Unemployment Tax Form 2020

Form 1099G tax information is available for. We also send this information to the IRS.

Unemployment Benefits And Taxes Here S What To Do About Incorrect Tax Forms And Other Issues The Denver Post

Unemployment Benefits And Taxes Here S What To Do About Incorrect Tax Forms And Other Issues The Denver Post

Unemployment for Individuals 2020 Individual Income Tax Information for Unemployment Insurance Recipients Form 1099G reports the total taxable income we issue you in a calendar year and is reported to the IRS.

/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg)

Unemployment tax form 2020. If you received unemployment your tax statement is called form 1099-G not form W-2. The 1099-G tax form includes the amount of benefits paid to you for any the following programs. If you received unemployment compensation in 2020 your state may issue an electronic Form 1099-G instead of it being mailed to you.

Most claimants who received Pandemic Unemployment Assistance PUA benefits during 2020 can access their 1099-G form within the MyUI application. Unemployment Compensation Exclusion Worksheet Schedule 1 Line 8. Unemployment Insurance UI Pandemic Unemployment Assistance PUA Pandemic Emergency Unemployment Compensation PEUC Extended Benefits EB Federal Pandemic Unemployment Compensation FPUC and Lost.

If you received 35 weeks of the maximum benefits 713 x 35 in 2020 plus FPUC 17 weeks x 600 plus FEMALWA 6 weeks x 300 your Form 1099-G will show the sum of all of these payments 36955 if you did not choose to have federal taxes withheld from the UI benefits. If you collected unemployment insurance last year you will need the 1099-G form from IDES to complete your federal and state tax returns. You must include this form with your tax filing for the 2020 calendar year.

That represents a lot of Americans who will find themselves grappling with taxes on their unemployment benefits when the filing season rolls around in 2021 for 2020 tax returns. On January 28 2021 the Arizona Department of Economic Security DES began mailing 1099-G tax forms to claimants who received unemployment benefits in the state of Arizona in 2020. As taxable income these payments must be reported on your state and federal tax return.

If you see a 0 amount on your 2020 form call 1-866-401-2849 Monday through Friday from 8 am. Anyone who repaid an overpayment of unemployment benefits to the State of Arizona in 2020 will also receive a 1099-G form. Individuals should receive a Form.

The new tax break is an exclusion workers exclude up to 10200 in jobless benefits from their 2020 taxable income. Pacific time except on state holidays. Check your states unemployment compensation website for more information.

1 day agoUnemployment compensation and stimulus payments should be included on 2020 federal income tax returns Including those payments is easy whether filing online or on paper The 2020 tax. The 2020 Publication 17 Your Federal Income Tax For Individuals was impacted by provisions in the American Rescue Plan Act of 2021 that was enacted on March 11 2021. We will mail you a paper Form 1099G if you do not choose electronic delivery by December 27.

The form 49T is a courtesy form providing claimants with a receipt of repayment that provides the amount paid to a Reemployment Assistance overpayment in a specific tax year. The publication is not being revised at this time to reflect the new exclusion of up to 10200 of unemployment compensation. Due to the COVID-19 pandemic the 49T form will not be provided for the 2020 tax year.

You would file an amended. Amended tax and wage report PDF 138K Payment coupon for UIWebTax PDF 30KB Refund request form Claim for refund EMS 5227 PDF 26KB Request TAX method payment PDF 137 KB Request a tax penalty waiver form online form. The good news is that up to 10200 of those benefits received in 2020 are tax-free thanks to the American Rescue Plan Act of 2021.

The 1099-G form is available as of January 2021. After logging in click View Correspondences in the left-hand navigation menu or in the hamburger menu at the top if youre on mobile. If you received unemployment benefits during 2020 youll need this form to file your taxes.

Unemployment tax payment and refund forms. The 1099-G form is used to report taxable benefits when filing with the IRS for anyone who was paid unemployment benefits or Alternative Trade Adjustment Assistance payments during the calendar year January 1 to December 31. Every year we send a 1099-G to people who received unemployment benefits.

Select Request a Tax Penalty Waiver from the dropdown list in the. An amended tax form -- formally called Form 1040-X Amended US Individual Income Tax Return-- is used to correct tax forms 1040 1040-A 1040-EZ 1040-NR or 1040-NR EZ. All individuals who received unemployment insurance UI benefits in 2020 will receive the 1099-G tax form.

Every January we send a 1099-G form to people who received unemployment benefits during the prior calendar year. 1099-G income tax statements for 2020 are available online.

Division Of Unemployment Insurance Federal Income Taxes On Unemployment Insurance Benefits

Division Of Unemployment Insurance Federal Income Taxes On Unemployment Insurance Benefits

Paying Taxes On Unemployment Checks Everything You Need To Know Cnet

Paying Taxes On Unemployment Checks Everything You Need To Know Cnet

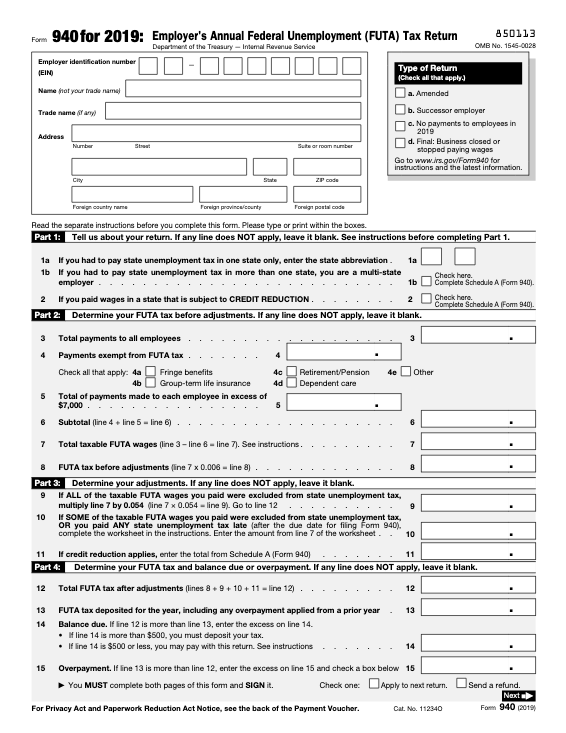

Form 940 How To File Your Futa Tax Return Bench Accounting

Form 940 How To File Your Futa Tax Return Bench Accounting

Arizona Unemployment Form 1099 G Vincegray2014

Arizona Unemployment Form 1099 G Vincegray2014

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Futa The Employer S Guide To Unemployment Taxes Bench Accounting

Futa The Employer S Guide To Unemployment Taxes Bench Accounting

Unemployment Insurance Tax Information Rhode Island Department Of Labor And Training

Unemployment Insurance Tax Information Rhode Island Department Of Labor And Training

Faqs Benefits Kansas Department Of Labor

Faqs Benefits Kansas Department Of Labor

Futa The Employer S Guide To Unemployment Taxes Bench Accounting

Futa The Employer S Guide To Unemployment Taxes Bench Accounting

If You Receive Unemployment Benefits Expect To Receive Form 1099 G Don T Mess With Taxes

Illinois Unemployment If You Got A 1099 G Tax Form From Ides Without Filing For Benefits You May Be Victim Of Fraud Abc7 Chicago

Illinois Unemployment If You Got A 1099 G Tax Form From Ides Without Filing For Benefits You May Be Victim Of Fraud Abc7 Chicago

:max_bytes(150000):strip_icc()/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg) 10 Things You Should Know About Form 1099

10 Things You Should Know About Form 1099

/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

Print Unemployment 1099 Tax Form Vincegray2014

Print Unemployment 1099 Tax Form Vincegray2014

Print Unemployment 1099 Tax Form Vincegray2014

Print Unemployment 1099 Tax Form Vincegray2014

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

Post a Comment for "Unemployment Tax Form 2020"