State Unemployment Tax Rates Oklahoma

Through the State Unemployment Tax Act SUTA states levy a payroll tax on employers to fund the majority of their unemployment benefit programs. OESC General Inquiries Physical Address.

Amazon Com Ok Labor Law Poster 2021 Edition State Federal And Osha Compliant Laminated Poster Oklahoma English Prints Office Products

Amazon Com Ok Labor Law Poster 2021 Edition State Federal And Osha Compliant Laminated Poster Oklahoma English Prints Office Products

After agreeing to the terms of usage select the Claimant option then follow the appropriate prompts.

State unemployment tax rates oklahoma. MQFE Annual Maximum Withholding. Oklahoma Employment Security Commission Will Rogers Memorial Office Building 2401 North Lincoln Boulevard. Starting in 2021 Proposition 208 approved by.

Like the Federal Income Tax Oklahomas income tax allows couples filing jointly to pay a lower overall rate on their combined income with wider tax brackets for joint filers. If a claimant returns to work fulltime they should keep their unemployment claim open with OESC and not certify a weekly claim. As a for-profit business operating in Oklahoma you are required to pay Unemployment Insurance UI tax.

Over the last decade it has ranged from around 13000 to around 20000. EZ Tax Help Desk Phone Number405 557-5452. For 2021 Conditional Factor D is to be in effect and.

That amount known as the taxable wage base goes up or down every year in Oklahoma. This is an increase form 2020 where rates ranged from 010 to 550. 45 on 327263 and over of taxable income for married joint filers and 163632 and over for single filers.

Tennessee SUI Tax Rate. State tax wont necessarily amount to much though depending on the respective tax rate. Here is a list of the non-construction new employer tax.

This button will take you to our EZ Tax Portal. If you would like to inquire about a missing CAA-related payment or regarding a 1099-G form please report it to the Virtual Agent on the OESC HomepageWhen you enter the homepage click on the Virtual Agent icon on the bottom right of the screen. 52 rows SUI tax rate by state.

Employers may report this activity by emailing returntoworkoescstateokus calling 405-962-7524 or mailing OESC at PO. Effective January 1 2021 Oklahomas experienced-employer unemployment tax rates are to be determined with Conditional Factor D causing rates to range from 030 to 750. EE MQFE Medicare Withholding Rate fo r wages in excess of 20000000.

EZ Tax Help Desk Fax Number. Utah SUI Tax Rate. Oklahoma collects a state income tax at a maximum marginal tax rate of spread across tax brackets.

Oregon SUI Tax Rate. EE MQFE Medicare Withholding Rate for wages not exceeding 20000000. That would translate into incremental state taxes of 841 on 10200 in.

Notably Oklahoma has the highest maximum marginal tax bracket in the United States. Rhode Island SUI Tax Rate. 1 2021 the wage base is to be 24000 for 2021 up from 18700 in 2020 the spokeswoman told Bloomberg Tax in an email.

The wage base for SUI is 24000 of each employees taxable income. For example taxpayers in Colorado pay a flat 463 on. Texas SUI Tax Rate.

Residents with 150000 in taxable income pay a marginal state tax rate of 825 percent. If youre a new employer congratulations by the way your rate will be 15. Oklahomas unemployment-taxable wage base and unemployment tax rates are to increase for 2021 a spokeswoman for the state Employment Security Commission said Sept.

Oklahoma SUI Tax Rate. Box 52006 Oklahoma City OK 73152-2006. 03 - 90.

Along with a third round of 1400 stimulus checks the sweeping 19 trillion COVID relief bill changed how taxes are levied on unemployment compensation to. Employer Contribution Rates for 2021. The state UI tax rate for new employers known as the standard beginning tax rate also changes from one year to the next.

South Carolina SUI Tax Rate. South Dakota SUI Tax Rate. UI tax is paid on each employees wages up to a maximum annual amount.

Oklahoma has a State Unemployment Insurance SUI which ranges from 03 to 75. EZ Tax Express Inquiries. Alaska New Jersey and Pennsylvania collect.

EZ Tax Help Desk Email Address. You will be taxed at the regular rate for any federal unemployment benefits above 10200. Pennsylvania SUI Tax Rate.

North Dakota Nebraska New Mexico Oklahoma Oregon Utah and Washington DC have all. Wage Base and Tax Rates.

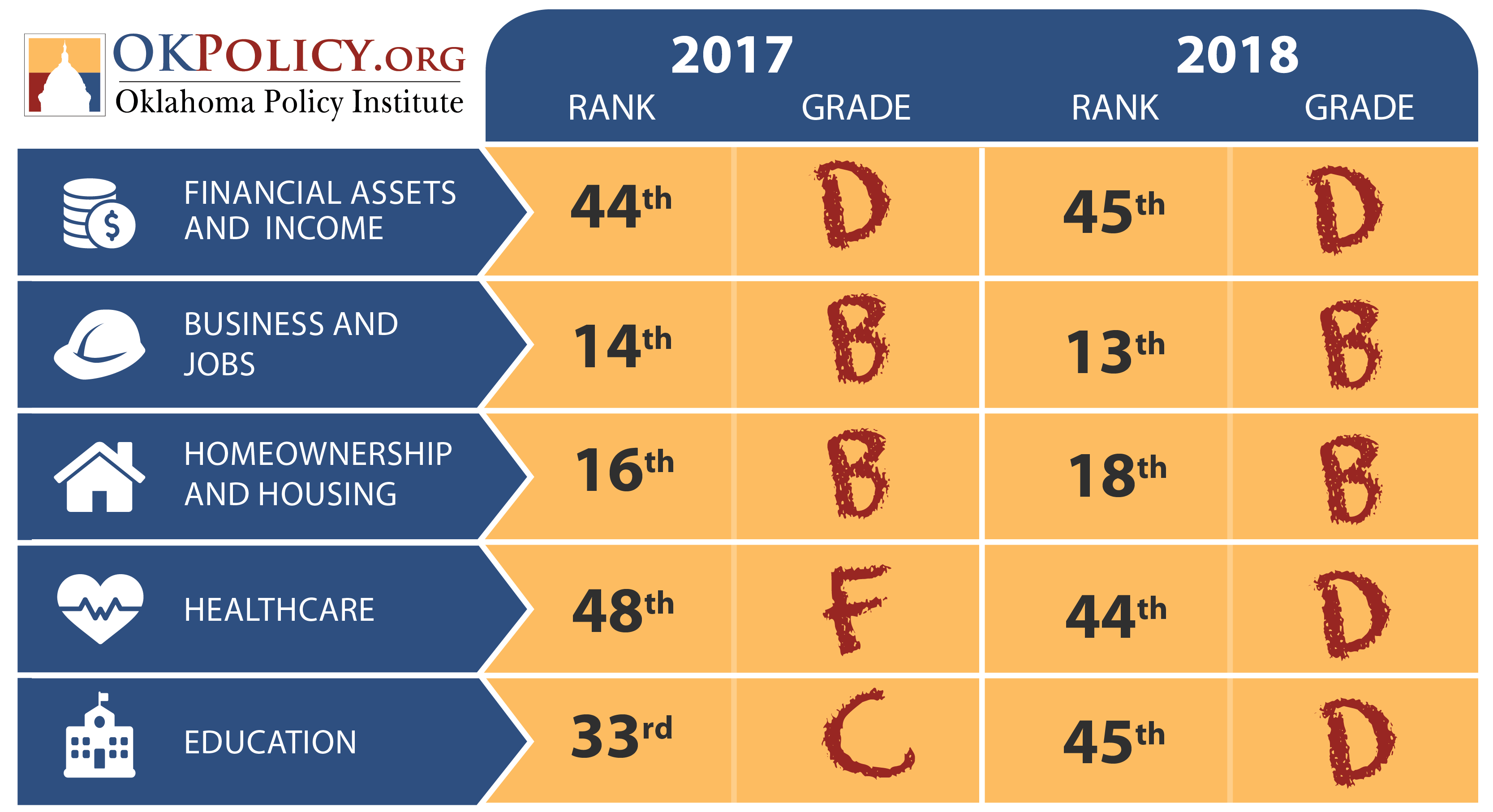

Oklahoma Slips In New Economic Rankings Oklahoma Policy Institute

Oklahoma Slips In New Economic Rankings Oklahoma Policy Institute

Learn About Oklahoma Tax Rates H R Block

Learn About Oklahoma Tax Rates H R Block

Oklahoma Reinstating 1 Week Waiting Period Work Search Requirement For Unemployment Public Radio Tulsa

Oklahoma Reinstating 1 Week Waiting Period Work Search Requirement For Unemployment Public Radio Tulsa

County Employment And Wages In Oklahoma Second Quarter 2020 Southwest Information Office U S Bureau Of Labor Statistics

County Employment And Wages In Oklahoma Second Quarter 2020 Southwest Information Office U S Bureau Of Labor Statistics

Oklahoma Employment Security Commission

Oklahoma Employment Security Commission To Make Additional Lost Wages Assistance Payments Public Radio Tulsa

Oklahoma Employment Security Commission To Make Additional Lost Wages Assistance Payments Public Radio Tulsa

Oklahoma To Officially Begin Reopening In Phases Amid Covid 19 Pandemic Gov Stitt Says Kfor Com Oklahoma City

Oklahoma To Officially Begin Reopening In Phases Amid Covid 19 Pandemic Gov Stitt Says Kfor Com Oklahoma City

5 Things You Should Know About Oklahoma Taxes Oklahoma Policy Institute

5 Things You Should Know About Oklahoma Taxes Oklahoma Policy Institute

Https Www Ok Gov Oesc Newhire App Forms Woes3 Rev 9 13 Three Page Pdf

5 Things You Should Know About Oklahoma Taxes Oklahoma Policy Institute

5 Things You Should Know About Oklahoma Taxes Oklahoma Policy Institute

County Employment And Wages In Oklahoma Second Quarter 2020 Southwest Information Office U S Bureau Of Labor Statistics

County Employment And Wages In Oklahoma Second Quarter 2020 Southwest Information Office U S Bureau Of Labor Statistics

3 Documents Ok Gov Oklahoma Digital Prairie Documents Images And Information

3 Documents Ok Gov Oklahoma Digital Prairie Documents Images And Information

Oklahoma Unemployment Frequently Asked Questions Ui Experts

Oklahoma Unemployment Frequently Asked Questions Ui Experts

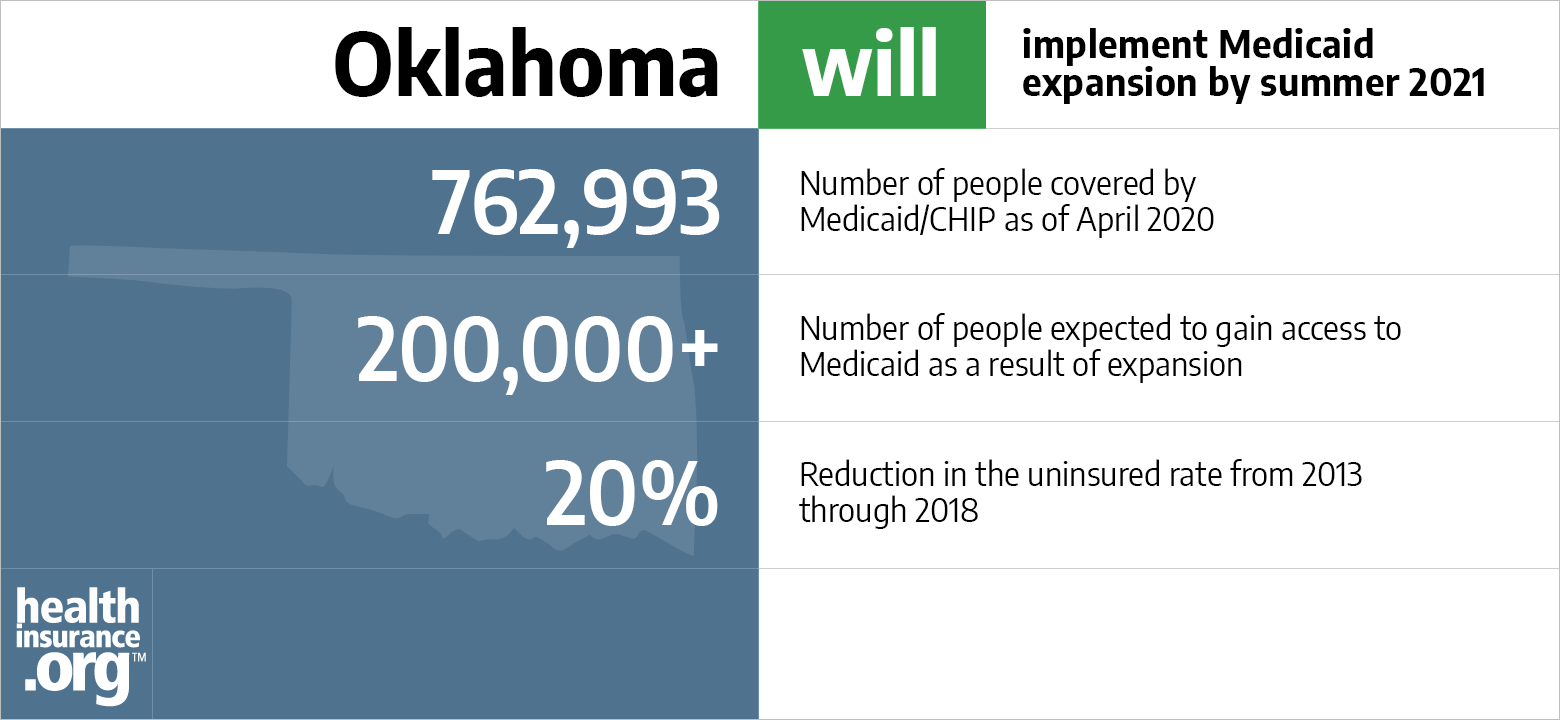

Oklahoma And The Aca S Medicaid Expansion Healthinsurance Org

Oklahoma And The Aca S Medicaid Expansion Healthinsurance Org

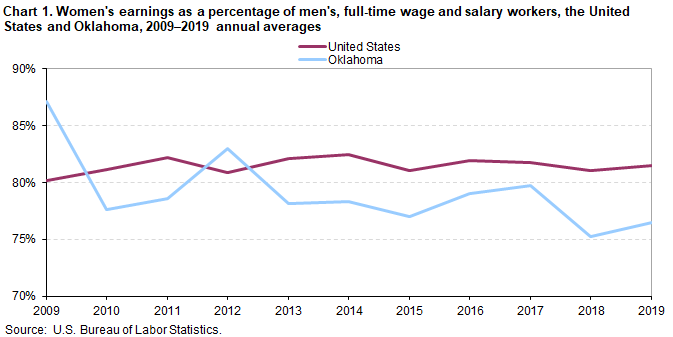

Women S Earnings In Oklahoma 2019 Southwest Information Office U S Bureau Of Labor Statistics

Women S Earnings In Oklahoma 2019 Southwest Information Office U S Bureau Of Labor Statistics

Texas Economy As A State It Is 18th Place In World Economy Scale That Is Above The Entire Country Of Russia Accounts Texas School Tops Gulf Of California

Texas Economy As A State It Is 18th Place In World Economy Scale That Is Above The Entire Country Of Russia Accounts Texas School Tops Gulf Of California

Complete And E File 2020 2021 Oklahoma Income State Taxes

Complete And E File 2020 2021 Oklahoma Income State Taxes

Oklahoma Continues To Lead U S For Deepest Cuts To Education Oklahoma Policy Institute

Oklahoma Continues To Lead U S For Deepest Cuts To Education Oklahoma Policy Institute

Post a Comment for "State Unemployment Tax Rates Oklahoma"