Amend Ohio Unemployment Tax Return

For example if you are single with an adjusted gross income AGI of 70000 and you received 15000 of unemployment benefits during the 2020 tax. Nothing is cast in stone yet but the most likely scenario is that the 10200 federal deduction will extend to Ohio.

Kentucky Tax Forms 2020 Printable State Ky 740 Form And Ky 740 Instructions

Kentucky Tax Forms 2020 Printable State Ky 740 Form And Ky 740 Instructions

Thirteen states arent offering a tax break on unemployment benefits received last year according to data from HR Block.

Amend ohio unemployment tax return. 2009-2020 Ohio Amended Individual Income Tax Return It will take several months for the Department to process your paper return. 2 days ago2021 TAX FILING. Failure to file the amended Ohio returns within this time period may result in an assessment for tax due.

Taxpayers who filed a Montana tax return on or before March 12 2021 should not amend the state return to report the federal exclusion of up to 10200 in unemployment. Details on your states tax amendment process. Amending your return basically means that you re-file your return but subtract up to 10200 of unemployment insurance benefits according to experts at The Century Foundation.

A separate Request to Amend the Quarterly Tax Return JFS-20129 must be. How and who has to file an Amended Return to get the 10200 IRS unemployment tax break. The Internal Revenue Service will begin refunding money to people in May who already filed their returns without claiming the new tax break on unemployment.

You should pay the tax due when the amended return is filed. IRS says some Americans may need to file amended return to get full 10200 unemployment tax break Megan Henney 1 day ago Interior secretary steps into Utah public lands tug-of-war. The TLDR is if you became ineligible for some tax credits due to the amount of unemployment you reported you may have to file an amended return.

Its looking like Ohio will be addressing and likely approving in the General Assembly a conformity bill which would align Ohio with all of the tax changes said Gary Gudmundson. Amended return may be needed to get full refund on 10200 unemployment tax break IRS says Published Tue Apr 6 2021 845 AM EDT Updated Tue Apr 6. The American Rescue Plan a 19 trillion Covid relief bill waived.

To file your amendment online please visit the Employer Resource Information Center ERIC. IRS says some Americans may need to file amended return to get full 10200 unemployment tax break Some taxpayers may still have to file an amended return to receive maximum refund. My fiance reported over 19k for unemployment and became ineligible for the Earned Income Tax Credit.

At the bottom is a list that you should file a tax amendment for. Some State Tax Returns use the Federal Tax Return Adjusted Gross Income AGI is listed on Form 1040 Line 11 to calculate your state income tax. COLUMBUS Ohioans who received unemployment benefits in 2020 wont have to pay income taxes on the first 10200 they received.

Additionally delaying payment may result in. If paying by check or money order include an IT 40XP andor SD 40XP payment voucher. As such your Federal AGI may now change because of the APRA Unemployment Income changes.

For faster processing we recommend you submit your return electronically using a commercial software product or tax preparer. Ohio taxes unemployment benefits to the extent they are included in federal adjusted gross income AGI. Some individuals who have already filed or will soon be filing their 2020 Ohio IT 1040 and SD 100 returns due by May 17 2021.

To file by paper use a Request to Amend the Quarterly Tax Return JFS-20129 to correct wage items. But unemployment benefits are subject to Ohio income taxes. IR-2021-71 March 31 2021 WASHINGTON To help taxpayers the Internal Revenue Service announced today that it will take steps to automatically refund money this spring and summer to people who filed their tax return reporting unemployment compensation before the recent changes made by the American Rescue Plan.

Anyone who received jobless benefits during 2020 may now be eligible for the earned income. In Ohio theres discussion in Columbus about whether state lawmakers will follow the federal law and pass legislation next week that would also exempt 10200 in unemployment benefits on state tax returns. Due to the ARPA the IRS is allowing certain taxpayers to deduct up to 10200 in unemployment benefits.

Despite Change By Irs For Federal Taxes At First Ohio Kept Original Filing Deadline Nbc4 Wcmh Tv

Despite Change By Irs For Federal Taxes At First Ohio Kept Original Filing Deadline Nbc4 Wcmh Tv

South Carolina Tax Forms 2020 Printable State Sc 1040 Form And Sc 1040 Instructions

South Carolina Tax Forms 2020 Printable State Sc 1040 Form And Sc 1040 Instructions

3 11 154 Unemployment Tax Returns Internal Revenue Service

3 11 154 Unemployment Tax Returns Internal Revenue Service

/ScreenShot2021-01-22at11.47.38AM-a4136c55ec6c45e58dcca62bddb1e2d2.jpeg) Form 1040 Sr U S Tax Return For Seniors Definition

Form 1040 Sr U S Tax Return For Seniors Definition

/ScreenShot2021-01-22at11.47.38AM-a4136c55ec6c45e58dcca62bddb1e2d2.jpeg) Form 1040 Sr U S Tax Return For Seniors Definition

Form 1040 Sr U S Tax Return For Seniors Definition

Why Unemployment Benefits Fraud Victims Are Getting Tax Bills Abc30 Fresno

Why Unemployment Benefits Fraud Victims Are Getting Tax Bills Abc30 Fresno

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

10 200 Unemployment Tax Break Irs Makes More People Eligible

10 200 Unemployment Tax Break Irs Makes More People Eligible

Illinois Tax Forms 2020 Printable State Il 1040 Form And Il 1040 Instructions

Illinois Tax Forms 2020 Printable State Il 1040 Form And Il 1040 Instructions

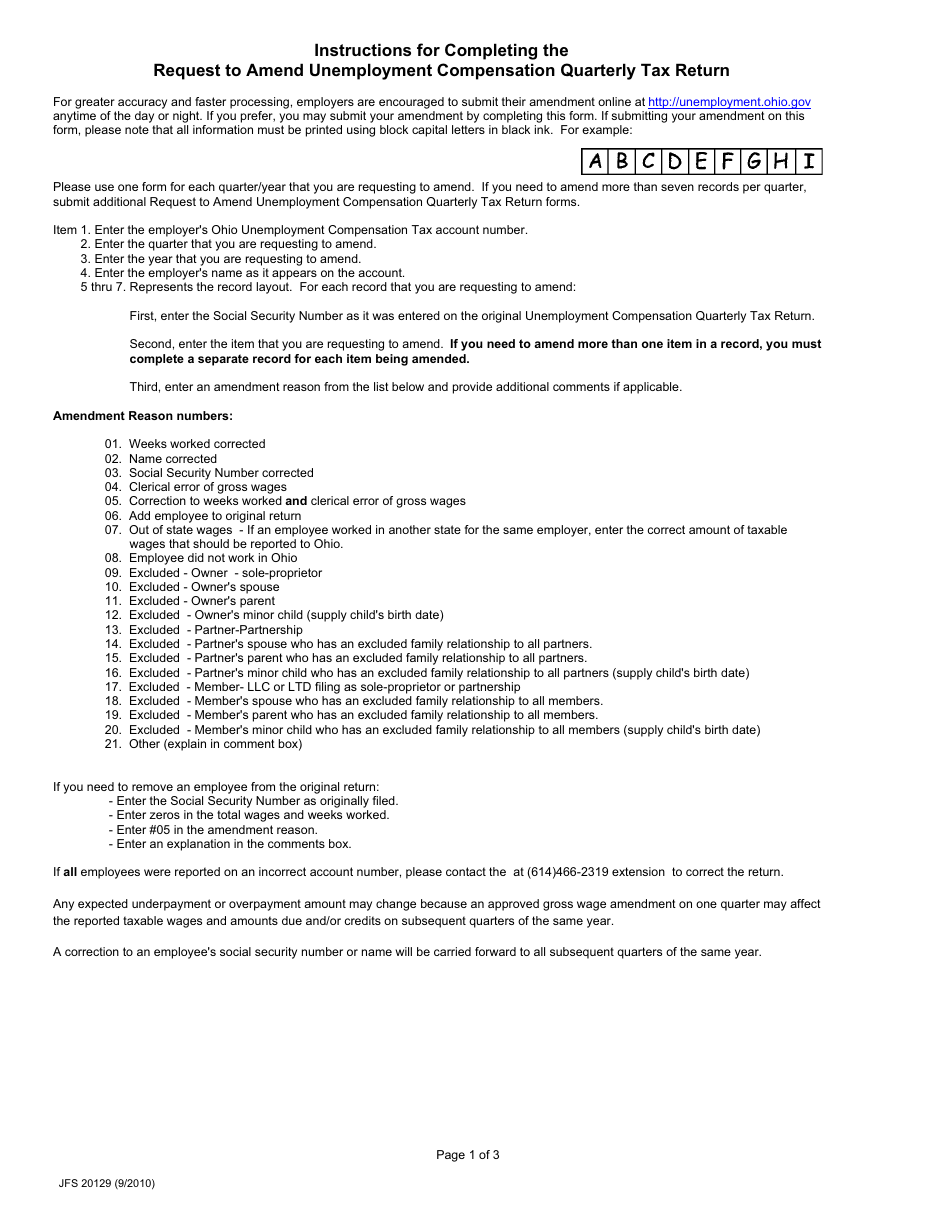

Download Instructions For Form Jfs20129 Request To Amend Unemployment Compensation Quarterly Tax Return Pdf Templateroller

Download Instructions For Form Jfs20129 Request To Amend Unemployment Compensation Quarterly Tax Return Pdf Templateroller

If You Receive Unemployment Benefits Expect To Receive Form 1099 G Don T Mess With Taxes

Paying Taxes On Unemployment Checks Everything You Need To Know Cnet

Paying Taxes On Unemployment Checks Everything You Need To Know Cnet

Alabama Tax Forms And Instructions For 2020 Form 40

Alabama Tax Forms And Instructions For 2020 Form 40

Ohio Postpones Tax Filing Deadline To May 17 Matching The Irs Revised Deadline For Federal Taxes Cleveland Com

Ohio Postpones Tax Filing Deadline To May 17 Matching The Irs Revised Deadline For Federal Taxes Cleveland Com

Arizona Tax Forms 2020 Printable State Az Form 140 And Az Form 140 Instructions

Arizona Tax Forms 2020 Printable State Az Form 140 And Az Form 140 Instructions

3 12 154 Unemployment Tax Returns Internal Revenue Service

3 12 154 Unemployment Tax Returns Internal Revenue Service

Connecticut Tax Forms And Instructions For 2020 Ct 1040

Connecticut Tax Forms And Instructions For 2020 Ct 1040

:max_bytes(150000):strip_icc()/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

Download Instructions For Form Jfs20129 Request To Amend Unemployment Compensation Quarterly Tax Return Pdf Templateroller

Download Instructions For Form Jfs20129 Request To Amend Unemployment Compensation Quarterly Tax Return Pdf Templateroller

Post a Comment for "Amend Ohio Unemployment Tax Return"