Federal Unemployment Tax Rate History

Federal Individual Income Tax Rates History Nominal Dollars Income Years 1913-2013 Nominal. The federal government applies a standard 6 FUTA tax rate across industries and it does not change based on how many former employees file for unemployment benefits.

How Severely Will Covid 19 Impact Sui Tax Rates

How Severely Will Covid 19 Impact Sui Tax Rates

Average effective tax rates number of tax returns total adjusted gross income and total tax after credits for highest AGI groups 1935 to 2015.

Federal unemployment tax rate history. Tax Rate Over But Not Over Tax Rate Over But Not Over Tax Rate Over But Not Over Tax Rate Over But Not Over 100 0 15100 100 0 7550 100 0 7550 100 0 10750. The ETT taxable wage limit is 7000 per employee per calendar year. Federal Pandemic Unemployment Compensation FPUC Mixed Earner Unemployment Compensation MEUC Frequently Asked Questions.

0540 54 or 378 per employee. Iowa Workforce Development. Congress chose a system of stamp duties as a source of revenue in order to raise funds for a Navy to defend the nations interests in re-sponse to an undeclared war with France that had be-gun in 1794.

IRS Form 940 generally must be. The FUTA tax rate protection for 2021 is 6 as per the IRS standards. Use Form 940 to report your annual Federal Unemployment Tax Act FUTA tax.

FUTA Tax Rates and Taxable Wage Base Limit for 2021. You cannot withhold UI tax from the wages you pay to employees. By the amount of money being held back the staff members have the ability to assert tax returns credit history.

California employers fund regular Unemployment Insurance UI benefits through contributions to the states UI Trust Fund on behalf of each employee. Indiana imposes a flat 323 tax on the personal income. Schedule F provides for UI contribution rates from 15 percent to 62 percent.

0029 29 or 2030 per employee. You can view your tax rate by logging in to the Departments Reemployment Tax file and pay website. Rate on property percent Rate on legacies percent Relationship 1864 Death Tax Rates The Stamp Tax of 1797 Figure A In 1797 the US.

Virginia law specifically exempts from unemployment taxes only nonprofits companies that have a 501 C3 federal tax exemption and have less than 4 employees for 20 weeks in the year. The base taxable amount is equal to the adjusted gross income determined on a payers federal tax return. Government in which employers subtract taxes from their workers payroll.

This tax rate is determined by dividing the total unemployment benefits paid to former employees by the total taxable wages paid to all their employees. The minimum and maximum tax rates effective January 1 2021 are as follows based on annual wages up to 7000 per employee. The rate steadily declined to 35 in 1969 but then rose to a historical peak of 97 in 1982.

All other non-profit employers are required to file as is any other business Churches however. The FUTA tax applies to the first 7000 of wages paid to each employee throughout the year. The Federal Unemployment Tax Act requires employers to file IRS Form 940 annually to report the paying of their FUTA taxes.

Historical Unemployment Insurance Tax Rate Tablepdf. Only employers pay FUTA tax. The US unemployment rate for persons 16 years of age and older rose from 39 in 1947 the first year data are available to 68 in 1958.

They also pay separate FUTA taxes to the federal government to help pay for the administration of the UI. 010 did not change from 2020 Experience rate. Tax Tables 2021 - Federal Withholding Tables 2021 is the process called for by the US.

10 rows An employers tax rate determines how much the employer pays in state Unemployment Insurance. The first 7000 for each employee will. Do not collect or deduct FUTA tax.

Most employers pay both a federal and a state unemployment tax. 35000 did not change from 2020 Base tax rate. The ETT rate for 2021 is 01 percent.

Tax rate factors for 2021. For more information including how to protest your UI rate visit Tax-Rated Employers. The taxable amount can be lowered by applying several income tax deductionsThe largest deductions in 2013 were a 3000 deduction for rent paid and a deduction equal to the amount of taxes paid out of state.

Your UI tax rate is applied to the taxable wages you pay to your employees. Together with state unemployment tax systems the FUTA tax provides funds for paying unemployment compensation to workers who have lost their jobs. The taxable wage limit is 7000 per employee per calendar year.

Federal Unemployment Tax Act FUTA FUTA Information for Wages Employers Paid in 2020. Historical Unemployment Insurance Tax Rate Table. Individual Taxes Itemized Charitable Contributions constant dollars 1917-2017.

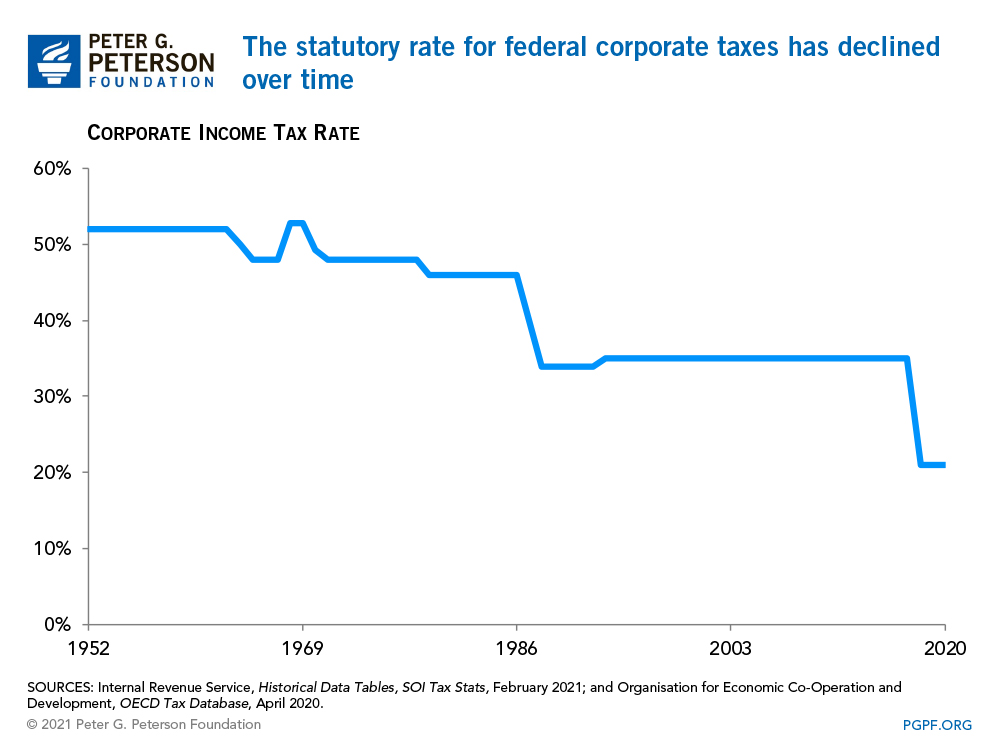

History Of Corporate Tax Rates Jobs Procon Org

History Of Corporate Tax Rates Jobs Procon Org

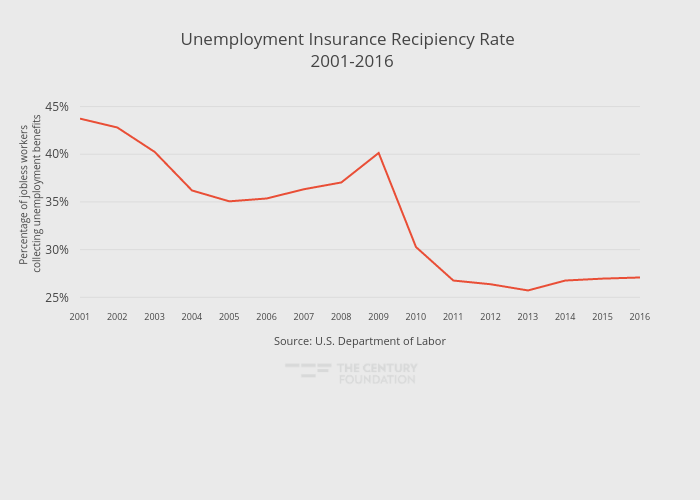

Unemployment Trust Fund Recovery Is Helping Employers Not Workers

Unemployment Trust Fund Recovery Is Helping Employers Not Workers

Https Fas Org Sgp Crs Misc R44527 Pdf

Doing Business In The United States Federal Tax Issues Pwc

Doing Business In The United States Federal Tax Issues Pwc

The Truth About Taxes High Rates On Rich People Do Not Hurt The Economy

Understanding The Budget Revenues

Understanding The Budget Revenues

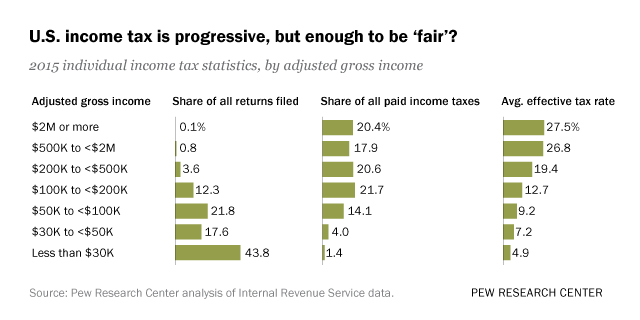

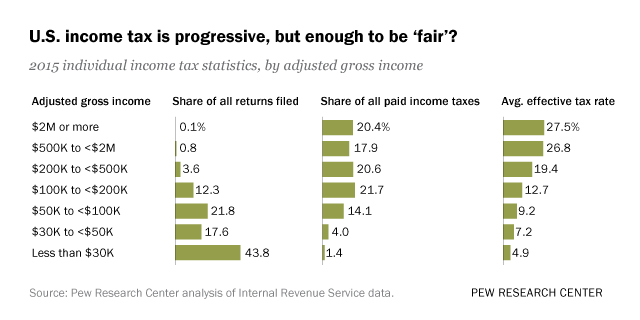

Who Pays U S Income Tax And How Much Pew Research Center

Who Pays U S Income Tax And How Much Pew Research Center

How Do Taxes Affect Income Inequality Tax Policy Center

How Do Taxes Affect Income Inequality Tax Policy Center

How Do Taxes Affect Income Inequality Tax Policy Center

How Do Taxes Affect Income Inequality Tax Policy Center

How Severely Will Covid 19 Impact Sui Tax Rates

How Severely Will Covid 19 Impact Sui Tax Rates

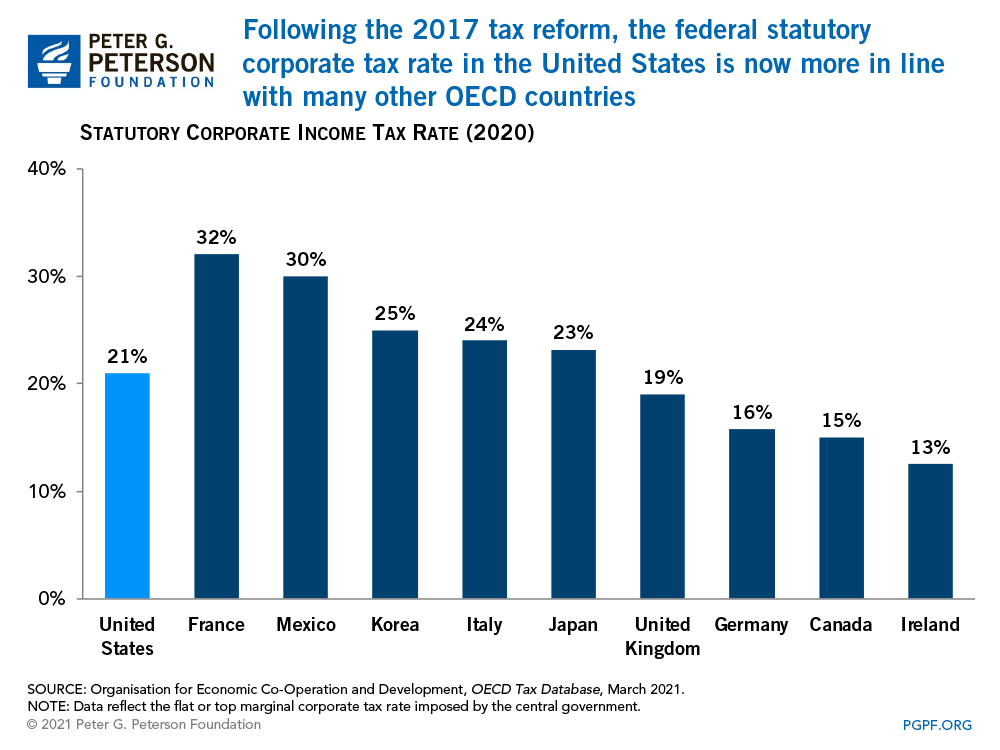

Six Charts That Show How Low Corporate Tax Revenues Are In The United States Right Now

Six Charts That Show How Low Corporate Tax Revenues Are In The United States Right Now

Taxation Of Social Security Benefits Mn House Research

Taxation Of Social Security Benefits Mn House Research

Six Charts That Show How Low Corporate Tax Revenues Are In The United States Right Now

Six Charts That Show How Low Corporate Tax Revenues Are In The United States Right Now

Who Pays U S Income Tax And How Much Pew Research Center

Who Pays U S Income Tax And How Much Pew Research Center

Https Eml Berkeley Edu Saez Course Labortaxes Taxableincome Taxableincome Attach Pdf

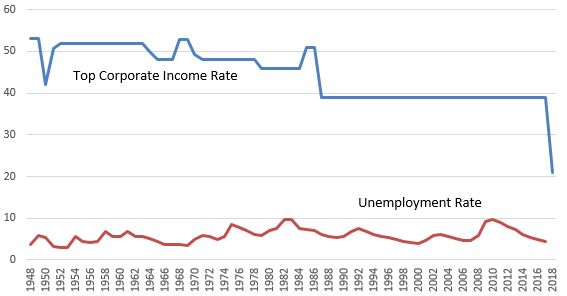

Top Federal Corporate Income Tax Rates Vs Unemployment Corporate Tax Rate Jobs Procon Org

Top Federal Corporate Income Tax Rates Vs Unemployment Corporate Tax Rate Jobs Procon Org

Https Fas Org Sgp Crs Misc R44527 Pdf

What Is Futa Tax 2021 Tax Rates And Information

What Is Futa Tax 2021 Tax Rates And Information

Post a Comment for "Federal Unemployment Tax Rate History"