Unemployment Compensation Cost Per Year

If your income is below. Once an employees wages for the calendar year go beyond 7000 you have no additional FUTA liability for that employee for the year.

How Severely Will Covid 19 Impact Sui Tax Rates

How Severely Will Covid 19 Impact Sui Tax Rates

Any amount your business pays in SUTA tax counts as a small business tax deduction.

Unemployment compensation cost per year. State and federal unemployment insurance programs have cost roughly 520 billion. The minimum benefit is 104 per week and the maximum benefit is 504 per week. This Notice addresses the unemployment compensation exclusion in the federal American Rescue Plan Act and its effect on the taxable income and total household resources of Michigan resident taxpayers and claimants under the Michigan Income Tax Act.

Bird served as a paralegal on. 4 New York and many other states waived the seven-day waiting period for benefits for people who are out of work. Final actual rates are produced after the end of the year based on data supplied by the US.

The estimated data is based on estimated contributions taxable wages and total wages. If your modified AGI is 150000 or more you cant exclude any unemployment compensation. Dollars were paid in.

Beverly Bird a paralegal with over two decades of experience has been the tax expert for The Balance since 2015 crafting digestible personal finance legal and tax content for readers. If you dont pay enough toward your income tax obligations you could end up with a tax bill and possibly penalties and. In 2020 regular unemployment benefit payments range from a minimum amount of 151 per week to a maximum amount of 648 per week.

In January 2021 575 billion US. The FUTA tax is imposed at a single flat rate on the first 7000 of wages that you give each employee. Treatment of Unemployment Compensation for Tax Year 2020.

Dollars were paid out in unemployment benefits in the United States. Costs to the Individual. Unemployment benefits are tax-free up to 10200.

The costs of unemployment to the individual are not hard to imagine. Example a worker who earned 1250 per hour working 40 hours per week for the past year would generally receive 325 per week in unemployment benefits. The High Cost Rate is the highest historical ratio of benefits to wages for a 12-month period.

Jobless Americans have collected more than half a trillion dollars in benefits over the past five years. Estimated rates are from state-reported data contained in the Unemployment Insurance Data Base UIDB. The first payment in a benefit year for a week of unemployment claimed under a specific program.

Department of Labors Bureau of Labor Statistics with final. This is a significant increase from March 2020 when 389 billion US. Unemployment compensation is generally still subject to income tax along with any other income you made during the year such as wages interest dividends retirement distributions etc said Christina Taylor head of operations at Credit Karma Tax.

This payment is an extension of Federal Pandemic Unemployment Compensation FPUC which was once worth 600 per week but has offered 300 per week since late Dec. April 1 2021. The 15200 excluded from income is all of the 5000 unemployment compensation paid to your spouse plus 10200 of the 20000 paid to you.

See chart 2 and table 1 Chart 3. Individuals receiving benefits through the Unemployment Compensation UC program and its two extensions Pandemic Emergency Unemployment Compensation PEUC and Extended Benefits EB may need to re-file their claim at the end of their benefit year BYE date which falls exactly one year after they initially applied for UC benefits. When a person loses their job there is often an immediate impact on that persons standard of living.

ETA 5159 HIGH-COST MULTIPLE HCM TF as of TW divided by the High Cost Rate. Workers nonproduction bonuses cost employers 084 per employee hour worked or 23 percent of total compensation overtime and premium pay cost 033 per hour worked 09 percent and shift differentials cost 008 per hour worked 02 percent. Use the Unemployment Compensation Exclusion Worksheet to figure your modified AGI and the amount to exclude.

This is used as a proxy for beneficiaries under a specific program. Credit for State Unemployment Taxes. The federal government uses the revenue to cover the administrative cost of state unemployment benefit programs.

Consumption Effects Of Unemployment Insurance During The Covid 19 Pandemic

Consumption Effects Of Unemployment Insurance During The Covid 19 Pandemic

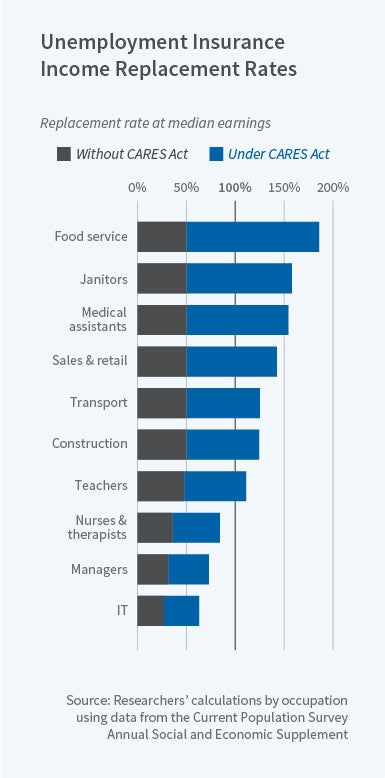

It Pays To Stay Unemployed That Might Be A Good Thing

It Pays To Stay Unemployed That Might Be A Good Thing

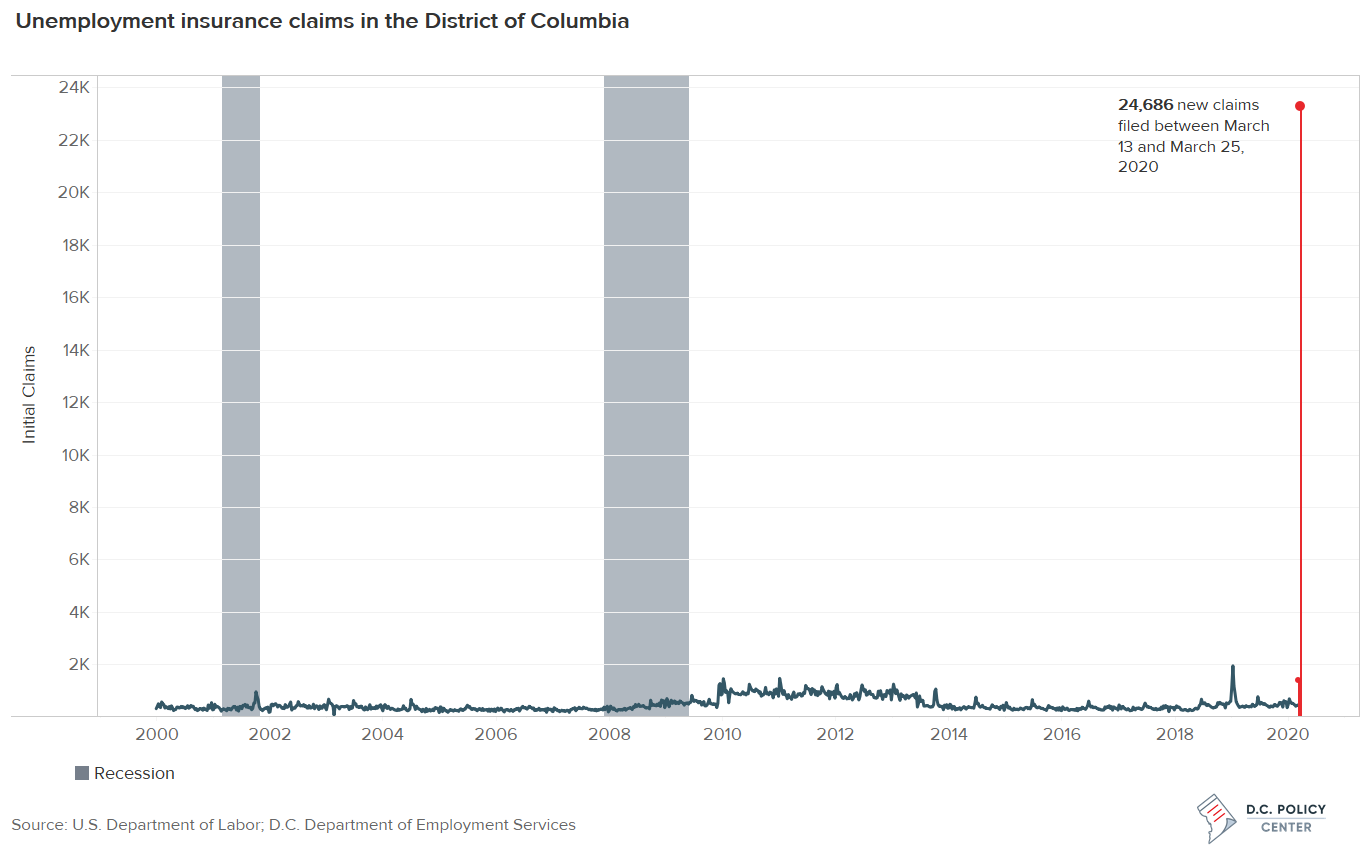

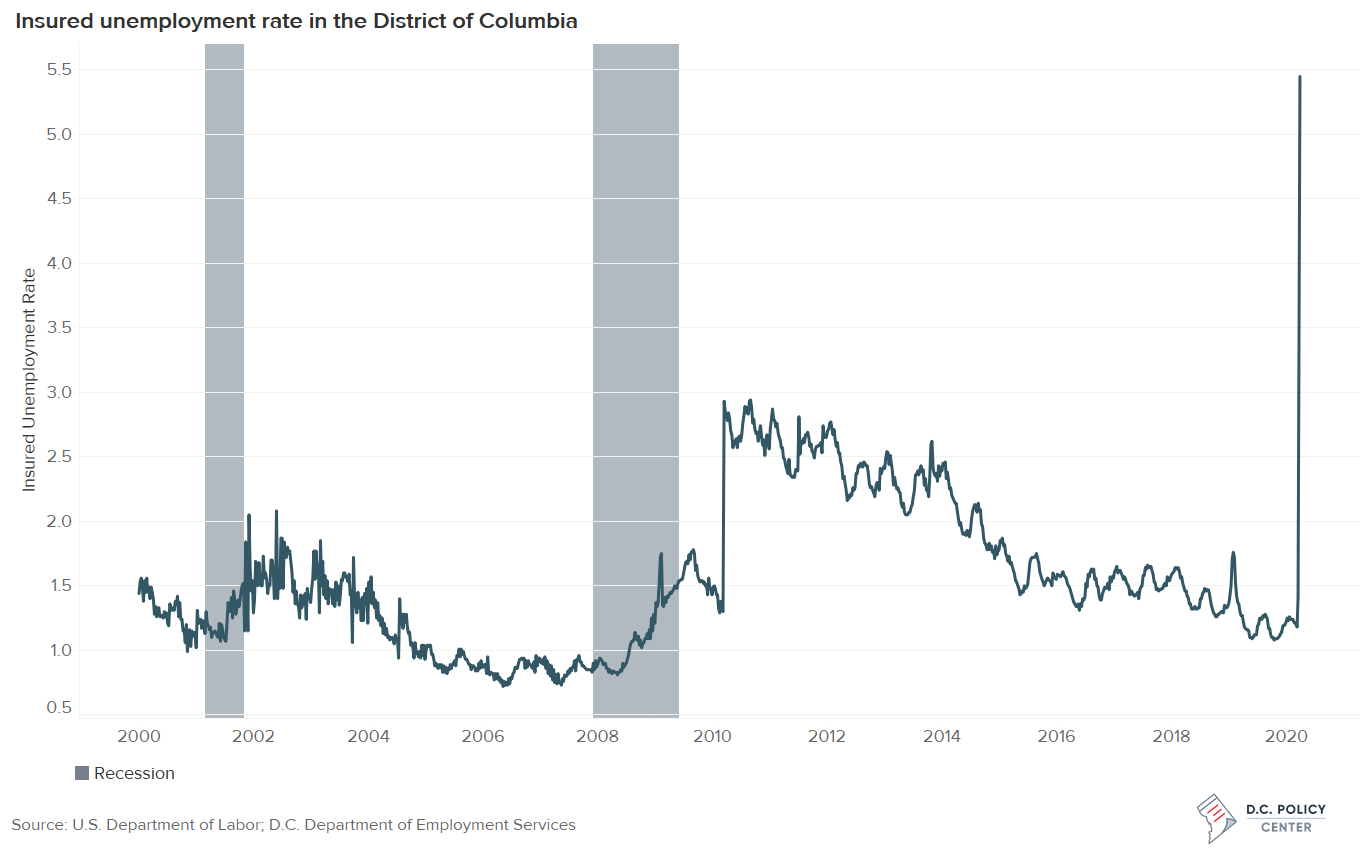

These Provisions Of The Federal Covid 19 Legislation Support And Supplement State Unemployment Programs D C Policy Center

These Provisions Of The Federal Covid 19 Legislation Support And Supplement State Unemployment Programs D C Policy Center

Debunking Myths About Covid 19 Relief S Unemployment Insurance On Steroids

Debunking Myths About Covid 19 Relief S Unemployment Insurance On Steroids

Rhode Island Unemployment Insurance Tax Life Insurance Quotes Term Life Insurance Quotes Home Insurance Quotes

Rhode Island Unemployment Insurance Tax Life Insurance Quotes Term Life Insurance Quotes Home Insurance Quotes

Employer Costs For Employee Compensation For The Regions December 2020 Southwest Information Office U S Bureau Of Labor Statistics

Employer Costs For Employee Compensation For The Regions December 2020 Southwest Information Office U S Bureau Of Labor Statistics

Health Insurance Costs Surpass 20 000 Per Year Hitting A Record Health Insurance Cost Health Insurance American Family Insurance

Health Insurance Costs Surpass 20 000 Per Year Hitting A Record Health Insurance Cost Health Insurance American Family Insurance

Free Unemployment Verification Letter Sample With Benefits Plus In Proof Of Unemployment Letter Template Business Letter Template Lettering Letter Templates

Free Unemployment Verification Letter Sample With Benefits Plus In Proof Of Unemployment Letter Template Business Letter Template Lettering Letter Templates

Legal Hourly Cost Of Employee 2012 Cost Of Required Benefits To Be Paid By Employers For Each Employee Workers Comp Employee Infographic Legal Infographic

Legal Hourly Cost Of Employee 2012 Cost Of Required Benefits To Be Paid By Employers For Each Employee Workers Comp Employee Infographic Legal Infographic

Unemployment Benefit Replacement Rates During The Pandemic Nber

Unemployment Benefit Replacement Rates During The Pandemic Nber

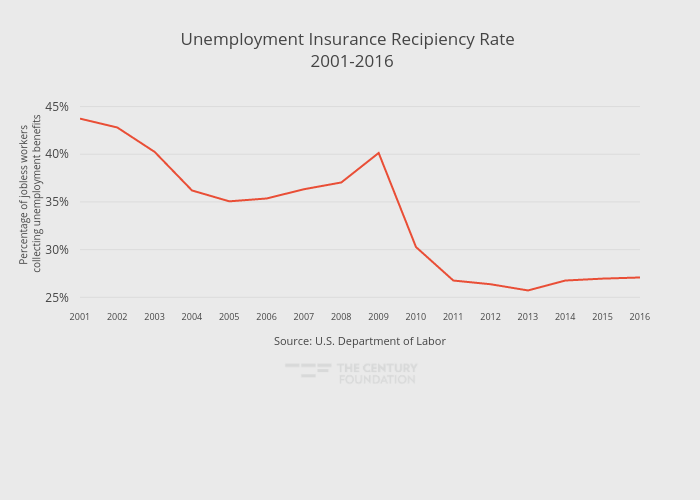

Unemployment Trust Fund Recovery Is Helping Employers Not Workers

Unemployment Trust Fund Recovery Is Helping Employers Not Workers

The Downside Of Low Unemployment

1 Linkedin Financial Advisors Federal Student Loans Financial

1 Linkedin Financial Advisors Federal Student Loans Financial

Economists Debate Why Wage Growth Has Been So Sluggish During The Recovery From Growth Global Economy Great Recession

Economists Debate Why Wage Growth Has Been So Sluggish During The Recovery From Growth Global Economy Great Recession

Causes Of Unemployment In The United States Wikipedia

Handy Printable Tax Prep Checklist Tax Prep Checklist Business Tax Tax Prep

Handy Printable Tax Prep Checklist Tax Prep Checklist Business Tax Tax Prep

These Provisions Of The Federal Covid 19 Legislation Support And Supplement State Unemployment Programs D C Policy Center

These Provisions Of The Federal Covid 19 Legislation Support And Supplement State Unemployment Programs D C Policy Center

How Severely Will Covid 19 Impact Sui Tax Rates

How Severely Will Covid 19 Impact Sui Tax Rates

Post a Comment for "Unemployment Compensation Cost Per Year"