When Will Unemployment 1099 Be Ready

The 1099-G tax form is commonly used to report unemployment compensation. While on your states website copy the contact information so you can contact the office directly if necessary.

Floridians Report Tax Documents With Inaccurate Information Wfmynews2 Com

Floridians Report Tax Documents With Inaccurate Information Wfmynews2 Com

RTAA benefits are also reported on a separate form.

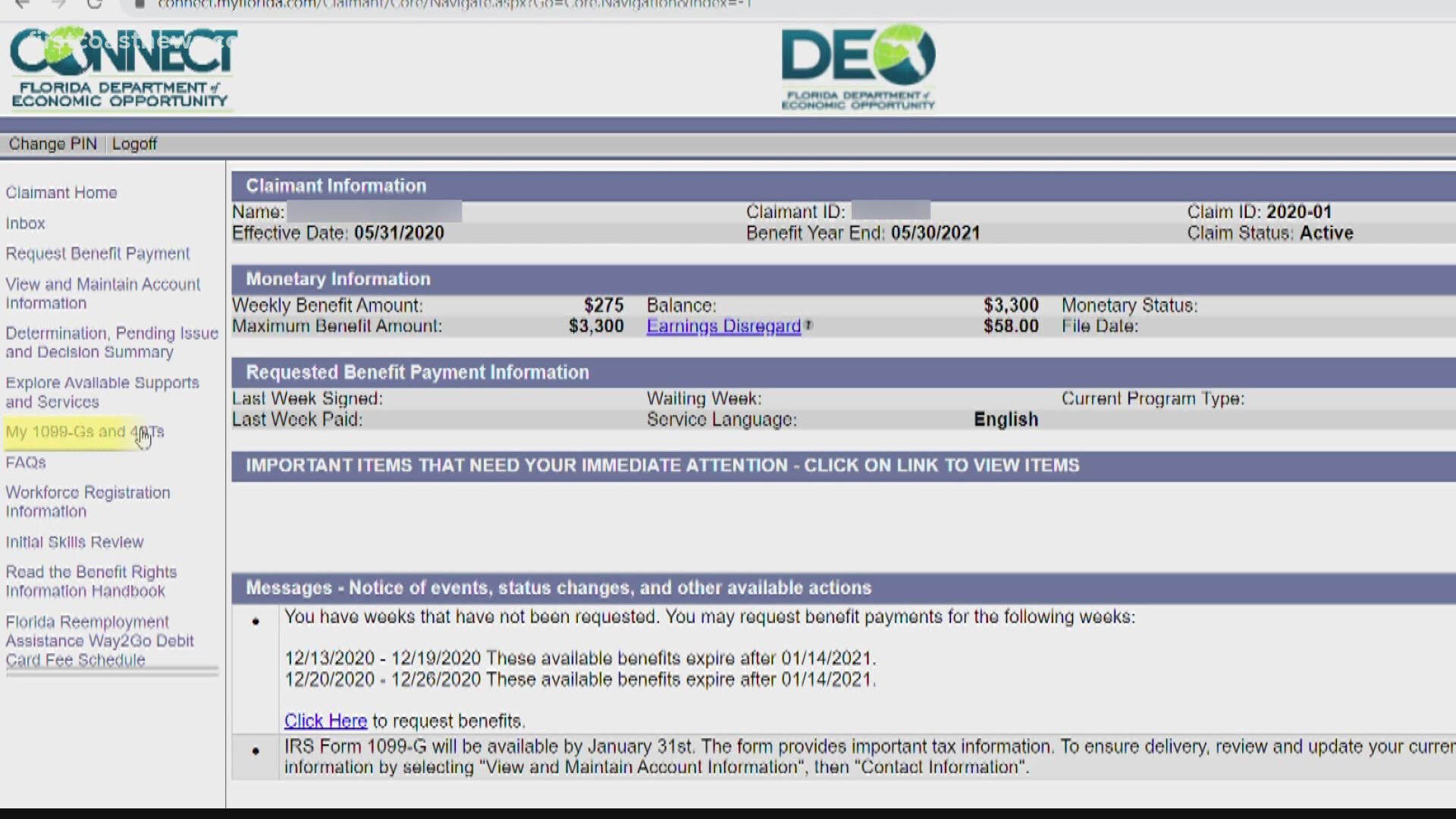

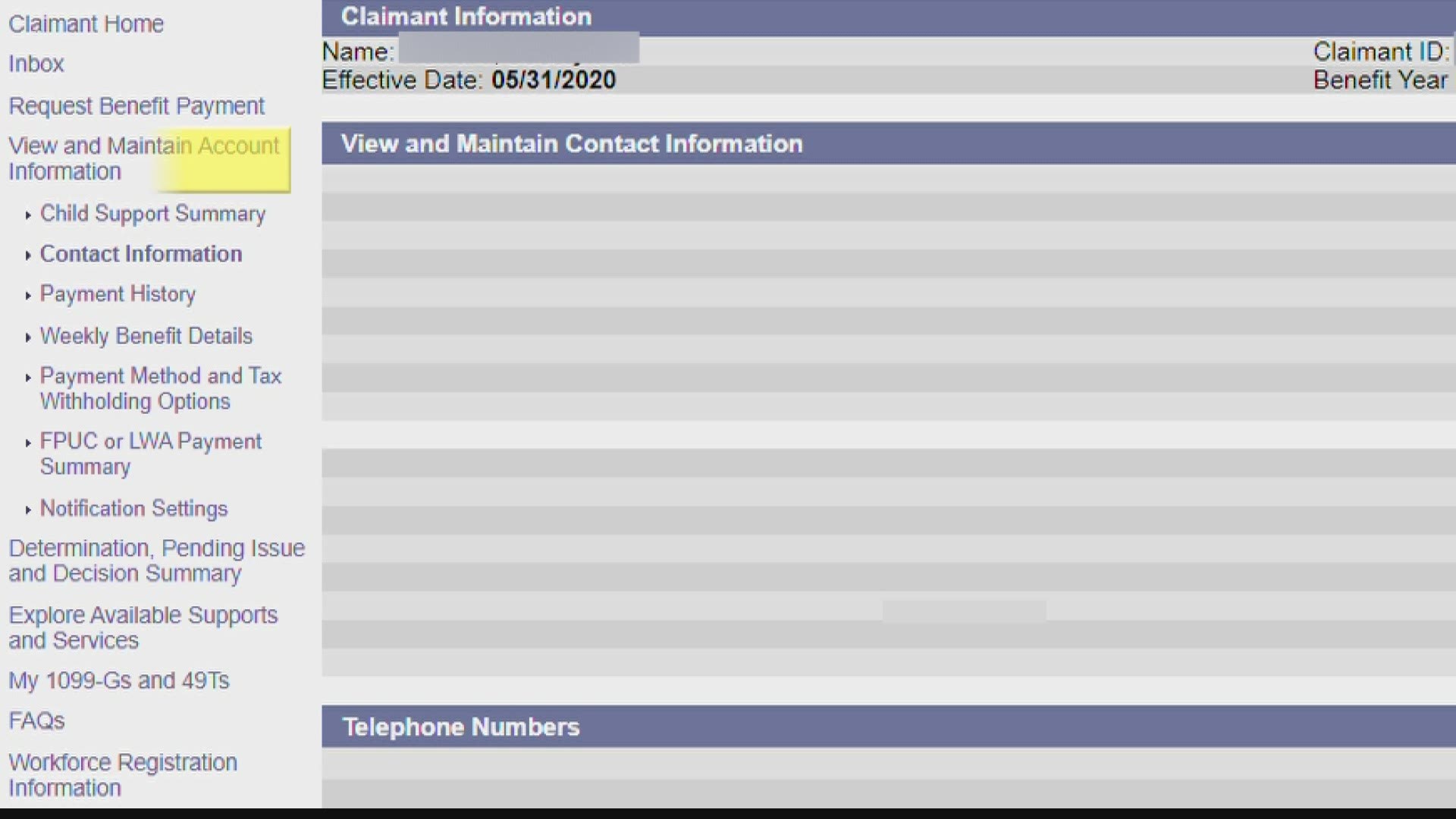

When will unemployment 1099 be ready. Digital and print 1099-G documentation will be available by January 31 2020. If you received unemployment your tax statement is called form 1099-G not form W-2. If you have received Unemployment Insurance benefits and would like to download and print a 1099 G form for income tax filing purposes enter the information requested below to view your form.

We also send this information to the IRS. If we have your email address on file we have sent you via email the information for your 1099-G for 2020. Similarly if you were paid for 2020 weeks in 2021 those will not be on your 1099-G for 2020 they will appear on your 1099-G for 2021.

The 1099-G form is used to report taxable benefits when filing with the IRS for anyone who was paid unemployment benefits or Alternative Trade Adjustment Assistance payments during the calendar year January 1 to December 31. Benefits are reported based on the issue date of the payment not the week ending date s that was paid. 1099-G information will also be available from the Check Claim Status tool no later than January 30.

In most cases 1099-Gs for the previous year are mailed on or before January 31. By January 31 2021 the Division will deliver the 1099-G for Calendar Year 2020. We will post an update on this page when the forms are mailed out and when UI Benefit payment information for 2020 can be viewed online.

Available in TurboTax Self-Employed and TurboTax Live Self-Employed starting 1252021. Feature available within Schedule C tax form for TurboTax filers with 1099-NEC income. President Joe Biden signed a 19 trillion Covid relief bill Thursday that waives federal tax on up to 10200 of unemployment benefits an individual received in 2020.

By January 31 2021 the Division will send the 1099-G for Calendar Year 2020. This form will soon be viewable on. Every January we send a 1099-G form to people who received unemployment benefits during the prior calendar year.

Box 1 will show the benefits received and. Email alerts will be sent to the claimants that elected to receive electronic notifications advising that they can view and print their 1099G online. All individuals who received unemployment insurance UI benefits in 2020 will receive the 1099-G tax form.

If you received unemployment compensation during the year you should receive Form 1099-G from your states unemployment office. How Do I Get My Unemployment Tax Form. If you received unemployment benefits during 2020 youll need this form to file your taxes.

1099-G income tax statements for 2020 are available online. For detailed instructions on how to use this page please click the Instructions button. It will not be available in your unemployment dashboard.

For example if you collected unemployment in 2018 the 1099-G should have been mailed by January 31 2019. PUA will be reported on a separate form from any UC including PEUC EB TRA that you may have received. 1099-Gs are only issued to the individual to whom benefits were paid.

The 1099s reflecting unemployment benefits paid in 2020 will be mailed to the last address on file no later than January 29 2021. 1099-NEC Snap and Autofill. The break applies this.

1099-Gs are not available until mid-January 2021. If you collected unemployment insurance last year you will need the 1099-G form from IDES to complete your federal and state tax returns. Instructions for the form can be found on the IRS website.

Unemployment Insurance Benefits Tax Form 1099-G. If your state does not mail out Form 1099-G see our state page and find how to contact the state or visit the states website. The Department will begin mailing IRS Forms 1099-G for the calendar year 2020 no later than January 31 2021.

Available in mobile app only. It is possible you may receive more than one 1099-G form. Claimants of all unemployment programs offered during 2020 receive a 1099 tax form detailing their benefit payments.

Your benefits are taxable and reportable on your federal return but you do not need to attach a copy of the Form 1099-G to your federal income tax return. Every year we send a 1099-G to people who received unemployment benefits. Your States Unemployment office should sent you a 1099-G by January 31 2021.

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements

Unemployment Insurance Tax Information Rhode Island Department Of Labor And Training

Unemployment Insurance Tax Information Rhode Island Department Of Labor And Training

I Got Unemployment In Florida How Will My Taxes Be Affected Wfmynews2 Com

I Got Unemployment In Florida How Will My Taxes Be Affected Wfmynews2 Com

1099 G Tax Form Causing Confusion For Some In Kentucky Wbir Com

1099 G Tax Form Causing Confusion For Some In Kentucky Wbir Com

Labor And Economic Opportunity How To Request Your 1099 G

Labor And Economic Opportunity How To Request Your 1099 G

Azdes On Twitter At The End Of January Des Will Mail 1099 G Tax Forms To Claimants Who Received Unemployment Benefits In 2020 Learn More Https T Co Spwnb2ywul Https T Co Gt9ltvoj2v

Azdes On Twitter At The End Of January Des Will Mail 1099 G Tax Forms To Claimants Who Received Unemployment Benefits In 2020 Learn More Https T Co Spwnb2ywul Https T Co Gt9ltvoj2v

Detr Advises And Encourages Claimants Regarding 1099 G Forms

Detr Advises And Encourages Claimants Regarding 1099 G Forms

1099 Form Fileunemployment Org

1099 Form Fileunemployment Org

Faqs Benefits Kansas Department Of Labor

Faqs Benefits Kansas Department Of Labor

If You Receive Unemployment Benefits Expect To Receive Form 1099 G Don T Mess With Taxes

2020 Form Irs 1099 G Fill Online Printable Fillable Blank Pdffiller

2020 Form Irs 1099 G Fill Online Printable Fillable Blank Pdffiller

Detr Advises And Encourages Claimants Regarding 1099 G Forms

Detr Advises And Encourages Claimants Regarding 1099 G Forms

Unemployment Benefits Fraud Victims Are Getting Tax Bills And Major Headaches

Unemployment Benefits Fraud Victims Are Getting Tax Bills And Major Headaches

Tax Refund Tax Preparer Near Me Fenixmar Solutions Llc 1099 G Unemployment Forms Are Ready In New York

Tax Refund Tax Preparer Near Me Fenixmar Solutions Llc 1099 G Unemployment Forms Are Ready In New York

Florida Deo On Twitter From Now Until January 31 2020 1099 G Forms Are Being Issued To Claimants Who Received Reemployment Assistance Benefits During 2020 These Forms Will Be Issued Through Connect Or

Florida Deo On Twitter From Now Until January 31 2020 1099 G Forms Are Being Issued To Claimants Who Received Reemployment Assistance Benefits During 2020 These Forms Will Be Issued Through Connect Or

Unemployment Tax Troubles Wrong 1099 G Amounts Benefits Id Theft Don T Mess With Taxes

Will I Get Taxed On My Unemployment Benefits Wfmynews2 Com

Will I Get Taxed On My Unemployment Benefits Wfmynews2 Com

Post a Comment for "When Will Unemployment 1099 Be Ready"