What Pays More Workers' Comp Or Unemployment

And you cant collect unemployment if youre unable to work. Workers comp allows injured workers to receive the care they need to get healthy in the event of a workplace or work-related accident.

Pin On Personal Money Management

Pin On Personal Money Management

Both federal and state unemployment taxes are computed as percentages so higher gross payroll will convert to a higher unemployment premium even if your tax rate is low.

What pays more workers' comp or unemployment. If your workers comp benefit is more than your. However the analysis also found that 40 of unemployment claimants who made more on unemployment than in their previous jobs were largely part-time workers with total compensation. What Pays More.

Unions have helped workers during the COVID-19 pandemic in a number of ways including by improving safety procedures for grocery store workers 1 securing paid leave for postal service workers 2. An experienced workers comp attorney can explain how the laws in your state apply to your situation whether you have a good reason to challenge a decision to deny your benefits and how any unemployment benefits you receive might affect what will be taken out of your workers comp settlement or award. Whats more the average person on unemployment received 14000 in benefits last year.

If your situation makes it so you fall into both of these categories at the same time you may still be able to collect benefits but there are some special considerations. People in that boat will still pay taxes on some of their unemployment income --. The Chicago workers compensation attorneys at Katz Friedman Eisenstein Johnson Bareck Bertuca have an extensive knowledge of the differences between workers compensation and other potential benefits such as unemployment.

Chicago Lawyers Advising Injured Workers Throughout Illinois. The key difference is that workers compensation covers you for injuries for which the employer would be liable for example carpal tunnel syndrome in office workers while disability benefits are not paid for through your employer but still help make up for lost income. Additionally workers comp pays benefits to family members in the event of a work-related fatality.

The more unemployment claims the state approves the more you contribute for unemployment taxes. Unemployment or Workers Compensation. The sum that you pay in the unemployment tax depends on the total sum of your payroll.

In essence you would be collecting two separate replacements to typical paychecks. The idea behind a 600 payment was simple. Unemployment Insurance Supports Those Out of Work Through No Fault of Their Own.

You will likely receive more overall and financial benefits from workers compensation than other benefits. In 2019 the national average unemployment payment was 370 per week and the national average salary for unemployment recipients was 970 per week. Illinois law has devised a system of benefits for employees who suffer a work-related injury.

Unemployment pays benefits but only if youre available to work and looking for a new job. For example mass layoffs due to the coronavirus do not affect employer SUTA tax accounts in some states eg Ohio. Workers compensation is typically available for a longer period of time than other benefits especially short-term disability benefits and unemployment compensation benefits which are usually limited to a maximum of 26 weeks.

Because of this youre unable to collect both workers compensation and unemployment. Further we are often asked whether there would be any advantage to collecting multiple benefits at the same time. Keep in mind that there may be exceptions.

However wages subject to federal unemployment taxes are limited at 7000 per employee so federal unemployment tax. But it only pays while youre disabled - while a doctor says your injury keeps you from working. For example in Virginia every dollar you receive in the form of workers compensation is deducted from your unemployment benefit check.

This is called an employer benefit ratio and it is determined by means of a formula that calculates the amount that the state has paid out in benefit claims tracked to this employer relative to the total amount that this employer has paid to employees in wages. Obviously workers compensation benefits are reserved for those who were hurt on the job while unemployment benefits are for those who are out of a job. As workers compensation lawyers we are often asked whether it is possible to receive workers compensation benefits in addition to unemployment andor Social Security benefits.

Under the Workers Compensation Act income replacement benefits are paid at two-thirds of your average weekly wage for the year before your injury. The fewer unemployment claims made by workers who have been laid off by your employer the lower his benefit ratio will be and the less he will pay in unemployment. Workers comp pays more.

Many Colorado business owners and workers might not realize unemployment. For most of you workers comp will pay much more than unemployment compensation benefits.

Benefits Of Union Membership Workers Compensation Insurance Labor Union Workplace Injury

Benefits Of Union Membership Workers Compensation Insurance Labor Union Workplace Injury

Does Workers Compensation Protect My Job And My Benefits

Does Workers Compensation Protect My Job And My Benefits

American Auto Insurance Buy Health Insurance Life Insurance Companies Universal Life Insurance

American Auto Insurance Buy Health Insurance Life Insurance Companies Universal Life Insurance

Canada S Job Market Is Looking Better Than It Has In Some Time The Unemployment Rate Hit 6 6 Per Cent In Top Paying Jobs Marketing Jobs Education And Training

Canada S Job Market Is Looking Better Than It Has In Some Time The Unemployment Rate Hit 6 6 Per Cent In Top Paying Jobs Marketing Jobs Education And Training

Why Is Gross Income Not Net Income Used For Child Support Payments In 2020 Child Support Payments Net Income Child Support

Why Is Gross Income Not Net Income Used For Child Support Payments In 2020 Child Support Payments Net Income Child Support

The 25 Top Hedge Fund Managers Earn More Than All Kindergarten Teachers Combined Hedge Fund Manager Kindergarten Teachers Education Inspiration

The 25 Top Hedge Fund Managers Earn More Than All Kindergarten Teachers Combined Hedge Fund Manager Kindergarten Teachers Education Inspiration

Explore Our Image Of Employee Benefit Statement Template Statement Template Statement Accounting Principles

Explore Our Image Of Employee Benefit Statement Template Statement Template Statement Accounting Principles

Peos Have Many Benefits But One Of The Biggest Lies In Their Workers Compensation Insurance Coverage Workers Compensation Insurance Company Benefits Payroll

Peos Have Many Benefits But One Of The Biggest Lies In Their Workers Compensation Insurance Coverage Workers Compensation Insurance Company Benefits Payroll

Average Workers Comp Settlement Amounts How Much Is My Case Worth

Average Workers Comp Settlement Amounts How Much Is My Case Worth

New Workers Compensation Laws California 2013 New Law Employment Law Business Administration

New Workers Compensation Laws California 2013 New Law Employment Law Business Administration

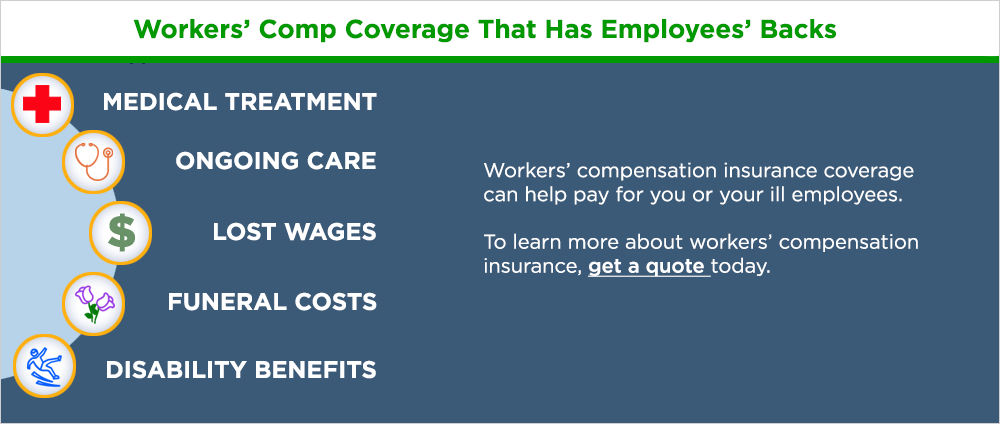

What Does Worker S Compensation Cover The Hartford

What Does Worker S Compensation Cover The Hartford

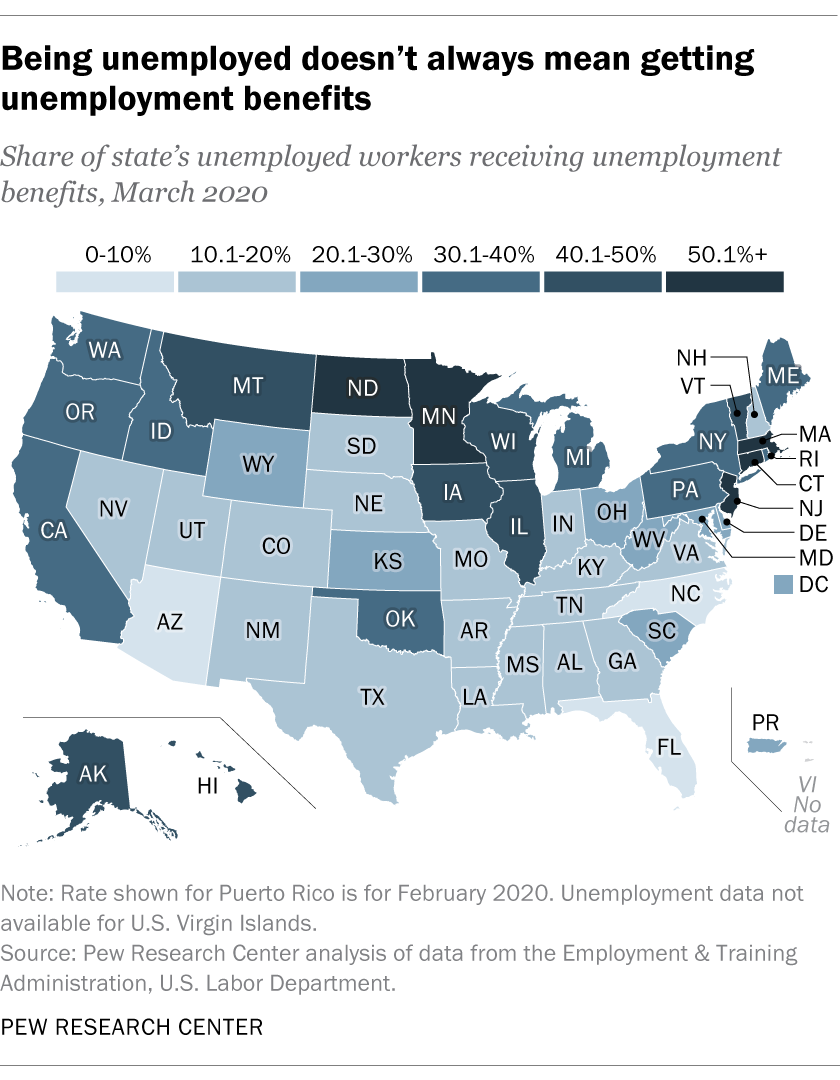

In Some States Very Few Unemployed People Get Unemployment Benefits Pew Research Center

In Some States Very Few Unemployed People Get Unemployment Benefits Pew Research Center

You Won T Miss The Work Involved With Payroll Unemployment Administration Workers Compensation Administration Comp Work Quotes Funny Work Quotes Work Humor

You Won T Miss The Work Involved With Payroll Unemployment Administration Workers Compensation Administration Comp Work Quotes Funny Work Quotes Work Humor

Legal Hourly Cost Of Employee 2012 Cost Of Required Benefits To Be Paid By Employers For Each Employee Workers Comp Employee Infographic Legal Infographic

Legal Hourly Cost Of Employee 2012 Cost Of Required Benefits To Be Paid By Employers For Each Employee Workers Comp Employee Infographic Legal Infographic

Can An Employer Retaliate Because Of A Workers Comp Claim Workers Compensation Insurance Compensation Claim Personal Injury Lawyer

Can An Employer Retaliate Because Of A Workers Comp Claim Workers Compensation Insurance Compensation Claim Personal Injury Lawyer

It Pays To Stay Unemployed That Might Be A Good Thing

It Pays To Stay Unemployed That Might Be A Good Thing

Employer Costs For Employee Compensation For The Regions December 2020 Southwest Information Office U S Bureau Of Labor Statistics

Employer Costs For Employee Compensation For The Regions December 2020 Southwest Information Office U S Bureau Of Labor Statistics

Enhanced Unemployment Benefits During The Coronavirus Crisis Smartasset

Enhanced Unemployment Benefits During The Coronavirus Crisis Smartasset

Work Comp Audit When Was Workers Compensation Established In The Compensation Worker Workplace Injury

Work Comp Audit When Was Workers Compensation Established In The Compensation Worker Workplace Injury

Post a Comment for "What Pays More Workers' Comp Or Unemployment"