Unemployment Vt Tax Form

All Vermont employers who have to pay Unemployment Insurance UI on their employees MUST file a quarterly wage and contribution report. Nonresidents with a filing requirement will file Form IN-111 Vermont Income Tax Return and Schedule IN-113 Income Adjustment Calculations.

State Vermonters Should Receive New 1099 G Forms By Friday

IN-111 Vermont Income Tax Return.

Unemployment vt tax form. MONTPELIER The Vermont Department of Labor VDOL is finalizing validation efforts this week and working with the Department of Buildings and General Services to print and mail new 1099-G tax forms by the beginning of next week to all 2020 unemployment insurance claimants. B-2 Notice of Change. Vermont School District Codes.

On March 17 the IRS extended the federal income tax filing due date for individuals for the 2020 tax year from April 15 2021 to May 17 2021. If you were paid unemployment insurance benefits in 2019 you will receive a 1099G form for your tax filing. Vermont personal income tax forms begin with federal adjusted gross income AGI line 11 of form 1040.

Additional details will be made available at laborvermontgov. State Taxes on Unemployment Benefits. Claimant tax information cannot be shared over the phone and claimants are not able to access this information by.

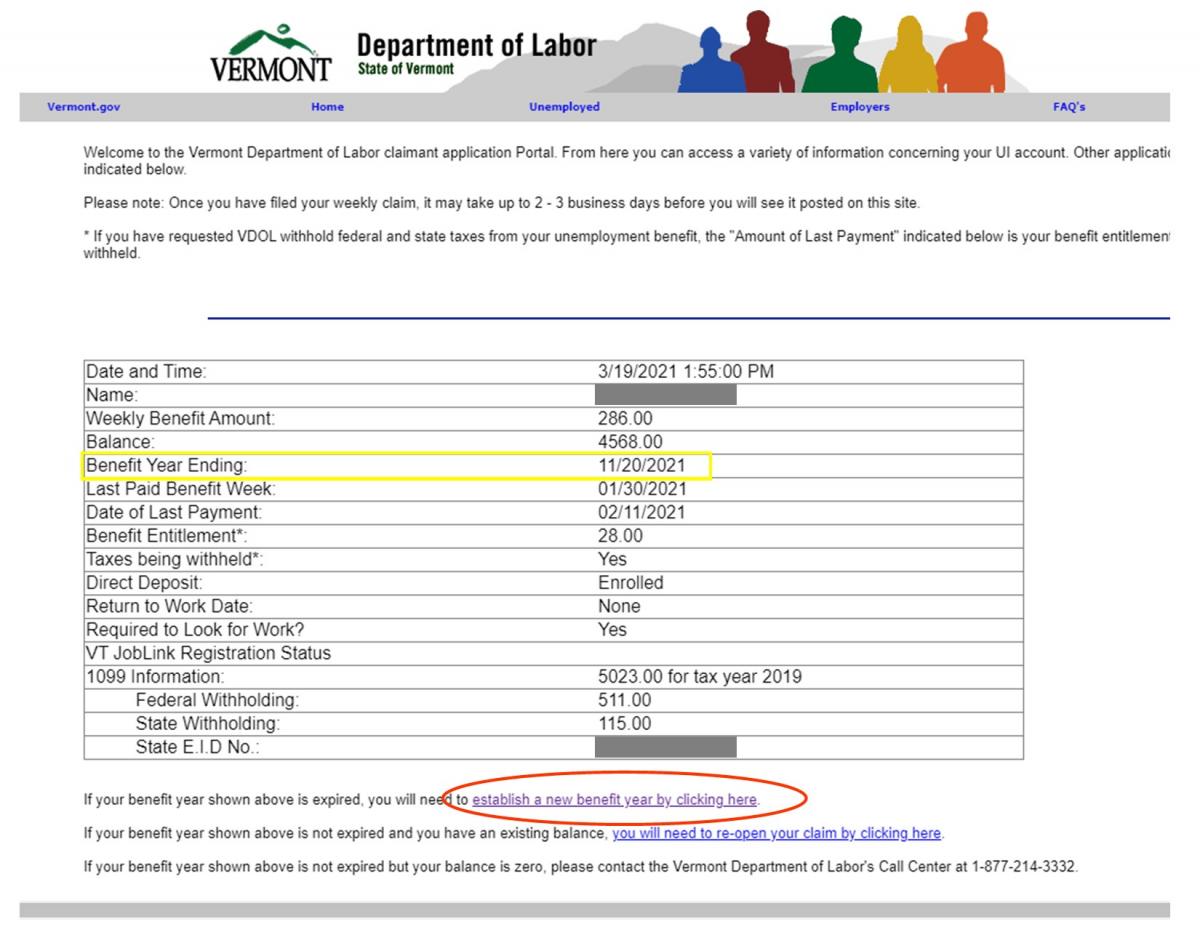

Reporting Unemployment Compensation You should receive a Form 1099-G Certain Government Payments showing the amount of unemployment compensation paid to you during the year in Box 1 and any federal income tax withheld in Box 4. Claimants will get a new 1099-G form from the Unemployment Insurance Division. You r 1099G information has been posted in Claimant Portal on your Welcome screen.

If this amount if greater than 10 you must report this income to the IRS. The information on the 1099-G tax form is provided as follows. The purpose of unemployment insurance benefits is to provide short term replacement of lost wages to individuals who lose their jobs through no fault of their own.

AP - The state of Vermont is offering identity theft protection to more than 100000 people who received unemployment benefits last year after tax forms. This is a result of the processing issue that occurred on January 29 2021 when a series of incorrect 1099-G tax forms were. All Forms and Instructions.

The current taxable wage base and. Vermont Labor Department officials remain on damage control a day after revealing a massive data breach involving tens of thousands of 1099-G unemployment tax forms. Adjustments - This box includes cash payments and income tax refunds used to pay back overpaid benefits.

The 1099-G is a tax form for Certain Government Payments. W-4VT Employees Withholding Allowance Certificate. The gross wages paid.

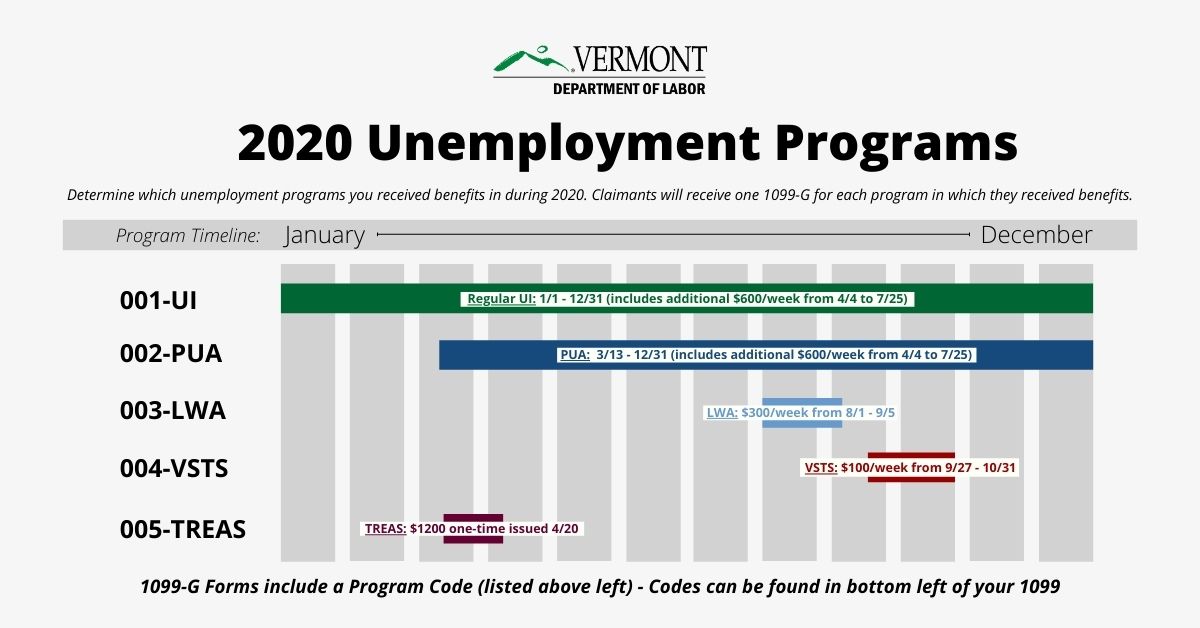

PA-1 Special Power of Attorney. This means many claimants should expect multiple 1099-G forms if they collected benefits for most of the year especially during the spring summer and fall and if their unemployment was a result of the COVID-19 pandemic. Learn More New Federal Exclusion of Unemployment.

Unemployment Compensation - This box includes the dollar amount paid in benefits to you during the calendar year. Arizona taxes unemployment compensation to the same extent as it is taxed under federal law. Vermont personal income tax forms begin with federal adjusted gross income AGI line 11 of form 1040.

Every January we send a 1099-G form to people who received unemployment benefits during the prior calendar year. Youll transfer the amount in Box 1 of Form 1099-G to Line 7 of Schedule 1 then the withholding amount in Box 4 of the 1099-G if any goes directly onto your 1040 tax return on Line 25b. Unemployment Insurance payments are taxable.

On your 1099-G form Box 1 Unemployment Compensation shows the amount you received in unemployment wages. Vermont has a mandatory electronic filing requirement for all employers. Unemployment compensation has its own line Line 7 on Schedule 1 which accompanies your 1040 tax return.

This means that for taxpayers who filed on or after March 15 2021 and who took the 10200 unemployment compensation exclusion above on their federal tax return their Vermont tax forms will automatically include this exclusion. The money for unemployment benefits is solely funded by employers by paying taxes into the unemployment insurance trust fund. Claimants will receive a 1099-G form for each program they collected unemployment insurance benefits from during the 2020 calendar year.

If you received unemployment benefits during 2020 youll need the information to file your taxes. The following types of income are not included as Vermont income for a nonresident. 2020 Income Tax Return Booklet.

This means that for taxpayers who filed on or after March 15 2021 and who took the UI exclusion on their federal tax return their Vermont tax forms will automatically include this exclusion. Unemployment Insurance has been in existence since 1939. The amount due is based on.

The Department mail ed your 1099G on Monday January 27 2020. The tax rate that has been assigned to the employer. Enter the amount from Box 1 on Line 19 Unemployment Compensation of your 1040 form.

Fact Sheets and Guides.

Vt Labor Dept Mails New Fixed 1099 G Tax Forms

Vt Labor Dept Mails New Fixed 1099 G Tax Forms

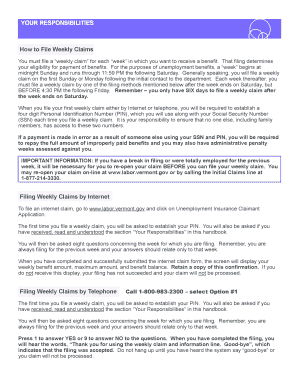

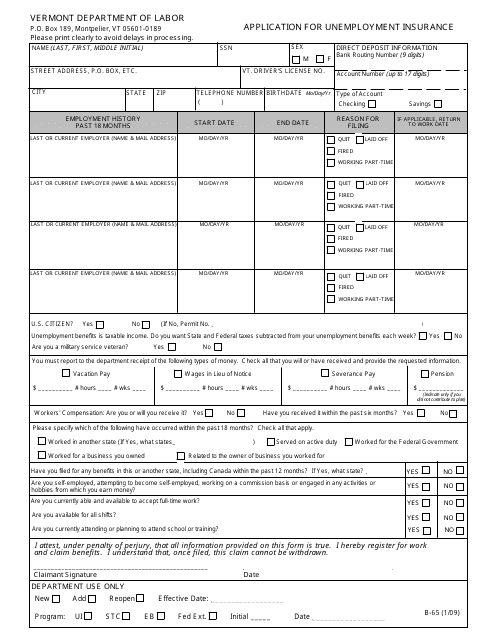

Dol Form B 65 Download Printable Pdf Or Fill Online Application For Unemployment Insurance Vermont Templateroller

Dol Form B 65 Download Printable Pdf Or Fill Online Application For Unemployment Insurance Vermont Templateroller

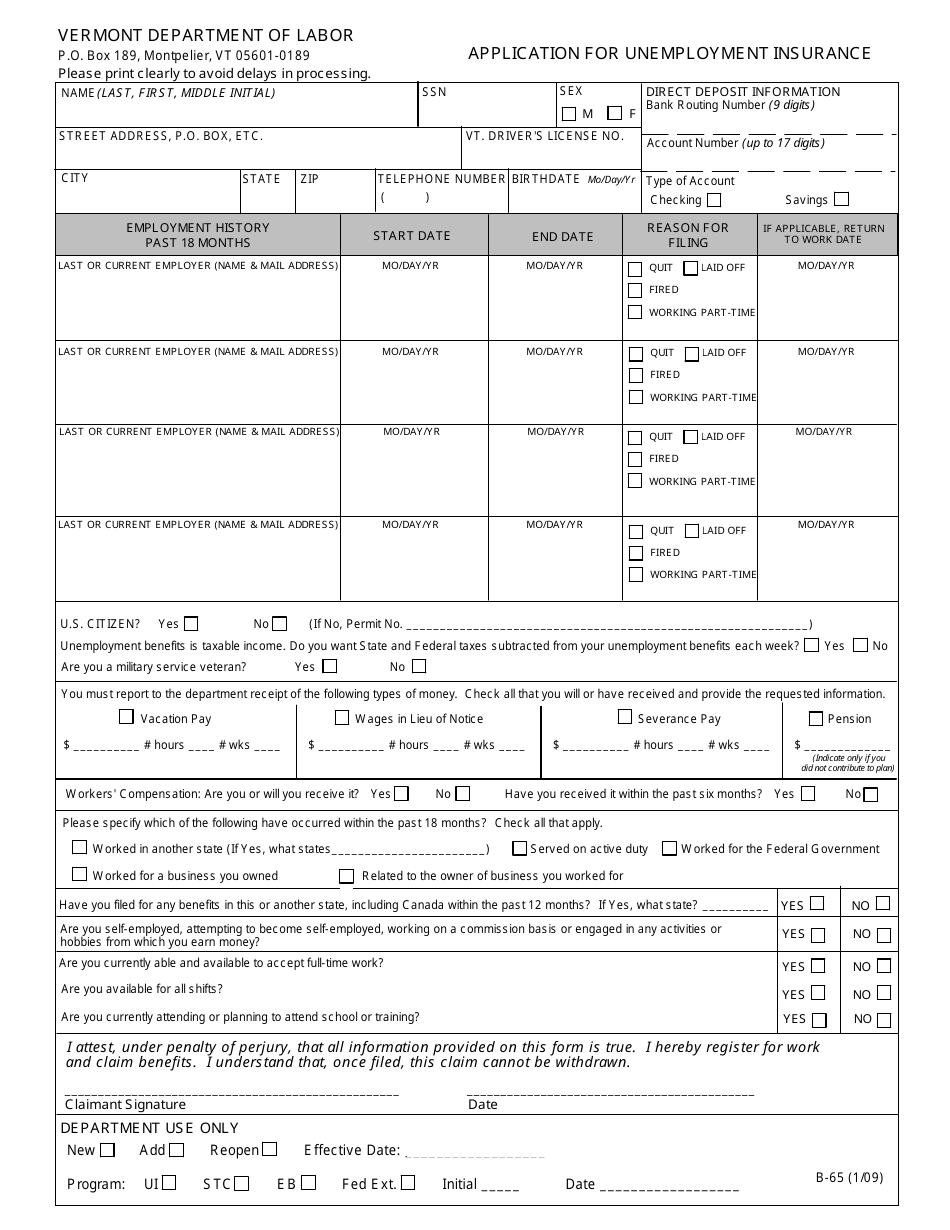

Form B 2 Download Printable Pdf Or Fill Online Claimant Change Of Address Form Vermont Templateroller

Form B 2 Download Printable Pdf Or Fill Online Claimant Change Of Address Form Vermont Templateroller

3 12 154 Unemployment Tax Returns Internal Revenue Service

3 12 154 Unemployment Tax Returns Internal Revenue Service

Vermont Department Of Taxes Issuing 1099 Gs For Economic Recovery Grants And Taxable Refunds Department Of Taxes

Vermont Department Of Taxes Issuing 1099 Gs For Economic Recovery Grants And Taxable Refunds Department Of Taxes

2016 2021 Form Vt Wht 434 Fill Online Printable Fillable Blank Pdffiller

2016 2021 Form Vt Wht 434 Fill Online Printable Fillable Blank Pdffiller

2020 Form Vt Schedule In 113 Fill Online Printable Fillable Blank Pdffiller

2020 Form Vt Schedule In 113 Fill Online Printable Fillable Blank Pdffiller

Vt Department Of Labor Begins Mailing Of New 1099 G Forms To 2020 Unemployment Insurance Claimants Department Of Labor

Vt Department Of Labor Begins Mailing Of New 1099 G Forms To 2020 Unemployment Insurance Claimants Department Of Labor

Department Of Labor Finishes Mailing Reissued 1099s To Unemployment Claimants Vtdigger

Department Of Labor Finishes Mailing Reissued 1099s To Unemployment Claimants Vtdigger

Vermont Labor Commissioner Apologizes For Tax Data Bungle

Vermont Labor Commissioner Apologizes For Tax Data Bungle

Https Tax Vermont Gov Sites Tax Files Documents Income Booklet 2020 Pdf

New Tax Forms Headed To Those Hit By 1099 G Breach

New Tax Forms Headed To Those Hit By 1099 G Breach

South Carolina Tax Forms 2020 Printable State Sc 1040 Form And Sc 1040 Instructions

South Carolina Tax Forms 2020 Printable State Sc 1040 Form And Sc 1040 Instructions

Vt Labor Dept Mails New Fixed 1099 G Tax Forms

Vt Labor Dept Mails New Fixed 1099 G Tax Forms

Dol Form B 65 Download Printable Pdf Or Fill Online Application For Unemployment Insurance Vermont Templateroller

Dol Form B 65 Download Printable Pdf Or Fill Online Application For Unemployment Insurance Vermont Templateroller

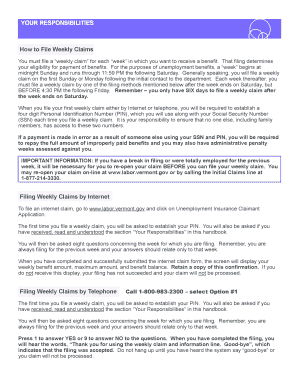

Vermont Unemployment 1099 G Fill Online Printable Fillable Blank Pdffiller

Vermont Unemployment 1099 G Fill Online Printable Fillable Blank Pdffiller

Unemployment 1099 Form Recall Leads Vt To Offer Id Theft Protection

Unemployment 1099 Form Recall Leads Vt To Offer Id Theft Protection

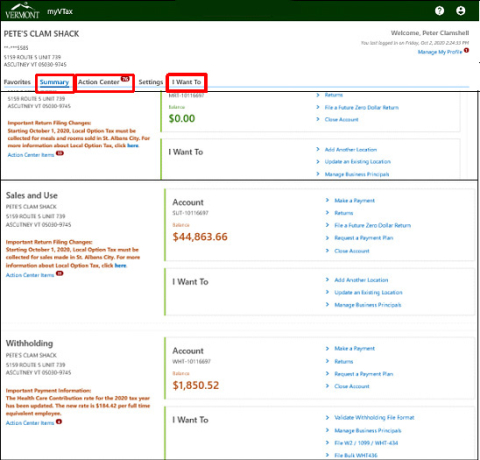

New Look For Myvtax Department Of Taxes

New Look For Myvtax Department Of Taxes

Post a Comment for "Unemployment Vt Tax Form"