Will The 600 Unemployment Affect My Tax Return

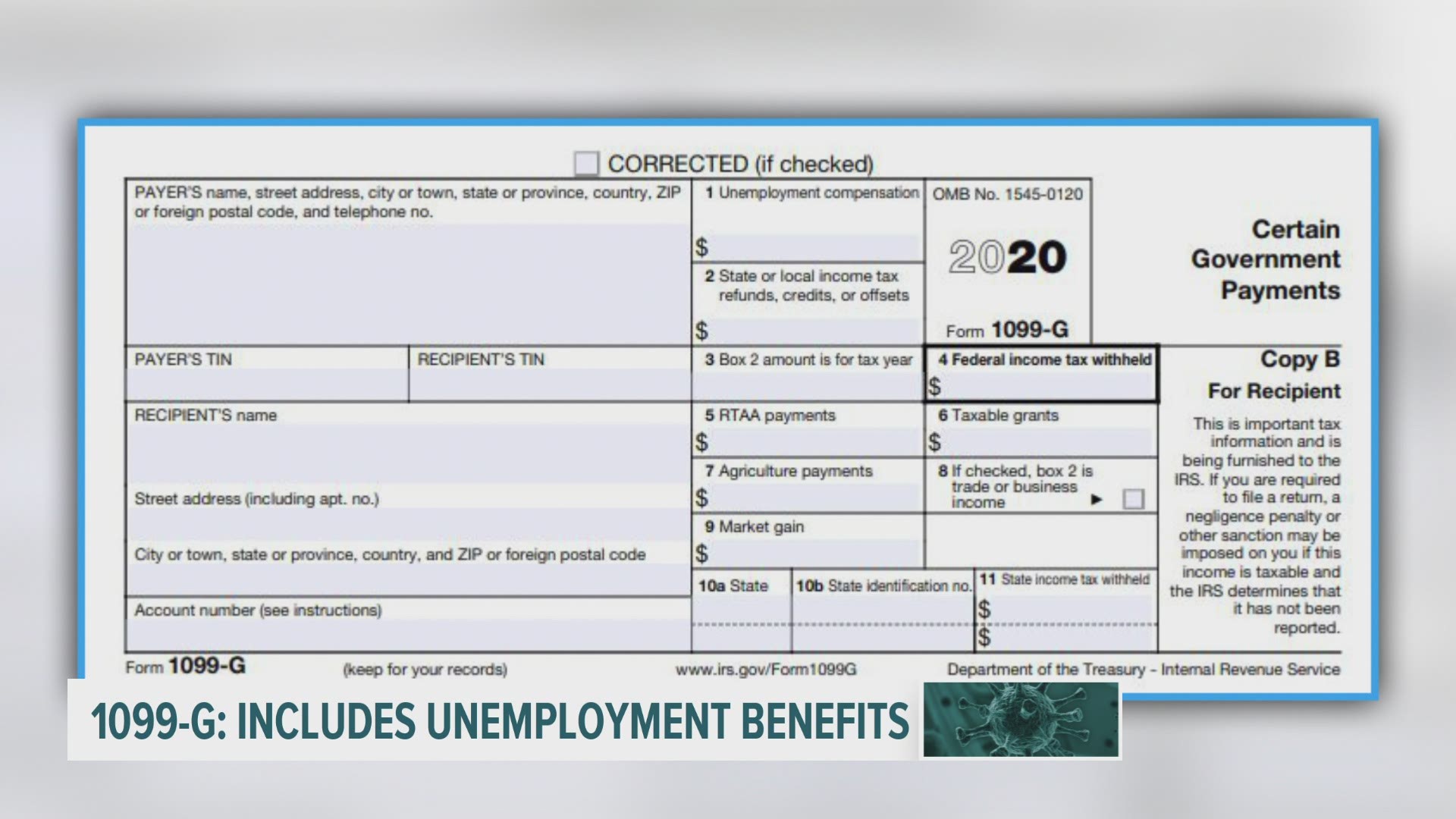

You must still report your unemployment compensation on your tax return even if you dont receive a Form 1099-G for some reason. Thats important because unemployment benefits are considered taxable income including the 600 and 300 enhanced benefit payments that lawmakers approved last year.

Unemployment Benefits And Taxes Here S What To Do About Incorrect Tax Forms And Other Issues The Denver Post

Unemployment Benefits And Taxes Here S What To Do About Incorrect Tax Forms And Other Issues The Denver Post

Always file your tax return.

Will the 600 unemployment affect my tax return. Some taxpayers may be in for. How does unemployment affect my taxes. If your total income for the year including wages unemployment benefits interest retirement distributions and all other income you made is less than the standard deduction for your filing status you normally arent required to file a tax return says Christina Taylor senior manager of tax operations for Credit Karma Tax.

For example if you are single with an adjusted gross income AGI of 70000 and you received 15000 of unemployment benefits during the 2020 tax. Will the timing of my 2020 tax return affect the size of my. How will my 2020 tax return affect my payment.

If you received unemployment benefits in 2020 and youve already filed your tax returns the Internal Revenue Service is saying you dont have to file an amended return to claim the new tax. In January those who had unemployment income should have received a. In addition many states have additional weekly unemployment funds available for qualified unemployed individuals.

If you have been made unemployed you should still file your tax return. This is classified as a tax credit and is not taxable. Tax season is here and there are many things you need to be aware of when it comes to your money and taxes especially if you got stimulus money and unemployment funds.

Will calculate payments based on your most recent tax return. You have to report that income on your 2020 federal tax return and state return if applicable. State Taxes on Unemployment Benefits.

If you dont get yours you can claim the money when you file your tax return. Unemployment benefits are generally taxable. Those benefits including the additional weekly 600 of Federal Pandemic Unemployment Compensation and the extra 300 weekly through the Lost Wages Assistance program are considered taxable.

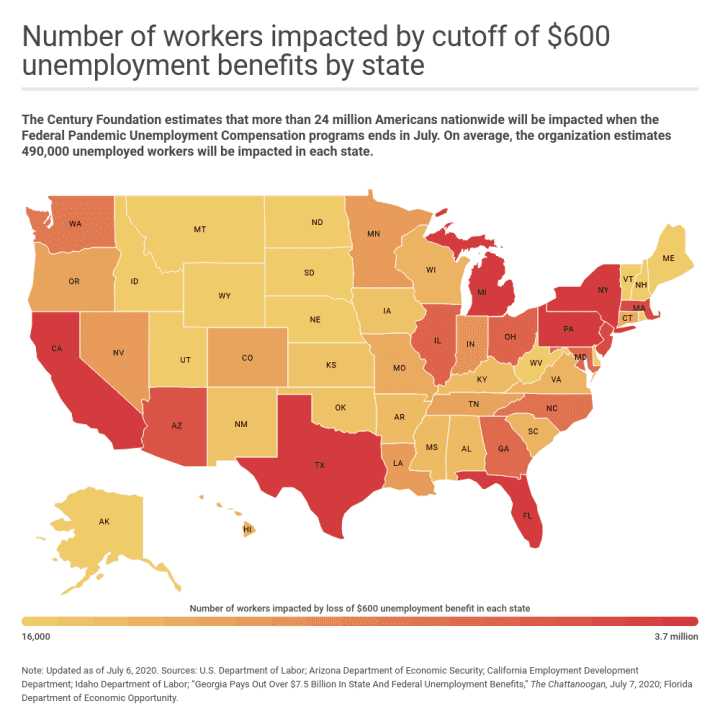

If youve received unemployment benefits they are generally taxable. If you applied for unemployment benefits the CARES Act allows for 13 additional weeks of benefits until December 26 plus an extra 600 a week through July 31 along with the standard amount you will receive. Some states like Missouri have exempted the stimulus payments from having any impact on 2020 taxes Mr.

How Unemployment Can Affect Your Tax Return. Effect on Other Tax Benefits Taxable unemployment benefits include the extra 600 per week that was provided by the federal government in response to the coronavirus pandemic accountant Chip Capelli of Provincetown Massachusetts told The Balance. How does unemployment affect my taxes.

Plus an extra 600 a week through July 31 along with the standard amount you will receive. IR-2020-185 August 18 2020 WASHINGTON With millions of Americans now receiving taxable unemployment compensation many of them for the first time the Internal Revenue Service today reminded people receiving unemployment compensation that they can have tax withheld from their benefits now to help avoid owing taxes on this income when they file their federal income tax return. It occurred to me that now that my unemployment claim has been approved I will begin collecting approximately 1000 per week 389 in regular unemployment plus the 600.

Generally unemployment income is taxable at the federal level so you have to report it on your tax return. The latest relief package includes another stimulus payment of up to 1400. If you had any unemployment income last year it is subject to taxes and needs to be reported on your 2020 income tax return.

The IRS will in most cases pay it directly into your bank account for your 2019 tax year. However there is a temporary 10200 exclusion for many Americans. To date 147 million second stimulus checks have been scheduled by the federal government.

Arizona taxes unemployment compensation to the same extent as it is taxed under federal law. For the 2020 tax year however the American Rescue Plan Act allows single taxpayers with modified adjusted gross income of less than 150000 to exclude up to 10200 in unemployment insurance from income.

If You Receive Unemployment Benefits Expect To Receive Form 1099 G Don T Mess With Taxes

You Could Have More Than 1 Stimulus Check Here S How You May Get 3 Payments Cnet

You Could Have More Than 1 Stimulus Check Here S How You May Get 3 Payments Cnet

Receiving Unemployment Payments Tax Season Might Cost You Next Year

Receiving Unemployment Payments Tax Season Might Cost You Next Year

That Extra 600 A Week In Unemployment Benefits Is Taxable Weareiowa Com

That Extra 600 A Week In Unemployment Benefits Is Taxable Weareiowa Com

Many Of Us Who Are Employees For A Company Look Forward To Tax Time We Hurriedly Get Our Annual Tax Returns Together And Anxiously Irs Tax Debt Tax Exemption

Many Of Us Who Are Employees For A Company Look Forward To Tax Time We Hurriedly Get Our Annual Tax Returns Together And Anxiously Irs Tax Debt Tax Exemption

Second Stimulus Check Problems Payment Status Not Available Error On Irs Website Means Some Need To Claim 600 On 2020 Tax Returns Abc7 Los Angeles

Second Stimulus Check Problems Payment Status Not Available Error On Irs Website Means Some Need To Claim 600 On 2020 Tax Returns Abc7 Los Angeles

Where S My Refund When The Irs Could Send Your Money And 2 Ways To Track It Cnet

Where S My Refund When The Irs Could Send Your Money And 2 Ways To Track It Cnet

Here S Who Qualifies For A 600 Stimulus Check With The New Covid 19 Relief Package

Here S Who Qualifies For A 600 Stimulus Check With The New Covid 19 Relief Package

How To Apply For Unemployment In La During Covid 19 Pandemic

How To Apply For Unemployment In La During Covid 19 Pandemic

Will Ordering An Irs Tax Transcript Help Me Find Out When I Ll Get My Refund Or Stimulus Check Aving To Invest

Will Ordering An Irs Tax Transcript Help Me Find Out When I Ll Get My Refund Or Stimulus Check Aving To Invest

Yes Your Extra 600 In Unemployment Is Taxable Income

Yes Your Extra 600 In Unemployment Is Taxable Income

Biden 2021 American Rescue Plan Passed In Congress 1400 Stimulus Checks Payment Updates And Extra Weeks Of Unemployment Benefits Extensions Aving To Invest

Biden 2021 American Rescue Plan Passed In Congress 1400 Stimulus Checks Payment Updates And Extra Weeks Of Unemployment Benefits Extensions Aving To Invest

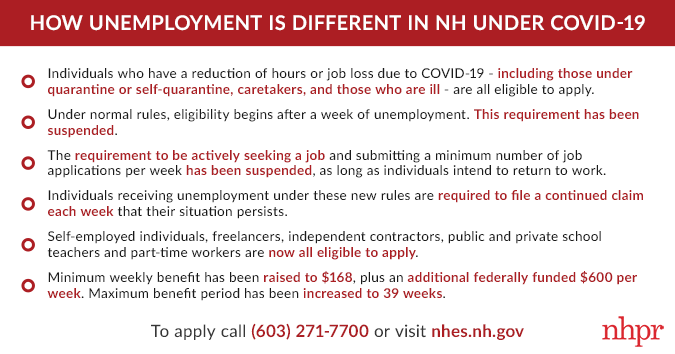

As Unemployment Surges In N H An Update On Changes To Benefits New Hampshire Public Radio

As Unemployment Surges In N H An Update On Changes To Benefits New Hampshire Public Radio

Why Stimulus Checks May Appear To Impact Your 2021 Tax Refund Abc11 Raleigh Durham

Why Stimulus Checks May Appear To Impact Your 2021 Tax Refund Abc11 Raleigh Durham

600 Stimulus Check For Californians Qualifications And When Your Payment Could Arrive Cnet

600 Stimulus Check For Californians Qualifications And When Your Payment Could Arrive Cnet

Did You Collect Unemployment Benefits In 2020 Act Now To Avoid A Tax Day Surprise Dollars And Sense Abc10 Com

Did You Collect Unemployment Benefits In 2020 Act Now To Avoid A Tax Day Surprise Dollars And Sense Abc10 Com

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

Receiving Unemployment Payments Tax Season Might Cost You Next Year

Receiving Unemployment Payments Tax Season Might Cost You Next Year

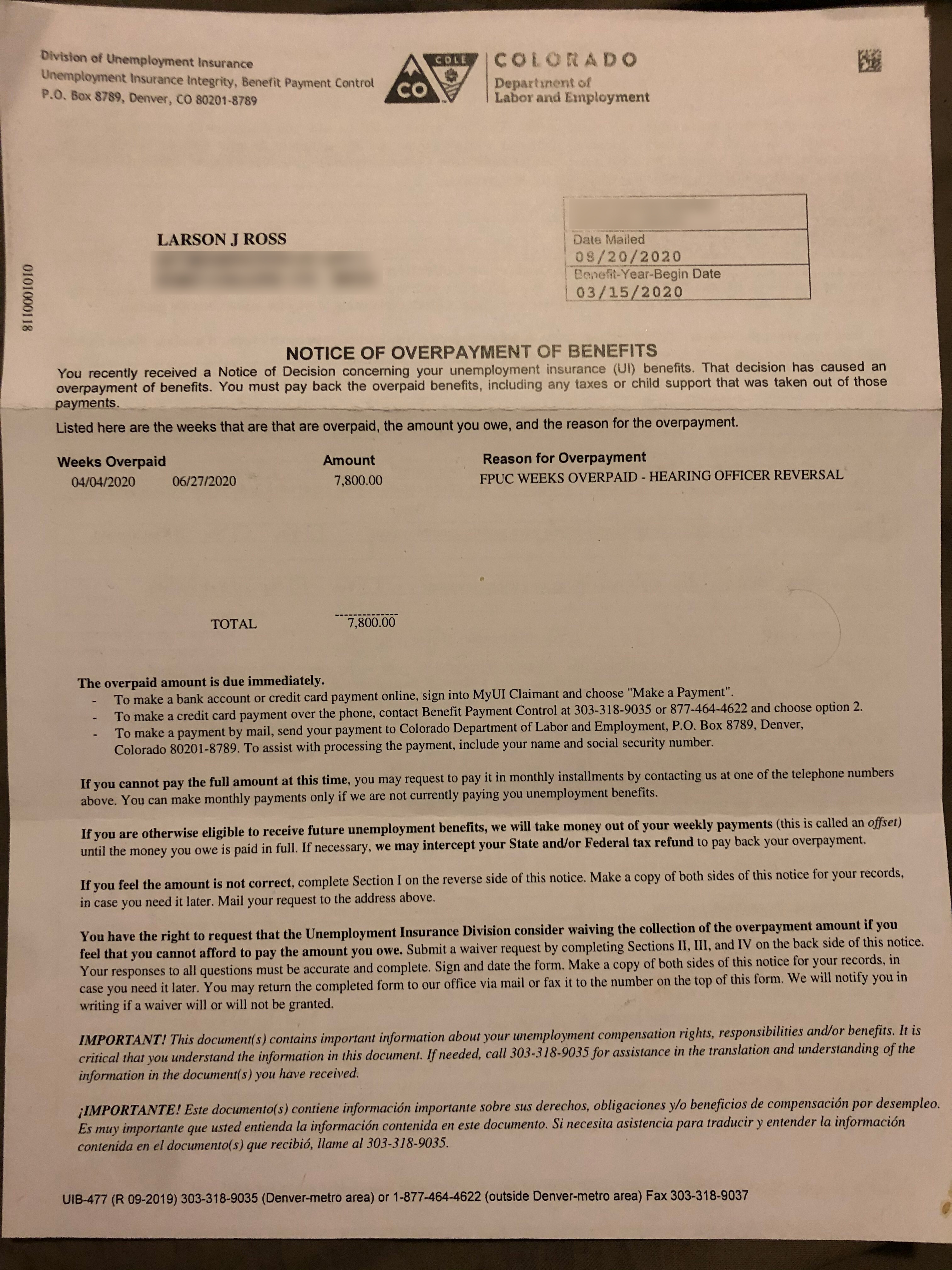

States Are Telling Some People To Pay Back Unemployment Benefits Marketplace

States Are Telling Some People To Pay Back Unemployment Benefits Marketplace

Post a Comment for "Will The 600 Unemployment Affect My Tax Return"