How To Download Unemployment Tax Form

If you collected unemployment insurance last year you will need the 1099-G form from IDES to complete your federal and state tax returns. 1099-Gs for years from 2018 forward are available through your online account.

Free 7 Sample Unemployment Tax Forms In Pdf

Free 7 Sample Unemployment Tax Forms In Pdf

As taxable income these payments must be reported on your federal tax return but they are exempt from California state income tax.

How to download unemployment tax form. All individuals who received unemployment insurance UI benefits in 2020 will receive the 1099-G tax form. Training on how to report unemployment insurance taxes and wages quarterly as well. The 1099G form reports the gross.

Unemployment and family leave. Unemployment Insurance UI benefits including. Most claimants who received Pandemic Unemployment Assistance PUA benefits during 2020 can access their 1099-G form within the MyUI application.

Use the forms below to register or update your unemployment tax account. This tax form provides the total amount of money you were paid in benefits from NYS DOL in 2020 as well as any adjustments or tax withholding made to your benefits. Log on using your username and password then go to the Unemployment Services menu to access your 1099-G tax formsIf you have questions about your user name and password see our frequently asked questions for accessing online benefit services.

The Form 1099-G reports the total taxable unemployment benefits paid to you from the Tennessee Department of Labor Workforce Development for a calendar year and the federal income tax. Unemployment Tax Forms 1099 By January 31 all 1099-Gs will be mailed out to individuals who had claimed Unemployment Insurance UI benefits in the previous calendar year. Check with your states taxing authority for information about the taxation of unemployment compensation.

The 1099-G form is available as of January 2021. Tax forms quickly and easily on-line or upon request. In addition to receiving a hard copy in the mail in January you will be able to log into the UI Tax Claims System and view your 1099G.

If you have received unemployment insurance payments last year you will need to report the total amount as found on your 1099-G on your federal taxes. 1099G form is needed to complete your state and federal tax returns if you received unemployment insurance benefits last year. Form 1099-Gs issued from 2009 through 2019 are available online by logging into the unemployment benefit system and going to your correspondence box.

After you are logged in you can also request or discontinue federal and state income tax withholding from each unemployment benefit payment. Every January we send a 1099-G form to people who received unemployment benefits during the prior calendar year. If you are not sure which office it is check the Form 4506-T instructions.

When you apply for unemployment insurance benefits you can choose to have 10 of your weekly benefit amount withheld for federal income taxes andor 6 for state income taxes. You can download Form 4506-T at IRSgov or order it from 800-TAX-FORM. Print this form and mail it in or register online.

A comprehensive Glossary of Tax Terms and common reasons businesses face tax penalties so that you can steer clear of them. Mail the completed form to the IRS office that processes returns for your area. 1099G is a tax form sent to people who have received unemployment insurance benefits.

Transferring 1099-G Information to IRS Form 1040. If you need a Form 1099-G for a year prior to 2009 please contact the Unemployment Hotline at 603 271-7700 and. Written requests for a hard copy of your 1099-G form from 2018 2019 2020 or 2021 may be.

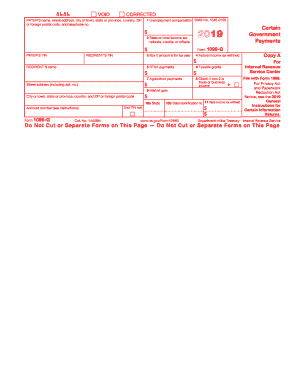

Form 1099G reports the total taxable income we issue you in a calendar year and is reported to the IRS. Claimants who received PUA benefits will have a separate 1099-G tax form than those claimants who received Unemployment Insurance UI Pandemic Emergency Unemployment Compensation PEUC and Extended Benefits EB. Do I need the 1099-G form to file my taxes.

You may download a copy of your current IRS Form 1099-G through your online account at desncgov at no charge. Yes you need the 1099-G form in order to complete and file your taxes. The Statement for Recipients of Certain Government Payments 1099-G tax forms are now available for New Yorkers who received unemployment benefits in calendar year 2020.

After logging in click View Correspondences in the left-hand navigation menu or in the hamburger menu at the top if youre on mobile. Your unemployment compensation may be taxed on the state level depending on where you live. Farm Ranch Employment Registration - Status Report - Form C-1FR enables TWC to establish a new account for a Farm or Ranch employer.

For Pandemic Unemployment Assistance PUA claimants the forms will also be available online in the PUA portal. Employers Registration - Status Report - Form C-1 enables TWC to establish a new account for a non-farm employer. It contains information about the benefit payments you received and any taxes.

Total taxable unemployment compensation includes. The 1099-G is a tax form for Certain Government PaymentsESD sends 1099-G forms for two main types of benefits. Scroll down toward the bottom of the page and you will see a.

After signing in scroll down to the Unemployment Insurance section on the right side of the page and select Unemployment Services.

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

Free 7 Sample Unemployment Tax Forms In Pdf

Free 7 Sample Unemployment Tax Forms In Pdf

What Is Irs Form W 9 Turbotax Tax Tips Videos

What Is Irs Form W 9 Turbotax Tax Tips Videos

Ui Online Access Tax Information Form 1099g Using Ui Online Youtube

Ui Online Access Tax Information Form 1099g Using Ui Online Youtube

Unemployment Benefits And Taxes Here S What To Do About Incorrect Tax Forms And Other Issues The Denver Post

Unemployment Benefits And Taxes Here S What To Do About Incorrect Tax Forms And Other Issues The Denver Post

Unemployment Insurance Tax Information Rhode Island Department Of Labor And Training

Unemployment Insurance Tax Information Rhode Island Department Of Labor And Training

:max_bytes(150000):strip_icc()/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

Free 7 Sample Unemployment Tax Forms In Pdf

Free 7 Sample Unemployment Tax Forms In Pdf

South Carolina Tax Forms 2020 Printable State Sc 1040 Form And Sc 1040 Instructions

South Carolina Tax Forms 2020 Printable State Sc 1040 Form And Sc 1040 Instructions

Faqs Benefits Kansas Department Of Labor

Faqs Benefits Kansas Department Of Labor

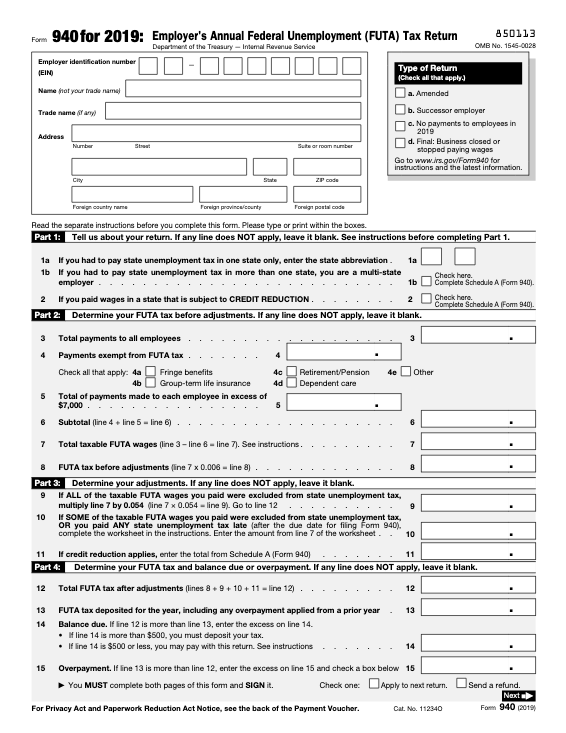

Form 940 How To File Your Futa Tax Return Bench Accounting

Form 940 How To File Your Futa Tax Return Bench Accounting

Accessing Your 1099 G Sc Department Of Employment And Workforce

Accessing Your 1099 G Sc Department Of Employment And Workforce

Oregon Tax Forms 2020 Printable State Form Or 40 And Form Or 40 Instructions

Oregon Tax Forms 2020 Printable State Form Or 40 And Form Or 40 Instructions

Free 7 Sample Unemployment Tax Forms In Pdf

Free 7 Sample Unemployment Tax Forms In Pdf

Futa The Employer S Guide To Unemployment Taxes Bench Accounting

Futa The Employer S Guide To Unemployment Taxes Bench Accounting

Free 7 Sample Unemployment Tax Forms In Pdf

Free 7 Sample Unemployment Tax Forms In Pdf

Post a Comment for "How To Download Unemployment Tax Form"