Can I Get A Tax Return If I'm Unemployed

For TurboTax Live Full Service your tax expert will amend your 2020 tax return for you through 11302021. If you received unemployment benefits in 2020 and your AGI is less than 150000 for single and married filers the first 10200 you received for unemployment will be exempt from tax.

Do I Have To File A Tax Return If I Don T Owe Tax Turbotax Tax Tips Videos

Do I Have To File A Tax Return If I Don T Owe Tax Turbotax Tax Tips Videos

To receive a refund or lower your tax burden make sure you either have taxes withheld or make estimated tax payments.

Can i get a tax return if i'm unemployed. Make changes to your 2020 tax return online for up to 3 years after it has been filed and accepted by the IRS through 10312023. There is an incentive to do this as you may fall into a lower tax band and therefore qualify for a tax refund on payments made in the last 12 months or so. Some people advise that you report 1 of interest income so that you can e-file.

If youre unemployed and unemployment benefits were your sole source of income for the tax year you probably dont qualify for tax credits but you could still get a refund if you file a return. The Accountant can help. Under the American Rescue Plan signed into law Thursday the IRS will make the first 10200 in unemployment benefits from 2020 tax-free.

I have already filed my 2020 tax return but qualify for the 10200 unemployment exclusionTaking the exclusion qualifies me for an EIC so I must file an amended return correctHow does an amended federal return affect my state tax return if I have not filed state taxes yet. Where are you currently located. If you qualified as a dependent for 2019 but will not be for 2020 you will most likely get it in 2021 when you file a 2020 tax return.

If you have received unemployment income at any point during the year you will be required to complete and return IRS Form 1099-G. If your total income for the year including what you get for unemployment is more than the minimum amount required to file some of it could be taxed. Even though jobless benefits count as income for tax purposes the newly-signed 19 trillion American Rescue Plan will not impose federal income.

Unemployment benefits are taxable income so recipients must file a Federal tax return and pay taxes on those benefits. You must still report your unemployment compensation on your tax return even if you dont receive a Form 1099-G for some reason. You can get a refund of tax you have already paid if you were employed and find yourself unemployed.

You can collected Form 1099-G by calling your local unemployment office or contacting the IRS directly. Effect on Other Tax Benefits Taxable unemployment benefits include the extra 600 per week that was provided by the federal government in response to the coronavirus pandemic accountant Chip Capelli of Provincetown Massachusetts told The Balance. Likely if you have no income and are unemployed youd qualify for the full 1200.

Always file your tax return If you have been made unemployed you should still file your tax return. You can also get tax back if you are still employed but have paid more tax than you were liable for. That tax break will put a lot of extra cash into peoples bank accounts.

Its adults who make a lot of money who will see either reduced or. If you have no income you have to mail in a paper tax return. Every cent counts in these situations.

You may also get a tax refund if you are out of work due to illness. Terms and conditions may vary and are subject to change without notice. By law unemployment compensation is taxable and must be reported on a 2020 federal income tax return.

This document will accurately summarize your unemployment compensation and ensure that you are taxed appropriately. But waiting until May to get a refund on that money could put a lot of people in a tight spot. The law waives federal income taxes on up to 10200 in unemployment insurance benefits for people who earn under 150000 a year potentially.

WASHINGTON With millions of Americans now receiving taxable unemployment compensation many of them for the first time the Internal Revenue Service today reminded people receiving unemployment compensation that they can have tax withheld from their benefits now to help avoid owing taxes on this income when they file their federal income tax return next year. Depending on your circumstances you may receive a tax refund even if your only income for the year was from unemployment.

Retirees Might Need To File Taxes In Certain Situations Star Advertiser Filing Taxes Tax Tax Return

Retirees Might Need To File Taxes In Certain Situations Star Advertiser Filing Taxes Tax Tax Return

Ep294 Is A Heloc Still Tax Deductible Morris Invest Tax Deductions Heloc Investing

Ep294 Is A Heloc Still Tax Deductible Morris Invest Tax Deductions Heloc Investing

Tax Preparation Checklist Tax Preparation Tax Prep Tax Prep Checklist

Tax Preparation Checklist Tax Preparation Tax Prep Tax Prep Checklist

Printable Tax Prep Checklist Tax Prep Checklist Tax Prep Business Tax

Printable Tax Prep Checklist Tax Prep Checklist Tax Prep Business Tax

Cheers To A New Year And Another Chance For Us To Get It Right Happy New Year Everyone Wish You Good H Happy New Year Everyone Irs Taxes Place Card Holders

Cheers To A New Year And Another Chance For Us To Get It Right Happy New Year Everyone Wish You Good H Happy New Year Everyone Irs Taxes Place Card Holders

Rejected Return Due To Stimulus H R Block

Rejected Return Due To Stimulus H R Block

Smart Ways To Spend Your Tax Return Tax Forms Tax Return Money Management

Smart Ways To Spend Your Tax Return Tax Forms Tax Return Money Management

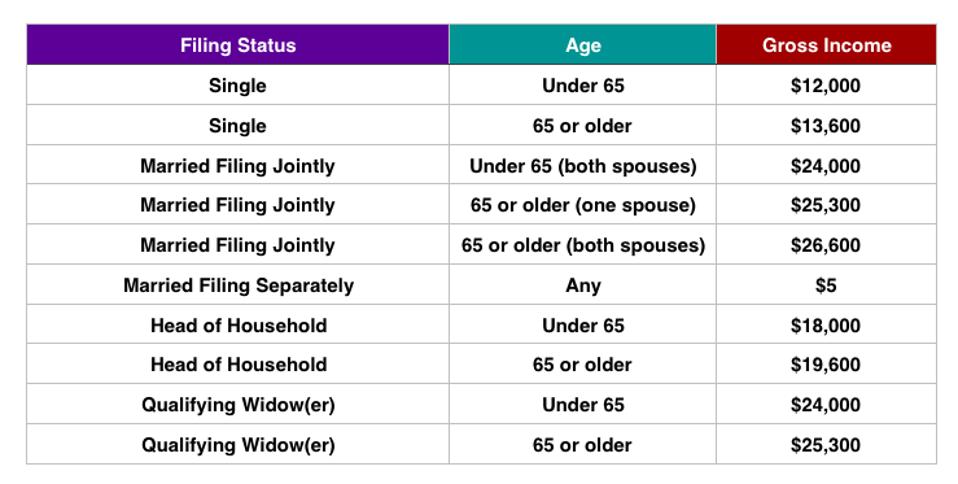

Do You Need To File A Tax Return In 2019

Do You Need To File A Tax Return In 2019

Can I File An Income Tax Return If I Don T Have Any Income Turbotax Tax Tips Videos

Can I File An Income Tax Return If I Don T Have Any Income Turbotax Tax Tips Videos

Faqs On Tax Returns And The Coronavirus

Faqs On Tax Returns And The Coronavirus

If You Need Any Help With Tax Or Other Financial Advice Please Email Thecpataxproblemsolver At Keith Keithjonescpa Com Or Financial Advice Sba Loans Irs Taxes

If You Need Any Help With Tax Or Other Financial Advice Please Email Thecpataxproblemsolver At Keith Keithjonescpa Com Or Financial Advice Sba Loans Irs Taxes

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Income Tax Checklist What Your Accountant Needs To File Your Income Taxes Copy Tax Checklist Income Tax Income

Income Tax Checklist What Your Accountant Needs To File Your Income Taxes Copy Tax Checklist Income Tax Income

What To Watch For When Filing 2020 Tax Returns The Blade

What To Watch For When Filing 2020 Tax Returns The Blade

Thecpataxproblemsolver Asks For Everyone 2 Share This Information About Recovering From A Disaster Like Hurricanemic Financial Advice Irs Taxes Sba Loans

Thecpataxproblemsolver Asks For Everyone 2 Share This Information About Recovering From A Disaster Like Hurricanemic Financial Advice Irs Taxes Sba Loans

Do I File A Tax Return If I Don T Earn An Income E File Com

Do I File A Tax Return If I Don T Earn An Income E File Com

Why Everyone Should File A Tax Return This Year Regardless Of Income

Why Everyone Should File A Tax Return This Year Regardless Of Income

Tax Cartoons Income Tax Humor Tax Day Taxes Humor

Tax Cartoons Income Tax Humor Tax Day Taxes Humor

Post a Comment for "Can I Get A Tax Return If I'm Unemployed"