What Is The Taxable Wage Base For Federal Unemployment

FUTA requires that each states taxable wage base must at least equal the FUTA taxable wage base of 7000 per employee and most states have wage bases that exceed the required amount. This 7000 is known as the taxable wage base.

What Is Social Security Tax Calculations Reporting More

What Is Social Security Tax Calculations Reporting More

The tax applies to the first 7000 you paid to each employee as wages during the year.

What is the taxable wage base for federal unemployment. You will pay your FUTA tax rate on the first 7000 that you pay each employee per year. The FUTA tax is 6 0060 on the first 7000 of income for each employee. FUTA Tax Rates and Taxable Wage Base Limit for 2021.

Its also important to keep in mind that not everyone will get a federal tax break on 10200 in unemployment income. Check with your individual state for details about your SUTA rate and wage base. See the IRS FAQ for more information.

If you qualify for the maximum tax credit of 54 the most you will pay per employee is 42 7000 X 06. The BWC ratio is the percentage of the amount of benefit wages charges are to the total. The taxable wage base may change from year to year.

2021 Wage Bracket Method Tables - Federal Withholding Tables 2021 is the procedure required by the United States federal government in which employers deduct tax obligations from their employees pay-roll. Most employers receive a maximum credit of up to 54 0054 against this FUTA tax for allowable state unemployment tax. However the taxable wage base for 20172018 remained at 10200 because the UI trust fund balance exceeded 200 million as of the prior September 30.

The first 7000 for each employee will. The maximum FUTA tax amount you can contribute per employee is 420 7000 X 6. The taxable wage base for calendar years 2018 and 2019 is 9500.

That provision only applies to tax. You must pay federal unemployment tax based on employee wages or salaries. Unemployment Insurance Agency What is the current taxable wage base.

The taxable wage base was expected to continue to increase by 300 each calendar year until it reaches 12000 in 2022. Please see Payroll Tax Compliance for wage bases and limits. The taxable wage base for calendar year 2020 and subsequent years is 9000.

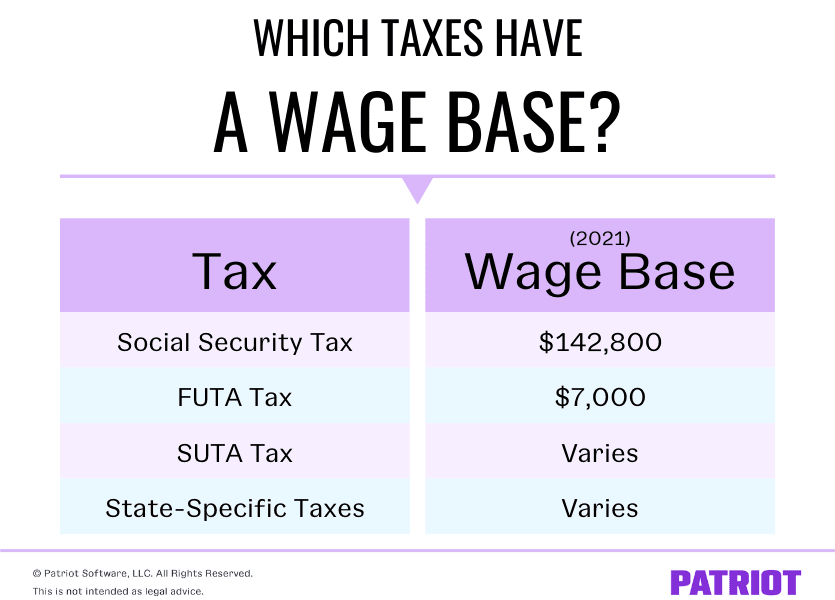

However FUTA and SUTA tax rates and wage base amounts may not be the same. Employees are subject to additional medicare withholding of 09 for a total rate of 235 if they reach the wage base limit for their filing status. The taxable wage base is the maximum amount of earned income that employees must pay Social Security taxes on.

The taxable wage base is 9500. The taxable wage base for the Federal Unemployment Tax Act FUTA you pay UI tax on each employees wages up to the taxable wage base you do not pay tax on wages exceeding the taxable wage base the taxable wage base in 2020 is 3160000 the taxable wage base in 2021 is 3240000. Consequently the effective rate works out to 06 0006.

State wage bases and limits vary for State Income Tax and State Unemployment Insurance. The FUTA tax rate is 60. In 2020 the Trust Fund balance fell below 25B therefore the 2021 taxable wage base is 9500.

2020 Federal Wage Base Limits Additional 9 assessed on employee wages exceeding 200000. The Taxable Wage Base is the amount of an employees wages upon which the employer is required to pay unemployment taxes each year. Form W-2 is filed by employers to report wages tips and other compensation paid to employees as well as FICA and withheld income taxes.

How much is the taxable wage base. The FUTA tax wage base is 7000. Employer FICA Wage Limits and Tax Rates 2020 2019 Social Security OASDI wage base 13770000 13290000 Medicare HI wage base No Limit No Limit.

The Federal Unemployment Tax Act FUTA requires that each states taxable wage base must at least equal the FUTA wage base of 7000 per employee although most. The 7000 is often referred to as the federal or FUTA wage base. FUTA tax rate.

By the quantity of cash being withheld the workers have the ability to assert tax returns credit scores. Information about Form W-2 Wage and Tax Statement including recent updates related forms and instructions on how to file. 2020 Retirement Plan Contribution Limits The following are the maximum annual elective deferrals.

The FUTA tax rate protection for 2021 is 6 as per the IRS standards. The taxable wage base is also known. The FUTA tax applies to the first 7000 of wages paid to each employee throughout the year.

Its worth noting that youll also need to pay SUTA taxes thanks to the State Unemployment Tax Act for your employees as well. Benefit wage charge amount of 10000 divided into an amount of timely taxable wages of 300000 ends up with a benefit wage charge ratio of 33. Review below to get more information concerning it in addition to to obtain 2021.

Your state wage base may be different based on the respective states rules. The taxable wage base is the amount of an employees wages that is taxed by the Unemployment Insurance Agency each calendar year and is payable by the employer.

Preparing For Tax Season Tax Season Staffing Agency Employment

Preparing For Tax Season Tax Season Staffing Agency Employment

Fix Quickbooks Generated Zero Amount Transaction Quickbooks Quickbooks Payroll Generation

Fix Quickbooks Generated Zero Amount Transaction Quickbooks Quickbooks Payroll Generation

Raymond J Busch Ltd Now Serving You From Two Locations 13011 S 104th Ave Suite 200 Small Business Accounting Services Business Accounting Information

Raymond J Busch Ltd Now Serving You From Two Locations 13011 S 104th Ave Suite 200 Small Business Accounting Services Business Accounting Information

1099 Forms Free Download 1099 Forms Free Driverlayer Search Engine Irs Forms 1099 Tax Form Tax Forms

1099 Forms Free Download 1099 Forms Free Driverlayer Search Engine Irs Forms 1099 Tax Form Tax Forms

Futa 2020 What Are Futa Taxes And How To Calculate Them Nav

Futa 2020 What Are Futa Taxes And How To Calculate Them Nav

Free Balance Sheet Form Printable Real Estate Forms Real Estate Forms Balance Sheet Template Balance Sheet

Free Balance Sheet Form Printable Real Estate Forms Real Estate Forms Balance Sheet Template Balance Sheet

Dreamweaver Cs6 The Missing Manual Missing Manuals Ebook Books Photoshop Elements

Dreamweaver Cs6 The Missing Manual Missing Manuals Ebook Books Photoshop Elements

What Is A Wage Base Definition Taxes With Wage Bases More

What Is A Wage Base Definition Taxes With Wage Bases More

Earned Income Tax Credit Eitc Qualification And Income Threshold Limits Tax Credits Income Tax Income

Earned Income Tax Credit Eitc Qualification And Income Threshold Limits Tax Credits Income Tax Income

101 Tax Write Offs For Business What To Claim On Taxes Business Tax Deductions Small Business Tax Business Tax

101 Tax Write Offs For Business What To Claim On Taxes Business Tax Deductions Small Business Tax Business Tax

Futa Tax Learn How To Calculate The Federal Futa Tax

Futa Tax Learn How To Calculate The Federal Futa Tax

401 K Plans Are Employer Sponsored Retirement Plans Where Employees Can Choose How Much They Contribute Compare The Type How To Plan Retirement Planning Type

401 K Plans Are Employer Sponsored Retirement Plans Where Employees Can Choose How Much They Contribute Compare The Type How To Plan Retirement Planning Type

Performance Incentive Compensation Plan Template Employee Incentive Plan Template Related Keywords Incentives For Employees How To Plan Keyword Suggestion

Performance Incentive Compensation Plan Template Employee Incentive Plan Template Related Keywords Incentives For Employees How To Plan Keyword Suggestion

Sui Sit Employment Taxes Explained Emptech Com

Sui Sit Employment Taxes Explained Emptech Com

All About Quickbooks Payroll Year End Center Quickbooks Quickbooks Payroll Payroll

All About Quickbooks Payroll Year End Center Quickbooks Quickbooks Payroll Payroll

Nj Department Of Labor Changes For 2020 What Are Your Rights Construction Work Workforce Development Supervisor

Nj Department Of Labor Changes For 2020 What Are Your Rights Construction Work Workforce Development Supervisor

The Price Of The Wage Gap In The United States It Is Completely Legal To Pay Disabled Workers Sub Minimum Wage Disability Quotes Wage Gap Fight The Good Fight

The Price Of The Wage Gap In The United States It Is Completely Legal To Pay Disabled Workers Sub Minimum Wage Disability Quotes Wage Gap Fight The Good Fight

Post a Comment for "What Is The Taxable Wage Base For Federal Unemployment"