How To Get My Unemployment Tax Form Florida

2 Enforce child support law on behalf of about 1025000 children with 126 billion collected in FY 0607. You should be able to get an electronic copy if you log into CONNECT and go to My 1099-G and 49Ts in the main menu.

Rhode Island Tax Forms And Instructions For 2020 Form Ri 1040

Rhode Island Tax Forms And Instructions For 2020 Form Ri 1040

Please remind your viewers if a claimant did not receive their 1099-G Tax Form received a 1099-G Tax Form by mistake 1099-G Tax Form is.

How to get my unemployment tax form florida. Florida Department of Revenue - The Florida Department of Revenue has three primary lines of business. 1 Administer tax law for 36 taxes and fees processing nearly 375 billion and more than 10 million tax filings annually. Then An electronic copy.

Floridas unemployment rate has improved considerably since the depths of the covid-19 induced job loses but the state is still missing over 500000 jobs. All it is keeping you b. The Statement for Recipients of Certain Government Payments 1099-G tax forms are now available for New Yorkers who received unemployment benefits in calendar year 2020.

2 days agoIf you received unemployment benefits last year you will need to report that information on your tax return using a document called a 1099-G form. Unemployed Floridians should receive a 1099G tax document from the Florida Department Of Economic Opportunity by the end of the month. This is the fastest method for receiving your tax forms if you selected Electronic as your correspondence type.

Report the amount shown in Box 1 on line 7 of Schedule 1 Form 1040 Additional Income and Adjustments to Income PDF and attach this to the Form 1040 or Form 1040-SR. Knightly said the forms are available on the site but it is a little tricky finding them. Youll transfer the amount in Box 1 of Form 1099-G to Line 7 of Schedule 1 then the withholding amount in Box 4 of the 1099-G if any goes directly onto your 1040 tax return on Line 25b.

You can also use Form 4506-T to request a copy of your previous years 1099-G. 2 Enforce child support law on behalf of about 1025000 children with 126 billion collected in FY 0607. Unemployment compensation has its own line Line 7 on Schedule 1 which accompanies your 1040 tax return.

Log into CONNECTand go to My 1099-G 49Ts in the main menu. They are available year-round for. But unemployment benefits are subject to Ohio income taxes.

People are assuming its not ready or being mailed out when actually all it is is your a pop-up blocker. There are three options. More information about 1099-G.

This tax form provides the total amount of money you were paid in benefits from NYS DOL in 2020 as well as any adjustments or tax withholding made to your benefits. 3 Oversee property tax administration involving 109. Fill out the form.

1 Administer tax law for 36 taxes and fees processing nearly 375 billion and more than 10 million tax filings annually. What theyre going to receive in the mail or theyre going. 3 Oversee property tax administration involving 109.

While the Paycheck Protection Program is a tax-free forgivable loan program both the unemployment benefits and the additional 600 per week. Unemployment benefits are not subject to municipal income taxes in Ohio so nothing changes there the Regional Income Tax Agency confirmed. Didnt have time to edit video but in this video I show you how to download your 1099G form from the connect site on Safari Chrome.

If a claimant did not receive their 1099-G Tax Form they received a 1099-G Tax Form by mistake their 1099-G Tax Form is incorrect or they cannot access their 1099-G Tax Form. Florida Department of Revenue - The Florida Department of Revenue has three primary lines of business. You should receive a Form 1099-G Certain Government Payments showing the amount of unemployment compensation paid to you during the year in Box 1 and any federal income tax withheld in Box 4.

This means if you cant print the information out youll simply need to note the pertinent number to plug into the unemployment compensation block as well as any refunds or credits that apply. But one local woman says her 1099-G form is. The maximum credit is allowed if all State Unemployment Tax SUTA was paid by the due date of Form 940 or if no State Unemployment Tax was due during the calendar year due to your State experience rate.

Mail the completed form to the IRS office that processes returns for your area. The IRS does not require you to submit a paper copy of your 1099-G form with your taxes. You can download Form 4506-T at IRSgov or order it from 800-TAX-FORM.

Contact the IRS at 800-829-1040 to request a copy of your wage and income information.

/ScreenShot2021-01-22at11.47.38AM-a4136c55ec6c45e58dcca62bddb1e2d2.jpeg) Form 1040 Sr U S Tax Return For Seniors Definition

Form 1040 Sr U S Tax Return For Seniors Definition

South Carolina Tax Forms 2020 Printable State Sc 1040 Form And Sc 1040 Instructions

South Carolina Tax Forms 2020 Printable State Sc 1040 Form And Sc 1040 Instructions

/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

:max_bytes(150000):strip_icc()/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg) 10 Things You Should Know About Form 1099

10 Things You Should Know About Form 1099

How To Fill Out Irs Form 940 Futa Tax Return Youtube

How To Fill Out Irs Form 940 Futa Tax Return Youtube

What Is Irs 1040ez Tax Form Tax Forms Income Tax Return Tax Refund Calculator

What Is Irs 1040ez Tax Form Tax Forms Income Tax Return Tax Refund Calculator

Oregon Tax Forms 2020 Printable State Form Or 40 And Form Or 40 Instructions

Oregon Tax Forms 2020 Printable State Form Or 40 And Form Or 40 Instructions

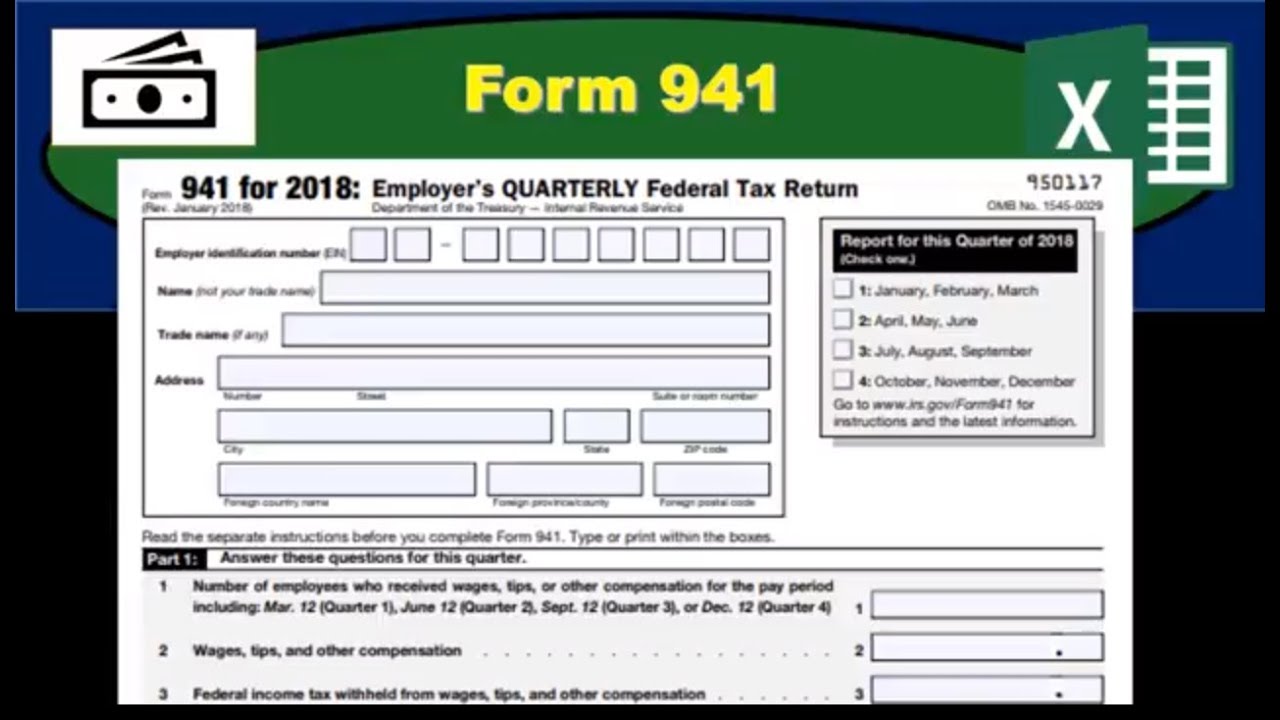

Form 941 Quarterly Payroll Tax Form How Fill Out Youtube

Form 941 Quarterly Payroll Tax Form How Fill Out Youtube

Illinois Tax Forms 2020 Printable State Il 1040 Form And Il 1040 Instructions

Illinois Tax Forms 2020 Printable State Il 1040 Form And Il 1040 Instructions

How To Report Your Unemployment Benefits On Your Federal Tax Return Get It Back Tax Credits For People Who Work

How To Report Your Unemployment Benefits On Your Federal Tax Return Get It Back Tax Credits For People Who Work

Unemployment Insurance Tax Information Rhode Island Department Of Labor And Training

Unemployment Insurance Tax Information Rhode Island Department Of Labor And Training

Alabama Tax Forms And Instructions For 2020 Form 40

Alabama Tax Forms And Instructions For 2020 Form 40

Learn How To Fill The Form 1040a U S Individual Income Tax Return Youtube

Learn How To Fill The Form 1040a U S Individual Income Tax Return Youtube

Kentucky Tax Forms 2020 Printable State Ky 740 Form And Ky 740 Instructions

Kentucky Tax Forms 2020 Printable State Ky 740 Form And Ky 740 Instructions

Arizona Tax Forms 2020 Printable State Az Form 140 And Az Form 140 Instructions

Arizona Tax Forms 2020 Printable State Az Form 140 And Az Form 140 Instructions

Minnesota Tax Forms 2020 Printable State Mn Form M1 And Mn Form M1 Instructions

Minnesota Tax Forms 2020 Printable State Mn Form M1 And Mn Form M1 Instructions

What Is Irs Tax Form 8880 The Dough Roller

What Is Irs Tax Form 8880 The Dough Roller

Ui Online Access Tax Information Form 1099g Using Ui Online Youtube

Ui Online Access Tax Information Form 1099g Using Ui Online Youtube

Post a Comment for "How To Get My Unemployment Tax Form Florida"