How Do I Determine My Unemployment Benefits

Next you would include the amount of benefits as a negative amount you. Once you file your claim the EDD will verify your eligibility and wage information to determine your weekly benefit amount WBA.

Senate Bill Indicates A Portion Of Unemployment Compensation May Not Be Taxable In 2020

Senate Bill Indicates A Portion Of Unemployment Compensation May Not Be Taxable In 2020

The number is in Box 1 on the tax form.

How do i determine my unemployment benefits. The legislation excludes only 2020 unemployment benefits from taxes. You can guess your Potential Benefits Online. Unemployment benefits turned out to be one of the most hotly debated parts of the 19 trillion aid package with legislators at odds over how long to extend benefits and for how much.

As of October 4 2020 the maximum weekly benefit amount is 855 per week. If you received unemployment benefits in 2020 heres how much money you may soon get back from the IRS. Your weekly benefit amount and the number of weeks of entitlement to benefits are based on the wages you were paid and amount of time you worked during your base period.

For more information refer to How Unemployment Insurance Benefits Are Computed PDF or the Unemployment Insurance Benefit. When those benefits run out you may be able to collect Extended Benefits EB another federal program designed to help states during periods of high unemployment. Add lines 1 2 and 3.

Says it expects to premiere some 2022 movies exclusively in theatres signaling confidence in a box office comeback. How we calculate benefits If you qualify for Unemployment Insurance benefits the amount of money youll get each week is called your weekly benefit rate WBR. Press Calculate to see how much you are potentially eligible to receive.

And yet another program created by coronavirus stimulus legislation Pandemic Unemployment Assistance PUA could offer you a few more weeks once your time to collect other. The legislation signed on March 11 allows taxpayers who earned less than 150000 in modified adjusted gross income to exclude unemployment compensation up to 20400 if married filing jointly and 10200 for all other eligible taxpayers. For instance according to the Missouri Department of Labor Unemployment Benefit Calculator if you earned 27000 in the year prior to your application you would receive an estimated 270 weekly.

Unfortunately theres no easy way to calculate exactly how much money youll receive through unemployment benefits or for how long youll be able to collect those benefits unless your state has an online unemployment calculator. Unemployment Benefits Tax Refund. The weekly benefit amount is calculated by dividing the sum of the wages earned during the highest quarter of the base period by 26 rounded down to the next lower whole dollar.

You must file an Unemployment Insurance claim to find out if you are eligible and learn your actual benefit amount. Your weekly benefit amount and the number of weeks of entitlement to benefits are based on the wages you were paid. When will you file for Unemployment Insurance benefits.

Individuals should receive a Form 1099-G showing their total unemployment compensation last year. April 5 2021 1118 AM. For married couples each spouse can exclude up to 10200.

This calculator helps you estimate your benefits. If you are eligible to receive Unemployment Insurance UI benefits you will receive a weekly benefit amount of approximately 50 of your average weekly wage up to the maximum set by law. Identify the two highest quarters in your base year.

The Unemployment Insurance UI benefit calculator will provide you with an estimate of your weekly UI benefit amount which can range from 40 to 450 per week. Enter your gross earnings for each of the calendar quarters. Each state has a different rate and benefits vary based on your earnings record and the date.

How do i calculate my unemployment benefits in florida Typically the amount of unemployment that you would receive is based on taxable income prior to separation. Key each total in the boxes below. This amount will depend on how much you earned in the base year period before you applied for Unemployment Insurance benefits.

First you report the full amount of unemployment benefits on Line 7 of Schedule 1. Do not reduce this amount by the amount of unemployment compensation you may be able to exclude. To try again press Clear and start over.

It is only advisory. However there are calculators you can use to estimate your benefits. Use the line 8 instructions to determine the amount to include on Schedule 1 line 8 and enter here.

How to Avoid Tax on Up to 10200 of Unemployment Benefits If unemployment benefits put you in a hole on your 2020 tax return you now have a better chance of getting a tax refund. Gross earnings are your wages before taxes and other deductions. If you are filing Form 1040 or 1040-SR enter the amount from line 10c.

How To Apply For Unemployment Benefits Information And Resources Semca

How To Apply For Unemployment Benefits Information And Resources Semca

600 A Week Unemployment Benefits Unlikely To Be Extended

600 A Week Unemployment Benefits Unlikely To Be Extended

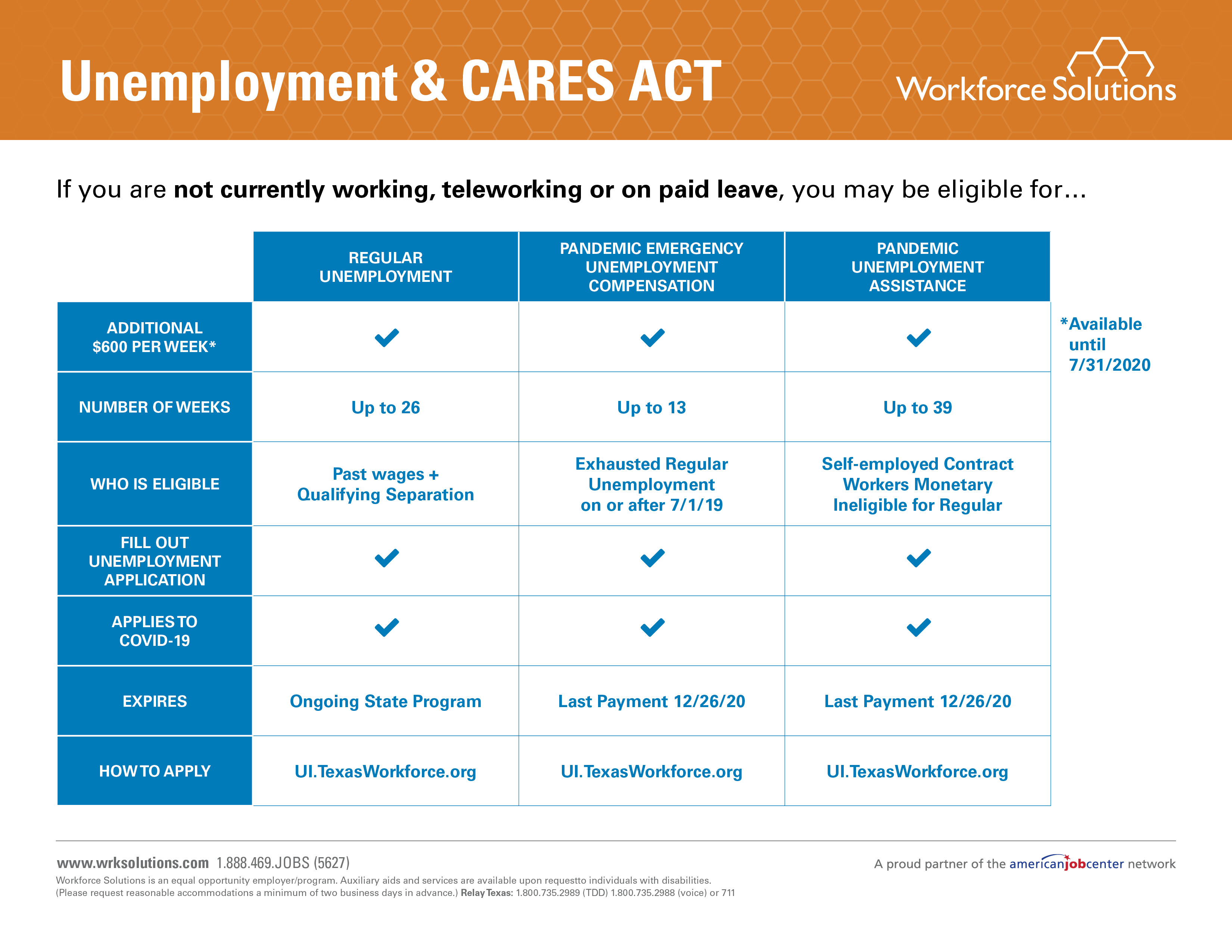

Frequently Asked Questions About Unemployment Benefits For The Self Employed Cares Act Nav

Frequently Asked Questions About Unemployment Benefits For The Self Employed Cares Act Nav

Unemployment Benefits Workforce Solutions

Unemployment Benefits Workforce Solutions

How To Apply For Unemployment In La During Covid 19 Pandemic

How To Apply For Unemployment In La During Covid 19 Pandemic

What Are Partial Unemployment Benefits Bench Accounting

What Are Partial Unemployment Benefits Bench Accounting

How Unemployment Benefits Are Calculated By State Bench Accounting

How Unemployment Benefits Are Calculated By State Bench Accounting

My Unemployment Says I Have A Break In My Claim What Does That Mean In 2020 Meant To Be Serious Problem Sayings

My Unemployment Says I Have A Break In My Claim What Does That Mean In 2020 Meant To Be Serious Problem Sayings

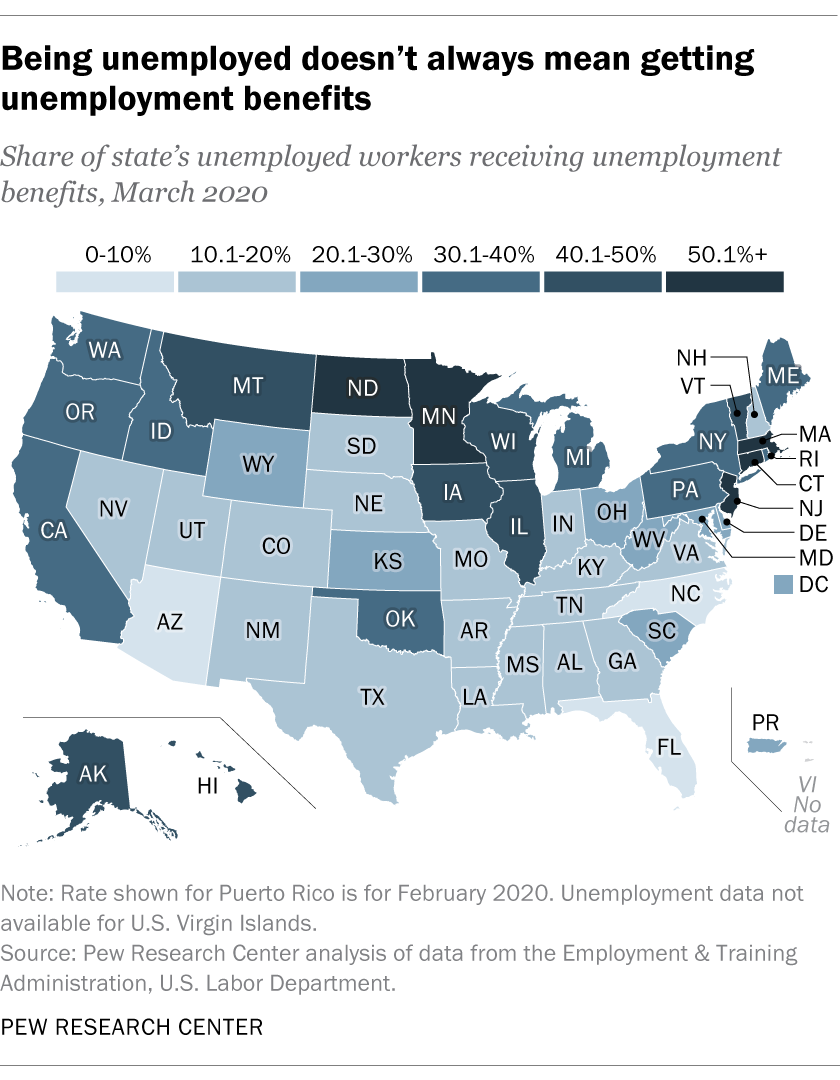

In Some States Very Few Unemployed People Get Unemployment Benefits Pew Research Center

In Some States Very Few Unemployed People Get Unemployment Benefits Pew Research Center

Self Employed Don T Give Up On Unemployment Benefits

Self Employed Don T Give Up On Unemployment Benefits

Des Covid 19 Information For Individuals

Des Covid 19 Information For Individuals

How To Apply For Unemployment Benefits Information And Resources Semca

How To Apply For Unemployment Benefits Information And Resources Semca

Extended Unemployment Benefits Set To End This Week

Extended Unemployment Benefits Set To End This Week

Unemployed Worker Benefits Pine Tree Legal Assistance

Unemployed Worker Benefits Pine Tree Legal Assistance

Esdwagov Calculate Your Benefit

Esdwagov Calculate Your Benefit

States Are Telling Some People To Pay Back Unemployment Benefits Marketplace

States Are Telling Some People To Pay Back Unemployment Benefits Marketplace

What You Should Know About Unemployment Compensation

Post a Comment for "How Do I Determine My Unemployment Benefits"