Unemployment Tax Form Kentucky

The tax rate is five 5 percent and allows itemized deductions and certain income reducing deductions as defined in KRS 141019. Employers can establish or reopen an unemployment insurance account submit quarterly tax reports or pay unemployment taxes on-line through this link.

1099 G Tax Form Causing Confusion For Some In Kentucky Wbir Com

1099 G Tax Form Causing Confusion For Some In Kentucky Wbir Com

Additionally HB 413 will decrease the 2021 unemployment taxable wage base from 11100 to 10800.

Unemployment tax form kentucky. Kentucky Career Center Certification Affiliate Standardsdocx. Kentuckys Unemployment Insurance Self-Service site. Confusion over 1099-G tax form and Kentucky unemployment FOCUS Unemployment filers frustrated as answers for help remain unsolved Make it easy to keep up-to-date with more stories like this.

On your 1099-G form Box 1 Unemployment Compensation shows the amount you received in unemployment wages. Department of Workers Claims 502 564-5550. Kentuckys unemployment office recently mailed out Form 1099-G and intends to make a digital copy available on online claim accounts by the end of.

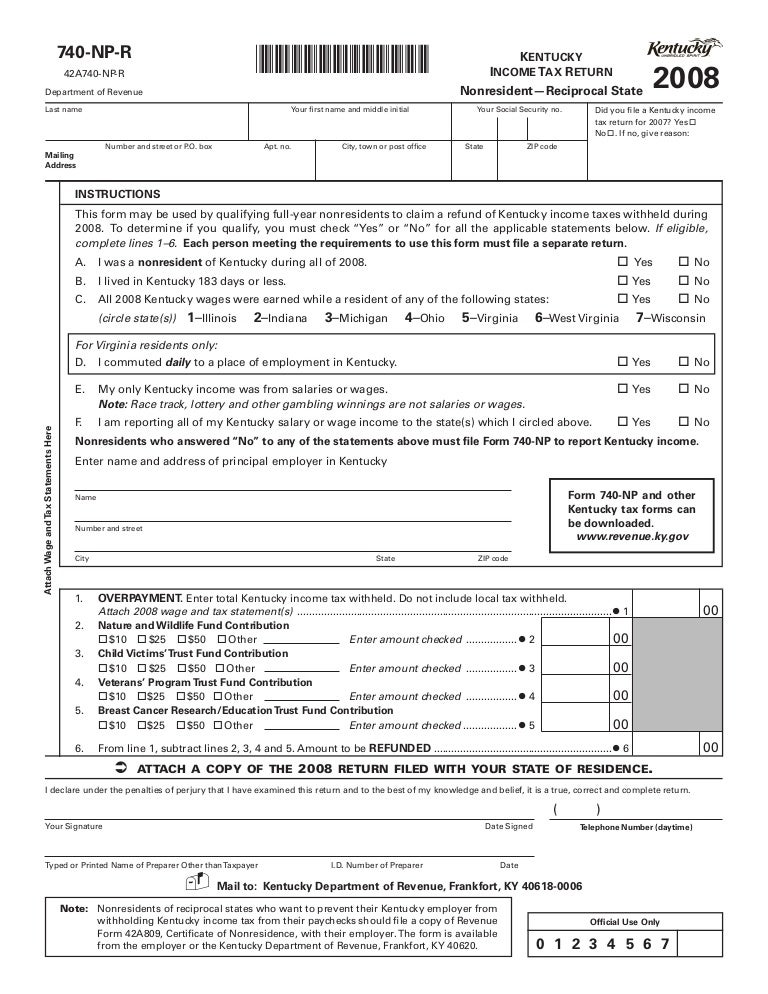

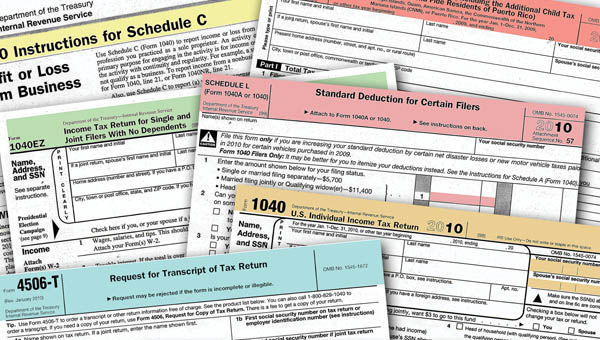

Register for Unemployment Insurance Tax - Employers can either register a new account or can reinstate an old. A full-year resident of Kentucky files Form 740 and a person who moves into or out of Kentucky during the year or is a full-year nonresident files Form 740-NP. State Taxes on Unemployment Benefits.

Confusion over 1099 tax forms add to ongoing issues with Kentucky unemployment system. To request your bi-weekly benefit payment by telephone call 877 3MY-KYUI or 877 369-5984 toll free. If you are registering because you purchased.

Unemployment compensation is fully taxable in Kentucky. When filing taxes unemployment benefit recipients need to reference Form 1099-G a tax form that shows how much they received in benefits and any amounts that were withheld for tax purposes. If this amount if greater than 10 you must report this income to the IRS.

Kentucky Career Center unemployment office at Sixth and Cedar Streets in downtown Louisville. 500 Mero Street 3rd Floor Frankfort KY 40601 Get Directions. Unemployment Insurance To submit quarterly tax reports over the Internet through either an on-screen form or a file upload option retrieve information about the Kentucky unemployment insurance program pay taxes by Electronic Funds Transfer EFT or establish a new UI account please go to.

Will the Kentucky Division of Unemployment Insurance be able to generate and issue revised 2021 tax rate notices for all employer prior to the first quarter 2021 filing and payment deadline of April 30 2021. Kentucky Tax Registration 10A100 - Basic Kentucky tax registration can be completed online or via the Kentucky Tax Registration Application 10A100. Enter the amount from Box 1 on Line 19 Unemployment Compensation of your 1040 form.

13 2019 file photo shows part of a 1040 federal tax form. The Unemployment Insurance Benefits Poster is required to be posted in a conspicuous place on the premises at which the payroll records are maintained 787 KAR 1040. The state has not adopted the federal exemption for up to 10200 of unemployment.

Commonwealth of KentuckyLabor Cabinet. Additional tax registrations may be required based on your industry for more information visit the Kentucky Department of Revenue. To register on paper use Form UI-1 Application for Unemployment Insurance Employer Reserve Account.

Its tax season and therefore Kentuckians who collected unemployment are receiving or will be receiving a 1099-G perhaps for the first. Tax Type Tax Year Select Current 2021 2020 2019 2018 2017 2016 2015 2014 2013 2012 2011 2010 2009 2008 2007 2006 2005 2004 2003 2002 2001 2000 1999 Clear Filters. However when they got her 1099-G tax form the unemployment compensation amount showed over 15000.

State Forms Report of Transfer. Blank forms are available for download from the Employer Account Registration section of the KEWES website. Forms Search by Keyword.

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Rhode Island Tax Forms And Instructions For 2020 Form Ri 1040

Rhode Island Tax Forms And Instructions For 2020 Form Ri 1040

Irs Distributing Tax Refunds Slower Than Usual This Year After Delayed Start National Wdrb Com

Irs Distributing Tax Refunds Slower Than Usual This Year After Delayed Start National Wdrb Com

3 21 3 Individual Income Tax Returns Internal Revenue Service

3 21 3 Individual Income Tax Returns Internal Revenue Service

3 12 154 Unemployment Tax Returns Internal Revenue Service

3 12 154 Unemployment Tax Returns Internal Revenue Service

Illinois Tax Forms 2020 Printable State Il 1040 Form And Il 1040 Instructions

Illinois Tax Forms 2020 Printable State Il 1040 Form And Il 1040 Instructions

Oregon Tax Forms 2020 Printable State Form Or 40 And Form Or 40 Instructions

Oregon Tax Forms 2020 Printable State Form Or 40 And Form Or 40 Instructions

New Jersey Tax Forms 2020 Printable State Nj 1040 Form And Nj 1040 Instructions

New Jersey Tax Forms 2020 Printable State Nj 1040 Form And Nj 1040 Instructions

Arizona Tax Forms 2020 Printable State Az Form 140 And Az Form 140 Instructions

Arizona Tax Forms 2020 Printable State Az Form 140 And Az Form 140 Instructions

740 Np R Kentucky Income Tax Return Nonresident Reciprocal State

740 Np R Kentucky Income Tax Return Nonresident Reciprocal State

3 21 3 Individual Income Tax Returns Internal Revenue Service

3 21 3 Individual Income Tax Returns Internal Revenue Service

Kentucky Tax Forms 2020 Printable State Ky 740 Form And Ky 740 Instructions

Kentucky Tax Forms 2020 Printable State Ky 740 Form And Ky 740 Instructions

Tax Forms Form Information Business And Individual Taxpayers

Tax Forms Form Information Business And Individual Taxpayers

South Carolina Tax Forms 2020 Printable State Sc 1040 Form And Sc 1040 Instructions

South Carolina Tax Forms 2020 Printable State Sc 1040 Form And Sc 1040 Instructions

Connecticut Tax Forms And Instructions For 2020 Ct 1040

Connecticut Tax Forms And Instructions For 2020 Ct 1040

Alabama Tax Forms And Instructions For 2020 Form 40

Alabama Tax Forms And Instructions For 2020 Form 40

Free 7 Sample Unemployment Tax Forms In Pdf

Free 7 Sample Unemployment Tax Forms In Pdf

3 11 13 Employment Tax Returns Internal Revenue Service

3 11 13 Employment Tax Returns Internal Revenue Service

3 21 3 Individual Income Tax Returns Internal Revenue Service

3 21 3 Individual Income Tax Returns Internal Revenue Service

Post a Comment for "Unemployment Tax Form Kentucky"