Unemployment Not Taxable Worksheet

You may subtract any social security benefits that were taxable on your federal Form 1040 or 1040-SR. Fill in on line 4 the amount from line 6b of federal Form 1040 or 1040-SR.

Stimulus Checks Won T Be Taxed But Unemployment Benefits Will Be News Wfsb Com

Stimulus Checks Won T Be Taxed But Unemployment Benefits Will Be News Wfsb Com

However the MFJ vs MFS Worksheet in ProSeries does not compute this properly.

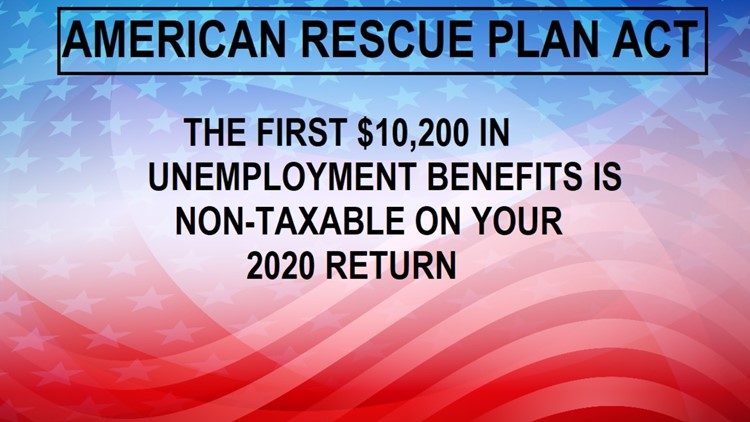

Unemployment not taxable worksheet. If you are married each spouse receiving unemployment compensation doesnt have to pay tax on unemployment compensation. If your modified adjusted gross income AGI is less than 150000 the American Rescue Plan enacted on March 11 2021 excludes from income up to 10200 of unemployment compensation paid in 2020 which means you dont have to pay tax on unemployment compensation of up to 10200. You and your spouses federal adjusted gross income is 25000.

On Line 7 and 8 of the form you include how much unemployment insurance you and your spouse received and add those numbers up. The 100 unemployment exclusion from taxable income is based on MAGI not exceeding 150000 per return so the exclusion on a Married Filing Separately MFS would be 150000 on each return. Married filing a joint return write 18000 on line 3 below.

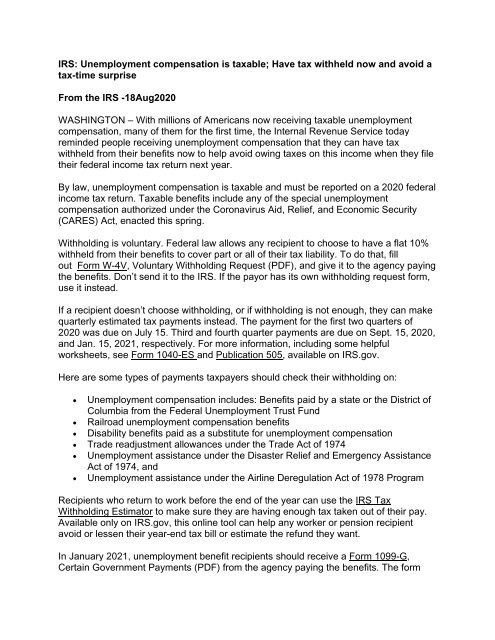

Reporting Unemployment Compensation You should receive a Form 1099-G Certain Government Payments showing the amount of unemployment compensation paid to you during the year in Box 1 and any federal income tax withheld in Box 4. The Internal Revenue Service has changed the calculation for determining the 10200 exclusion on unemployment benefits in the new pandemic relief package allowing more taxpayers to qualify but forcing tax software developers to update their programs. Taxpayers who received unemployment benefits in 2020 and whose modified adjusted gross income was less than 150000 dont have to pay tax on the first 10200 in unemployment compensation.

The federal government considers unemployment benefits to be taxable income although taxes are not automatically withheld from benefits payments the way an employer might take taxes out of your. If you received unemployment benefits in 2020 and youve already filed your tax returns the Internal Revenue Service is saying you dont have to file an amended return to claim the new tax. Normally unemployment benefits are taxed at the federal level and some states impose their own taxes on them as well.

If you did not receive this form in the mail refer to the Department of Workforce Developments website you may need to enter the Uplink system to print your copy. The worksheet will ask you to provide total unemployment compensation calculate MAGI ensure you havent exceeded the income threshold and calculate the amount you can exclude from unemployment. Unemployment compensation is not taxable for Pennsylvania income tax purposes.

The worksheet is completed as follows this worksheet refers to the 2020 Schedule SB. State Income Tax Range. The total number is the amount of unemployment compensation excluded from your income Spencer PlattGetty Images FILE.

State Taxes on Unemployment Benefits. In this example only 3500 of your unemployment compensation is taxable. Thanks to the American Rescue Plan which was passed and signed into law in March 2021 the full amount of unemployment benefits are not taxable.

The provision should help millions of taxpayers who lost their jobs last year due to. Pennsylvania has a flat rate of 307. Up to 10200 in unemployment payments is tax-free.

But as part of the new relief bill jobless workers are entitled to a. 3 If you filed your taxes before the American Rescue Plan was passed you had to pay taxes on the full amount of your unemployment benefits. Provide guidance related to recent changes concerning Massachusetts unemployment compensation worksheet changes in tax releases 2020-331 and 2020-34.

Your unemployment compensation is taxable on both your federal and state tax returns. Be sure to include information from your 1099G. On 422021 the MA department of revenue released the unemployment compensation exclusion worksheet.

Unemployed workers can waive up to 10200 in unemployment benefits received in 2020 from their taxable income. Instead the worksheet incorre. If youve already filed your 2020 tax.

The IRS updated the instructions Tuesday on how to figure the amount of modified adjusted gross income to use for deciding how much of a taxpayers unemployment benefits from 2020 qualify for the 10200 exclusion on taxes. People who had unemployment income in 2020 and have not yet filed their tax return may need to wait to ensure that they submit all information to. Unemployment compensation is taxable.

The IRS recommends using that form to fill out the Form 1040 the standard tax worksheet. This amount does not include any social security benefits or taxable refunds credits or offsets. Social security benefits are not taxable for Wisconsin.

The IRS updated the worksheet on March 23 2021 to clarify that taxpayers should not include the first 10200 in received unemployment compensation when calculating AGI for the purposes of qualifying for the unemployment exclusion.

Income Tax Task Cards Activity Financial Literacy Math For Kids Filing Taxes

Income Tax Task Cards Activity Financial Literacy Math For Kids Filing Taxes

Is Unemployment Taxed H R Block

Is Unemployment Taxed H R Block

Collecting Unemployment Take These Steps To Avoid A Tax Bill Next Year

Collecting Unemployment Take These Steps To Avoid A Tax Bill Next Year

Unemployment Benefits Being Taxed By Federal Government Cbs8 Com

Unemployment Benefits Being Taxed By Federal Government Cbs8 Com

California Anyone Else Not Have Their 600 Taxed Even Though You Clearly Opted To Have Taxes Withheld Unemployment

California Anyone Else Not Have Their 600 Taxed Even Though You Clearly Opted To Have Taxes Withheld Unemployment

Irs Unemployment Compensation Is Taxable Nassau County Chamber Of Commerce

2020 Unemployment Tax Break H R Block

2020 Unemployment Tax Break H R Block

Irs Unemployment Compensation Is Taxable The Trussville Tribune

Irs Unemployment Compensation Is Taxable The Trussville Tribune

Types Of Tax And Their Definitions Personal Financial Literacy Financial Literacy Lessons Financial Literacy Anchor Chart Personal Financial Literacy

Types Of Tax And Their Definitions Personal Financial Literacy Financial Literacy Lessons Financial Literacy Anchor Chart Personal Financial Literacy

Got Unemployment Compensation Don T Rush To File Or Amend Just Yet Wiss Company Llp

Got Unemployment Compensation Don T Rush To File Or Amend Just Yet Wiss Company Llp

Unemployment Benefits Are Taxable

Unemployment Benefits Are Taxable

Senate Bill Indicates A Portion Of Unemployment Compensation May Not Be Taxable In 2020

Senate Bill Indicates A Portion Of Unemployment Compensation May Not Be Taxable In 2020

Irs Unemployment Compensation Is Taxable Have Tax Withheld Now And Avoid A Tax Time Surprise Communal News Online Business Wholesale B2b Marketplace News

Irs Unemployment Compensation Is Taxable Have Tax Withheld Now And Avoid A Tax Time Surprise Communal News Online Business Wholesale B2b Marketplace News

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

Make Sure You Don T Pay Taxes On These Unemployment Benefits Cbs8 Com

Make Sure You Don T Pay Taxes On These Unemployment Benefits Cbs8 Com

Handy Printable Tax Prep Checklist Tax Prep Checklist Business Tax Tax Prep

Handy Printable Tax Prep Checklist Tax Prep Checklist Business Tax Tax Prep

Taxes On Unemployment Checks May Surprise Some

Taxes On Unemployment Checks May Surprise Some

Post a Comment for "Unemployment Not Taxable Worksheet"