How Does Unemployment Work In Ohio For Employers

The participating employee works the reduced hours each week and the Ohio Department of Job and Family Services provides eligible individuals an unemployment benefit proportionate to their reduced hours. 1 day agoDuring March employers added 916000 jobs the most since August and the unemployment rate declined from 62 to 6.

Https Unemployment Ohio Gov Pdf New Workers Self Service User Guide Pdf

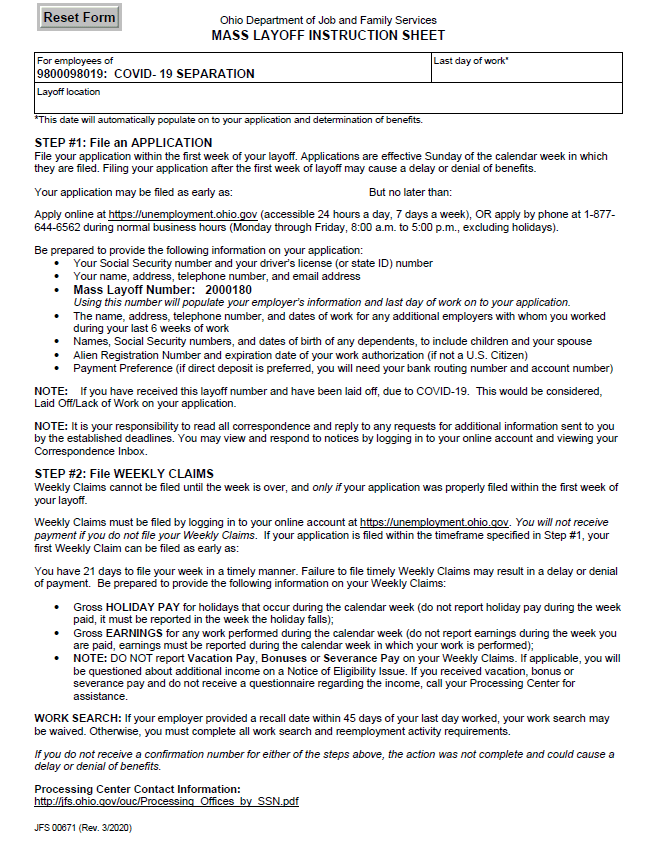

To see if you are eligible apply at unemploymentohiogov or call 877 644-6562.

How does unemployment work in ohio for employers. COLUMBUS Ohio AP Ohio unemployment claimants would receive 300 in federal weekly unemployment assistance under an option provided by the White House that doesnt require. 1 online using the Ohio Job Insurance OJI benefits system or 2 by paper. Under a SharedWork Ohio plan the participating employer reduces affected employees hours in a uniform manner.

Unlike Ohios traditional unemployment program there is no minimum work requirement for PUA. If you or your third party administrator elected to receive your correspondence via e-mail you will be expected to log into OJI via httpsunemploymentohiogovEmployerChoicehtml and open the Request to Employer for Separation Information item in your Correspondence Inbox. The participating employee works the reduced hours each week and the Ohio Department of Job and Family Services ODJFS provides eligible individuals an unemployment insurance benefit proportionate to their reduced hours.

Yes unemployment benefits will be available for eligible Ohioans who lose their job due to their employer shutting down operations or laying off workers as a result of loss of production caused by COVID-19. You can apply for PUA here. Employees that do not qualify for regular unemployment benefits due to insufficient hours or wages may be eligible for the Pandemic Unemployment.

A valid email address and telephone number your SSA DOB and Drivers License or State ID number and your 2019 tax return if filed. Your responsibility for unemployment benefits begins when you hire an employee not when you terminate employment. Under a SharedWork Ohio plan the participating employer reduces affected employees hours in a uniform manner.

Federal Unemployment Tax Act FUTA This is an employer-only tax that is 6 on the first 7000 each employee earns per calendar year which means the maximum amount youll have to pay per employee is 420 per year. For eligibility details please visit unemploymenthelpohiogovemployee. If your small business has employees working in Ohio youll need to pay Ohio unemployment insurance UI tax.

Here are the things you will need. How long you can receive unemployment benefits will depend on your work history. The two most traditional methods are.

These reports and payments are used to pay benefits to unemployed workers. In Ohio state UI tax is just one of several taxes that employers must pay. This program is available through Dec.

Extra money for unemployment ohio december 2020. You must pay federal and state unemployment taxes for each employee you have. Click on the Login button.

In February the pace of job. Highlighted below are two important pieces of information to help you register your business and begin reporting. Typically youll receive a up to a 54 credit for paying state unemployment taxes.

If you live in Ohio and have lost your job you may be able to get cash assistance through Ohios unemployment program. After your first successful login the system will prompt you to change your password 3. Unemployment benefits provide short-term income to unemployed workers who lose their jobs through no fault of their own and who are actively seeking work.

How to Obtain an Employer Account Number. Ive never filed for unemployment before but it says I already have an account. To receive your Unemployment tax account number and contribution rate immediately.

The UI tax funds unemployment compensation programs for eligible employees. Section 2103 of the federal Coronavirus Aid Relief and Economic Security CARES Act provides a 50 federal reimbursement for regular unemployment benefits paid by reimbursing employers through December 31 2020. You must have worked full-time or part-time at least 20 weeks during the base period see the first chart below for any number of employers who pay unemployment contributions.

Thank you to all employers who are able to file and pay their quarterly reports and taxes on time. A Second Stimulus Check Might Bring Some People More Money Does That Mean You Cnet. Employer Login To login to Employer Self Service.

Enter the User Name that the system automatically generated during registration. Other important employer taxes not covered here include federal UI tax and state and federal withholding taxes. Money to fund unemployment benefits comes from employer taxes which means employees dont pay any part of the costs to fund unemployment benefits.

Due to COVID-19 please email ALL WARNs to rapdrespjfsohiogov until further notice. These taxes fund your states unemployment insurance program. A week may be established with any.

The Ohio Department of Job and Family Services administers unemployment insurance benefits for workers in the state who have become unemployed through no fault of their own. When you hire new employees report them to your state. Enter the Password that the system automatically generated during registration.

Under the Ohio Unemployment Law most employers are liable to pay Unemployment taxes and report wages paid to their employees on a quarterly basis. How Ohios Unemployment Insurance Benefit Amounts Are Calculated Minimum number of weeks worked. See the Ohio Department of Job and Family Services ODJFS unemployment tool to estimate the amount of money you could get based on your old wages.

Https Unemployment Ohio Gov Pdf New Workers Self Service User Guide Pdf

Https Unemployment Ohio Gov Pdf New Workers Self Service User Guide Pdf

Who In Ohio Is Qualified For Coronavirus Related Jobless Benefit Wfmj Com

Who In Ohio Is Qualified For Coronavirus Related Jobless Benefit Wfmj Com

Respond To Employer Request For Separation Information Office Of Unemployment Insurance Operations Ohio Department Of Job And Family Services

Respond To Employer Request For Separation Information Office Of Unemployment Insurance Operations Ohio Department Of Job And Family Services

Https Unemployment Ohio Gov Pdf New Workers Self Service User Guide Pdf

Several Of Cincinnati S Top Employers Are In Health Services Grocery And Merchandise And Financial Services Industries Cincinnati Federal Agencies Employment

Several Of Cincinnati S Top Employers Are In Health Services Grocery And Merchandise And Financial Services Industries Cincinnati Federal Agencies Employment

Https Jfs Ohio Gov Ocomm Pdf 120220 New Unemployment Claimants Required To Conduct Work Search Activities Stm

Https Unemployment Ohio Gov Pdf New Workers Self Service User Guide Pdf

Covid 19 Unemployment Benefits Hamilton Ryker

Covid 19 Unemployment Benefits Hamilton Ryker

Covid 19 Unemployment Benefits Hamilton Ryker

Covid 19 Unemployment Benefits Hamilton Ryker

Ohio Department Of Job And Family Services Filing For Your Weekly Unemployment Benefits Youtube

Ohio Department Of Job And Family Services Filing For Your Weekly Unemployment Benefits Youtube

Odjfs Wants Businesses To Report Employees Who Refuse To Return To Work

Odjfs Wants Businesses To Report Employees Who Refuse To Return To Work

Ohio Unemployment Help Wkyc Com

Ohio Unemployment Help Wkyc Com

Covid 19 Pandemic Information For Employers Ohiomeansjobs Summit County

Covid 19 Pandemic Information For Employers Ohiomeansjobs Summit County

How To Apply For Unemployment Benefits Online In Ohio Youtube

How To Apply For Unemployment Benefits Online In Ohio Youtube

The Biden Plan To Scale Up Employment Insurance By Reforming Short Time Compensation Programs Joe Biden For President Official Campaign Website In 2020 Work Relationships Awareness Campaign Employment

The Biden Plan To Scale Up Employment Insurance By Reforming Short Time Compensation Programs Joe Biden For President Official Campaign Website In 2020 Work Relationships Awareness Campaign Employment

Previous Employment Verification Form Lovely Employment Verification Letter What Information To Include Letter Template Word Letter Templates Lettering

Previous Employment Verification Form Lovely Employment Verification Letter What Information To Include Letter Template Word Letter Templates Lettering

Respond To Employer Request For Separation Information Office Of Unemployment Insurance Operations Ohio Department Of Job And Family Services

Respond To Employer Request For Separation Information Office Of Unemployment Insurance Operations Ohio Department Of Job And Family Services

Post a Comment for "How Does Unemployment Work In Ohio For Employers"