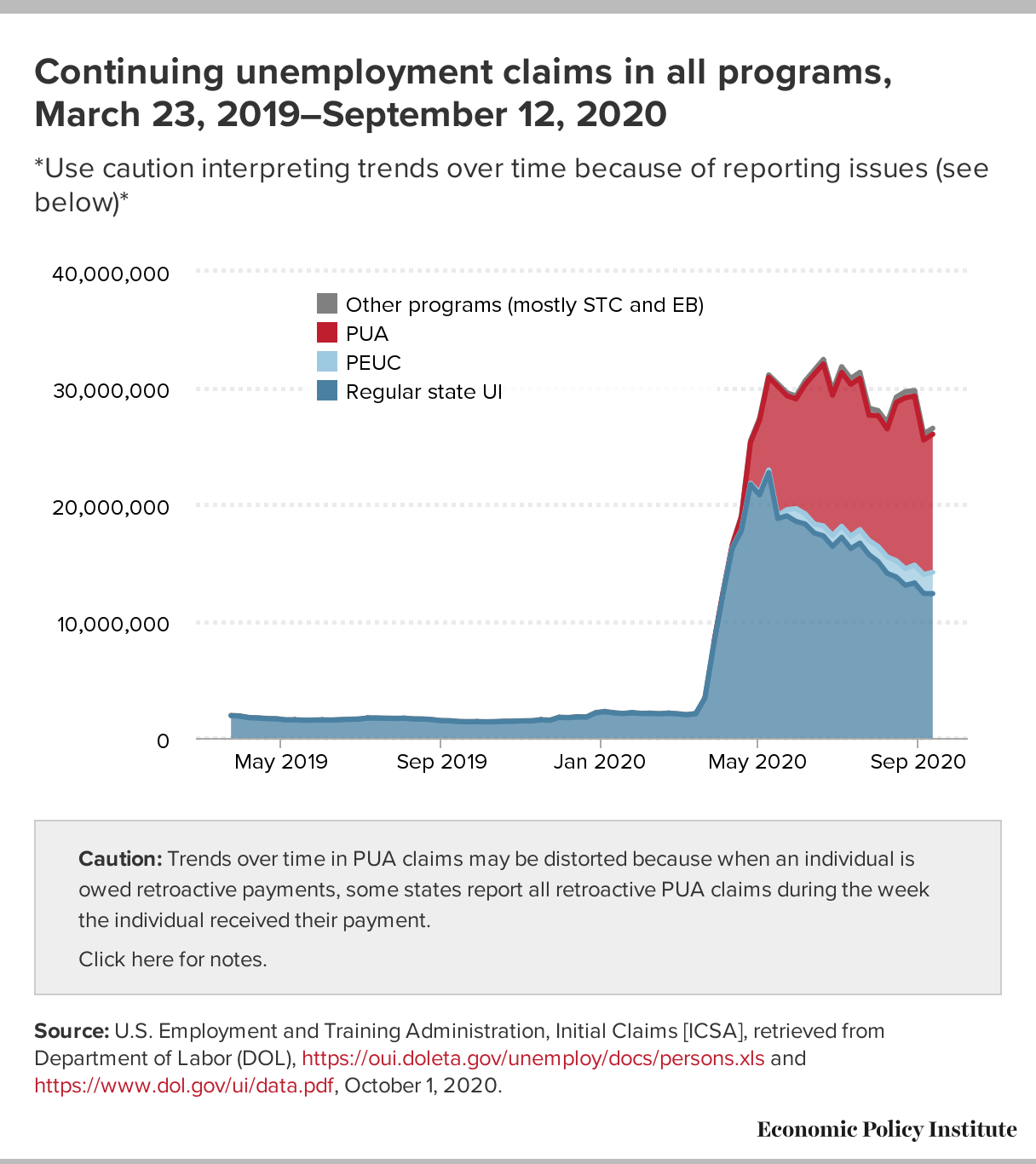

Joblessness Remains At Historic Levels And There Is No Evidence Ui Is Disincentivizing Work Congress Must Extend The Extra 600 In Ui Benefits Economic Policy Institute

Joblessness Remains At Historic Levels And There Is No Evidence Ui Is Disincentivizing Work Congress Must Extend The Extra 600 In Ui Benefits Economic Policy Institute

That Extra 600 A Week In Unemployment Benefits Is Taxable Weareiowa Com

That Extra 600 A Week In Unemployment Benefits Is Taxable Weareiowa Com

Dwd Starts Issuing Extra 600 To Eligible Unemployment Recipients

Dwd Starts Issuing Extra 600 To Eligible Unemployment Recipients

With Millions Of Workers Receiving Unemployment Benefits And No End In Sight For The Covid 19 Pandemic Congress Must Act Economic Policy Institute

With Millions Of Workers Receiving Unemployment Benefits And No End In Sight For The Covid 19 Pandemic Congress Must Act Economic Policy Institute

Post a Comment for "Is The Extra $600 Unemployment Counted As Income"